Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company")

reported today results for the quarter ended March 31, 2013.

Amerigo's President and CEO, Dr. Klaus Zeitler, stated, "We are

pleased to report excellent production and financial results for

the first quarter of 2013. MVC produced 12.8 million pounds of

copper at a cash cost of $1.95/lb Cu. Net earnings for the quarter

at $3.2 million were 39% higher than in Q1-2012 and operating cash

flow was $7.3 million. MVC also continued to make progress in

negotiations with Codelco with respect to the right to process

tailings from the Cauquenes impoundment and an extension to the

fresh tailings contract."

Rob Henderson, Chief Operating Officer, said, "A recent slide in

one of the Colihues working areas has necessitated a change to

MVC's mine plan, and during the second and third quarters Colihues

extraction rates and grades will be lower than originally

anticipated. Copper production is now expected to be at the lower

end of our previously announced guidance of 45 to 50 million pounds

and guidance for molybdenum has been revised downward to 700,000

pounds for 2013. The Company is also conducting a detailed economic

review of molybdenum production under current prices."

Dr. Zeitler added, "The recent volatility in the copper price

together with our revised production guidance has adversely

affected projected financial performance for the remainder of 2013,

and particularly for the next two quarters. In light of these

circumstances the board of directors has decided that it is prudent

to defer a decision on the Company's next dividend payment until

Q3-2013. Amerigo remains committed to its current dividend policy

of paying dividends averaging at least one-third of reported net

earnings calculated over a period of years."

Comparative Quarterly Overview

---------------------------------------------------------------------------

Three months ended March 31,

2013 2012 Change

$ %

---------------------------------------------------------------------------

Copper produced, million pounds 12.83 13.88 (1.05) (8%)

Copper sold, million pounds 12.48 14.08 (1.60) (11%)

Molybdenum produced, pounds 258,301 216,292 42,009 19%

Molybdenum sold, pounds 240,744 303,547 (62,803) (21%)

Percentage of copper production from 49% 52% (3%)

old tailings

Revenue ($ thousands) 43,161 50,499 (7,338) (15%)

Cost of sales(1) ($ thousands) 38,037 47,367 (9,330) (20%)

El Teniente royalty costs ($ 10,700 11,684 (984) (8%)

thousands)

Gross profit ($ thousands) 5,124 3,132 1,992 64%

Net profit ($ thousands) 3,238 2,310 928 40%

Operating cash flow ($ thousands) 7,335 7,141 194 2.72%

Cash flow paid for plant expansion (3,645) (8,601) 4,956 (58%)

($ thousands)

Cash and cash equivalents ($ 13,280 19,176 (5,896) (31%)

thousands)

Bank debt ($ thousands) 999 4,394 (3,395) (77%)

Average realized copper price per 3.52 3.55 (0.03) (1%)

pound

Cash cost per pound 1.95 2.35 (0.40) (17%)

Total cost per pound 3.11 3.48 (0.37) (11%)

---------------------------------------------------------------------------

(1) Includes El Teniente royalty costs

Financial results

-- Revenue was $43.2 million, compared to $50.5 million in Q1-2012.

Revenues decreased 15% due to lower copper and molybdenum sales volume

and lower average metal prices.

-- Cost of sales was $38 million, compared to $47.4 million in Q1-2012, a

decrease of 20% driven by lower production levels and substantially

reduced power costs mainly as a result of the change in the Company's

power contract from a variable to a lower fixed rate.

-- Gross profit was $5.1 million, compared to $3.1 million in Q1-2012.

-- Net profit was $3.2 million, compared to $2.3 million in Q1-2012.

Production

-- The Company produced 12.8 million pounds of copper, 8% lower than the

13.9 million pounds produced in Q1-2012.

-- Molybdenum production was 258,301 pounds, 19% higher than the 216,292

pounds produced in Q1-2012.

Revenue

-- Revenue decreased to $43.2 million, compared to $50.5 million in Q1-

2012, due to lower production levels and lower metal prices. The

Company's copper selling price before smelting, refining and other

charges was $3.52/lb compared to $3.55/lb in Q1-2012, and the Company's

molybdenum selling price was $11.34/lb compared to $14.10/lb in Q1-2012.

