Allied Properties Real Estate Investment Trust Announces Continued Expansion in Western Canada and Toronto With $179 Million in

21 Juillet 2011 - 10:14PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OF AMERICA.

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into

agreements to purchase the following properties for $179 million:

Total Office Retail Parking

Address GLA GLA GLA Spaces

----------------------------------------------------------------------------

Alberta Hotel Building, Calgary 47,569 17,325 30,244 -

Fashion Central, Calgary 25,640 - 25,640 -

Art Central, Calgary 27,207 7,803 19,404 -

Cooper Block, Calgary 35,793 35,793 - 34

Kipling Square, Calgary 44,940 44,940 - 13

Revillon Boardwalk Building,

Edmonton 255,217 224,423 30,794 224

60 Adelaide Street East, Toronto 110,154 105,155 4,999 17

184 Front Street East, Toronto 86,920 80,674 6,246 54

----------------------------------------------------------------------------

Total 633,440 516,113 117,327 342

----------------------------------------------------------------------------

Allied also announced that it has entered into an agreement with a syndicate of

underwriters led by Scotia Capital Inc. to issue to the public, on a bought-deal

basis, 3,830,000 units from treasury at a price of $23.50 per unit for gross

proceeds of $90 million. Allied has granted the underwriters an option to

purchase up to an additional 574,500 units on the same terms and conditions,

exercisable at any time, in whole or in part, for a period of 30 days following

the closing of the offering. The issue will be offered in all provinces of

Canada. The units being offered have not been, and will not be, registered under

the U.S. Securities Act of 1933 and state securities laws. Closing of the

offering is expected to occur on or about August 12, 2011, and is subject to

regulatory approvals. Allied intends to use the net proceeds of the offering to

fund a portion of the purchase price for the properties and for general trust

purposes.

"The six acquisitions in Western Canada will add real depth to our Calgary and

Edmonton portfolios," said Michael Emory, President & CEO. "In Toronto, 60

Adelaide will be an excellent complement to our properties at 151 Front and 905

King, and 184 Front will integrate well with many of our properties in Downtown

East."

With the acquisitions announced today, Allied has completed or announced 19

acquisitions in 2011 for $350 million, 13 in Western Canada, five in Toronto and

one in Montreal. Less than 12 months ago, Allied had no property west of

Winnipeg. On closing of all announced acquisitions, Allied will own nine Class I

or heritage properties in Calgary, two in Edmonton, three in Vancouver and one

in Victoria with total GLA of 920,687 square feet.

Calgary Acquisitions

Located on the Stephen Avenue Mall, adjacent to a property Allied acquired

earlier this year (the Bang & Olufsen Building), the Alberta Hotel Building (804

- 1st Street S.W.) is a restored heritage property comprised of 47,569 square

feet of GLA. Built in 1889 and 1901 as a hotel, the property was extensively

restored and renovated in 1972 and 1997. It is designated by the Province of

Alberta as a historic resource under the Historical Resources Act.

Located on the Stephen Avenue Mall, across the street from the Alberta Hotel

Building, Fashion Central (203 - 8th Avenue S.W.) is a restored heritage

property comprised of 25,640 square feet of GLA. Built in the early 1900s as

three separate buildings (the Hull Block, the McNaughton Block and the Alberta

Block), the property was extensively restored and renovated in 2008 and 2009. It

is on the Inventory of Evaluated Historic Resources maintained by the City of

Calgary.

Located across the street from the second phase of the Bow, Art Central (100 -

7th Avenue S.W.) is a restored heritage property comprised of 27,207 square feet

of GLA. Built in 1929 and originally known as the Jubilee Block, the property

was extensively restored and renovated in 2003 and 2004. It is on the Inventory

of Evaluated Historic Resources maintained by the City of Calgary.

