HIGHLIGHTS

SECOND QUARTER 2018

- Revenues increased 7.0% year over year

to $78.2 million compared with $73.1 million in the prior year,

fuelled by a 5.1% increase in our core DCM business

- Adjusted EBITDA of $4.1 million,

compared to $4.3 million in the prior year (See Table 2 and

“Non-IFRS Measures” below)

- Net Loss of $1.2 million,

including restructuring expenses of $0.7 million, acquisition costs

of $0.3 million and one-time business reorganization costs of $0.8

million compared to Net Loss of $0.6 million, including

restructuring expenses of $1.7 million in the prior comparative

period

- Adjusted net income of

$0.2 million, compared to $0.7 million in the prior

comparative period (See Table 3 and “Non-IFRS Measures” below)

YEAR TO DATE

- Revenues increased 16.4% year over year

to $166.7 million compared with $143.2 million in the prior year,

enhanced by a 10.9% increase in our core DCM business

- Adjusted EBITDA of $10.4 million, an

increase of 45.6% year over year (See Table 2 and “Non-IFRS

Measures” below)

- Net Income of $0.6 million, including

restructuring expenses of $0.8 million, acquisition costs of $0.3

million and one-time business reorganization costs of $1.2 million

compared to Net Loss of $2.7 million, including restructuring

expenses of $3.6 million and acquisition costs of $1.0 million in

the prior comparative period

- Adjusted Net Income of $2.3 million,

compared to $1.0 million in the prior comparative period (See Table

3 and “Non-IFRS Measures” below)

- Adopts new accounting standards IFRS 9

Financial Instruments ("IFRS 9") and IFRS 15 Revenue from Contracts

with Customers ("IFRS 15") effective January 1, 2018

RECENT EVENTS

- Announces new hybrid digital label

press to support customer wins in emerging Canadian cannabis

packaging label market and other growth opportunities in label

markets

- Reconfirms financial outlook for fiscal

2018

DATA Communications Management Corp. (TSX:DCM) (“DCM” or the

"Company"), a leading provider of business communication solutions

to companies across North America, announced its consolidated

financial results for three and six months ended June 30, 2018.

“Our revenue continued to demonstrate year over year growth,

thanks to contributions from our recent acquisitions and a second

consecutive quarter of growth in our core DCM business. Our sales

pipeline continues to be robust, strengthened by recent wins in the

licensed cannabis industry in which we have recently been awarded

multi-year contracts with several leading licensed producers to

provide Health Canada compliant packaging labels for a variety of

cannabis products. We expect to see incremental revenue in this

emerging market in the third and fourth quarters as these producers

come to market,” said Gregory J. Cochrane, President & CEO.

“I am disappointed with our gross margin in the second quarter,

which was largely attributed to higher volumes of lower margin

product mix compared to last year, and to a lesser extent the

impact of paper and other raw materials price increases that are

being experienced industry-wide. Nonetheless, we plan to effect

price increases as contract terms allow us, and longer-term we

expect to achieve higher margins with these customers. On the

positive side, we continue to see gross margin improvements on

non-contracted business and we expect significantly improved

margins in our packaging label business and other newly contracted

business in the second half of the year, which is typically

seasonally stronger in any event,” he continued.

To support anticipated growth in the cannabis market and other

growth opportunities in the label market, DCM announces it has

secured the first Gallus Heidelberg Labelfire 340 hybrid digital

ink-jet / flexographic label press in the Canadian market.

“DCM has been successful in applying its expertise in managing

highly complex, regulatory compliant, variable content for web to

print-on-demand production and has developed innovative solutions

for the cannabis market. This press is expected to further

differentiate DCM’s capabilities in the market,” Mr. Cochrane

concluded.

RESULTS OF OPERATIONS

All financial information in this press release is presented in

Canadian dollars and in accordance with International Financial

Reporting Standards (“IFRS”), as issued by the International

Accounting Standards Board (“IASB”).

Table 1 The following table sets out selected historical

consolidated financial information for the periods noted.

For the periods ended June 30, 2018 and 2017 Apr.

1 to Apr. 1 to Jan. 1 to

Jan. 1 to June 30, June 30, June 30,

June 30, 2018 2017 2018 2017 (in

thousands of Canadian dollars, except share and per share amounts,

unaudited)

$ $ $

$ Revenues (1) 78,176 73,066 166,692 143,192 Cost of

revenues 59,587 55,062 126,628

108,828 Gross profit 18,589 18,004 40,064

34,364 Selling, general and administrative expenses 17,750

15,715 35,422 30,739 Restructuring expenses 736 1,735 800 3,621

Acquisition costs 270 13 313

969 (Loss) income before finance costs

and income taxes (167 ) 541 3,529

(965 ) Finance costs (income) Interest expense

1,273 1,181 2,412 2,131 Interest income (2 )

-

(4 ) 0 Amortization of transaction costs 158

121 301 236 1,429

1,302 2,709 2,367

(Loss) income before income taxes (1,596 )

(761 ) 820 (3,332 ) Income tax

(recovery) expense Current (288 ) 288 555 339 Deferred (114

) (468 ) (304 ) (993 ) (402 )

(180 ) 251 (654 ) Net (loss)

income for the period (1,194 ) (581 ) 569

(2,678 ) Basic (loss) earnings per share (0.06

) (0.04 ) 0.03 (0.20 ) Diluted (loss) earnings per share (0.06 )

(0.04 ) 0.03 (0.20 ) Weighted average number of common shares

outstanding, basic 20,870,234 13,637,875 20,456,993 13,079,515

Weighted average number of common shares outstanding, diluted

20,870,234 13,637,875 20,495,793

13,079,515

(1)

2018 revenues include the impact of the

adoption of new accounting standard IFRS 15. Refer to note 3 of the

unaudited consolidated interim financial statements for three and

six months ended June 30, 2018 for further details on the impact of

the adoption of new accounting standards.

As at June 30, 2018 and December 31, 2017 As at

June As at Dec. 31, 30, 2018 2017

(in thousands of Canadian dollars, unaudited)

$

$ Current assets 83,402 82,804 Current liabilities

61,919 68,648 Total assets 141,648 131,859 Total non-current

liabilities 72,254 68,610 Shareholders’ equity / (deficit)

7,475 (5,399 )

Table 2 The following table provides reconciliations of

net (loss) income to EBITDA and of net (loss) income to Adjusted

EBITDA for the periods noted. See “Non-IFRS Measures”.

