Allied Properties Real Estate Investment Trust Announces Strategic Acquisitions in Downtown Toronto and Provides Update on QRC W

30 Juin 2011 - 5:00PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into an

agreement to purchase two commercial parking facilities for $6.95 million.

Allied also provided an update on its QRC West intensification project.

Acquisitions

The commercial parking facilities are as follows:

Address Levels Parking Spaces

----------------------------------------------------------------------------

388 Richmond Street West, Toronto Three above grade 117

301 Markham Street, Toronto Two below grade 46

----------------------------------------------------------------------------

Total 163

----------------------------------------------------------------------------

The acquisitions are part of Allied's ongoing effort to provide superior parking

solutions to its tenants. The facility at 388 Richmond Street West is part of

District Lofts, a condominium located on the north side of Richmond Street, one

building west of Allied's QRC West intensification project. It is comprised of

three levels above grade and includes 117 parking spaces. The facility will

enhance Allied's ability to provide extensive and desirable parking solutions to

the tenants of QRC West.

The facility at 301 Markham Street is part of Ideal Lofts, a condominium located

on the east side of Markham Street, in relatively close proximity to Allied's

property at 555 College Street. It is comprised of two levels below grade and

includes 46 parking spaces. The facility will enhance Allied's ability to

provide parking solutions to the tenants of 555 College.

The acquisitions are expected to close on July 29, 2011, subject to customary

conditions. The purchase price for the facilities represents an initial

capitalization rate of approximately 6%. On closing, Allied will assume an

existing first mortgage in the approximate principal amount of $2.5 million,

having a term expiring in March 31, 2018, bearing interest at 6.04% per year and

payable in blended installments of principal and interest based on an initial

20-year amortization period.

QRC West

When it initiated the pre-leasing of the first phase of QRC West in January of

2010, Allied estimated that 12-18 months would be required to secure a

lead-tenant. Despite the encouraging level of interest demonstrated by

prospective office tenants, Allied is not currently negotiating with a

prospective lead-tenant and will require additional time to achieve the level of

pre-leasing necessary to commence new construction.

Allied remains fully committed to both phases of the QRC West intensification

project. It has decided to proceed with the renovation and retrofit of the

existing structure at 134 Peter Street. This work has to be completed in any

event, and it will put Allied in a position to complete the new construction

within the shortest possible timeframe once an appropriate level of pre-leasing

is achieved.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

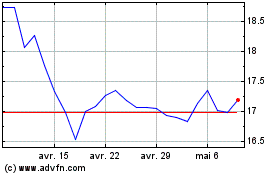

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024