Allied Properties Real Estate Investment Trust Announces Continued Expansion in Calgary With Major Class I Office Acquisition...

19 Février 2013 - 9:11PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OF AMERICA

Allied Properties REIT (TSX:AP.UN) announced today that it has entered into an

agreement to purchase the following Class I office property for $110 million:

Total Office Retail Parking

Address GLA GLA GLA Spaces

----------------------------------------------------------------------------

Vintage I & II, 322-326 - 11th Avenue

S.W., Calgary 210,430 190,237 20,193 210

----------------------------------------------------------------------------

Allied also announced that it has entered into an agreement with a syndicate of

underwriters led by Scotiabank to issue to the public, on a bought-deal basis,

3,210,000 units from treasury at a price of $34.30 per unit for gross proceeds

of approximately $110 million. Allied has granted the underwriters an option to

purchase up to an additional 481,500 units on the same terms and conditions,

exercisable at any time, in whole or in part, for a period of 30 days following

the closing of the offering. The issue will be offered in all provinces of

Canada. The units being offered have not been, and will not be, registered under

the U.S. Securities Act of 1933 and state securities laws. Closing of the

offering is expected to occur on or about March 7, 2013, and is subject to

regulatory approvals. Allied intends to use the net proceeds of the offering to

fund the acquisition of Vintage I & II, with the balance, if any, to be used for

general trust purposes.

"This is one of the finest Class I office complexes in Calgary," said Michael

Emory, President & CEO. "In addition to being immediately accretive on

acquisition, it will continue our consolidation of ownership in the urban core

of Calgary in a meaningful way."

The Property

Located on the north side of 11th Avenue S.W., between 4th and 1st Streets, the

property is comprised of 210,430 square feet of GLA and 210 underground parking

spaces. Vintage I was built in 1924 and was renovated and expanded in 1999.

Vintage II was built in 2004 on the eastern portion of the original site. The

two buildings are nearly identical in appearance and are integrated through a

two storey entrance area. With this property, Allied's Calgary portfolio will

increase to 15 properties with a total of approximately 777,660 square feet of

GLA.

Although 98.8% leased to tenants consistent in character and quality with

Allied's tenant base, the occupancy of the property will decline to 76.6% on May

1. Most of the space to be vacated is in Vintage I and is divided among four

floors of 11,700 square feet each, which Allied considers very leasable, given

the desirability of the space and the strength of the Calgary office leasing

market.

Closing and Financing of the Acquisition

The acquisition is scheduled to close in March of 2013, subject to customary

conditions. The purchase price for the property represents a capitalization rate

of approximately 6.1% applied to the anticipated year-one net operating income

("NOI") and approximately 7.3% applied to the stabilized NOI from year two

onward. The property will be free and clear of mortgage financing at closing.

Allied is evaluating the possibility of placing a first mortgage on the property

after closing in the approximate principal amount of $66 million for a term of

10 years.

Cautionary Statements

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. The actual results and

performance of Allied discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations, including that the transactions contemplated herein are completed.

Important factors that could cause actual results to differ materially from

expectations include, among other things, general economic and market factors,

competition, changes in government regulations and the factors described under

"Risk Factors" in Allied's Annual Information Form, which is available at

www.sedar.com. These cautionary statements qualify all forward-looking

statements attributable to Allied and persons acting on Allied's behalf. Unless

otherwise stated, all forward-looking statements speak only as of the date of

this press release and the parties have no obligation to update such statements.

"Capitalization rate" is not a measure recognized under International Financial

Reporting Standards ("IFRS") and does not have any standardized meaning

prescribed by IFRS. Capitalization rate is presented in this press release

because management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the properties being acquired. Capitalization

rate, as computed by Allied, may differ from similar computations as reported by

other similar organizations and, accordingly, may not be comparable to

capitalization rate reported by such organizations.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is relevant in

interpreting the purchase price of the property being acquired. NOI, as computed

by Allied, may differ from similar computations as reported by other similar

organizations and, accordingly, may not be comparable to NOI reported by such

organizations.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties REIT

Michael R. Emory

President and Chief Executive Officer

(416) 977-0643

memory@alliedreit.com

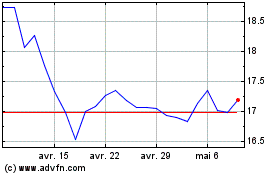

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024