Allied Properties Real Estate Investment Trust Announces Strategic Acquisitions in Toronto's Downtown West

10 Novembre 2009 - 11:07PM

Marketwired

Allied Properties REIT (TSX: AP.UN) announced today that it has

entered into agreements to purchase two properties in Toronto's

Downtown West, one in the Queen & Peter area and the other in

the King & Spadina area.

Queen & Peter

The property in the Queen & Peter area is 375-381 Queen

Street West, which Allied has agreed to acquire for $21.75 million.

Located on the southwest corner of the intersection of Queen and

Peter Streets, this Class I property is comprised of 32,557 square

feet of gross leasable area and 4,381 square feet of surplus land.

It is 87% leased to high- quality tenants, including The Gap,

Payless Shoesource and Red Bull Canada.

With 89 feet of frontage on Queen Street and 142 feet of

frontage on Peter Street, the property is just north of Allied's

property at 134 Peter Street. Earlier this year, Allied received

zoning approval for a large-scale intensification project at 134

Peter Street. Allied plans to incorporate the surplus land into the

project by creating dedicated parking spaces using parking-stacker

technology. Allied also plans to incorporate the existing building

into the intensification project and to create additional office

space by building onto and out from the building.

By incorporating 375-381 Queen Street West, the intensification

of 134 Peter Street will now extend along Peter Street all the way

from Queen Street to Richmond Street. For this reason, Allied has

decided to refer to the expanded intensification project as Queen

Richmond Centre West or QRC West. Not only is this name

descriptive, it builds on the fact that Allied owns QRC, one of the

very best Class I office complexes in Downtown East, as well as the

neighbouring QRC South. Allied plans to launch the pre-leasing of

QRC West in January of next year and expects that 12 to 18 months

will be required to secure an appropriate anchor tenant.

"We've long believed that the intensification of 134 Peter

Street would be a landmark project in Downtown West," said Michael

Emory, President & CEO. "With the integration of 375-381 Queen

Street West, the project is destined to become one of the best

mixed-use, urban developments in the entire city."

The acquisition is expected to close on or about December 17,

2009, subject to customary conditions. The purchase price

represents a 7.4% capitalization rate applied to the annual net

operating income ("NOI") from the property. The property will be

free and clear of mortgage financing on closing. Allied will

finance the acquisition with cash from recent debt and equity

financings. Although it will be incorporated into QRC West, 375-381

Queen Street West will be carried as a rental property for the time

being.

King & Spadina

The property in the King & Spadina area, which Allied agreed

to acquire for approximately $8.9 million, is comprised of the

following:

i. an undivided 50% interest in 18,360 square feet of retail space that

will form part of Fashion House, a condominium project at 560 King

Street West in Toronto; and

ii. an undivided 50% interest in 140 underground commercial parking spaces

to be constructed as part of Fashion House, directly beneath the retail

space referred to above.

The acquisition is conditional upon final condominium

registration and is expected to close in 2013, subject to customary

conditions. Allied will manage the property on behalf of the

co-owners, giving it operating control over another 140 parking

spaces in addition to the 208 underground parking spaces at its

King-Brant parking structure, the 163 underground parking over

which it will have control on completion of existing purchase

agreements, expected in 2011, and the surface parking spaces

adjacent to its numerous properties in the King & Spadina

area.

"Like the acquisitions of underground commercial parking spaces

announced earlier this year, this will be another small but highly

strategic acquisition for us," said Michael Emory, President and

CEO. "Not only will it afford us a reasonable yield on our capital,

it'll add meaningfully to the competitive advantages of some of our

best Class I office properties in the King & Spadina area."

Cautionary Statements

This press release may contain forward-looking statements with

respect to the REIT, its operations, strategy, financial

performance and condition. These statements generally can be

identified by use of forward looking words such as "may", "will",

"expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The

actual results and performance of the REIT discussed herein could

differ materially from those expressed or implied by such

statements. Such statements are qualified in their entirety by the

inherent risks and uncertainties surrounding future expectations,

including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ

materially from expectations include, among other things, general

economic and market factors, competition, changes in government

regulations and the factors described under "Risk Factors" in the

Annual Information Form of the REIT which is available at

www.sedar.com. These cautionary statements qualify all

forward-looking statements attributable to the REIT and persons

acting on the REIT's behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release and the parties have no obligation to update such

statements.

"Capitalization rate" is not a measure recognized under Canadian

generally accepted accounting principles ("GAAP") and does not have

any standardized meaning prescribed by GAAP. Capitalization rate is

presented in this press release because management of the REIT

believes that this non-GAAP measure is relevant in interpreting the

purchase price of the properties being acquired. Capitalization

rate, as computed by the REIT, may differ from similar computations

as reported by other similar organizations and, accordingly, may

not be comparable to capitalization rate reported by such

organizations.

NOI is not a measure recognized under Canadian GAAP and does not

have any standardized meaning prescribed by GAAP. NOI is presented

in this press release because management of the REIT believes that

this non-GAAP measure is relevant in interpreting the purchase

price of the property being acquired. NOI, as computed by the REIT,

may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI

reported by such organizations.

Allied Properties REIT is the leading provider of Class I office

space in Canada, with portfolio assets in the urban areas of

Toronto, Montreal, Winnipeg, Quebec City and Kitchener-Waterloo.

Its objectives are to provide stable and growing cash distributions

to unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

Contacts: Allied Properties Real Estate Investment Trust Michael

R. Emory President and Chief Executive Officer (416) 977-9002

memory@alliedpropertiesreit.com

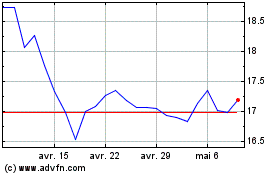

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024