CN (TSX: CNR) (NYSE: CNI) said today that it has asked the Surface

Transportation Board (STB) to take a new approach to CN's proposed

acquisition of the major portion of the Elgin, Joliet & Eastern

Railway Company (EJ&E). CN has asked the Board to issue a final

decision on the transportation merits of the transaction in time to

permit the transaction to close before year-end, but to preserve

the environmental status quo pending further STB action on the

environmental issues posed by the transaction. The new approach

would assure adequate protection of the environment for communities

along the EJ&E. At the same time, it would avoid the risk to

the broader public interest in improved rail transportation posed

by regulatory delays that threaten termination of the transaction.

CN's petition requests that the STB decide by September 15, 2008

whether it will modify its procedural schedule to provide for a

final decision by October 15, 2008 on the transportation merits of

the proposed EJ&E acquisition. Under law, that decision would

be based on whether the Board has found adverse competitive impacts

that are both "likely" and "substantial." CN is also asking the

Board, if it decides to approve the transaction in October, to

condition its approval on preserving the environmental status quo

until the Board's Section of Environmental Analysis (SEA) has

completed its environmental review of the transaction. CN contends

that, so long as the environment is not affected by the transaction

during environmental review, the law requires the Board to approve

the transaction on its competitive merits. Once the STB's

environmental review is completed, the Board would be expected to

issue a decision governing any change in the environmental status

quo.

"This transaction has far-reaching economic and transportation

benefits to the Chicago region, the Midwest, and the nation as well

as for CN and its customers," said E. Hunter Harrison, President

and Chief Executive Officer of CN. "This transaction enjoys

significant support from a broad array of shippers and the range of

other parties who have a stake in making sure that the serious rail

congestion issues plaguing Chicago are being addressed by sound

transportation initiatives such as the acquisition by CN of the

EJ&E.

"At the same time, we are well aware of the concerns raised by

communities along the EJ&E line about the environmental impacts

of increased train traffic. We are asking the STB to set a schedule

providing for a decision on the merits which, if favorable to CN,

would allow us to close on this transaction before the end of this

year, but would not cause any adverse environmental impacts before

the Board completes its environmental review and develops a full

record on which to base the environmental mitigation that it may

impose on the transaction."

CN is entitled to and requires this relief because the STB

declined CN's request for a fixed timetable that would conclude its

regulatory and environmental review by the end of the year and,

despite CN's continuing best efforts, a substantial risk remains

that EJ&E, which is an indirect subsidiary of United States

Steel Corporation (U. S. Steel), would terminate the proposed

transaction if it is not closed before year-end. U. S. Steel has

recently declined CN's request for a modification of the Stock

Purchase Agreement (SPA) or other action that would assure that the

transaction could still be closed if approved after December 31,

2008. That decision has highlighted the risk that the transaction

would be terminated before it was reviewed by the STB. As a result,

CN is seeking relief to allow this important transaction to close

prior to the end of 2008.

"CN is prepared to take the positive step of closing this

transaction before year-end in a way that provides the STB with

additional time to complete its environmental review by early

2009," Harrison said. "We are hopeful that the final EIS will

conform to the view that this transaction is clearly beneficial to

the environment of the broader Chicago region and that the

legitimate impacts on affected communities are not novel and can

all be reasonably mitigated in accordance with sound STB precedents

and the long-established public policy framework governing railroad

transactions throughout the United States.

"The chief concerns raised by opponents of this transaction are

the impacts of train traffic that will be diverted from CN lines in

Chicago onto the EJ&E," Harrison said. "Our proposal would

ensure that the STB has sufficient time to review those matters

fully before it authorizes any diversion of traffic. The action we

are requesting would not interfere in any way with SEA's

environmental review process and we are seeking to protect the

interests of all parties. At the same time, we would be moving one

step closer to meaningful rail congestion relief and rail

efficiency enhancements in the Chicago region.

"We have consistently stated that we understand and are willing

to address the concerns of communities that will experience train

traffic increases as a result of this transaction," Harrison said.

CN has been actively engaged in the SEA's environmental review

process and will participate in the SEA's public hearings in August

and September in communities in the region. CN also will continue

to work with affected communities along the EJ&E line in an

effort to reach voluntary mitigation agreements addressing

reasonable environmental concerns associated with increased train

traffic on the EJ&E.

