“Dundee is pleased to announce a strong and transformative quarter,

marked by broad positive performance in our core investment

portfolio and key initiatives that further align our capital

structure with our long-term growth objectives." said Jonathan

Goodman, President and Chief Executive Officer of Dundee

Corporation. “During the quarter, we sold 11 million shares of our

position in G Mining Ventures Corp. for proceeds of $95.9 million,

which was partially used to redeem both classes of our preferred

shares and substantially pay down our outstanding loan balance. The

redemption of the preferred shares is a significant milestone,

enhancing our financial flexibility and positioning the company for

continued, sustainable growth for the long-term. In addition, we

backstopped an $8.0 million rights offering for Maritime Resources

Corp. to support the company’s strategic plan to substantially

derisk the restart of the Hammerdown Mine and, in the process,

increased our ownership interest in the company to 43% on an

undiluted basis. Furthermore, we have continued to make

progress on divesting our non-core assets with the sale of our

flow-through funds. This will further streamline our operations

and, importantly, allow us to place even greater focus on executing

our core strategy."

“Our success in the current quarter underscores

the strength of our core strategy, driven by strong investment

performance amidst record gold prices and continued progress on

cost reduction efforts. We foresee numerous opportunities on the

horizon, as the market, in our opinion, continues to undervalue

companies engaged in the discovery and development of high-quality

precious metals, as well as base metals and strategic resources. We

see a compelling value proposition in the disconnect between metals

prices and mining stocks. Given the opportunity set we are seeing,

while we have more ideas than capital, we remain very focused on

our core asset base. We are committed to long-term investments in

high-quality projects, acting as advisors and partners to our

investee companies to maximize asset value and achieve their full

potential.”

Mr. Goodman concluded: “The entire team at

Dundee continues to work diligently to implement and execute our

strategy across all fronts. I am encouraged by our ability to

sustain and grow our momentum in 2024 as we look forward to the

opportunities ahead of us. Our team remains committed to growing

the core business, and positioning Dundee to deliver long-term,

sustainable value for our stakeholders, shareholders and partners.

I would like to thank the entire team for their hard work in

navigating a time of continued evolution.”

SOLID THIRD QUARTER AND FIRST NINE

MONTHS OF 2024 RESULTS

- In August 2024, the Corporation

sold 11,000,000 shares of G Mining Ventures Corp. (“GMIN”) for net

proceeds to the Corporation of $95.9 million. The Corporation

continues to hold 2,919,921 shares of GMIN.

- Upon the sale of GMIN, the

Corporation partially repaid $14.0 million of its outstanding loan

with Earlston Investments Corp.

- In September 2024, the Corporation

paid an aggregate of $46.7 million to exercise its option to redeem

all its outstanding Preference Shares Series 2 and Preference

Shares Series 3 at a price of $25.00 per share and pay the final

associated dividends, saving the Corporation approximately over

$4.0 million per annum in dividend and associated tax

payments.

- In September 2024, Dundee

backstopped an $8.0 million rights offering for Maritime Resources

Corp. (“Maritime”) and made purchases pursuant to private

agreements to acquire approximately 253.0 million common shares of

the company and increase our undiluted ownership interest to 43%.

The Corporation earned 33.2 million compensation warrants for

backstopping the rights offering.

- Reported net income from portfolio

investments for the third quarter of 2024 of $10.1 million (2023 –

loss of $24.7 million). The key drivers of performance during the

quarter included a $5.8 million market appreciation in the

Corporation’s investment in Ausgold Limited (“Ausgold”), a $4.9

million investment gain in Saturn Metals Limited (“Saturn”) and a

$4.6 million investment gain in Greenheart Gold Inc.

(“Greenheart”). For the nine months ended September

30, 2024, the Corporation reported net income from portfolio

investments of $68.0 million (2023 – loss of $22.2 million). The

top performer of 2024 was the $53.6 million fair value gain in

Reunion Gold Corporation.

- On October 7, 2024, the Corporation

announced the completion of the sale of 8,000 shares of TauRx to a

private investor at a price of US$125.00 per share for proceeds of

US$1.0 million (Cdn$1.4 million).

