CareRx Corporation (“

CareRx” or the

“

Company”) (TSX:CRRX), Canada's leading provider

of pharmacy services to seniors communities, announced today that

it has entered into a definitive agreement to acquire the Long-Term

Care Pharmacy Division (the “

LTC Pharmacy

Division”) of Medical Pharmacies Group Limited

(“

MPGL”), which is comprised of 18 fulfillment

centres serving approximately 36,000 residents of long-term care,

assisted living and other congregate care settings across Ontario,

Alberta and British Columbia (the “

Acquisition”).

Upon closing, CareRx expects to service over 88,000 residents

through a significantly strengthened national fulfillment network.

Acquisition Highlights

- Adds approximately $150 million in

annual revenue and is expected to be immediately accretive with

significant synergies

- Continues CareRx’s development as

Canada’s leading seniors pharmacy provider with more than 88,000

beds

- Increased scale will allow CareRx

to capitalize on favourable industry dynamics including a rapidly

growing seniors population

- $75 million1 acquisition price to

be financed through offering of subscription receipts and

refinancing of existing credit facilities

“The acquisition of MPGL’s LTC Pharmacy Division

is our most transformational acquisition to date and will increase

the number of homes and residents we service by approximately 70%,”

said David Murphy, President and Chief Executive Officer of CareRx.

“MPGL’s LTC Pharmacy Division has a reputation for service and

clinical excellence and, as part of CareRx, will provide strategic

benefits that we are confident will further strengthen our service

offering to our customers, while enhancing our future growth

opportunities. With our proven track record of integrating

acquisitions, we expect to generate significant operational

synergies that will contribute to a meaningful expansion of our

EBITDA margin.”

Mr. Murphy added, “The number of Canadians

living in seniors housing is expected to more than double over the

next 15 years. This Acquisition significantly expands our national

platform, which we believe will be increasingly valued by home

operators as they look to partner with a pharmacy provider that can

support the highest levels of service, quality and care for their

residents.”

“We are pleased to announce the signing of the

sale of our LTC Pharmacy Division. We believe that this transaction

is in the best interest of our stakeholders and that the combined

business will be well positioned to provide outstanding service to

its customers,” said John Leader, Chief Executive Officer of

MPGL.

The Acquisition is expected to be immediately

accretive to CareRx’s earnings, contributing run-rate revenue of

approximately $150 million to CareRx on an annualized basis,

with the integration of the two businesses expected to result in

significant synergies, based on CareRx’s history of successful

integrations.

The consideration for the Acquisition is

comprised of $70 million of cash and the issuance of 1 million

common shares of CareRx (“Common Shares”), payable

at closing of the Acquisition (the “Acquisition

Closing”). The Acquisition is expected to close in

late June or early July of 2021, subject to the satisfaction of

customary closing conditions, including the receipt of applicable

regulatory approvals, including the approval of the applicable

college of pharmacies and the Competition Bureau.

Acquisition Financing

Bought Deal Private Placement of

Subscription Receipts: CareRx has entered into an

agreement with Eight Capital and Cormark Securities Inc. (the

“Co-Lead Underwriters”), on behalf of a syndicate

of underwriters (together with the Co-Lead Underwriters, the

“Underwriters”) pursuant to which the Underwriters

have agreed to purchase, on a “bought deal” basis, 8,911,000

subscription receipts of the Company (the “Subscription

Receipts”) at a price of $5.05 per Subscription Receipt

(the “Issue Price”) for aggregate gross proceeds

of approximately $45 million (the “Bought Deal

Financing”).

Concurrent Private Placement to

Yorkville Asset Management: CareRx has also entered into a

binding term sheet with Yorkville Asset Management Inc. (for and on

behalf of certain managed funds, “Yorkville”)

pursuant to which Yorkville will purchase 1,980,200 Subscription

Receipts at the Issue Price, on a non-brokered basis, for aggregate

gross proceeds of approximately $10 million (the

“Non-Brokered Financing” and, together with the

Bought Deal Financing, the “Equity

Financings”).

Refinancing of Existing Credit

Facilities: The Company has entered into binding

commitment letters with Crown Capital Partners Inc. (including

certain entities and funds controlled by it, “Crown

Capital”) and Yorkville, pursuant to which Crown Capital

and Yorkville will amend their existing credit facilities with the

Company and advance $39 million of total incremental indebtedness

to CareRx, to fund a portion of the cash closing price for the

Acquisition.

