Amerigo Resources Ltd. (TSX: ARG; OTCQX: ARREF) (“Amerigo” or the

“Company”) is pleased to announce that it has received approval

from the Toronto Stock Exchange (the “TSX”) to proceed with a new

normal course issuer bid (the “NCIB”).

The NCIB will commence on December 2, 2024, and

may continue until December 1, 2025, or at such earlier time as the

NCIB is completed or terminated at the Company's option.

Under the NCIB, Amerigo may purchase for

cancellation up to 12,000,000 common shares of the Company (the

“Shares”), approximately 10% of Amerigo’s public float as of

November 26, 2024. As of November 26, 2024, there were 164,532,844

issued and outstanding Shares of the Company, of which 120,238,264

were forming the public float. All Shares purchased under the NCIB

will be purchased in accordance with the requirements of the

TSX.

“The NCIB is one of the three main tools we use

to return capital to shareholders, and we have renewed our ability

to buy back shares for cancellation for another year,” said Aurora

Davidson, Amerigo’s President and CEO. “Since we launched Amerigo’s

Capital Return Policy three years ago, we are pleased to report

that we have retired more than 21.6 million Shares1. Over the next

12 months, we will continue opportunistically utilizing the NCIB,

depending on copper prices and market conditions. At a minimum, we

intend to buy back enough Shares to eliminate annual shareholder

dilution,” added Ms. Davidson.

Amerigo’s average daily trading volume (“ADTV”)

for the six months ending October 31, 2024, was 249,238 Shares.

Therefore, the new NCIB’s daily purchase limit will be 62,309

Shares, 25% of ADTV. However, once per calendar week, Amerigo may

make one block purchase that exceeds the daily purchase

restriction.

Under the NCIB, Shares may be purchased in open

market transactions on the TSX at the prevailing market price at

the time of such trade. All Shares purchased under the NCIB will be

cancelled.

Under Amerigo’s previous NCIB, which commenced

on December 2, 2023, and will expire on December 1, 2024, Amerigo

received TSX approval to purchase up to 10,900,000 Shares in open

market transactions on the TSX. As of the date of this release,

Amerigo had repurchased and cancelled 1,436,754 Shares at a

weighted average purchase price of Cdn$1.76 per Share under that

earlier NCIB.

Amerigo has a high-yield2 Capital Return

Strategy that uses quarterly dividends, performance dividends and

share buybacks to consistently return capital to shareholders.

Amerigo believes that the opportunistic purchase of Shares under

NCIBs is an appropriate use of available funds and is accretive to

the value of Amerigo’s Shares. The NCIB is in line with Amerigo’s

long-term commitment to creating value for Amerigo’s

shareholders.

Amerigo will determine the actual number of

shares purchased under the NCIB and the timing of such purchases.

There cannot be any assurance as to how many Shares, if any, will

ultimately be acquired by the Company.

1 Capital returned to

shareholdersThe table below summarizes the capital

returned to shareholders since Amerigo’s Capital Return Strategy

was implemented in October 2021.

|

(Expressed in millions) |

|

|

|

|

|

|

|

|

|

Shares Repurchased |

Dividends Paid |

Total |

|

|

$ |

$ |

$ |

|

2021 |

8.8 |

2.8 |

11.6 |

|

2022 |

12.3 |

15.8 |

28.1 |

|

2023 |

2.6 |

14.6 |

17.2 |

|

2024 |

1.8 |

15.8 |

17.6 |

|

|

25.5 |

49.0 |

74.5 |

2 Dividend

yieldThe annual yield at the time of this news release is

9.4% based on four quarterly dividends of Cdn$0.03 per share each

and the July 8, 2024, Performance Dividend of Cdn$0.04, divided

over Amerigo’s November 26, 2024 closing share price of

Cdn$1.71.

About Amerigo and Minera Valle Central

(“MVC”)

Amerigo Resources Ltd. is an innovative copper

producer with a long-term relationship with Corporación Nacional

del Cobre de Chile (“Codelco”), the world’s largest copper

producer.

Amerigo produces copper concentrate and

molybdenum concentrate as a by-product at the MVC operation in

Chile by processing fresh and historic tailings from Codelco’s El

Teniente mine, the world's largest underground copper mine. Tel:

(604) 681-2802; Web: www.amerigoresources.com; TSX: ARG; OTCQX:

ARREF.

Contact Information

| Aurora

Davidson |

Graham

Farrell |

| President and CEO |

Investor Relations |

| (604) 697-6207 |

(416) 842-9003 |

| ad@amerigoresources.com |

Graham@49northir.ca |

Forward-Looking Information

Forward-looking information (“forward-looking

statements”) is included in this news release. These

forward-looking statements are identified by the use of terms such

as “anticipate”, “believe”, “could”, “estimate”, “expect”,

“intend”, “may”, “plan”, “predict”, “project”, “will”, “would”, and

“should” and similar terms and phrases, including references to

assumptions. Such statements may involve, but are not limited to,

Amerigo’s plans, objectives, expectations and intentions, including

Amerigo’s objectives and expectations regarding the number of

shares that Amerigo may purchase under the NCIB, Amerigo’s return

of capital policy and other comments concerning strategies,

expectations, planned operations or future actions.