- Reported consolidated general and

administrative expenses for the third quarter of $4.3 million (2023

– $4.6 million). Excluding share-based compensation of $0.8 million

(2023 – $0.5 million), consolidated general and administrative

expenses declined 16% year-over-year. For the nine months ended

September 30, 2024, the Corporation reported consolidated general

and administrative expenses of $12.5 million (2023 – $13.6

million).

- Reported net earnings attributable

to owners of the Corporation for the third quarter of 2024 of $7.3

million (2023 – loss of $26.5 million), or earnings of $0.07 per

share (2023 – a loss of $0.31 per share). For the nine months ended

September 30, 2024, the Corporation reported net earnings

attributable to owners of the Corporation of $67.3 million (2023 –

loss of $36.0 million), or earnings of $0.73 per share (2023 – a

loss of $0.43 per share).

SEGMENTED FINANCIAL RESULTS

Mining Investments

In the third quarter of 2024, the Corporation

reported net earnings before taxes from the mining investments

segment of $10.4 million (2023 – loss of $23.3 million).

Performance from the mining portfolio investments generated income

of $9.0 million (2023 – loss of $25.6 million), which is included

in net earnings or loss from this segment. Notable performers

during the quarter include gains of $5.8 million in Ausgold, $4.9

million in Saturn and $4.6 million in Greenheart, respectively,

offset by a $9.8 million loss in GMIN. The share of income from

equity accounted mining investments during the third quarter of

2024 was $0.7 million (2023 – $3,000).

During the first nine months of 2024, the

Corporation reported net earnings before taxes from the mining

investments segment of $65.8 million (2023 – loss of $22.4

million). Performance from the mining investments portfolio

contributed $65.1 million (2023 – loss of $22.7 million) to net

earnings or loss before taxes in this segment. The key driver of

performance during this period was a $53.6 million market

appreciation in the Corporation’s investment in Reunion Gold

Corporation. The share of loss from equity accounting mining

investments during the first nine months 2024 was $0.1 million

(2023 – $1.9 million).

Corporate and others

The Corporation reported pre-tax losses from the

corporate and others segment, including non-core subsidiaries, of

$2.0 million (2023 – $3.5 million) during the three months ended

September 30, 2024. During the first nine months of 2024, the

corporate and others segment reported pre-tax earnings of $6.0

million (2023 – loss of $11.7 million).

The fair value of non-mining portfolio

investments in the corporate and others segment increased by $1.2

million (2023 – $0.9 million) during the third quarter of the

current year. The fair value of portfolio investments in this

segment increased by $2.8 million (2023 – $0.5 million) during the

first nine months of 2024.

In the third quarter, the segment’s non-mining

equity accounted investments reported pre-tax earnings of $0.7

million (2023 – loss of $0.6 million). During the same period, the

segment’s subsidiaries reported pre-tax losses of $0.4 million

(2023 – $1.1 million). During the first nine months of 2024, the

segment’s non-mining equity accounted investments and subsidiaries

reported pre-tax losses of $0.4 million (2023 – $2.1 million) and

$1.2 million (2023 – $3.1 million), respectively.

Mining Services

During the three months ended September 30,

2024, the mining services segment, comprised of the Corporation’s

78%-owned subsidiary, Dundee Sustainable Technologies Inc. (“Dundee

Technologies”), reported a pre-tax loss of $0.8 million (2023 –

$0.6 million). During the first nine months of 2024, Dundee

Technologies incurred a pre-tax loss of $3.4 million (2023 – $3.1

million).