EBITDA and Adjusted EBITDA Reconciliation

For the periods ended June 30, 2018 and 2017 Apr.

1 to Apr. 1 to Jan. 1 to

Jan. 1 to June 30, June 30, June 30,

June 30, 2018 2017 2018 2017 (in

thousands of Canadian dollars, unaudited)

$

$ $ $ Net (loss) income for the

period (1,194 ) (581 ) 569

(2,678 ) Interest expense 1,273 1,181 2,412 2,131 Interest

income (2 )

-

(4 )

-

Amortization of transaction costs 158 121 301 236 Current income

tax (recovery) expense (288 ) 288 555 339 Deferred income tax

recovery (114 ) (468 ) (304 ) (993 ) Depreciation of property,

plant and equipment 1,176 1,058 2,324 1,943 Amortization of

intangible assets 1,232 906

2,301 1,599 EBITDA 2,241 2,505 8,154 2,577

Restructuring expenses 736 1,735 800 3,621 One-time business

reorganization costs 839

-

1,171

-

Acquisition costs 270 13 313

969 Adjusted EBITDA (1) 4,086

4,253 10,438 7,167

(1)

2018 revenues include the impact of the

adoption of new accounting standard IFRS 15. Refer to note 3 of the

unaudited consolidated interim financial statements for three and

six months ended June 30, 2018 for further details on the impact of

the adoption of new accounting standards.

Table 3 The following table provides reconciliations of

net (loss) income to Adjusted net (loss) income and a presentation

of Adjusted net (loss) income per share for the periods noted. See

“Non-IFRS Measures”.

Adjusted Net (Loss) Income Reconciliation

For the periods ended June 30, 2018 and 2017 Apr.

1 to Apr. 1 to Jan. 1 to

Jan. 1 to June 30, June 30, June 30,

June 30, 2018 2017 2018 2017 (in

thousands of Canadian dollars, except share and per share amounts,

unaudited)

$ $ $

$ Net (loss) income for the period (1,194 )

(581 ) 569 (2,678 ) Restructuring

expenses 736 1,735 800 3,621 One-time business reorganization costs

839

-

1,171

-

Acquisition costs 270 13 313 969 Tax effect of the above

adjustments (410 ) (453 ) (513 ) (945 )

Adjusted net (loss) income (1) 241 714

2,340 967 Adjusted net (loss)

income per share, basic 0.01 0.05

0.11 0.07 Adjusted net (loss) income

per share, diluted 0.01 0.05

0.11 0.07 Weighted average number of common

shares outstanding, basic 20,870,234

13,637,875 20,456,993 13,079,515

Weighted average number of common shares outstanding, diluted

21,742,477 13,637,875 20,495,793

13,079,515 Number of common shares

outstanding, basic 21,523,515 19,263,235

21,523,515 19,263,235 Number of

common shares outstanding, diluted 22,395,758

19,263,235 21,587,945 19,263,235

(1)

2018 revenues include the impact of the

adoption of new accounting standard IFRS 15. Refer to note 3 of the

unaudited consolidated interim financial statements for three and

six months ended June 30, 2018 for further details on the impact of

the adoption of new accounting standards.

Revenues

For the quarter ended June 30, 2018, DCM recorded revenues of

$78.2 million, an increase of 7.0% or $5.1 million compared

with the same period in 2017. Excluding the effects of adopting

IFRS 15, for the quarter ended June 30, 2018, revenues were $3.9

million, or 5.3%, higher than the same period last year. The

increase in revenues for the quarter ended June 30, 2018 was

primarily due to additional revenues from the acquisitions of

BOLDER Graphics and Perennial, new revenues contributed by a major

Canadian Schedule I bank which DCM won late in the third quarter of

2017 and increased volumes in labels and thermal paper work for

customers. The increase in revenues was partially offset by the

reduction in spend by certain customers, particularly in the

financial institutions sector due to a technological shift in the

way they conduct business.

For the six months ended June 30, 2018, DCM recorded revenues of

$166.7 million, an increase of 16.4% or $23.5 million compared

with the same period in 2017. Excluding the effects of adopting

IFRS 15, for the six months ended June 30, 2018, revenues were $3.9

million, or 5.3%, higher than the same period last year. The

increase in revenues for the six months ended June 30, 2018 was

primarily due to additional revenues from the acquisitions of

Eclipse, Thistle BOLDER Graphics and Perennial, new revenues

contributed by a major Canadian Schedule I bank which DCM won late

in the third quarter of 2017, increased volumes in labels work for

existing and new retailer customers, and a one-time increase in

volume from a long-standing customer which generated $8.9 million

in higher revenues relative to the same period last year. The

increase in revenues was partially offset by the reduction in spend

by certain customers, particularly in the financial institutions

sector due to a technological shift in the way they conduct

business. Overall, DCM continues to benefit from the growth

initiatives it effected throughout 2017 and the first half of 2018

to help offset some of the secular declines experienced by the

industry.

Cost of Revenues and Gross Profit

For the quarter ended June 30, 2018, cost of revenues increased

to $59.6 million from $55.1 million for the same period in 2017,

resulting in a $4.5 million or 8.2% increase over the same period

last year. Excluding the effects of the adjustments upon adoption

of IFRS 15, cost of revenues $2.8 million or 5.0% relative to the

same period last year. For the six months ended June 30, 2018, cost

of revenues increased to $126.6 million from $108.8 million for the

same period in 2017, resulting in a $17.8 million or 16.4% increase

over the same period last year. Excluding the effects of the

adjustments upon adoption of IFRS 15, cost of revenues increased by

$13.5 million or 12.4% relative to the same period last year.

Gross profit for the quarter ended June 30, 2018 was

$18.6 million, which represented an increase of

$0.6 million or 3.2% from $18.0 million for the same

period in 2017. Excluding the effects of adopting IFRS 15, gross

profit $1.1 million or 6.3% relative to the same period last

year. Gross profit as a percentage of revenues decreased to 23.8%

for the quarter ended June 30, 2018 compared to 24.6% for the same

period in 2017 however, excluding the effects of adopting IFRS 15,

gross profit as a percentage of revenues was 24.9% for the quarter

ended June 30, 2018. The decrease in gross profit as a percentage

of revenues for the quarter ended June 30, 2018 was positively

impacted by higher gross margins attributed to Eclipse, Thistle,

BOLDER Graphics and Perennial, and due to the refinement of DCM's

pricing discipline and cost reductions realized from prior cost

savings initiatives. The increase in gross profit as a percentage

of revenues was, however, partially offset by changes in product

mix, the impact of paper and other raw materials price increases

and compressed margins on contracts with certain existing

customers.

