Chorus Aviation Inc. ('Chorus') (TSX: CHR) is pleased to announce

that it has entered into an agreement with CIBC Capital Markets and

RBC Capital Markets, as joint bookrunners, on behalf of a syndicate

of underwriters consisting of Scotiabank, National Bank Financial

Inc., TD Securities Inc., BMO Capital Markets, Canaccord Genuity

Corp., Cormark Securities Inc. and Paradigm Capital Inc.

(collectively, the ‘Underwriters’), under which the Underwriters

have agreed to purchase $75 million aggregate principal amount of

senior unsecured debentures due December 31, 2024 (the

‘Debentures’) at a price of $1,000 per Debenture (the

‘Offering’). Chorus has also granted the Underwriters an

option to purchase up to an additional $11.25 million aggregate

principal amount of Debentures, on the same terms and conditions,

exercisable in whole or in part, for a period of 30 days following

the closing of the Offering.

The Debentures will bear interest from the date

of issue at 5.75% per annum, payable semi-annually in arrears on

June 30 and December 31 of each year commencing June 30, 2020, and

will mature on December 31, 2024.

The net proceeds of the Offering will be used to

fund the growth of Chorus Aviation Capital (Chorus’ aircraft

leasing business), including the acquisition of aircraft intended

for or currently on lease to third parties, as well as for working

capital requirements and other general corporate purposes.

The Debentures will not be redeemable by Chorus

before December 31, 2022, except upon the occurrence of a change of

control of Chorus in accordance with the terms of the indenture

governing the Debentures (the ‘Indenture’). On and after

December 31, 2022 and prior to December 31, 2023, the Debentures

will be redeemable, in whole or in part, at Chorus’ option at a

price equal to 102.875% of the principal amount of the Debentures

redeemed plus accrued and unpaid interest. On and after

December 31, 2023, the Debentures will be redeemable at Chorus’

option at a price equal to the principal amount of the Debentures

redeemed plus accrued and unpaid interest. Chorus will be

required to provide not more than 60 nor less than 40 days’ prior

notice of redemption of the Debentures.

Subject to any required regulatory approval and

provided no event of default has occurred and is continuing under

the Indenture, Chorus will have the option to satisfy its

obligation to pay the principal amount of the Debentures due at

redemption or maturity (together with any applicable premium) by

delivering freely tradeable Class B Voting Shares (‘Class B

Shares’) to holders of the Debentures (‘Debentureholders’) who are

Canadians (as defined in the Canada Transportation Act (‘Qualified

Canadians’) or Class A Variable Voting Shares (‘Class A Shares’

and, together with the Class B Shares, the ‘Voting Shares’) to

Debentureholders who are not Qualified Canadians. Any accrued and

unpaid interest will be paid in cash. In such event, payment

will be satisfied by delivering for each $1,000 due, that number of

freely tradeable Voting Shares obtained by dividing $1,000 by 95%

of the current market price (determined in accordance with the

Indenture) on the date fixed for redemption or maturity. The

Debentures will not be convertible into Voting Shares at the option

of the Debentureholders at any time.

The Debentures will be direct, senior unsecured

obligations of Chorus and will rank: (i) subordinate to all

existing and future senior secured and other secured indebtedness

of Chorus, but only to the extent of the value of the assets

securing such secured indebtedness; (ii) pari passu with one

another and equally in right of payment from Chorus with all other

unsubordinated unsecured indebtedness of Chorus except as

prescribed by law; and (iii) senior to any other existing and

future subordinated unsecured indebtedness of Chorus.

An agreement (the ‘Intercreditor Agreement’)

will be entered into between the trustee (the ‘Trustee’) appointed

under the Indenture, on behalf of the Debentureholders, and Chorus’

lender(s) (the ‘Senior Creditors’) under certain credit facilities

made available pursuant to a second amended and restated credit

agreement dated June 28, 2019 (as further amended, the ‘Credit

Facilities’). The Intercreditor Agreement will, among other things,

provide that to the extent any amounts remain outstanding under the

Credit Facilities after the Senior Creditors have realized on their

security in the context of an insolvency event involving Chorus,

any proceeds received by the Trustee on behalf of the

Debentureholders in connection with such event will be directly

remitted to the applicable Senior Creditors until the applicable

Credit Facilities are paid in full.

A preliminary short form prospectus qualifying

the distribution of the Debentures will be filed with the

securities regulatory authorities in each of the provinces and

territories of Canada. The Debentures have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and

may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements of

such Act. This news release shall not constitute an offer to sell

or the solicitation of an offer to buy nor shall there be any sale

of the securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

The Offering is subject to customary regulatory

approvals, including approval of the Toronto Stock Exchange.

The Offering is expected to close on or about December 6, 2019.

About Chorus

Chorus Aviation is a global provider of

integrated regional aviation solutions. Chorus’ vision is to

deliver regional aviation to the world. Headquartered in Halifax,

Nova Scotia, Chorus comprises Chorus Aviation Capital, a leading,

global lessor of regional aircraft, and Jazz Aviation and Voyageur

Aviation, companies that have long histories of safe operations

with excellent customer service. Chorus provides a full suite

of regional aviation support services that encompasses every stage

of an aircraft’s lifecycle, including: aircraft acquisitions and

leasing; aircraft refurbishment, engineering, modification,

repurposing and preparation; contract flying; aircraft and

component maintenance, disassembly, and parts provisioning.

Chorus Class A Variable Voting Shares and Class

B Voting Shares trade on the Toronto Stock Exchange under the

trading symbol ‘CHR’. www.chorusaviation.com

Forward-Looking Information

This news release may contain 'forward-looking

information'. Forward-looking information is identified by the use

of terms and phrases such as "anticipate", "believe", "could",

"estimate", "expect", "intend", "may", "plan", "predict",

"potential", "pending", "project", "will", "would", and similar

terms and phrases. In particular, this news release includes

forward-looking information relating to the proposed timing

of completion of the Offering, the anticipated use of the net

proceeds of the Offering and the terms of the Intercreditor

Agreement. Forward-looking information involves known and unknown

risks, uncertainties and other factors that may cause actual

results, performance or achievements to differ materially from

those indicated in the forward-looking information. These risks

include, but are not limited to, the failure or delay in satisfying

any of the conditions to the completion of the Offering. Actual

results may differ materially from results indicated in

forward-looking information for a number of reasons, including the

failure to close the transactions referenced in this news release

on the terms and conditions currently contemplated by Chorus, or at

all, as well the risk factors identified in Chorus' Annual

Information Form dated February 21, 2019, in Chorus' public

disclosure record available at www.sedar.com and in the short

form prospectus to be filed in connection with the Offering.

Statements containing forward-looking information in this news

release represent Chorus' expectations as of the date of this news

release (or as of the date they are otherwise stated to be made)

and are subject to change after such date. Chorus disclaims any

intention or obligation to update or revise such statements to

reflect new information, subsequent events or otherwise, unless

required by applicable securities laws.

Chorus Media Contacts:

Manon Stuart, Halifax, Nova Scotia (902)

873-5054 manon.stuart@chorusaviation.com Debra

Williams, Toronto, Ontario (905) 671-7769

debra.williams@chorusaviation.com

Analyst Contact:

Nathalie Megann, Halifax, Nova Scotia, (902) 873-5094

nathalie.megann@chorusaviation.com

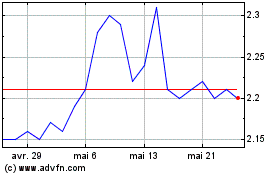

Chorus Aviation (TSX:CHR)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

Chorus Aviation (TSX:CHR)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025