These forward-looking statements involve known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such statements. Inherent in forward-looking

statements are risks and uncertainties beyond Amerigo’s ability to

predict or control, including risks that may affect Amerigo’s

operating or capital plans; risks generally encountered in the

permitting and development of mineral projects such as unusual or

unexpected geological formations, negotiations with government and

other third parties, unanticipated metallurgical difficulties,

delays associated with permits, approvals and permit appeals,

ground control problems, adverse weather conditions, process upsets

and equipment malfunctions; risks associated with labour

disturbances and availability of skilled labour and management;

risks related to the potential impact of global or national health

concerns, and the inability of employees to access sufficient

healthcare; government or regulatory actions or inactions;

fluctuations in the market prices of Amerigo’s principal

commodities, which are cyclical and subject to substantial price

fluctuations; risks created through competition for mining projects

and properties; risks associated with lack of access to markets;

risks associated with availability of and Amerigo’s ability to

obtain both tailings from Codelco’s Division El Teniente’s current

production and historic tailings from tailings deposits; risks with

respect to the ability of Amerigo to draw down funds from lines of

credit and the availability of and ability of Amerigo to obtain

adequate funding on reasonable terms for expansions and

acquisitions; mine plan estimates; risks posed by fluctuations in

exchange rates and interest rates, as well as general economic

conditions; risks associated with environmental compliance and

changes in environmental legislation and regulation; risks

associated with Amerigo’s dependence on third parties for the

provision of critical services; risks associated with

non-performance by contractual counterparties; title risks; social

and political risks associated with operations in foreign

countries; risks of changes in laws affecting Amerigo’s operations

or their interpretation, including foreign exchange controls; and

risks associated with tax reassessments and legal proceedings. Many

of these risks and uncertainties apply to Amerigo and its

operations and Codelco and its operations. Codelco’s ongoing mining

operations provide a significant portion of the materials Amerigo

processes and its resulting metals production. Therefore, these

risks and uncertainties may also affect their operations and have a

material effect on Amerigo.

Actual results and developments are likely to

differ materially from those expressed or implied by the

forward-looking statements in this news release. Such statements

are based on several assumptions which may prove to be incorrect,

including, but not limited to, assumptions about:

- general business and economic

conditions;

- interest and currency exchange

rates;

- changes in commodity and power

prices;

- acts of foreign governments and the

outcome of legal proceedings;

- the supply and demand for,

deliveries of, and the level and volatility of prices of copper,

molybdenum and other commodities and products used in our

operations;

- the ongoing supply of material for

processing from DET’s current mining operations;

- the grade and projected recoveries

of tailings processed by MVC;

- the ability of the Company to

profitably extract and process material from the historic tailings

deposit;

- the timing of the receipt of and

retention of permits and other regulatory and governmental

approvals;

- our costs of production and our

production and productivity levels, as well as those of our

competitors;

- changes in credit market conditions

and conditions in financial markets generally;

- our ability to procure equipment

and operating supplies in sufficient quantities and on a timely

basis;

- the availability of qualified

employees and contractors for our operations;

- our ability to attract and retain

skilled staff;

- the satisfactory negotiation of

collective agreements with unionized employees;

- the impact of changes in foreign

exchange rates and capital repatriation on our costs and

results;

- engineering and construction

timetables and capital costs for our expansion projects;

- costs of closure of various

operations;

- market competition;

- tax benefits and tax rates;

- the outcome of our copper

concentrate sales and treatment and refining charge

negotiations;

- the resolution of environmental and

other proceedings or disputes;

- the future supply of reasonably

priced power;

- average recoveries for fresh and

historic tailings;

- our ability to obtain, comply with

and renew permits and licenses in a timely manner; and

- Our ongoing relations with our

employees and entities we do business with.

Future production levels and cost estimates

assume no adverse mining or other events significantly affecting

budgeted production levels.

Climate change is a global issue that could pose

challenges that could affect the Company's future operations. This

could include more frequent and intense droughts followed by

intense rainfall. In the last several years, Central Chile has had

drought conditions and also rain episodes of significant magnitude.

The Company’s operations are sensitive to water availability and

the reserves required to process projected historic tailings

tonnage.

Although the Company believes that these

assumptions were reasonable when made, they are inherently subject

to significant uncertainties and contingencies that are difficult

or impossible to predict and are beyond the Company’s control.

Therefore, the Company cannot assure that it will achieve or

accomplish the expectations, beliefs, or projections described in

the forward-looking statements.

The preceding list of important factors and

assumptions is not exhaustive. Other events or circumstances could

cause our results to differ materially from those estimated,

projected, and expressed in or implied by our forward-looking

statements. You should also consider the matters discussed under

Risk Factors in the Company`s Annual Information Form. The

forward-looking statements contained herein speak only as of the

date of this news release. Except as required by law, we undertake

no obligation to revise any forward-looking statements or the

preceding list of factors, whether due publicly or otherwise, to

new information or future events.

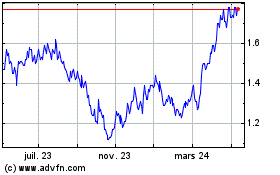

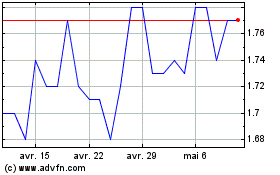

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024