Gross profit for the six months ended June 30, 2018 was

$40.1 million, which represented an increase of

$5.7 million or 16.6% from $34.4 million for the same

period in 2017. Excluding the effects of adopting IFRS 15, gross

profit increased by $5.0 million or 14.5% relative to the same

period last year. Gross profit as a percentage of revenues for the

six months ended June 30, 2018 remained largely unchanged from the

prior year at 24.0%, however, excluding the effects of adopting

IFRS 15, gross profit as a percentage of revenues was 24.3% for the

six months ended June 30, 2018. The increase in gross profit as a

percentage of revenues for the six months ended June 30, 2018 was

positively impacted by higher gross margins attributed to Eclipse,

Thistle, BOLDER Graphics and Perennial, and due to the refinement

of DCM's pricing discipline and cost reductions realized from prior

cost savings initiatives. The increase in gross profit as a

percentage of revenues was, however, partially offset by changes in

product mix, the impact of paper and other raw materials price

increases and compressed margins on contracts with certain existing

customers.

Selling, General and Administrative Expenses

Selling, general and administrative (“SG&A”) expenses for

the quarter ended June 30, 2018 increased $2.0 million or

12.9% to $17.8 million compared to $15.7 million in the

same period in 2017. Excluding the effects of adopting IFRS 9 and

15, SG&A expenses were $2.1 million higher for the quarter

ended June 30, 2018 when compared to the same period last year. As

a percentage of revenues, these costs were 22.7% (or 23.1% before

the affects of adopting IFRS 9 and 15) of revenues for the six

months ended June 30, 2018 and 2017, respectively. The increase in

SG&A expenses for the quarter ended June 30, 2018 was primarily

attributable to the acquisitions of Eclipse, Thistle, BOLDER

Graphics and Perennial, one time business reorganization costs of

$0.8 million, additional professional fees and higher sales

commission costs commensurate with the increase in revenues.

SG&A expenses for the six months ended June 30, 2018

increased $4.7 million or 15.2% to $35.4 million compared

to $30.7 million for the same period of 2017. Excluding the

effects of adopting IFRS 9 and 15, SG&A expenses were

$4.5 million higher for the six months ended June 30, 2018

when compared to the same period last year. As a percentage of

revenues, these costs were 21.2% (or 21.8% before the effects of

adopting IFRS 9 and 15) and 21.5% of revenues for the six months

ended June 30, 2018 and 2017, respectively. The increase in

SG&A expenses for the six months ended June 30, 2018 was

primarily attributable to the acquisitions of Eclipse, Thistle,

BOLDER Graphics and Perennial, one time business reorganization

costs of $0.8 million, additional professional fees and higher

sales commission costs commensurate with the increase in

revenues.

Restructuring Expenses

For the quarter ended June 30, 2018, DCM incurred restructuring

expenses of $0.7 million compared to $1.7 million in the same

period in 2017. The restructuring expenses of $0.7 million during

the quarter ended June 30, 2018 primarily related to headcount

reductions across the operational, sales and administration

functions of the business. For the quarter ended June 30, 2017, DCM

incurred restructuring expenses of $1.7 million of which $1.5

million primarily related to headcount reductions across the sales

and customer service functions of the business and a lease exit

charge of $0.3 million associated with the closure of its

manufacturing and warehouse facility in Regina, Saskatchewan.

For the six months ended June 30, 2018, DCM incurred net

restructuring expenses $0.8 million compared to $3.6 million in the

same period in 2017. DCM incurred $1.9 million of restructuring

costs related to 1) headcount reductions in indirect labour as a

result of the plant consolidations completed during the current

quarter, in addition to reductions of certain individuals within

the sales and administrative functions, and 2) costs incurred to

facilitate the closure and consolidation of the Multiple Pakfold,

BOLDER Graphics and Granby, Quebec facilities into DCM's Brampton,

Ontario, Calgary, Alberta and Drummondville, Quebec facilities,

respectively. Total restructuring costs were offset by a recovery

of $1.1 million related to the termination of DCM's lease agreement

for its Granby, Quebec facility

For the six months ended June 30, 2017, DCM incurred

restructuring expenses of $3.6 million. $3.7 million of

restructuring costs were incurred related to headcount reductions

in DCM's indirect labour force across its operations, which were

designed to streamline DCM's order-to-production process and across

the sales and customer service functions of the business. These

restructuring costs were offset by a recovery of $0.3 million

related to a sub-lease of a closed facility in Richmond Hill,

Ontario and DCM also incurred a lease exit charge associated with

the closure of its manufacturing and warehouse facility in Regina,

Saskatchewan of $0.3 million.

Adjusted EBITDA

For the quarter ended June 30, 2018, Adjusted EBITDA was $4.1

million, or 5.2% of revenues, after adjusting EBITDA for the $0.7

million in restructuring charges, $0.3 million of acquisition costs

and $0.8 million of one-time business reorganization costs.

Excluding the effects of adopting IFRS 9 and 15, Adjusted EBITDA

was $4.6 million or 6.0% of revenues for the quarter ended June 30,

2018 compared with an Adjusted EBITDA of $4.3 million or 5.8% for

the same period last year. Adjusted EBITDA for the three months

ended June 30, 2018 decreased $0.2 million or 3.9% from the same

period in the prior year which was 5.8% of revenues in 2017. The

decrease in Adjusted EBITDA for the three months ended June 30,

2018 was primarily attributable to lower gross profit as a result

of product mix and higher SG&A expenses. This was partially

offset by improved pricing discipline and cost savings from

restructuring efforts carried out in the second half of 2017.

For the six months ended June 30, 2018, Adjusted EBITDA was

$10.4 million, or 6.3% of revenues, after adjusting EBITDA for the

$0.8 million in restructuring charges, $0.3 million of acquisition

costs and $1.2 million of one-time business reorganization costs.

