CareRx Corporation (“

CareRx” or the

“

Company”) (TSX: CRRX), Canada’s leading provider

of specialty pharmacy services to seniors, is pleased to announce

that it has entered into an amended agreement pursuant to which

Eight Capital and Cormark Securities Inc., as co-lead underwriters

and joint bookrunners, together with a syndicate of underwriters

(collectively, the “

Underwriters”), have now

agreed to purchase on a “bought deal” basis 3,059,000 common shares

of the Company (the “

Shares”) at a price of $4.25

per Share (the “

Issue Price") for aggregate gross

proceeds to CareRx of $13,000,750 (the

“

Offering”).

The Company has granted the Underwriters an

option, exercisable, in whole or in part, at any time not later

than 30 days following the closing of the Offering, to purchase up

to an additional 15% of the Shares at the Issue Price for market

stabilization purposes and to cover over-allotments, if any (the

“Over-Allotment Option”). If the Over-Allotment

Option is exercised in full, the total gross proceeds of the

Offering will be approximately $14,950,000.

The Shares will be offered by way of (i) a

prospectus supplement (the “Prospectus

Supplement”) to CareRx’s short form base shelf prospectus

dated September 17, 2020, which Prospectus Supplement will be filed

with the securities commissions and other similar regulatory

authorities in each of the provinces of Canada; (ii) in the United

States by way of private placement pursuant to the exemption from

registration provided for under Rule 144A of the United States

Securities Act of 1933, as amended; and (iii) in jurisdictions

outside of Canada and the United States as are agreed to by the

Company and the Underwriters on a private placement or equivalent

basis.

Concurrent with the closing of the Offering, the

Company expects to complete a non-brokered private placement of

1,176,470 common shares, at the Issue Price, for aggregate gross

proceeds of $5,000,000, to Yorkville Asset Management Inc. for and

on behalf of certain managed funds and Dr. Jack Shevel, each of

whom are existing major shareholders of the Company.

The net proceeds of the Offering and the

Concurrent Private Placement are expected to be used to satisfy the

$4 million cash component of the purchase price payable at closing

in connection with the Company’s proposed acquisition of SmartMeds

Pharmacy Inc., and for working capital and general corporate

purposes.

Each of the Offering and the Concurrent Private

Placement is expected to close on or about February 3, 2021 and is

subject to certain conditions including, but not limited to, the

receipt of all necessary approvals, including the approval of the

Toronto Stock Exchange.

The securities being offered have not been, nor

will they be, registered under the United States Securities Act of

1933, as amended, and may not be offered or sold in the United

States or to, or for the account or benefit of, U.S. persons absent

registration or an applicable exemption from the registration

requirements. This press release shall not constitute an offer to

sell or the solicitation of an offer to buy nor shall there be any

sale of the securities in any State in which such offer,

solicitation or sale would be unlawful.

About CareRx

Corporation:CareRx is Canada's leading provider of

specialty pharmacy services to seniors. We serve approximately

50,000 residents in over 900 seniors and other communities

(long-term care homes, retirement homes, assisted living

facilities, and group homes). We are a national organization with a

large network of pharmacy fulfillment centres strategically located

across the country. This allows us to deliver medications in a

timely and cost-effective manner and quickly respond to routine

changes in medication management. We use best-in-class technology

that automates the preparation and verification of multi-dose

compliance packaging of medication, providing the highest levels of

safety and adherence for individuals with complex medication

regimes. We take an active role in working with our home operator

partners to promote resident health, staff education, and

medication system quality and efficiency.

Forward Looking Statements:

This press release contains statements that may

constitute "forward-looking statements" within the meaning of

applicable Canadian securities legislation. These forward-looking

statements include, among others, statements regarding the

Company's business strategy, plans and other expectations, beliefs,

goals, objectives, information and statements about possible future

events, including the intended use of proceeds of the Offering and

the Concurrent Private Placement. Forward-looking statements

generally can be identified by the use of forward-looking

terminology such as "may", "will", "expect", "intend", "estimate",

"anticipate" or similar expressions suggesting future outcomes or

events. Such forward looking statements reflect management's

current beliefs and are based on information currently available to

management.

Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those contemplated by such statements. Factors that could

cause such differences include the Company's liquidity and capital

requirements, government regulation and funding, the highly

competitive nature of the Company's industry, reliance on contracts

with key customers and other risk factors described from time to

time in the reports and disclosure documents filed by the Company

with Canadian securities regulatory agencies and commissions. These

and other factors should be considered carefully and readers should

not place undue reliance on the Company's forward-looking

statements. As a result of the foregoing and other factors, no

assurance can be given as to any such future results, levels of

activity or achievements and neither the Company nor any other

person assumes responsibility for the accuracy and completeness of

these forward looking statements. The factors underlying current

expectations are dynamic and subject to change.

For more information: visit

www.carerx.ca or contact: David Murphy, President & Chief

Executive Officer, CareRx Corporation, 416-927-8400; Lawrence

Chamberlain, Investor Relations, LodeRock Advisors, 416-519-4196,

lawrence.chamberlain@loderockadvisors.com.

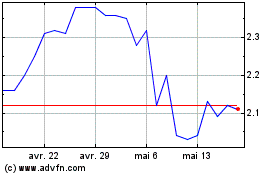

CareRX (TSX:CRRX)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

CareRX (TSX:CRRX)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025