SHAREHOLDERS’ EQUITY ON A PER SHARE BASIS

|

|

|

|

|

|

|

|

Carrying value as at |

September 30, 2024 |

|

December 31, 2023 |

|

|

Mining Investments |

|

|

|

|

|

Portfolio investments |

$ |

96,530 |

|

$ |

126,671 |

|

|

|

Equity accounted investments |

|

27,262 |

|

|

15,731 |

|

|

|

Royalty |

|

18,921 |

|

|

18,921 |

|

|

|

|

|

|

142,713 |

|

|

161,323 |

|

|

|

Corporate and Others |

|

|

|

|

|

Corporate |

|

39,418 |

|

|

18,342 |

|

|

|

Portfolio investments ‒ other |

|

71,311 |

|

|

68,482 |

|

|

|

Equity accounted investments ‒ other |

|

26,921 |

|

|

28,874 |

|

|

|

Real estate joint ventures |

|

2,977 |

|

|

2,852 |

|

|

|

Subsidiaries |

|

4,862 |

|

|

7,738 |

|

|

|

|

|

|

145,489 |

|

|

126,288 |

|

|

|

Mining Services |

|

|

|

|

|

Subsidiaries |

|

3,036 |

|

|

2,439 |

|

|

|

Equity accounted investment |

|

- |

|

|

98 |

|

|

|

|

|

|

3,036 |

|

|

2,537 |

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY |

$ |

291,238 |

|

$ |

290,148 |

|

|

|

Less: Shareholders' equity attributable to holders of: |

|

|

|

|

|

|

Preference Shares, series 2 |

|

- |

|

|

(27,667 |

) |

|

|

|

Preference Shares, series 3 |

|

- |

|

|

(18,125 |

) |

|

|

SHAREHOLDERS' EQUITY ATTRIBUTABLE TO CLASS A SUBORDINATE

SHARES AND CLASS B SHARES OF THE CORPORATION |

$ |

291,238 |

|

$ |

244,356 |

|

|

|

|

|

|

|

|

|

|

Number of shares of the Corporation issued and outstanding: |

|

|

|

|

|

|

Class A Subordinate Shares |

|

86,279,255 |

|

|

85,832,805 |

|

|

|

|

Class B Shares |

|

3,114,491 |

|

|

3,114,491 |

|

|

|

Total number of shares issued and outstanding |

|

89,393,746 |

|

|

88,947,296 |

|

|

|

|

|

|

|

|

|

|

SHAREHOLDERS' EQUITY ON A PER SHARE BASIS * |

$ |

3.26 |

|

$ |

2.75 |

|

|

* Shareholders' Equity on a per share

basis is calculated as total shareholders' equity per the financial

statements, less the carrying amount of Preference shares, series 2

and series 3, and divided by the total number of Class A and Class

B shares issued and outstanding.

The Corporation’s unaudited interim consolidated

financial statements as at and for three and nine months ended

September 30, 2024 and 2023, along with the accompanying

management’s discussion and analysis, have been filed on the System

for Electronic Document Analysis and Retrieval (“SEDAR”) and may be

viewed by interested parties under the Corporation’s profile at

www.sedarplus.ca or the Corporation’s website at

www.dundeecorporation.com.

ABOUT DUNDEE CORPORATION:

Dundee Corporation is a public Canadian

independent holding company, listed on the Toronto Stock Exchange

under the symbol “DC.A”. Through its operating subsidiaries, Dundee

Corporation is an active investor focused on delivering

long-term, sustainable value as a trusted partner in the mining

sector with more than 30 years of experience making accretive

mining investments.

FORWARD-LOOKING STATEMENTS:

This press release may contain forward-looking

information within the meaning of applicable securities

legislation, which reflects Dundee Corporation’s current

expectations regarding future events. Forward-looking information

is based on a number of assumptions and is subject to a number of

risks and uncertainties, many of which are beyond Dundee

Corporation’s control, which could cause actual results and events

to differ materially from those that are disclosed in or implied by

such forward-looking information. Such risks and uncertainties

include, but are not limited to, the factors discussed under “Risk

Factors” in the Annual Information Form of Dundee Corporation and

subsequent filings made with securities commissions in Canada.

Dundee Corporation does not undertake any obligation to update such

forward-looking information, whether as a result of new

information, future events or otherwise, except as expressly

required by applicable law.

FOR FURTHER INFORMATION PLEASE

CONTACT:

Investor and Media RelationsT: (416) 864-3584E:

ir@dundeecorporation.com

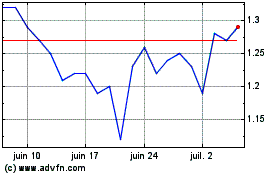

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Dundee (TSX:DC.A)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025