Costs

-- Cash cost (the aggregate of smelting, refining and other charges,

production costs net of molybdenum-related net benefits, administration

and transportation costs) before El Teniente royalty was $1.95/lb,

compared to $2.35/lb in Q1-2012. Cash costs decreased in Q1-2013 mostly

as a result of a $0.46/lb reduction in power costs.

-- Total cost (the aggregate of cash cost, El Teniente royalty,

depreciation and accretion) was $3.11/lb compared to $3.48/lb in Q1-

2012.

-- Power costs in Q1-2013 were $6.4 million ($0.0970/kwh) compared to $13.3

million ($0.2151/kwh) in Q1-2012. Similar lower power cost levels are

expected to December 31, 2017, the end of the term of MVC's current

power contract.

-- Total El Teniente royalties were $10.7 million in Q1-2013, compared to

$11.7 million in Q1-2012, due to lower production and metal prices.

Cash and Financing Activities

-- Cash balance was $13.3 million at March 31, 2013 compared to $9.3

million at December 31, 2012.

Investments

-- Cash payments for capital expenditures ("Capex") were $3.6 million

compared to $8.6 million in Q1-2012. Capex payments have been funded

from operating cash flow and cash at hand.

-- Capex incurred in Q1-2013 totaled $2 million (Q1-2012: $7.4 million) and

included project investments in anticipation of the Company obtaining

the rights to process tailings from Cauquenes and sustaining Capex

projects.

-- The Company's investments in Candente Copper Corp. ("Candente Copper)",

Candente Gold Corp. ("Candente Gold"), Cobriza Metals Corp. ("Cobriza")

and Los Andes Copper Ltd. ("Los Andes") had an aggregate fair value of

$4.8 million at March 31, 2013 (December 31, 2012: $4.1 million).

Outlook

-- Management guidance for 2013 copper production remains at the lower end

of the previously announced range of 45 to 50 million pounds. Guidance

for molybdenum production has been revised downwards to approximately

700,000 pounds. The Company is also conducting a detailed economic

review of molybdenum production under current prices, given the minimal

profitability provided by the molybdenum operations.

-- Cash cost continues to be projected to be between $1.95/lb and $2.15/lb

Cu in 2013.

-- Excluding the Cauquenes project, 2013 Capex at MVC is now estimated to

be approximately $7.2 million, an increase of $0.2 million from prior

guidance. Capex for Cauquenes engineering and permitting in 2013 has

been revised from $1.9 million to $2.4 million. Codelco/El Teniente has

agreed to reimburse up to $3.8 million of these costs in the event the

parties are unable to reach an agreement for the processing of Cauquenes

tailings.

The information in this news release and the Selected Financial

Information contained in the following page should be read in

conjunction with the Unaudited Condensed Consolidated Interim

Financial Statements and Management's Discussion and Analysis for

the quarter ended March 31, 2013 and the Audited Consolidated

Financial Statements and Management's Discussion and Analysis for

the year ended December 31, 2012, which will be available at the

Company's website at www.amerigoresources.com and at

www.sedar.com.

Amerigo Resources Ltd. produces copper and molybdenum under a

long term partnership with the world's largest copper producer,

Codelco, by means of processing fresh and old tailings from the

world's largest underground copper mine, El Teniente near Santiago,

Chile. Tel: (604) 681-2802; Fax: (604) 682-2802; Web:

www.amerigoresources.com; Listing: ARG:TSX

Certain of the information and statements contained herein that

are not historical facts, constitute "forward-looking information"

within the meaning of the Securities Act (British Columbia),

Securities Act (Ontario) and the Securities Act (Alberta)