Excluding the effects of adopting IFRS 9 and 15, Adjusted EBITDA

was $9.9 million or 6.1% of revenues for the six months ended June

30, 2018 compared with an Adjusted EBITDA of $7.2 million or 5.0%

for the same period last year. The $3.3 million increase in

Adjusted EBITDA for the six months ended June 30, 2018 over the six

months of 2017 was attributable to higher gross profit as a result

of revenues contributed by DCM's core business, in addition to the

Eclipse, Thistle, BOLDER Graphics and Perennial acquisitions,

improved pricing initiatives implemented part-way through the prior

year, and cost savings from the restructuring efforts carried out

in the second half of 2017. This was partially offset by higher

SG&A expenses.

Interest Expense

Interest expense, including interest on debt outstanding under

DCM’s credit facilities, on certain unfavourable lease obligations

related to closed facilities, and on DCM’s employee benefit plans

and including interest accretion expense related to certain debt

obligations recorded at fair value, was $1.3 million for the three

months ended June 30, 2018 compared to $1.2 million for the same

period in 2017, and was $2.4 million for the six months ended June

30, 2018 compared to $2.1 million for the same period in 2017.

Interest expense for the three and six months ended June 30, 2018

was higher than the same periods in the prior year primarily due to

the increase in the debt outstanding under DCM's credit facilities

in order to fund a portion of the upfront cash components of the

purchase price, settle certain debt assumed and pay for related

costs incurred to complete the acquisitions of Eclipse, Thistle and

BOLDER Graphics in 2017 and the acquisition of Perennial in

2018.

Income Taxes

DCM reported a loss before income taxes of $1.6 million and a

net income tax recovery of $0.4 million for the quarter ended June

30, 2018 compared to a loss before income taxes of $2.6 million and

a net income tax recovery of $0.2 million for the quarter ended

June 30, 2017. Excluding the impacts of adopting IFRS 9 and 15, the

net income tax recovery was $0.3 million for the quarter ended June

30, 2017. The current income tax recovery and expense were

primarily related to the income taxes payable on DCM's estimated

taxable income for the quarters ended June 30, 2018, and 2017,

respectively. The deferred income tax recoveries primarily related

to changes in estimates of future reversals of temporary

differences and new temporary differences that arose during the

quarters ended June 30, 2018 and 2017, respectively.

DCM reported income before income taxes of $0.8 million and a

net income tax expense of $0.3 million for the six months ended

June 30, 2018 compared to a loss before income taxes of $3.3

million and a net income tax recovery of $0.7 million for the six

months ended June 30, 2017. Excluding the impacts of adopting IFRS

9 and 15, the net income tax expense was $0.1 million for the six

months ended June 30, 2018. The current income tax expense was due

to the taxes payable on DCM's estimated taxable income for the six

months ended June 30, 2018. The deferred income tax recovery for

the six months ended June 30, 2018 primarily relates to changes in

estimates of future reversals of temporary differences, primarily

representing adjustments due to the adoption of IFRS 15 including

the full utilization of loss carryforwards and new temporary

differences that arose during the six month period ended June 30,

2018.

Net Income

Net loss for the quarter ended June 30, 2018 was $1.2 million

compared to net loss of $2.1 million for the same period in 2017.

Excluding the impacts of adopting IFRS 9 and 15, net loss for the

quarter ended June 30, 2018 was $0.8 million. The decrease in

comparable profitability for the quarter ended June 30, 2018 was

primarily due to lower gross profit as a percentage of revenue, due

to higher volumes of lower margin product and higher levels of

SG&A including the post-acquisition financial results of

Eclipse, Thistle, BOLDER Graphics and Perennial, and was partially

offset by refined discipline in DCM's pricing strategy and cost

reductions as a result of the restructuring efforts.

Net income for the six months ended June 30, 2018 was $0.6

million compared to a net loss of $2.7 million for the same period

in 2017. Excluding the impacts of adopting IFRS 9 and 15, for the

six months ended June 30, 2018 was $0.2 million. The decrease in

comparable profitability the six months ended June 30, 2018 was

primarily due to the increase in revenues which included the

post-acquisition financial results of Eclipse, Thistle, BOLDER

Graphics and Perennial, in addition to a refined discipline in

DCM's pricing strategy and cost reductions as a result of the

restructuring efforts. This increase was partially offset by lower

gross profit as a percentage of revenue, due to higher volumes of

lower margin product and higher levels of SG&A including the

post-acquisition financial results of Eclipse, Thistle, BOLDER

Graphics and Perennial.

Adjusted Net Income

Adjusted net income for the quarter ended June 30, 2018 was $0.2

million compared to Adjusted net income of $0.7 million for the

same period in 2017. Excluding the impacts of adopting IFRS 9 and

15, Adjusted net income for the quarter ended June 30, 2018 was

$0.6 million. The decrease in comparable profitability for the

quarter ended June 30, 2018 was primarily due to lower gross profit

as a percentage of revenue, due to higher volumes of lower margin

product and higher levels of SG&A including the

post-acquisition financial results of Eclipse, Thistle, BOLDER

Graphics and Perennial, and was partially offset by refined

discipline in DCM's pricing strategy and cost reductions as a

result of the restructuring efforts.

Adjusted net income for the six months ended June 30, 2018 was

$2.3 million compared to Adjusted net income of $1.0 million for

the same period in 2017. Excluding the impacts of adopting IFRS 9

and 15, for the six months ended June 30, 2018 was $1.9 million.

The increase in comparable profitability for the six months ended

June 30, 2018 was primarily due to the increase in revenues which

included the post-acquisition financial results of Eclipse,

Thistle, BOLDER Graphics and Perennial, in addition to a refined

discipline in DCM's pricing strategy and cost reductions as a

result of the restructuring efforts. This increase was partially

offset by lower gross profit as a percentage of revenue, due to

higher volumes of lower margin product and higher levels of

SG&A including the post-acquisition financial results of

Eclipse, Thistle, BOLDER Graphics and Perennial.

