Prime U.S. Banking Sector Split Corp. Announces Initial Public Offering

01 Octobre 2013 - 9:35PM

Marketwired

Prime U.S. Banking Sector Split Corp. ("The Company") is pleased to

announce the filing of a preliminary prospectus dated September 30,

2013 for a proposed new offering. The offering is an investment in

common shares of a portfolio consisting primarily of 15 U.S.

financial services companies selected from a portfolio universe

consisting of 20 companies. The Company will offer two investment

choices: Priority Equity Shares at $10 per share and Class A shares

at $10 per share.

The Company's Priority Equity Shares will provide holders with

monthly cumulative preferential floating rate cash dividends at an

annual rate of U.S. prime plus 1.75% (Min: 5.0% / Max: 7.0%) based

on the original issue price.

The Company's Class A Shares offer regular monthly cash

dividends initially targeted to be 6.5% per annum based on the

original issue price. The Class A shares will be entitled on

redemption to the benefit of any capital appreciation in the market

price of the shares in the portfolio.

The Company has been created to provide investors with an

opportunity to invest in a portfolio of 15 U.S. financial services

companies whose shares will likely continue to benefit from an

improving economy. The Company will employ a covered call writing

strategy to generate additional income to the portfolio.

The 15 portfolio companies will be selected from a portfolio

universe consisting of the following 20 companies:

American Express Company City National Corporation Northern Trust

Corporation

Bank of America Fifth Third Bancorp The PNC Financial

Corporation Services Group Inc.

The Bank of New York The Goldman Sachs Group, Regions Financial

Mellon Corporation Inc. Corporation

BB&T Corporation JPMorgan Chase & Co. State Street Corporation

Capital One Financial KeyCorp. SunTrust Banks Inc.

Corp.

Citigroup Inc. M&T Bank Corporation U.S. Bancorp

Morgan Stanley Wells Fargo & Company

The proposed offering is co-lead by RBC Capital Markets and CIBC

World Markets Inc. The other members of the syndicate are BMO

Capital Markets, National Bank Financial Inc., Scotiabank, TD

Securities Inc., GMP Securities L.P., Raymond James Ltd., Canaccord

Genuity Corp., Desjardins Securities Inc. and Mackie Research

Capital Corporation.

Please visit our website at: www.primeusbanking.com

Contacts: Prime U.S. Banking Sector Split Corp. Investor

Relations 77 King Street West, Toronto, Ontario, M5K 1K7

416-304-4443 or 877-478-2372info@quadravest.com

www.primeusbanking.com

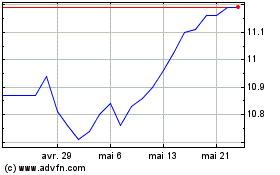

Canadian Banc (TSX:BK)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

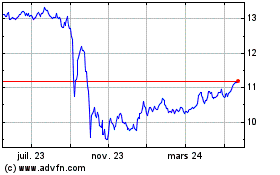

Canadian Banc (TSX:BK)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024