Brookfield Global Infrastructure Securities Income Fund Announces Normal Course Issuer Bid For Units

10 Octobre 2013 - 4:34PM

Marketwired Canada

Brookfield Global Infrastructure Securities Income Fund (the "Fund")

(TSX:BGI.UN) announced today acceptance by the Toronto Stock Exchange (the

"TSX") of the Fund's Notice of Intention to make a Normal Course Issuer Bid (the

"NCIB").

Pursuant to the NCIB, the Fund proposes to purchase through the facilities of

the TSX, from time to time, if it is considered advisable, up to 3,440,000 units

of the Fund, representing approximately 10% of the public float, being

34,400,000 units of the Fund (the "Units") as of the close of business on

October 4, 2013. The Fund will not purchase in any given 30-day period, in the

aggregate, more than 688,000 Units, representing approximately 2% of the issued

and outstanding Units, being 34,400,000 Units as of the close of business on

October 4, 2013. Purchases of Units under the NCIB may commence on October 15,

2013. The Fund believes that such purchases are in the best interests of the

Fund and are a desirable use of the Fund's funds. All purchases will be made

through the facilities of the TSX in accordance with its rules and policies. All

Units purchased by the Fund pursuant to the NCIB will be cancelled. The NCIB

will expire on October 14, 2014.

Brookfield Asset Management

Brookfield is a global alternative asset manager with over $183 billion in

assets under management as of June 30, 2013. We have over a 100-year history of

owning and operating assets with a focus on property, renewable power,

infrastructure and private equity. We offer a range of public and private

investment products and services, which leverage our expertise and experience

and provide us with a distinct competitive advantage in the markets where we

operate. On behalf of our clients, Brookfield is also an active investor in the

public securities markets, where our experience extends over 30 years. Over this

time, we have successfully developed several investment operations and built

expertise in the management of institutional portfolios, retail mutual funds,

and structured product investments.

Brookfield Investment Management

Through our registered investment advisor, Brookfield Investment Management, our

public market activities complement our core competencies as a direct investor.

These activities encompass global listed real estate and infrastructure

equities, corporate high yield investments, opportunistic credit strategies and

a dedicated insurance asset management division. Headquartered in New York, NY,

Brookfield Investment Management maintains offices and investment teams in

Toronto, Chicago, Boston and London and has over $10 billion of assets under

management as of June 30, 2013.

The Fund uses its web site as a channel of distribution of material company

information. Financial and other material information regarding the Fund is

routinely posted on and accessible at www.brookfieldim.com.

FOR FURTHER INFORMATION PLEASE CONTACT:

Brookfield Global Infrastructure Securities Income Fund

Investor Relations

(855) 777-8001

funds@brookfield.com

www.brookfieldim.com

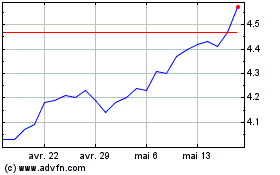

Brookfield Global Infras... (TSX:BGI.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Brookfield Global Infras... (TSX:BGI.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024