CASH FLOW FROM OPERATIONS

During the three months ended June 30, 2018, cash flows

generated by operating activities were $5.8 million compared to

cash flows generated by operating activities of $3.9 million during

the same period in 2017. $2.7 million of current year cash flows

resulted from operations, after adjusting for non-cash items,

compared with $3.3 million in 2017. Current period cash flows from

operations were positively impacted by the increase in revenues and

better gross margins from improved pricing discipline however this

was slightly offset by a $2.0 million increase in SG&A expense

over the prior year comparative period. Changes in working capital

during the three months ended June 30, 2018 generated $5.4 million

in cash compared with $2.7 million in the prior year. Given the

increase in trade receivables as a result of higher sales in the

current quarter, there was a corresponding increase in accounts

payable for higher volumes in inventory purchases and related

manufacturing costs. Timing of payments to suppliers are fairly

commensurate with collections on outstanding receivables from DCM's

customers.

In addition, $1.8 million of cash was used to make payments

primarily related to severances and lease termination costs,

compared with $1.7 million of payments in 2017. Contributions made

to the Company's pension plans were $0.3 million which decreased

from $0.5 million in the prior year while income tax payments

increased by $0.3 million for the three months ended June 30,

2018.

During the six months ended June 30, 2018, cash flows generated

by operating activities were $11.9 million compared to cash flows

generated by operating activities of $2.3 million during the same

period in 2017. A total of $8.2 million of the current period cash

flows resulted from operations, after adjusting for non-cash items,

compared with $4.7 million for the same period last year. Current

period cash flows from operations were positively impacted by the

increase in revenues and better gross margins from improved pricing

discipline however this was slightly offset by a $4.7 million

increase in SG&A expense over the prior year comparative

period. Changes in working capital during the six months ended June

30, 2018 generated $9.1 million in cash compared with $1.8 million

of cash generated in the prior year. There was an increase in

accounts payable for higher volumes in inventory purchases and

related manufacturing costs as a result of higher revenues during

the six month period ended June 30, 2018.

In addition, $3.9 million of cash was used to make payments

primarily related to severances and lease termination costs,

compared with $3.3 million of payments in 2017. Contributions made

to the Company's pension plans were $0.6 million, which decreased

from $0.9 million in the prior year while income tax payments

increased by $0.9 million for the six months ended June 30,

2018.

INVESTING ACTIVITIES

During the three months ended June 30, 2018, $9.8 million in

cash flows were used for investing activities compared with $1.7

million during the same period in 2017. In 2018, $0.7 million of

cash was used to invest in IT equipment, in addition to incurring

certain costs for leasehold improvements to facilitate the

consolidation of the Granby, Québec and BOLDER Graphics facilities

into DCM's Drummondville, Quebec and Calgary, Alberta locations,

respectively. Furthermore, $1.6 million of cash was used to further

invest in DCM's ERP project. In 2018, $7.5 million of net cash was

used to acquire the business of Perennial.

During the six months ended June 30, 2018, $11.2 million in cash

flows were used for investing activities compared with $6.6 million

during the same period in 2017. In 2018, $1.3 million of cash was

used to invest in IT equipment, in addition to incurring certain

costs for leasehold improvements to facilitate the consolidation of

the Multiple Pakfold, Granby, Québec and BOLDER Graphics facilities

into DCM's Brampton, Ontario, Drummondville, Quebec and Calgary,

Alberta locations, respectively. Furthermore, $2.5 million of cash

was used to further invest in DCM's ERP project. In 2018, $7.5

million of net cash was used to acquire the business of

Perennial.

FINANCING ACTIVITIES

During the three months ended June 30, 2018, cash flow generated

by financing activities was $4.7 million compared to cash flow used

for financing activities of $5.0 million during the same period in

2017. DCM used net cash received from the issuance of common shares

and warrants of $0.7 million and cash from advances under its

credit facilities totaling $10.4 million to repay $4.8 million in

outstanding principal amounts under its credit facilities. DCM also

paid a total of $0.6 million related to the promissory notes issued

in connection with the acquisitions of Thistle Eclipse and BOLDER.

DATA also incurred $0.9 million of transaction costs related to the

amendments to its senior credit facilities and the establishment of

a new credit facility.

During the six months ended June 30, 2018, cash flow used for

financing activities was $0.1 million compared to cash flow

generated by financing activities of $1.9 million during the same

period in 2017. DCM used a portion of cash generated from its

operations to repay $6.7 million in outstanding principal amounts

under its various credit facilities and paid a total of $3.4

million related to the promissory notes issued in connection with

the acquisitions of Thistle, Eclipse and BOLDER. DATA also incurred

$0.9 million of transaction costs related to the amendments to its

senior credit facilities and the establishment of a new credit

facility.

OUTLOOK

In the second quarter of 2018, DCM continued to experience

higher revenues over the prior year as a result of modest growth in

its core business, combined with incremental revenue from the

acquisitions made in 2017 and the first half of 2018. DCM maintains

the 2018 financial outlook it issued in February 2018, buoyed by

continued revenue growth trends, expanding opportunities within its

existing customer base and new customer wins, particularly as a

leading supplier in the emerging market for Health Canada compliant

packaging labels in the licensed cannabis market.

Despite lower margins experienced in the second quarter compared

to the first quarter, and price and inflationary pressures the

Company is experiencing, DCM continues to realize gross margin

improvements on non-contracted business and expects significantly

improved margins in the packaging label business and other newly

contracted business in the second half of the year, which is

typically seasonally stronger in any event.

Revenues

DCM anticipates total revenues of between $295.0 million and

$310.0 million for fiscal 2018, representing growth of

approximately 2% to 7% compared to revenues of $289.5 million in

fiscal 2017.

Adjusted EBITDA

Adjusted EBITDA for fiscal 2018 is estimated to be between $22.0

million and $25.0 million compared to Adjusted EBITDA in fiscal

2017 of $16.1 million.

Capital Expenditures

For fiscal 2018, DCM presently expects to spend approximately

$1.5 million on capital expenditures. DCM expects to incur

approximately $3.0 million mostly relating to the ERP project which

will be incurred primarily through the first three quarters of

2018.

As part of establishing the above guidance, DCM made the

following assumptions:

- New customer wins and sales initiatives

focused on capturing greater wallet share from DCM’s existing

customer base, including increasingly capitalizing on its

technology-enabled value-added services provided to customers, will

offset continued expected declines in the Company’s traditional

business communications market;

- DCM will benefit from the full-year

results of the acquisitions of Eclipse, Thistle and BOLDER Graphics

and continue to experience growth rates in each of those businesses

consistent with the past year, and DCM will benefit from the

partial year of results from the acquisition of Perennial,

commencing May 8, 2018.