Summary of the Equity

Financings

The aggregate gross proceeds from the Equity

Financings are expected to be approximately $55 million, which will

be used by the Company to fund a portion of the cash purchase price

payable in connection with the Acquisition.

In addition, the Company will grant the

Underwriters an option (the "Underwriters’

Option") to sell an additional 1,336,650 Subscription

Receipts at the Issue Price for additional gross proceeds of up to

approximately $6.75 million which is exercisable up to 48 hours

prior to the closing date of the Equity Financings. To the extent

the Underwriters’ Option is exercised, Yorkville will have an

option to purchase up to an additional 297,030 Subscription

Receipts at the Issue Price for additional gross proceeds of up to

approximately $1.5 million on similar terms as the Underwriters’

Option.

The gross proceeds from the Equity Financings,

net of the expenses of the Underwriters and 50% of the commissions

payable to the Underwriters, will be placed into escrow and will be

released upon the satisfaction of certain conditions, including

CareRx shareholder approval of the Equity Financings (as described

below) and completion of the Acquisition. Upon satisfaction of such

escrow release conditions, each Subscription Receipt will be

exchanged for one Common Share, subject to certain adjustments in

the event that the Acquisition Closing does not occur by certain

prescribed dates, in which case each Subscription Receipt will be

exchanged for up to 1.1 Common Shares.

The Equity Financings are expected to close on

or about May 19, 2021 and are each subject to certain conditions

including, but not limited to, the receipt of all necessary

approvals including the approval of the Toronto Stock Exchange (the

“TSX”). Under applicable TSX policies, the Company

is required to obtain shareholder approval for the Equity

Financings, including disinterested shareholder approval, prior to

the exercise of the Subscription Receipts into Common Shares. The

Company expects to convene an annual and special meeting of

shareholders (the “Meeting”) in early June at

which it will seek shareholder approval of the Equity Financings.

In connection therewith, certain significant shareholders of CareRx

representing, in the aggregate, approximately 42% of the Common

Shares entitled to vote at the Meeting, have signed voting support

agreements under which they have committed to approving the Equity

Financings at the Meeting.

The Subscription Receipts to be issued under the

Equity Financings and the Common Shares exchanged for the

Subscription Receipts upon the Acquisition Closing will be subject

to a hold period in Canada expiring four months and one day from

the closing date of the Equity Financings.

Summary of the Refinancing of Existing

Credit Facilities

The Company has signed a binding commitment

letter with Crown Capital, on behalf of a syndicate of lenders,

pursuant to which Crown Capital will advance new credit facilities

to the Company of $60 million (the “Senior

Facility”). $32 million of the Senior Facility will be

used to pay a portion of the cash closing price for the Acquisition

and related transaction costs, with the remaining $28 million being

used to repay the existing term loan with Crown Capital in full.

The Senior Facility will be advanced contemporaneously with the

Acquisition Closing. Interest on the Senior Facility will accrue at

an annual rate of between 7.5% and 9% based on applicable financial

covenants, and the Senior Facility will mature on the 5th

anniversary of the Acquisition Closing, subject to certain

prepayment rights in favour of the Company.

The Company has also signed a binding commitment

letter with Yorkville pursuant to which Yorkville will increase the

principal amount outstanding under its existing subordinated

facility with the Company (the “Subordinated

Facility”) by $6 million, which Subordinated Facility will

be used to fund working capital needs of the Company. The credit

agreement for the Subordinated Facility will also be amended to

reduce the interest rate from 12% to 10.5% per annum, and the

maturity date of the Subordinated Facility will be extended until

the 5th anniversary of the Acquisition Closing, subject to certain

prepayment rights in favour of the Company. The amendments to the

Subordinated Facility are not conditional on completion of the

Acquisition, and are expected to become effective on or about May

1, 2021.

The Subordinated Facility constitutes a "related

party transaction" within the meaning of Multilateral Instrument

61-101 – Protection of Minority Holders in Special Transactions

(“MI 61-101”) as Yorkville is a control person of

CareRx and is therefore a “related party” of CareRx under MI

61-101. The Company has relied on the exemption from the minority

approval requirement contained in section 5.7(1)(f) of MI 61-101 in

respect of the Subordinated Facility as the Subordinated Facility

has been obtained from Yorkville on reasonable commercial terms

that are not less advantageous to the Company than if the

Subordinated Facility was obtained from a person dealing at arm’s

length with the Company and is not convertible or repayable in

Common Shares. A material change report in respect of the

Acquisition, the Equity Financings, the Senior Facility and the

Subordinated Facility will be filed as required, but is not

expected to be filed 21 days in advance of the closing of the

Subordinated Facility due to the Company’s immediate need for the

proceeds of the Subordinated Facility. The disinterested members of

the Company’s Board of Directors have unanimously approved the

Subordinated Facility.

