Aditxt Acquisition Target Evofem Biosciences Secures Investor Support Through Voting Agreements for Merger with Aditxt's Subsidiary Adifem

06 Novembre 2024 - 2:30PM

Business Wire

Aditxt, Inc. (NASDAQ: ADTX) (“Aditxt” or the “Company”), a

social innovation platform dedicated to accelerating promising

health innovations, announced today that its acquisition target,

Evofem Biosciences, Inc. (“Evofem”) (OTCQB: EVFM), has secured

voting agreements with certain of its investors to ensure they will

vote in favor of the merger proposal at Evofem’s upcoming Special

Meeting of Stockholders (the “Special Meeting”).

“We believe that the proposed merger represents a compelling

opportunity to accelerate Evofem’s growth trajectory in women’s

sexual and reproductive health as a subsidiary of Aditxt,” said

Saundra Pelletier, CEO of Evofem.

“We are making steady progress towards completing this

transaction, which will establish Aditxt’s women’s health mission,”

said Amro Albanna, Chairman, Co-Founder, and CEO of Aditxt. “With

Aditxt’s final pre-merger equity investment completed last week, we

believe that these voting agreements are critical in ensuring that

Evofem reaches a quorum at its upcoming special meeting and we hope

it will lead to a successful passage of the merger proposal.”

Under the voting agreements, certain holders of Evofem’s Series

E-1 Convertible Preferred Stock have agreed to vote the voting

power of their shares, and certain holders of Evofem’s Convertible

Notes have agreed to vote any Evofem common stock they hold as of

the record date for the Special Meeting, in favor of the merger

proposal.

Per the Amended and Restated Merger Agreement, as amended (the

“A&R Merger Agreement”), between the companies, Aditxt’s

subsidiary Adifem, Inc. is expected to merge with and into Evofem,

with Evofem remaining as the surviving entity and a wholly owned

subsidiary of Aditxt. The closing of the transactions is subject to

several conditions, including approval of the transactions by a

majority of the combined voting power of Evofem’s E-1 and Common

Stock, voting together as a single class, at a meeting where quorum

is present, and Aditxt raising sufficient capital to fund its

obligations prior to and at closing.

On October 28, 2024, Aditxt invested $2.28 million in Evofem

through the purchase of Evofem Series F-1 convertible preferred

stock. This was the final pre-merger equity investment stipulated

under the A&R Merger Agreement.

During its virtual stakeholder update on November 1, 2024,

Aditxt discussed its current non-compliance with Nasdaq’s minimum

bid price requirement and its expectation that it would be eligible

for an additional 180 calendar days to regain compliance if its

common stock closes below $1.00 for thirty consecutive days. As of

the date of this release, Aditxt’s common stock has closed below

$1.00 for 10 consecutive trading days. Aditxt is hereby clarifying

such statement that it may be eligible for an additional 180

calendar days to regain compliance if it meets all other initial

listing standards for The Nasdaq Capital Market. The Company

remains subject to a Nasdaq Panel Monitor until December 29,

2024.

About Aditxt, Inc.

Aditxt, Inc.® is a social innovation platform dedicated to

accelerating promising health innovations. Aditxt’s ecosystem of

research institutions, industry partners, and shareholders

collaboratively drives their mission to "Make Promising Innovations

Possible Together." The innovation platform is the cornerstone of

Aditxt’s strategy, where multiple disciplines drive disruptive

growth and address significant societal challenges. Aditxt operates

a unique model that democratizes innovation, ensures every

stakeholder’s voice is heard and valued, and empowers collective

progress.

Aditxt currently operates two programs focused on immune health

and precision health. The Company plans to introduce two additional

programs dedicated to public health and women’s health. For these,

Aditxt has entered into an Arrangement Agreement with Appili

Therapeutics, Inc. (“Appili”) (TSX: APLI; OTCPink: APLIF), which

focuses on infectious diseases, and a Merger Agreement with Evofem

Biosciences, Inc. (“Evofem”) (OTCQB:EVFM), a commercial stage

company with revenues from two FDA-approved products. Each program

will be designed to function autonomously while collectively

advancing Aditxt’s mission of discovering, developing, and

deploying innovative health solutions to tackle some of the most

urgent health challenges. The closing of each of the transactions

with Appili and Evofem is subject to several conditions, including

but not limited to approval of the transactions by the respective

target shareholders and Aditxt raising sufficient capital to fund

its obligations at the closings of the respective transactions,

which will require cash payments in the amounts of approximately

$17 million and approximately $17 million (which includes

approximately $15.2 million to satisfy certain senior indebtedness

of Evofem), respectively. No assurance can be provided that all of

the conditions to closing will be obtained or satisfied or that

either of the transactions will ultimately close.

For more information, www.aditxt.com.

Follow us on:

LinkedIn: https://www.linkedin.com/company/aditxt Facebook:

https://www.facebook.com/aditxtplatform/

Forward-Looking Statements

Certain statements in this press release constitute

“forward-looking statements” within the meaning of federal

securities laws. Forward-looking statements include statements

regarding the Company’s intentions, beliefs, projections, outlook,

analyses, or current expectations concerning, among other things :

the number of common shares of Evofem that the investors with whom

Evofem entered into the voting agreements will own on the record

date for Evofem’s Special Meeting of Stockholders and therefore be

entitled to vote in favor of the merger proposal; the date of

Evofem’s Meeting of Stockholders; the likelihood that a quorum will

be present at Evofem’s Meeting of Stockholders; the likelihood that

the merger agreement will be approved at Evofem’s Meeting of

Stockholders; Aditxt’s ability to secure the required funding to

meet its closing obligations on terms favorable to the Company, if

at all; Aditxt’s ability to regain and maintain compliance with

Nasdaq listing standards; the Company’s ongoing and planned product

and business development; the Company’s ability to finance and

execute its strategic M&A initiatives; the Company’s ability to

obtain the necessary funding and partner to commence clinical

trials; the Company’s intellectual property position; the Company’s

ability to develop commercial functions; expectations regarding

product launch and revenue; the Company’s results of operations,

cash needs, spending, financial condition, liquidity, prospects,

growth, and strategies; the Company’s ability to raise additional

capital; the industry in which the Company operates; and the trends

that may affect the industry or the Company. Forward-looking

statements are not guarantees of future performance, and actual

results may differ materially from those indicated by these

forward-looking statements as a result of various important

factors, as well as market and other conditions and those risks

more fully discussed in the section titled “Risk Factors” in

Aditxt’s most recent Annual Report on Form 10-K and Quarterly

Report on Form 10-Q, as well as discussions of potential risks,

uncertainties, and other important factors in the Company’s other

filings with the Securities and Exchange Commission. All such

statements speak only as of the date made, and the Company

undertakes no obligation to update or revise publicly any

forward-looking statements, whether as a result of new information,

future events or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106032852/en/

Aditxt, Inc. Investors: Jeff

Ramson, PCG Advisory, Inc. T: 646-863-6893 M: 917-912-9130

Jramson@pcgadvisory.com

Corporate Communications: Mary O’Brien Mobrien@aditxt.com

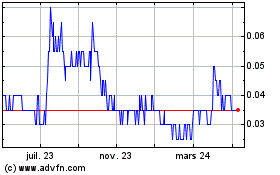

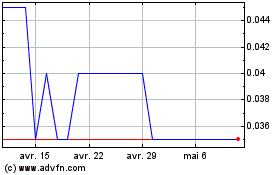

Appili Therapeutics (TSX:APLI)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Appili Therapeutics (TSX:APLI)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025