Allied Properties Real Estate Investment Trust Announces Fourth-Quarter and Year-End Results With Continuing Growth in FFO an...

04 Mars 2014 - 9:34PM

Marketwired Canada

Allied Properties REIT (TSX:AP.UN) today announced results for its fourth

quarter and year ended December 31, 2013. "It was all about execution and

financial discipline," said Michael Emory, President and CEO. "We delivered FFO

and AFFO per unit growth of 8% and 16% in 2013, pushing our FFO and AFFO pay-out

ratios for the year down to 70% and 82%. This enabled us at year-end to increase

our annual distribution by 4% to $1.41 per unit. We also continued our

unwavering commitment to the balance sheet by further improving our debt ratios,

interest coverage ratios and immediate and near-term liquidity."

The results for the fourth quarter are summarized below and compared to the same

quarter in 2012:

(In thousands except for per unit and %

amounts) Q4 2013 Q4 2012 CHANGE % CHANGE

----------------------------------------------------------------------------

Net income 31,169 25,524 5,645 22.1%

Same-asset net operating income ("NOI") 40,701 36,676 4,025 11.0%

Funds from operations ("FFO") 34,796 28,020 6,776 24.2%

FFO per unit (diluted) $0.51 $0.45 $0.06 13.3%

FFO pay-out ratio 67.7% 73.2% (5.5%)

Adjusted FFO ("AFFO") 29,506 23,430 6,076 25.9%

AFFO per unit (diluted) $0.43 $0.38 $0.05 13.2%

AFFO pay-out ratio 79.8% 87.5% (7.7%)

Total debt as a % of fair value of

investment properties 35.7% 36.4% (0.7%)

Net debt as a multiple of annualized Q4

EBITDA 6.3:1 6.5:1 (0.2:1)

Operating interest-coverage ratio 4.1:1 3.7:1 0.4:1

Total interest-coverage ratio 3.0:1 2.8:1 0.2:1

----------------------------------------------------------------------------

The results for the year ended December 31, 2013, are summarized below and

compared to the same period in 2012:

(In thousands except for per unit

and % amounts) 2013 2012 CHANGE % CHANGE

----------------------------------------------------------------------------

Net income 118,234 93,325 24,909 26.7%

Same-asset net operating income

("NOI") 139,059 126,670 12,389 9.8%

Funds from operations ("FFO") 131,679 102,152 29,527 28.9%

FFO per unit (diluted) $1.94 $1.79 $0.15 8.4%

FFO pay-out ratio 70.0% 73.8% (3.8%)

Adjusted FFO ("AFFO") 112,135 81,707 30,428 37.2%

AFFO per unit (diluted) $1.66 $1.43 $0.23 16.1%

AFFO pay-out ratio 82.2% 92.3% (10.1%)

Total debt as a % of fair value of

investment properties 35.7% 36.4% (0.7%)

Net debt as a multiple of annualized

Q4 EBITDA 6.3:1 6.5:1 (0.2:1)

Operating interest-coverage ratio 4.0:1 3.2:1 0.8:1

Total interest-coverage ratio 3.0:1 2.7:1 0.3:1

----------------------------------------------------------------------------

Allied's financial performance measures for the fourth quarter and fiscal year

were up from the comparable quarter and period in 2012, despite a continuing

reduction in its debt ratios. This is a result of increased occupancy,

portfolio-wide rental growth, accretion from recent acquisitions and increasing

NOI as a result of value-creation activity.

Allied's operating performance measures were also strong. Having leased over 1.5

million square feet of space in 2013, Allied finished the year with its rental

portfolio 91.9% leased, 94.4% leased if upgrade properties are excluded. Allied

renewed or replaced leases for 85.6% of the GLA that matured in the 2013. This

resulted in an overall increase of 8.9% in net rental income per square foot

from the affected space.

With $182 million in acquisitions completed in 2013, Allied exceeded its targets

for the year. As expected, most of the acquisitions were immediately accretive

to FFO and AFFO per unit. They were also heavily weighted in Western Canada,

continuing the ongoing improvement in Allied's geographic diversification.

Allied's value-creation activity progressed well in 2013. Having completed one

upgrade project and five redevelopment projects over the course of the year,

Allied now has two upgrade projects and three redevelopment projects scheduled

for completion in 2014. Allied also has 11 intensification projects underway,

two of which are Properties Under Development and the remaining nine of which

are rental properties going through the municipal approval or pre-development

process. At the end of 2013, Allied's Properties Under Development represented

4% of the fair value of its portfolio.

Allied recently announced a major lease transaction at The Breithaupt Block in

Kitchener for 185,000 square feet and another at QRC West, Phase I, in Toronto

for 70,000 square feet. "These long-term commitments to our development

portfolio bode well for our value-creation activity going forward," said Mr.

Emory.

Allied's balance sheet continued to grow and strengthen in 2013. At the end of

the year, the fair value of its assets was $3.4 billion, up 16% from the end of

2012 through a combination of acquisitions ($182 million) and value appreciation

($285 million), offset somewhat by dispositions ($7 million). Allied's total

debt was 36% of fair value and comprised entirely of first mortgages with a

weighted average term of six years and a weighted average interest rate of 4.8%

Its immediate liquidity was $133 million, and it had approximately $400 million

in unencumbered properties, affording it very considerable near-term liquidity.

FFO, AFFO and EBITDA, total debt and net debt are not financial measures defined

by International Financial Reporting Standards ("IFRS"). Please see Allied's

MD&A for a description of these measures and their reconciliation to financial

measures defined by IFRS, as presented in Allied's consolidated financial

statements for the year ended December 31, 2013. These statements, together with

accompanying notes and MD&A, have been filed with SEDAR, www.sedar.com, and are

also available on Allied's web-site, www.alliedreit.com.

NOI is not a measure recognized under IFRS and does not have any standardized

meaning prescribed by IFRS. NOI is presented in this press release because

management of Allied believes that this non-IFRS measure is an important

financial performance indicator. NOI, as computed by Allied, may differ from

similar computations as reported by other similar organizations and,

accordingly, may not be comparable to NOI reported by such organizations.

This press release may contain forward-looking statements with respect to

Allied, its operations, strategy, financial performance and condition. These

statements generally can be identified by use of forward looking words such as

"may", "will", "expect", "estimate", "anticipate", intends", "believe" or

"continue" or the negative thereof or similar variations. Allied's actual

results and performance discussed herein could differ materially from those

expressed or implied by such statements. Such statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations. Important factors that could cause actual results to differ

materially from expectations include, among other things, general economic and

market factors, competition, changes in government regulations and the factors

described under "Risk Factors" in the Allied's Annual Information Form which is

available at www. sedar.com. The cautionary statements qualify all

forward-looking statements attributable to Allied and persons acting on its

behalf. Unless otherwise stated, all forward-looking statements speak only as of

the date of this press release, and Allied has no obligation to update such

statements.

Allied Properties REIT is a leading owner, manager and developer of urban office

environments that enrich experience and enhance profitability for business

tenants operating in Canada's major cities. Its objectives are to provide stable

and growing cash distributions to unitholders and to maximize unitholder value

through effective management and accretive portfolio growth.

FOR FURTHER INFORMATION PLEASE CONTACT:

Allied Properties Real Estate Investment Trust

Michael R. Emory

President & Chief Executive Officer

416.977.9002

memory@alliedreit.com

www.alliedreit.com

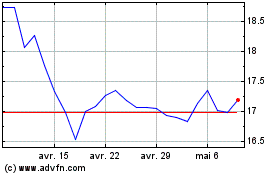

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Allied Properties Real E... (TSX:AP.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024