Advisors and Counsel

In connection with the Acquisition, Origin

Merchant Partners and BDO Canada LLP acted as the financial

advisors to CareRx and Stikeman Elliott LLP acted as legal advisor.

Richter LLP acted as the financial advisor to MPGL and Torys LLP

acted as legal advisor. Bennett Jones LLP is acting as legal

counsel to the Underwriters. Eight Capital and Cormark Securities

Inc. acted as strategic advisors to CareRx.

The securities described in this press

release have not been, nor will they be, registered under the

United States Securities Act of 1933, as amended, and may not be

offered or sold in the United States or to, or for the account or

benefit of, U.S. persons absent registration or an applicable

exemption from the registration requirements. This press release

shall not constitute an offer to sell or the solicitation of an

offer to buy nor shall there be any sale of the securities in any

State in which such offer, solicitation or sale would be

unlawful.

ABOUT CARERX

CareRx is Canada's leading provider of pharmacy

services to seniors communities. We serve over 52,000 residents in

over 900 seniors and other congregate care communities (long-term

care homes, retirement homes, assisted living facilities, and group

homes). We are a national organization with a large network of

pharmacy fulfillment centres strategically located across the

country. This allows us to deliver medications in a timely and

cost-effective manner and quickly respond to routine changes in

medication management. We use best-in-class technology that

automates the preparation and verification of multi-dose compliance

packaging of medication, providing the highest levels of safety and

adherence for individuals with complex medication regimes. We take

an active role in working with our home operator partners to

promote resident health, staff education, and medication system

quality and efficiency.

ABOUT MEDICAL PHARMACIES

MPGL is one of Canada’s leading continuing care

pharmacies, providing services and support to complex continuing

care residents and clients across Ontario, Alberta and British

Columbia. MPGL also provides specialty pharmacy services and

support to physician and specialist clinics, hospitals and other

care institutions. Through its subsidiary Ontario Medical Supply

(www.oms.ca), MPGL also offers a comprehensive and complementary

suite of medical products. For more information on MPGL, please

visit www.medicalpharmacies.com.

FORWARD-LOOKING STATEMENTS

This press release contains statements that may

constitute "forward-looking statements" within the meaning of

applicable Canadian securities legislation. These forward-looking

statements include, among others, statements regarding the

Company’s business strategy, plans and other expectations, beliefs,

goals, objectives, information and statements about possible future

events, including in respect of the Acquisition, the Equity

Financings, the Senior Facility and the Subordinated Facility.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “may”, “will”, “expect”,

“intend”, “estimate”, “anticipate” or similar expressions

suggesting future outcomes or events. Such forward-looking

statements reflect management's current beliefs and are based on

information currently available to management.

Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those contemplated by such statements. Factors that could

cause such differences include the Company's exposure to and

reliance on government regulation and funding, the Company's

liquidity and capital requirements, exposure to epidemic or

pandemic outbreak, the highly competitive nature of the Company's

industry, reliance on contracts with key customers and other risk

factors described from time to time in the reports and disclosure

documents filed by the Company with Canadian securities regulatory

agencies and commissions. These and other factors should be

considered carefully and readers should not place undue reliance on

the Company's forward-looking statements. As a result of the

foregoing and other factors, no assurance can be given as to any

such future results, levels of activity or achievements and neither

the Company nor any other person assumes responsibility for the

accuracy and completeness of these forward-looking statements. The

factors underlying current expectations are dynamic and subject to

change.

For more information,

visit www.carerx.ca or

contact:

|

David MurphyPresident & Chief Executive OfficerCareRx

Corporation416-927-8400 |

|

Lawrence ChamberlainInvestor RelationsLodeRock

Advisors416-519-4196lawrence.chamberlain@loderockadvisors.com |

_______________________1 Purchase Price consideration comprised

of $70 million of cash and the issuance of 1 million common shares

of CareRx.

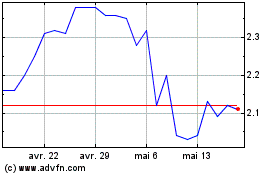

CareRX (TSX:CRRX)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

CareRX (TSX:CRRX)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024