Allied Properties Real Estate Investment Trust Announces $50 Million Public Equity Offering

26 Août 2010 - 2:13PM

Marketwired Canada

NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES OR FOR DISSEMINATION TO THE UNITED

STATES

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into an

agreement with a syndicate of underwriters led by Scotia Capital Inc. to issue

to the public, on a bought-deal basis, 2,376,000 units from treasury at a price

of $21.05 per unit for gross proceeds of $50,014,800. Allied has also granted

the underwriters an option to purchase up to an additional 356,400 units on the

same terms and conditions, exercisable at any time, in whole or in part, for a

period of 30 days following the closing of the offering. The issue will be

offered in all provinces of Canada. The units being offered have not been, and

will not be, registered under the U.S. Securities Act of 1933 and state

securities laws. Closing of the offering is expected to occur on or about

September 15, 2010, and is subject to regulatory approvals. The REIT intends to

use the net proceeds of the offering to pay down its acquisition line of credit

and for general trust purposes.

"In addition to securing the equity component for acquisitions completed or

announced thus far in 2010, this offering will give us full access to our $70

million acquisition line for anticipated acquisitions over the remainder of the

year," said Michael Emory, President & CEO. "As stated in our most recent

quarterly report, we remain committed to our acquisition target of between $100

and $150 million for 2010."

This press release may contain forward-looking statements with respect to the

REIT, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of the REIT discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in the Annual Information Form of the REIT which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to the REIT and persons acting on the REIT's behalf.

Unless otherwise stated, all forward-looking statements speak only as of the

date of this press release and the parties have no obligation to update such

statements.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating from Toronto, Montreal, Winnipeg, Quebec City and

Kitchener-Waterloo. Its objectives are to provide stable and growing cash

distributions to unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

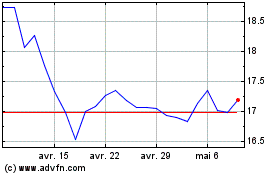

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024