Allied Properties Real Estate Investment Trust Announces Continued Expansion Into Western Canada and Entry Into Downtown Vancouv

16 Décembre 2010 - 1:51PM

Marketwired

Allied Properties REIT (TSX: AP.UN) announced today that it has

entered into agreements to purchase the following properties for

$39.4 million:

Parking

Address Total GLA Office GLA Retail GLA Spaces

----------------------------------------------------------------------------

123 Bannatyne Avenue,

Winnipeg 20,511 20,511 0 0

840 Cambie Street, Vancouver 91,746 91,746 0 20

----------------------------------------------------------------------------

Total 112,257 112,257 0 20

----------------------------------------------------------------------------

"This is another good step forward," said Michael Emory,

President & CEO. "The acquisitions will augment our Winnipeg

portfolio and establish downtown Vancouver as our seventh target

market. Most importantly, they'll propel our urban office platform

to a national scale, something we believe will benefit both our

tenants and unitholders going forward."

Located in the Exchange District on the north side of Bannatyne

Avenue, immediately west of Allied's property at 115 Bannatyne, 123

Bannatyne is a Class I office property with 20,511 square feet of

gross leasable area ("GLA"). It is fully leased to tenants

consistent in character and quality with Allied's tenant base.

Located in Yaletown on Cambie Street, near the intersection with

Robson Street, 840 Cambie is a Class I office property with 91,746

square feet of GLA. It is fully leased to tenants consistent in

character and quality with Allied's tenant base, including

Microsoft and Ubisoft. Ubisoft also occupies space in Allied's

Montreal and Quebec City portfolios.

The acquisitions are expected to close before the end of the

year, subject to customary conditions. The combined purchase price

of $39.4 million represents a capitalization rate 6.7% applied to

the annual net operating income ("NOI") from the properties. On

closing, 123 Bannatyne will be free and clear and 840 Cambie will

be subject to a first mortgage in the principal amount of $20

million, having a term ending in May of 2013, bearing interest at

6% per year and payable in monthly instalments of interest only.

Allied will finance the remainder of the purchase price with the

proceeds from mortgage financings on other properties in its

portfolio.

This press release may contain forward-looking statements with

respect to Allied, its operations, strategy, financial performance

and condition. These statements generally can be identified by use

of forward looking words such as "may", "will", "expect",

"estimate", "anticipate", intends", "believe" or "continue" or the

negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from

those expressed or implied by such statements. Such statements are

qualified in their entirety by the inherent risks and uncertainties

surrounding future expectations, including that the transactions

contemplated herein are completed. Important factors that could

cause actual results to differ materially from expectations

include, among other things, general economic and market factors,

competition, changes in government regulations and the factors

described under "Risk Factors" in the Annual Information Form of

the REIT which is available at www.sedar.com. These cautionary

statements qualify all forward-looking statements attributable to

Allied and persons acting on Allied's behalf. Unless otherwise

stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update

such statements.

"Capitalization rate" is not a measure recognized under Canadian

generally accepted accounting principles ("GAAP") and does not have

any standardized meaning prescribed by GAAP. Capitalization rate is

presented in this press release because management of Allied

believes that this non-GAAP measure is relevant in interpreting the

purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations

as reported by other similar organizations and, accordingly, may

not be comparable to capitalization rate reported by such

organizations.

NOI is not a measure recognized under Canadian GAAP and does not

have any standardized meaning prescribed by GAAP. NOI is presented

in this press release because management of Allied believes that

this non-GAAP measure is relevant in interpreting the purchase

price of the property being acquired. NOI, as computed by Allied,

may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI

reported by such organizations.

Allied Properties REIT is a leading owner, manager and developer

of urban office environments that enrich experience and enhance

profitability for business tenants operating from Toronto,

Montreal, Winnipeg, Quebec City, Kitchener and Calgary. Its

objectives are to provide stable and growing cash distributions to

unitholders and to maximize unitholder value through effective

management and accretive portfolio growth.

Contacts: Allied Properties REIT Michael R. Emory President and

Chief Executive Officer (416) 977-9002

memory@alliedpropertiesreit.com

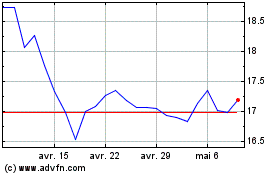

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024