("Forward-Looking Information"). Forward-Looking Information is

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect" and

"intend"; statements that an event or result is "due" on or "may",

"will", "should", "could", or might" occur or be achieved; and,

other similar expressions. More specifically, Forward-Looking

Information contained herein includes, without limitation,

information concerning future tailings production volumes and the

Company's copper and molybdenum production, all of which involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company, or industry results, to be materially different from any

future results, performance or achievements expressed or implied by

such Forward-Looking Information; including, without limitation,

material factors and assumptions relating to, and risks and

uncertainties associated with, the supply of tailings from El

Teniente and extraction of tailings from the Colihues tailings

impoundment, the achievement and maintenance of planned production

rates, the evolving legal and political policies of Chile, the

volatility in the Chilean economy, military unrest or terrorist

actions, metal price fluctuations, favourable governmental

relations, the availability of financing for activities when

required and on acceptable terms, the estimation of mineral

resources and reserves, current and future environmental and

regulatory requirements, the availability and timely receipt of

permits, approvals and licenses, industrial or environmental

accidents, equipment breakdowns, availability of and competition

for future mineral acquisition opportunities, availability and cost

of insurance, labour disputes, land claims, the inherent

uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other

risks and uncertainties, including those described under Risk

Factors in the Company's Annual Information Form and in

Management's Discussion and Analysis in the Company's financial

statements.

Such Forward-Looking Information is based upon the Company's

assumptions regarding global and Chilean economic, political and

market conditions and the price of metals, including copper and

molybdenum, and future tailings production volumes and the

Company's copper and molybdenum production. Among the factors that

have a direct bearing on the Company's future results of operations

and financial conditions are changes in project parameters as plans

continue to be refined, interruptions in the supply of fresh

tailings from El Teniente, further delays in the extraction of

tailings from the Colihues tailings impoundment, a change in

government policies, competition, currency fluctuations and

restrictions and technological changes, among other things. Should

one or more of any of the aforementioned risks and uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from any conclusions, forecasts

or projections described in the Forward-Looking Information.

Accordingly, readers are advised not to place undue reliance on

Forward-Looking Information. Except as required under applicable

securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Information, whether as a

result of new information, future events or otherwise.

AMERIGO RESOURCES LTD.

SELECTED FINANCIAL INFORMATION

QUARTERS ENDED MARCH 31, 2013 AND 2012

All figures expressed in US Dollars and presented under IFRS

Consolidated Statements of Financial Position

2013 2012

$ $

------------------------

Cash and cash equivalents 13,280 9,250

Property, plant and equipment 157,775 157,073

Other assets 37,233 38,093

------------------------

Total assets 208,288 204,416

------------------------

Total liabilities 69,913 72,218

Shareholders' equity 138,375 132,198

------------------------

Total liabilities and shareholders' equity 208,288 204,416

------------------------

Consolidated Statements of Comprehensive Income

March 31, March 31,

2013 2012

$ $

------------------------

Revenue 43,161 50,499

Cost of sales (38,037) (47,367)

Other expenses (703) (42)

Finance expense (185) (199)

Income tax expense (998) (581)

------------------------

Profit for the period 3,238 2,310

Other comprehensive income 2,908 8,567

------------------------

Comprehensive income 6,146 10,877

------------------------

EPS- Basic and Diluted 0.02 (0.01)

Consolidated Statements of Cash Flows

March 31, March 31,

2013 2012

$ $

------------------------

Net cash provided by operating activities 8,203 7,584

Net cash used in investing activities (3,645) (8,601)

Net cash used in financing activities (504) (353)

------------------------

Net cash inflow (outflow) during the period 4,054 (1,370)

------------------------

Contacts: Amerigo Resources Ltd. Dr. Klaus Zeitler President

& CEO (604) 218-7013 Amerigo Resources Ltd. (604) 697-6201

www.amerigoresources.com

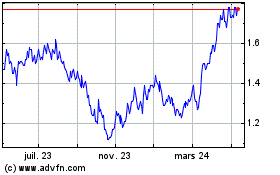

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

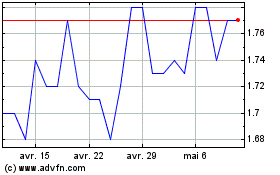

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025