Allied Properties REIT (TSX: AP.UN) today announced results for its

second quarter and half-year period ended June 30, 2010. "We had a

solid second quarter," said Michael Emory, President & CEO.

"Our financial performance measures were on target, our leasing was

strong across the portfolio, our acquisition activity accelerated,

two of our development properties reached completion and our

liquidity position remained excellent."

Financial Results

The financial results for the quarter are summarized below and

compared to the same quarter in 2009:

(In thousands except for per unit

and % amounts) Q2 2010 Q2 2009 Change %Change

----------------------------------------------------------------------------

Net income 4,608 3,950 658 16.7%

Net income per unit (diluted) $ 0.12 $ 0.13 ($0.01) (7.7%)

Funds from operations ("FFO") 15,882 13,928 1,954 14.0%

FFO per unit (diluted) $ 0.41 $ 0.44 ($0.03) (6.8%)

FFO pay-out ratio 81.1% 74.0% 7.1%

Adjusted FFO ("AFFO") 11,641 12,632 (991) (7.8%)

AFFO per unit (diluted) $ 0.30 $ 0.40 ($0.10) (25.0%)

AFFO pay-out ratio 110.6% 81.6% 29.0%

Debt ratio 48.0% 49.3% (1.3%)

----------------------------------------------------------------------------

The financial results for the half-year period are summarized

below and compared to the same period in 2009:

(In thousands except for per unit

and % amounts) H1 2010 H1 2009 Change %Change

----------------------------------------------------------------------------

Net income 9,189 7,826 1,363 17.4%

Net income per unit (diluted) $ 0.23 $ 0.25 ($0.02) (8.0%)

Funds from operations ("FFO") 32,751 27,857 4,894 17.6%

FFO per unit (diluted) $ 0.84 $ 0.89 ($0.05) (5.6%)

FFO pay-out ratio 78.6% 74.0% 4.6%

Adjusted FFO ("AFFO") $ 26,321 $ 24,902 1,419 5.7%

AFFO per unit (diluted) $ 0.67 $ 0.79 ($0.12) (15.2%)

AFFO pay-out ratio 97.8% 82.7% 15.1%

Debt ratio 48.0% 49.3% (1.3%)

----------------------------------------------------------------------------

The declines in FFO per unit are largely attributable to lower

occupancy and a lower Debt Ratio in the current quarter and

half-year period. Over the remainder of the year, Allied expects

its occupancy to increase and plans to utilize its leverage

capacity more fully.

The declines in AFFO per unit are largely attributable to an

abnormally high volume of leasing activity and corresponding

leasing expenditure in the current quarter and half-year period.

For the purposes of calculating AFFO and AFFO per unit, Allied

recognizes leasing expenditures in the period in which the relevant

leases commence, which can cause volatility in AFFO per unit on a

periodic basis. Allied expects its leasing expenditures over the

remainder of the year to be more consistent with past periods.

Leasing

Allied finished the quarter with leased area of 95%. It renewed

or replaced 51.2% of the leases that mature in 2010, in most cases

at rental rates equal to or above in-place rents. This will result

in an overall increase of 3% in the net rental income per square

foot from the affected space.

Allied also finalized several more large-scale renewal

negotiations at Cite Multimedia in Montreal.

-- GFI currently leases 42,175 square feet pursuant to several leases that

expire between 2010 and 2013. GFI has agreed to renew its leases and

take up another 12,195 square feet for a term of 10 years from January

1, 2011, at net rental rates above in-place rents and with a net rental

escalation for the second five years of the term.

-- Fujitsu currently leases 15,594 square feet pursuant to a lease that

expires on October 31, 2010. Fujitsu has agreed to renew its lease for a

term of two years at net rental rates above in-place rents.

-- Compuware currently leases 54,166 square feet pursuant to a lease that

expires on September 30, 2010. Compuware has agreed to renew its lease

with respect to 13,562 square feet (with GFI taking over the most of its

remaining space as part of its renewal and expansion) for a term of five

years years at net rental rates below in-place rents.

-- Orthosoft currently leases 12,122 square feet pursuant to a lease that

expires on December 31, 2010. Orthosoft has agreed to renew its lease

for a term of five years at net rental rates equal to in-place rents.