- The three acquisitions DCM completed in

2017 will continue to generate incremental cross-selling

opportunities and cost synergies across the entire business of the

Company in 2018, as will the acquisition of Perennial in May

2018;

- DCM will be able to translate its sales

pipeline into new customer acquisitions;

- Improved year over year margins will be

achieved through ongoing strategic initiatives relating to

productivity improvements and continuing efforts by management to

drive improved profitability;

- DCM will be able to effect increases in

the prices of products sold to customers to mitigate increases in

the costs of paper, and consumables, CPI and freight charges that

are being experienced industry-wide and longer-term realize higher

margins with these customers, while experiencing nominal if any

volume loss;

- The Company continues to explore

additional strategic acquisition opportunities, and, while there

can be no certainty that any such opportunities will be completed,

such acquisitions could impact the outlook provided;

- Economic conditions in North America

will not deteriorate; and

- The above guidance is based on the

accounting policies applied in the unaudited interim consolidated

financial statements and accompanying notes of DCM for the second

quarter of 2018 and IFRS in effect for the period ended June 30,

2018.

DCM cautions that the assumptions used to prepare the guidance

provided above, although currently reasonable, may prove to be

incorrect or inaccurate. Accordingly, actual results may differ

materially from expectations as set forth above. The guidance

provided above should be read in conjunction with, and is qualified

by, the section Forward-looking Statements contained in this press

release.

About DATA Communications Management Corp.

DCM is a communication solutions partner that adds value for

major companies across North America by creating more meaningful

connections with their customers. We pair customer insights and

thought leadership with cutting-edge products, modular enabling

technology and services to power our clients’ go-to market

strategies. We help our clients manage how their brands come to

life, determine which channels are right for them, manage

multimedia campaigns, deploy location-specific and 1:1 marketing,

execute custom loyalty programs, and fulfill their commercial

printing needs all in one place.

Our extensive experience has positioned us as experts at

providing communication solutions across many verticals, including

the financial, retail, healthcare, consumer health, energy, and

not-for-profit sectors. Thanks to our locations throughout Canada

and in the United States (Chicago, Illinois and New York, New

York), we are able to meet our clients’ varying needs with scale,

speed, and efficiency - no matter how large or complex the ask. And

we can do it all with advanced DCM security, regulatory compliance,

and bilingual communications, in print or digital.

Additional information relating to DATA Communications

Management Corp. is available on www.datacm.com, and in the

disclosure documents filed by DATA Communications Management Corp.

on the System for Electronic Document Analysis and Retrieval

(SEDAR) at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance, objectives or achievements of DCM, or industry

results, to be materially different from any future results,

performance, objectives or achievements expressed or implied by

such forward-looking statements. When used in this press release,

words such as “may”, “would”, “could”, “will”, “expect”,

“anticipate”, “estimate”, “believe”, “intend”, “plan”, and other

similar expressions are intended to identify forward-looking

statements. These statements reflect DCM’s current views regarding

future events and operating performance, are based on information

currently available to DCM, and speak only as of the date of this

press release. These forward-looking statements involve a number of

risks, uncertainties and assumptions and should not be read as

guarantees of future performance or results, and will not

necessarily be accurate indications of whether or not such

performance or results will be achieved. Many factors could cause

the actual results, performance, objectives or achievements of DCM

to be materially different from any future results, performance,

objectives or achievements that may be expressed or implied by such

forward-looking statements. The principal factors, assumptions and

risks that DCM made or took into account in the preparation of

these forward-looking statements include: the limited growth in the

traditional printing industry and the potential for further

declines in sales of DCM’s printed business documents relative to

historical sales levels for those products; the risk that changes

in the mix of products and services sold by DCM will adversely

affect DCM’s financial results; the risk that DCM may not be

successful in reducing the size of its legacy print business,

realizing the benefits expected from restructuring and business

reorganization initiatives, reducing costs, reducing and repaying

its long-term debt, and growing its digital and marketing

communications businesses; the risk that DCM may not be successful

in managing its organic growth; DCM’s ability to invest in, develop

and successfully market new digital and other products and

services; competition from competitors supplying similar products

and services, some of whom have greater economic resources than DCM

and are well-established suppliers; DCM’s ability to grow its sales

or even maintain historical levels of its sales of printed business

documents; the impact of economic conditions on DCM’s businesses;

risks associated with acquisitions by DCM; the failure to realize

the expected benefits from the acquisitions of Thistle Printing,

Eclipse Colour & Imaging, BOLDER Graphics and Perennial Group

of Companies and risks associated with the integration of such

acquired businesses; risks related to the disruption of management

time from ongoing business operations due to the acquisition of the

Perennial Group of Companies; increases in the costs of paper and

other raw materials used by DCM; and DCM’s ability to maintain

relationships with its customers. Additional factors are discussed

elsewhere in this press release and under the headings "Risk

Factors" and “Risks and Uncertainties” in DCM’s management’s

discussion and analysis and in DCM’s other publicly available

disclosure documents, as filed by DCM on SEDAR (www.sedar.com).

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results may vary materially from those described

in this press release as intended, planned, anticipated, believed,

estimated or expected. Unless required by applicable securities

law, DCM does not intend and does not assume any obligation to

update these forward-looking statements.

NON-IFRS MEASURES

This press release includes certain non-IFRS measures as

supplementary information. Except as otherwise noted, when used in

this press release, EBITDA means earnings before interest and

finance costs, taxes, depreciation and amortization and Adjusted

net income (loss) means net income (loss) adjusted for the impact

of certain non-cash items and certain items of note on an after-tax

basis. Adjusted EBITDA means EBITDA adjusted for restructuring

expenses, one-time business reorganization costs, goodwill

impairment charges, gain on redemption of convertible debentures,

and acquisition costs. Adjusted net income (loss) means net income

(loss) adjusted for restructuring expenses, one-time business

reorganization costs, goodwill impairment charges, gain on

redemption of convertible debentures, acquisition costs and the tax

effects of those items. Adjusted net income (loss) per share (basic

and diluted) is calculated by dividing Adjusted net income (loss)

for the period by the weighted average number of common shares

(basic and diluted) outstanding during the period. In addition to

net income (loss), DCM uses non-IFRS measures including Adjusted

net income (loss), Adjusted net income (loss) per share, EBITDA and

Adjusted EBITDA to provide investors with supplemental measures of

DCM’s operating performance and thus highlight trends in its core

business that may not otherwise be apparent when relying solely on

IFRS financial measures. DCM also believes that securities

analysts, investors, rating agencies and other interested parties

frequently use non-IFRS measures in the evaluation of issuers.

