BIP Investment Corporation Announces Preferred Shareholder Meeting for Early Redemption of Preferred Shares

24 Octobre 2024 - 10:34PM

BIP Investment Corporation (“BIPIC”) (TSX: BIK.PR.A), an indirect

subsidiary of Brookfield Infrastructure Partners L.P. (“Brookfield

Infrastructure”) (NYSE: BIP; TSX: BIP.UN), today announced that it

will be holding a special meeting of holders of senior preferred

shares, series 1 (the “Preferred Shares”) on November 27, 2024 at

10:00 a.m. (Eastern time) (the “Meeting”) in a virtual format

whereby holders may attend and participate via live webcast.

At the meeting, BIPIC will be seeking approval

from holders of the Preferred Shares (“Preferred Shareholders”) to

pass a special resolution (the “Special Resolution”) to permit the

redemption of the Preferred Shares by BIPIC at any time on not less

than three business days’ notice for an amount in cash equal to

C$26.75 per Preferred Share (the “Enhanced Redemption Price”). If

the Special Resolution is approved, BIPIC intends to provide notice

promptly following the Meeting of its intention to redeem all of

the outstanding Preferred Shares for the Enhanced Redemption Price

(the “Redemption”).

BIPIC intends to declare a quarterly dividend

for the fourth quarter of 2024 in the amount of C$0.4671875 per

Preferred Share payable immediately prior to the Redemption (the

“Q4 2024 Dividend”) and to elect that the Q4 2024 Dividend be

deemed a capital gains dividend. The Q4 2024 Dividend, if declared,

will be paid to Preferred Shareholders of record as of November 29,

2024 in addition to the Enhanced Redemption Price in the event the

Special Resolution is approved at the Meeting and the Preferred

Shares are redeemed by BIPIC.

Preferred Shareholders of record as of market

close on October 25, 2024 will be entitled to receive notice of and

vote at the Meeting. The Special Resolution must be passed by the

affirmative vote of 66 2/3% of the votes cast at the Meeting.

A management information circular containing the

details of the Meeting and the matters to be presented and voted on

will be mailed on or about November 1, 2024 to all holders of

Preferred Shares of record as of market close on October 25, 2024,

and will also be available on BIPIC’s SEDAR+ profile at

https://sedarplus.ca.

About Brookfield

Infrastructure

Brookfield Infrastructure is a leading global

infrastructure company that owns and operates high-quality,

long-life assets in the utilities, transport, midstream and data

sectors across the Americas, Asia Pacific and Europe. We are

focused on assets that have contracted and regulated revenues that

generate predictable and stable cash flows. Investors can access

its portfolio either through Brookfield Infrastructure Partners

L.P. (NYSE: BIP; TSX: BIP.UN), a Bermuda-based limited partnership,

or Brookfield Infrastructure Corporation (NYSE, TSX: BIPC), a

Canadian corporation. Further information is available

at https://bip.brookfield.com.

Brookfield Infrastructure is the flagship listed

infrastructure company of Brookfield Asset Management, a global

alternative asset manager with approximately US$1 trillion of

assets under management. For more information, go

to https://brookfield.com.

Contact Information

|

Media:Simon MaineManaging DirectorCorporate

CommunicationsTel: +44 739 890 9278Email:

simon.maine@brookfield.com |

Investor Relations: Stephen FukudaSenior Vice

President Corporate Development & Investor RelationsTel: +1

(416) 956 5129 Email: Stephen.fukuda@brookfield.com |

|

|

|

Cautionary Statement Regarding

Forward-looking Statements

This news release contains forward-looking

statements and information within the meaning of applicable

securities laws. The words, “will”, “intend” and “expect” or

derivations thereof and other expressions which are predictions of

or indicate future events, trends or prospects, and which do not

relate to historical matters, identify forward-looking statements.

Forward-looking statements in this news release include statements

regarding BIPIC’s intentions with respect to the redemption of the

Preferred Shares, the declaration and payment of BIPIC’s regular

quarterly dividend in respect of the Preferred Shares and the

conduct of the Meeting. Factors that could cause actual results,

performance, achievements or events to differ from current

expectations include, among others, risks and uncertainties related

to: obtaining approvals or satisfying other requirements necessary

or desirable to permit or facilitate the redemption of the

Preferred Shares; and business cycles, including general economic

conditions. Although Brookfield Infrastructure believes that these

forward-looking statements and information are based upon

reasonable assumptions and expectations, the reader should not

place undue reliance on them, or any other forward-looking

statements or information in this news release. The future

performance and prospects of Brookfield Infrastructure are subject

to a number of known and unknown risks and uncertainties.

Factors that could cause actual results of

Brookfield Infrastructure to differ materially from those

contemplated or implied by the statements in this news release are

described in the documents filed by Brookfield Infrastructure with

the securities regulators in Canada and the United States including

under “Risk Factors” in Brookfield Infrastructure’s most recent

Annual Report on Form 20-F and other risks and factors that are

described therein. Except as required by law, Brookfield

Infrastructure undertakes no obligation to publicly update or

revise any forward-looking statements or information, whether as a

result of new information, future events or otherwise.

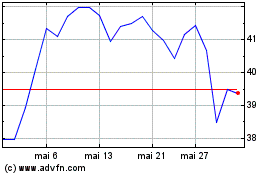

Brookfield Infrastructur... (TSX:BIP.UN)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Brookfield Infrastructur... (TSX:BIP.UN)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025