Allied also made progress with CGI's space at Cite Multimedia,

the lease for which expires at the end of this year. The space is

comprised of six contiguous office floors between 30,000 and 38,000

square feet each and 19,020 square feet on the ground floor that is

currently used as office space. Allied leased 10,867 square feet of

the ground floor space to Kids & Co for a day-care facility and

plans to lease the balance to other retail service tenants. (Two of

the office tenants at the complex, Morgan Stanley and SAP Labs,

have already made long-term commitments for a significant portion

of the day-care capacity at the Kids & Co facility.) Of the six

office floors, Allied has leased one floor to SAP Labs, leaving

five floors to lease. Allied has made proposals to prospective new

tenants for each of the five floors.

Allied has decided not to renew CGI's lease, as Management

believes it can achieve a superior outcome for the complex with

replacement tenants. Even though Allied will experience temporary

turnover vacancy as a result, Management believes that the complex

will be strengthened by reduced single-tenant exposure, an improved

tenant-mix and a longer weighted average lease term.

Finally, Allied entered into three significant new leases, two

for retail space and the other for office space. Patagonia has

agreed to lease 6,195 square feet at 500 King Street West in

Toronto for a term of 15 years at net rental rates above prior

in-place rents. This is the first time in recent years that a

clothing merchandiser has located in the King & Spadina area,

an indication that the next wave of retail use in the area may be

underway. A further indication of strength is the decision by

Design Within Reach to expand its store at 425-439 King West by

3,397 square feet. At 645 Wellington Street in Montreal, we leased

the entire fourth floor (22,209 square feet) to a new tenant. The

lease is expected to commence on March 1, 2011, furthering our plan

to add value to the property in the next two years.

Development

In the second quarter, Allied leased 544 King Street West in

Toronto to The Hive for a term of five years commencing December 1,

2010. The Hive is a marketing firm that currently operates from

425-439 King Street West. It will move to make way for Loblaw

Properties' expansion later this year, at which time 544 King will

become a rental property for accounting purposes.

Allied also leased 7,632 square feet at 47-47A Fraser Avenue in

Toronto to Loblaw Properties for a term of three years commencing

October 1, 2010, bringing the leased area to 100%. This property

will also become a rental property for accounting purposes upon

commencement of the lease.

Liquidity

Allied finished the quarter in a strong liquidity position with

a conservative Debt Ratio of 48%. Aside from $39.6 million drawn on

its $70 million line of credit, Allied had no variable rate debt at

the end of the quarter. Going forward, Allied has a very moderate

mortgage maturity schedule, with no remaining mortgages maturing

this year, $20 million next year and $37 million in 2012.

Even with the acquisitions announced today, Allied expects its

liquidity to strengthen over the remainder of the year as it takes

advantage of the favourable debt markets in Canada. Allied expects

to complete a $6.9 million first mortgage financing on 645

Wellington before the end of third quarter. It also expects to

raise another $20 million over the remainder of the year by placing

first mortgages on unencumbered properties in its portfolio.

Cautionary Statement

FFO and AFFO are not financial measures defined by Canadian

GAAP. Please see Allied's MD&A for a description of these

measures and their reconciliation to net income or cash flow from

operations, as presented in Allied's consolidated financial

statements for the quarter ended March 31, 2010. These statements,

together with accompanying notes and MD&A, have been filed with

SEDAR, www.sedar.com, and are also available on Allied's web-site,

www.alliedpropertiesreit.com.

This press release may contain forward-looking statements with

respect to Allied, its operations, strategy, financial performance

and condition. These statements generally can be identified by use

of forward looking words such as "may", "will", "expect",

"estimate", "anticipate", intends", "believe" or "continue" or the

negative thereof or similar variations. Allied's actual results and

performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including that the transactions

contemplated herein are completed. Important factors that could

cause actual results to differ materially from expectations

include, among other things, general economic and market factors,

competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information

Form which is available at www.sedar.com. The cautionary statements

qualify all forward-looking statements attributable to Allied and

persons acting on its behalf. Unless otherwise stated, all

forward-looking statements speak only as of the date of this press

release, and Allied has no obligation to update such

statements.

Allied Properties REIT is a leading owner, manager and developer

of urban office environments that enrich experience and enhance

profitability for business tenants operating from Toronto,

Montreal, Winnipeg, Quebec City and Kitchener-Waterloo. Its

objectives are to provide stable and growing cash distributions to

unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

Contacts: Allied Properties Real Estate Investment Trust Michael

R. Emory President and Chief Executive Officer (416) 977-9002

memory@alliedpropertiesreit.com

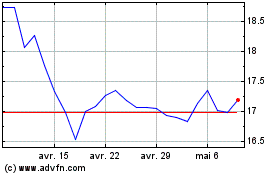

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024