CN's petition notes that if the Board does not act by September

15, 2008, CN will be prepared to petition the U.S. Court of Appeals

for the District of Columbia Circuit immediately thereafter to

compel the STB to issue a final decision that would permit CN to

close the transaction by December 31, 2008. By requesting an STB

decision by September 15 solely on the question of whether the STB

will agree to issue a final decision on the transportation merits

by October 15, 2008, CN hopes to avoid the need for judicial

intervention.

CN and U. S. Steel announced on September 26, 2007, an agreement

under which CN would acquire most of the EJ&E for $300 million,

subject to regulatory approval by the STB. The transaction would

enable CN to re-route its trains along the EJ&E arc around the

periphery of the Chicago area, reducing rail congestion in the

inner core of Chicago while significantly improving the flow of

CN's rail operations in the Chicago region. CN has committed an

additional $100 million for integration, new connections, and

infrastructure improvements to add capacity on the EJ&E line

and allow network synergies to be realized over time. This $400

million of private-sector investment, combined with the roughly $40

million that CN would expect to spend to mitigate the impacts of

increased train traffic along the EJ&E line, would better

utilize and enhance capacity on the Chicago-area rail network.

More information on the transaction, including a map of the

areas served by the EJ&E and CN, is available by clicking on

the EJ&E Acquisition icon on the About CN section of its

website http://www.cn.ca/about/EJE/about_EJE/en_About.shtml.

Forward-Looking Statements

This news release contains forward-looking statements. CN

cautions that, by their nature, forward-looking statements involve

risk, uncertainties and assumptions. In addition to the other

assumptions contained in this release, the Company believes the

U.S. economy is currently experiencing recessionary conditions, but

assumes that it will recover within the next six to nine months,

and that the global economy will grow at a moderate pace throughout

this period. The Company cautions that these assumptions may not

materialize. The Company's results could differ materially from

those expressed or implied in such forward-looking statements.

Important factors that could cause such differences include, but

are not limited to, industry competition, legislative and/or

regulatory developments, compliance with environmental laws and

regulations, various events which could disrupt operations,

including natural events such as severe weather, droughts, floods

and earthquakes, the effects of adverse general economic and

business conditions, inflation, currency fluctuations, changes in

fuel prices, labor disruptions, environmental claims,

investigations or proceedings, other types of claims and

litigation, and other risks detailed from time to time in reports

filed by CN with securities regulators in Canada and the United

States. Reference should be made to CN's most recent Form 40-F

filed with the United States Securities and Exchange Commission,

its Annual Information Form filed with the Canadian securities

regulators, and its 2007 Annual Consolidated Financial Statements

and Notes thereto and Management's Discussion and Analysis

(MD&A), as well as its 2008 quarterly consolidated financial

statements and MD&A, for a summary of major risks.

CN assumes no obligation to update or revise forward-looking

statements to reflect future events, changes in circumstances, or

changes in beliefs, unless required by applicable laws. In the

event CN does update any forward-looking statement, no inference

should be made that CN will make additional updates with respect to

that statement, related matters, or any other forward-looking

statement.

CN - Canadian National Railway Company and its operating railway

subsidiaries - spans Canada and mid-America, from the Atlantic and

Pacific oceans to the Gulf of Mexico, serving the ports of

Vancouver, Prince Rupert, B.C., Montreal, Halifax, New Orleans, and

Mobile, Ala., and the key metropolitan areas of Toronto, Buffalo,

Chicago, Detroit, Duluth, Minn./Superior, Wis., Green Bay, Wis.,

Minneapolis/St. Paul, Memphis, and Jackson, Miss., with connections

to all points in North America. For more information on CN, visit

the company's website at www.cn.ca.

www.cn.ca

Contacts: CN Jim Kvedaras (Media) Senior Manager U.S. Public

& Government Affairs (708) 332-3508 CN Robert Noorigian

(Investors) Vice-President Investor Relations (514) 399-0052

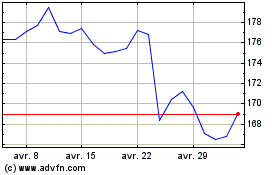

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Canadian National Railway (TSX:CNR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024