Located in the Beltline area on 10th Avenue, the Cooper Block (801-805 - 10th

Avenue S.W.) is a Class I property with 35,793 square feet of GLA and 34 surface

parking spaces. Built in 1912 as a warehouse for the Calgary Paint and Glass

Factory and later used by the Canadian Army as a munitions building, the

property was extensively restored and renovated in 1995. It is on the Inventory

of Evaluated Historic Resources maintained by the City of Calgary.

Located in the Beltline area on the southwest corner of 10th Avenue and 5th

Street, Kipling Square (601 - 10th Avenue S.W.) is a Class I property with

44,940 square feet of GLA and 13 surface parking spaces. Built in the early

1900s as a warehouse, the property was extensively restored and renovated in

1981. It is on the Inventory of Evaluated Historic Resources maintained by the

City of Calgary.

The Calgary properties are 92% leased to tenants consistent in character and

quality with Allied's tenant base. The weighted average term to maturity of the

leases is 4.6 years.

Edmonton Acquisition

Located at the western edge of the financial core, on the north side of 102nd

Avenue, between 103rd and 104th Street, across the street from a property that

Allied is scheduled to acquire next month (the Metals Limited Building), the

Revillon Boardwalk Building (10310 - 102nd Avenue and 10230 - 104th Street) is a

Class I property with 255,217 square feet of GLA and 224 parking spaces in an

adjacent, six-storey, above-ground parkade. Built in the early 1900s, the

property was extensively restored and renovated in 1986. It is on the Inventory

and Register of Historic Resources maintained by the City of Edmonton.

The property is 99% leased to tenants consistent in character and quality with

Allied's tenant base. The weighted average term to maturity of the leases is 5.3

years.

Toronto Acquisitions

Located on the north side of Adelaide Street, between Yonge and Church Streets,

60 Adelaide Street East is comprised of 110,154 square feet of GLA and 17

underground parking spaces. With some of the attributes of Allied's properties

at 151 Front Street West and 905 King Street West in Toronto, 60 Adelaide has

the capacity to accommodate tenants with extensive requirements for data

processing equipment and internet connectivity.

Located on the northeast corner of Front and Princess Streets, 184 Front Street

East is comprised of 86,920 square feet of GLA and 54 underground parking

spaces. Allied will acquire a leasehold interest in the property that expires in

2091, subject to a right of extension in the event of redevelopment.

The Toronto properties are 90% leased to tenants consistent in character and

quality with Allied's tenant base, including Verizon Canada. The weighted

average term to maturity of the leases is 5.5 years.

Closing and Financing of Acquisitions

The acquisitions are expected to close in August of 2011, subject to customary

conditions. The purchase price for the eight properties represents a

capitalization rate of 7% applied to the current annual net operating income

("NOI"). On closing, the Alberta Hotel Building will be subject to a first

mortgage in the approximate principal amount of $7.4 million, bearing interest

at the rate of 6.34% per year and having a term expiring on November 30, 2014,

Fashion Central will be subject to a first mortgage in the approximate principal

amount of $8.1 million, bearing interest at the rate of 7.59% per year and

having a term expiring on January 31, 2012, and Art Central will be subject to a

first mortgage in the approximate principal amount of $4.5 million, bearing

interest at the rate of 5.36% per year and having a term expiring on November

30, 2016. Allied will refinance Fashion Central at current interest rates as

soon after closing as possible. The remaining five properties will be free and

clear on closing. Allied will place bridge-financing and subsequent first

mortgage financing on these properties as it deems advisable.

Allied has a significant number of unencumbered properties in its portfolio. It

intends to place first mortgage financing on several of these properties with a

view to funding additional growth through acquisitions and locking-in the

currently favourable cost of debt. On closing of all announced acquisitions and

the anticipated first-mortgage financings, Allied will continue to have a very

conservative debt ratio and significant internal liquidity and acquisition

capacity.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

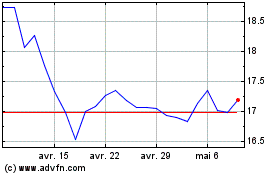

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024