Amerigo Announces Cauquenes Approval and Contract Extension to 2037

22 Juillet 2013 - 6:00PM

Marketwired

Amerigo Resources Ltd. (TSX:ARG) ("Amerigo" or the "Company")

announced today that it has received official notice that the board

of directors of the Corporacion Nacional del Cobre de Chile

("Codelco") has approved the major terms of an agreement between

Codelco's El Teniente Division ("ET") and the Company's Chilean

subsidiary, Minera Valle Central, S.A. ("MVC") granting MVC the

rights to process the historic tailings in the Cauquenes deposit

located near MVC's plant and extending the fresh tailings contract

to 2037.

Dr. Klaus Zeitler, Amerigo's President and CEO, stated "This is

a major milestone for the Company. It will allow Amerigo to double

annual copper and molybdenum production and will extend from 2021

to 2037 MVC's right to process fresh and old tailings from El

Teniente. The Company anticipates receiving final environmental and

regulatory approval for the project within the next several months,

during which time the Company and ET will work together to finalize

the details of the formal agreement. The Company is also currently

in advanced discussions to obtain project financing."

Rob Henderson, Amerigo's Chief Operating Officer, added "When

Cauquenes reaches full production levels in 2015, Amerigo's per

pound production costs are estimated to be reduced by more than 20%

from current levels, significantly improving the Company's

financial results and reducing MVC's dependence on El Teniente's

daily production. The feasibility study is in its final stages and

MVC is now in a position to place equipment orders for the first

phase of the expansion."

Copper production from Cauquenes will be subject to a sliding

scale royalty for LME prices from US$1.95 to US$5.50 per pound,

with a base rate of 16% that will vary with the copper price. There

will be an adjustment mechanism in the formal agreement for prices

outside of the LME price range for the Cauquenes royalty. The fresh

tailings royalty will also be changed to a sliding scale and

modified to remove disadvantageous foreign exchange rate

provisions. .The base rate for the fresh tailings royalty will be

13.5%, and the threshold increased from US$0.80 per pound to

US$1.95 per pound, the same minimum level as that for the Cauquenes

royalty. The minimum price level for paying royalties is based on

MVC's operating costs, including depreciation and financing costs,

and will be adjusted to MVC's actual costs one year after Cauquenes

is in full production. The parties will meet and review the cost

and royalty structure if and when MVC's cost structure changes

significantly. The formal agreement will also contain provisions

allowing Codelco to purchase MVC's operations at certain

predetermined times based on their future net present value.

The Company will provide additional details after all

environmental approvals are obtained, the feasibility study has

been completed, and financing arrangements and the formal agreement

have been finalized.

Amerigo Resources Ltd. produces copper and molybdenum under a

long term partnership with the world's largest copper producer,

Codelco, by means of processing fresh and old tailings from the

world's largest underground copper mine, El Teniente near Santiago,

Chile. Tel: (604) 681-2802; Fax: (604) 682-2802; Web:

www.amerigoresources.com; Listing: ARG:TSX

Certain of the information and statements contained herein that

are not historical facts, constitute "forward-looking information"

within the meaning of the Securities Act (British Columbia),

Securities Act (Ontario) and the Securities Act (Alberta)

("Forward-Looking Information"). Forward-Looking Information is

often, but not always, identified by the use of words such as

"seek", "anticipate", "believe", "plan", "estimate", "expect" and

"intend"; statements that an event or result is "due" on or "may",

"will", "should", "could", or might" occur or be achieved; and,

other similar expressions. More specifically, Forward-Looking

Information contained herein includes, without limitation,

information concerning future tailings production volumes and the

Company's copper and molybdenum production, all of which involve

known and unknown risks, uncertainties and other factors which may

cause the actual results, performance or achievements of the

Company, or industry results, to be materially different from any

future results, performance or achievements expressed or implied by

such Forward-Looking Information; including, without limitation,

material factors and assumptions relating to, and risks and

uncertainties associated with, the supply of tailings from El

Teniente and extraction of tailings from the Colihues and Cauquenes

tailings impoundments, the achievement and maintenance of planned

production rates, the evolving legal and political policies of

Chile, the volatility in the Chilean economy, military unrest or

terrorist actions, metal price fluctuations, favourable

governmental relations, the availability of financing for

activities when required and on acceptable terms, the estimation of

mineral resources and reserves, current and future environmental

and regulatory requirements, the availability and timely receipt of

permits, approvals and licenses, industrial or environmental

accidents, equipment breakdowns, availability of and competition

for future mineral acquisition opportunities, availability and cost

of insurance, labour disputes, land claims, the inherent

uncertainty of production and cost estimates, currency

fluctuations, expectations and beliefs of management and other

risks and uncertainties, including those described under Risk

Factors in the Company's Annual Information Form and in

Management's Discussion and Analysis in the Company's financial

statements.

Such Forward-Looking Information is based upon the Company's

assumptions regarding global and Chilean economic, political and

market conditions and the price of metals, including copper and

molybdenum, and future tailings production volumes and the

Company's copper and molybdenum production. Among the factors that

have a direct bearing on the Company's future results of operations

and financial conditions are changes in project parameters as plans

continue to be refined, interruptions in the supply of fresh

tailings from El Teniente, delays in the extraction of tailings

from the Colihues and Cauquenes tailings impoundments, a change in

government policies, competition, currency fluctuations and

restrictions and technological changes, among other things. Should

one or more of any of the aforementioned risks and uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from any conclusions, forecasts

or projections described in the Forward-Looking Information.

Accordingly, readers are advised not to place undue reliance on

Forward-Looking Information. Except as required under applicable

securities legislation, the Company undertakes no obligation to

publicly update or revise Forward-Looking Information, whether as a

result of new information, future events or otherwise

Contacts: Amerigo Resources Ltd. Dr. Klaus Zeitler President and

CEO (604) 218-7013 Amerigo Resources Ltd. (604) 697-6201

www.amerigoresources.com

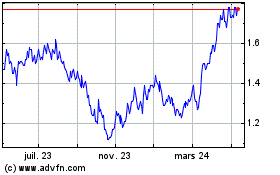

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

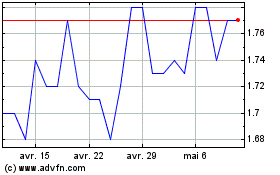

Amerigo Resources (TSX:ARG)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025