DCM’s management also uses non-IFRS measures in order to facilitate

operating performance comparisons from period to period, prepare

annual operating budgets and assess its ability to meet future debt

service, capital expenditure and working capital requirements.

Adjusted net income (loss), Adjusted net income (loss) per share,

EBITDA and Adjusted EBITDA are not earnings measures recognized by

IFRS and do not have any standardized meanings prescribed by IFRS.

Therefore, Adjusted net income (loss), Adjusted net income (loss)

per share, EBITDA and Adjusted EBITDA are unlikely to be comparable

to similar measures presented by other issuers.

Investors are cautioned that Adjusted net income (loss),

Adjusted net income (loss) per share, EBITDA and Adjusted EBITDA

should not be construed as alternatives to net income (loss)

determined in accordance with IFRS as an indicator of DCM’s

performance. For a reconciliation of net income (loss) to EBITDA

and a reconciliation of net income (loss) to Adjusted EBITDA, see

Table 2 above. For a reconciliation of net income (loss) to

Adjusted net income (loss) and a presentation of Adjusted net

income (loss) per share, see Table 3 above.

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(in thousands of Canadian

dollars, unaudited)

June 30, 2018$

December 31, 2017$ Assets

Current assets Trade receivables 70,067 41,193 Inventories 10,052

36,519 Prepaid expenses and other current assets 3,283

5,092 83,402 82,804 Non-current assets Other

non-current assets 454

-

Deferred income tax assets 2,899 6,108 Restricted cash 515 515

Property, plant and equipment 17,900 18,831 Pension assets 2,010

760 Intangible assets 17,553 14,473 Goodwill 16,915

8,368 141,648 131,859

Liabilities Current liabilities Bank overdraft 2,164 2,868

Trade payables and accrued liabilities 41,508 34,306 Current

portion of credit facilities 5,480 8,725 Current portion of

promissory notes 4,823 4,374 Provisions 3,188 3,950 Income taxes

payable 2,627 3,188 Deferred revenue 2,129 11,237

61,919 68,648 Non-current liabilities Provisions 475 2,702

Credit facilities 53,597 47,207 Promissory notes 1,494 2,829

Deferred income tax liabilities 1,985 1,295 Other non-current

liabilities 3,688 3,413 Pension obligations 7,850 8,133 Other

post-employment benefit plans 3,165 3,031

134,173 137,258

Equity

Shareholders’ equity/(deficit) Shares 251,217 248,996 Warrants 806

287 Contributed surplus 1,633 1,368 Translation reserve 220 183

Deficit (246,401 ) (256,233 ) 7,475 (5,399 )

141,648 131,859

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands of Canadian dollars, except

per share amounts,

For the three months For the three

months

unaudited)

ended June 30, 2018

ended June 30, 2017 $ $

Revenues 78,176 73,066

Cost of revenues

59,587 55,062

Gross profit

18,589 18,004

Expenses Selling,

commissions and expenses 9,200 8,690 General and administration

expenses 8,550 7,025 Restructuring expenses 736 1,735 Acquisition

costs 270 13 18,756 17,463

(Loss) income before finance costs and income

taxes (167 ) 541

Finance costs (income) Interest

expense 1,273 1,181 Interest income (2 )

-

Amortization of transaction costs 158 121

1,429 1,302

Loss before income

taxes (1,596 ) (761 )

Income tax (recovery)

expense Current (288 ) 288 Deferred (114 ) (468 ) (402 )

(180 )

Net loss for the period (1,194 )

(581 )

Basic loss per share (0.06 ) (0.04 )

Diluted loss per share (0.06 ) (0.04 )

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands of Canadian dollars, except

per share amounts,

For the six months For the six months

unaudited)

ended June 30, 2018 ended June 30, 2017

$ $ Revenues 166,692 143,192

Cost of revenues 126,628 108,828

Gross profit 40,064 34,364

Expenses Selling, commissions and expenses 19,661

17,208 General and administration expenses 15,761 13,531

Restructuring expenses 800 3,621 Acquisition costs 313

969 36,535 35,329

Income (loss) before finance costs and income taxes 3,529

(965 )

Finance costs (income) Interest expense 2,412

2,131 Interest income (4 ) — Amortization of transaction costs 301

236 2,709 2,367

Income (loss) before income taxes 820 (3,332 )

Income tax (recovery) expense Current 555 339

Deferred (304 ) (993 ) 251 (654 )

Net income (loss) for the period 569 (2,678 )

Basic earnings (loss) per share 0.03

(0.20 )

Diluted earnings (loss) per share 0.03

(0.20 )

CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(in thousands of Canadian dollars,

unaudited)

For the three months For the three

months ended June 30, 2018 ended June 30, 2017

$ $ Net loss for the

period (1,194 ) (581 )

Other

comprehensive income (loss): Items that may be

reclassified subsequently to net loss Foreign currency

translation 15 (56 ) 15 (56 )

Items that will not be reclassified to net loss

Re-measurements of pension and other post-employment benefit

obligations 891 (758 ) Taxes related to pension and other

post-employment benefit adjustment above (232 ) 197

659 (561 )

Other comprehensive income

(loss) for the period, net of tax 674 (617 )

Comprehensive loss for the period (520 )

(1,198 )

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS)

(in thousands of Canadian dollars,

unaudited)

For the six months For the six months

ended June 30, 2018 ended June 30, 2017

$ $ Net income (loss) for the

period 569 (2,678 )

Other

comprehensive loss: Items that may be reclassified

subsequently to net income (loss) Foreign currency translation

37 (74 ) 37 (74 )

Items that

will not be reclassified to net income (loss) Re-measurements

of pension and other post-employment benefit obligations 1,214

(2,103 ) Taxes related to pension and other post-employment benefit

adjustment above (316 ) 547 898 (1,556

)

Other comprehensive income (loss) for the period, net

of tax 935 (1,630 )

Comprehensive

income (loss) for the period 1,504 (4,308 )

