Allied Properties Real Estate Investment Trust Announces Closing of Public Equity Offering

07 Mars 2013 - 1:30PM

Marketwired Canada

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE

UNITED STATES OF AMERICA

Allied Properties REIT (TSX:AP.UN) announced today that it has closed its

previously announced offering of 3,691,500 units (inclusive of 481,500 units

issued pursuant to the exercise in full of the underwriters' over-allotment

option) at a price of $34.30 per unit for gross proceeds of just over $126

million. The units were qualified by a short form prospectus dated February 28,

2013, and were underwritten by a syndicate of underwriters led by Scotiabank and

including RBC Capital Markets, CIBC, TD Securities Inc., BMO Capital Markets,

Macquarie Capital Markets Canada Ltd., National Bank Financial Inc., Canaccord

Genuity Corp., Desjardins Securities Inc., Dundee Securities Ltd., GMP

Securities L.P. and Raymond James Ltd.

Allied intends to use the entire net proceeds of the offering to fund the

acquisition of Vintage I & II, Calgary, with the balance to be used for general

trust purposes.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth. For further

information, please refer to Allied's website at www.alliedreit.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties REIT

Michael R. Emory

President and Chief Executive Officer

(416) 977-9002

memory@alliedreit.com

www.alliedreit.com

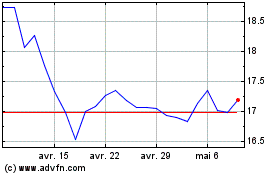

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024