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY

(DEFICIT)

(in thousands of Canadian dollars,

Conversion Contributed

Translation Total equity

unaudited)

Shares Warrants options surplus

reserve Deficit (deficit)

$ $ $

$ $ $ Balance as at

December 31, 2016 237,432

-

128 1,164 258

(248,917 ) (9,935 ) Net loss for the period

-

-

-

-

-

(2,678 ) (2,678 ) Other comprehensive loss for the period

-

-

-

-

(74 ) (1,556 ) (1,630 ) Total

comprehensive loss for the period

-

-

-

-

(74 ) (4,234 ) (4,308 ) Shares

issued on the redemption of convertible debentures

-

-

(128 ) 128

-

-

-

Cancellation of convertible debentures

-

-

-

-

-

-

-

Issuance of common shares 10,662 280

-

(15 )

-

-

10,927 Share-based compensation expense

-

-

-

59

-

-

59

Balance as at June 30, 2017

237,432

-

-

1,292 184 (253,151 )

(14,243 )

Balance as at December 31,

2017 248,996 287

-

1,368 183 (256,233 )

(5,399 ) Impact of change in accounting policy

-

-

-

-

-

8,365 8,365 248,996

287

-

1,368 183 (247,868 )

2,966 Net income for the period

-

-

-

-

-

569 569 Other comprehensive income for the period

-

-

-

-

37 898 935 Total

comprehensive income for the period

-

-

-

-

37 1,467 1,504

Issuance of common shares and warrants, net 2,221 519

-

-

-

-

2,740 Share-based compensation expense

-

-

-

265

-

-

265

Balance as at June 30, 2018

251,217 806

-

1,633 220 (246,401 )

7,475

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars,

unaudited)

For the three months For the three

months ended June 30, 2018 ended June 30, 2017

$ $ Cash provided by

(used in) Operating activities

Net loss for the period (1,194 ) (581 ) Adjustments

to net loss Depreciation of property, plant and equipment 1,176

1,058 Amortization of intangible assets 1,232 906 Share-based

compensation expense 171 7 Pension expense 135 135 (Gain) loss on

disposal of property, plant and equipment (5 ) 42 Write-off of

intangible assets 242

-

Provisions 870 1,735 Amortization of transaction costs 158 121

Accretion of non-current liabilities and related interest expense

150 219 Other non-current liabilities 120 (248 ) Other

post-employment benefit plans, net 67 55 Income taxes recovery (402

) (180 ) 2,720 3,269 Changes in working capital 5,418 2,721

Contributions made to pension plans (304 ) (453 ) Provisions paid

(1,769 ) (1,653 ) Income taxes paid (278 ) (5 ) 5,787

3,879

Investing activities

Purchase of property, plant and equipment (665

) (811 ) Purchase of intangible assets (1,616 ) (846 ) Proceeds on

disposal of property, plant and equipment 26 2 Net cash

consideration for acquisition of businesses (7,505 )

-

(9,760 ) (1,655 )

Financing activities

Issuance of common shares and warrants,

net 685 8,080 Proceeds from credit facilities 10,395 3,500

Repayment of credit facilities (4,816 ) (4,003 ) Repayment of

convertible debentures

-

(11,175 ) Repayment of other liabilities (100 ) (166 ) Repayment of

promissory notes (585 ) (935 ) Transaction costs (863 ) (288 )

Finance lease payments (6 ) (18 ) 4,710 (5,005

)

Decrease in (bank overdraft) / (decrease) in cash and

cash equivalents during the period 737

(2,781 )

(Bank overdraft) cash and cash equivalents – beginning

of period (2,916 ) 1,838

Effects of

foreign exchange on cash balances 15 (46 )

Bank overdraft – end of period (2,164 ) (989 )

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars,

unaudited)

For the six months For the six months

ended June 30, 2018 ended June 30, 2017

$ $ Cash provided by (used in)

Operating activities Net

income (loss) for the period 569 (2,678 ) Adjustments to net income

(loss) Depreciation of property, plant and equipment 2,324 1,943

Amortization of intangible assets 2,301 1,599 Share-based

compensation expense 265 59 Pension expense 269 270 (Gain) loss on

disposal of property, plant and equipment (129 ) 22 Write-off of

intangible assets 242

-

Provisions 934 3,621 Amortization of transaction costs 301 236

Accretion of non-current liabilities and related interest expense

311 317 Other non-current liabilities 446 (118 ) Other

post-employment benefit plans, net 134 110 Income tax expense

(recovery) 251 (654 ) 8,218 4,727 Changes in working

capital 9,107 1,836 Contributions made to pension plans (588 ) (912

) Provisions paid (3,923 ) (3,340 ) Income taxes paid (894 )

(5 ) 11,920 2,306

Investing

activities Purchase of property,

plant and equipment (1,286 ) (948 ) Purchase of intangible assets

(2,518 ) (1,079 ) Proceeds on disposal of property, plant and

equipment 150 22 Net cash consideration for acquisition of

businesses (7,505 ) (4,638 ) (11,159 ) (6,643 )

Financing activities

Issuance of common shares and warrants, net 685 8,069 Proceeds from

credit facilities 10,395 17,089 Repayment of credit facilities

(6,695 ) (7,601 ) Repayment of convertible debentures

-

(11,175 ) Repayment of other liabilities (201 ) (455 ) Repayment of

promissory notes (3,393 ) (1,064 ) Transaction costs (868 ) (605 )

Finance lease payments (13 ) (2,400 ) (90 ) 1,858

Decrease in (bank overdraft) / (decrease) in cash

and cash equivalents during the period 671

(2,479 )

(Bank overdraft) cash and cash equivalents – beginning

of period (2,868 ) 1,544

Effects of

foreign exchange on cash balances 33 (54 )

Bank overdraft – end of period (2,164 ) (989 )

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180813005712/en/

DATA Communications Management Corp.Mr. Gregory J. Cochrane,

905-791-3151President and Chief Executive OfficerorMr. James E.

Lorimer, 905-791-3151Chief Financial Officerir@datacm.com

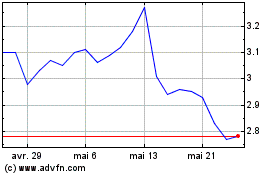

Data Communications Mana... (TSX:DCM)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Data Communications Mana... (TSX:DCM)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024