DATA Communications Management Corp. (TSX: DCM; OTCQX: DCMDF)

(“DCM” or the "Company"), a leading provider of marketing and

business communication solutions to companies across North America,

is pleased to report accelerated momentum in the second quarter of

2022 with revenue up +23.4%, gross profit up +29.0%, net income up

+490.7% and EBITDA1 up +48.7%, compared to the second quarter of

2021, respectively. Through the first half of fiscal 2022, revenue

is up +16.8%, gross profit is up +17.7%, net income is up +211.8%,

and EBITDA is up +38.1%, compared to the first half of 2021,

respectively. Strong client demand for the Company's solutions and

services is leading this growth.

SECOND QUARTER 2022 HIGHLIGHTS - BUILDING A BIGGER

BUSINESS

- Revenue for Q2 2022 was up 23.4%, or +$12.9 million, vs. Q2

year ago (YA), for total revenues of $68.1 million;

- Gross profit accelerated 29.0%, or +$4.6 million, vs. YA to

$20.4 million;

- Net income increased 490.7%, or +$3.1 million, vs. YA to $3.8

million;

- EBITDA grew 48.7%, or +$3.1 million, vs. YA to $9.5

million;

- Adjusted EBITDA1 grew 30.0%, or +$2.2 million, vs. YA to $9.5

million;

- No restructuring expenses or other “adjustments” to EBITDA in

the second quarter of 2022. The Company’s current outlook

anticipates no restructuring charges in the balance of fiscal

2022;

- SG&A expenses decreased by 3.8%, or -$0.5 million, vs. YA

to $13.8 million;

- Term debt lower by 17.4%, or -$5.9 million, vs. year end 2021

to $28.1 million;

- Basic and diluted EPS of $0.09 and $0.08, respectively,

compared with $0.01 in second quarter of 2021.

SECOND QUARTER 2022 OPERATIONAL HIGHLIGHTS – BUILDING A

BETTER BUSINESS

- We have been awarded more than $22 million of new business year

to date, from both existing and new clients, and our tech-enabled

services pipeline remains strong at +$10 million;

- Thirteen change management projects in place, with the

objective to accelerate attainment of our 5-year strategic

goals;

- Our first-ever digital lead generation program was introduced,

with the intent to help drive commercial sales;

- More than 40 of our clients are now engaged with our

PrintReleaf program; and we have reforested over 332,000 trees

through this innovative sustainability program, since its

introduction last fall.

MANAGEMENT COMMENTARY

"Our second quarter results are further evidence that our

unrelenting focus on building both a better and a bigger business

is paying off," says Richard Kellam, CEO and President of DCM. "Our

positive momentum that started in the second half of 2021 continues

– and as you’ve heard me say multiple times before: “momentum

builds momentum.” We continue to focus on our strategic shift from

a “print first” to a “digital first” company. New client wins, as

well as expansion revenues from existing clients are driving this

momentum; almost all of which are attributed to our tech-enabled

workflow solutions."

“The biggest challenge we currently face in our business is

access to raw materials. This has resulted in longer lead times and

increased inventory, having an impact on our working capital line

of credit. However, our +23.4% revenue growth, +48.7% increase in

EBITDA and +490.7% increase in net income, is evidence that this

has been a good investment.”

"Our pipeline of business remains strong, and we expect this

positive momentum to continue through the balance of 2022. We are

seeing ongoing benefits from the operational initiatives we

implemented last year, and our constant focus on cost controls

continues to help us build a better business."

SECOND QUARTER 2022 EARNINGS CALL

The Company will host a conference call and webcast on

Wednesday, August 10, 2022, at 9.00 a.m. Eastern time. Mr. Kellam,

and James Lorimer, CFO, will present the second quarter 2022

results followed by a live Q&A period.

Instructions on how to access both the webcast and telephone

call are available below. For those unable to join live, a replay

of the webcast will be available on the DCM Investor Relations

page.

DCM will be using Microsoft Teams to broadcast our earnings

call, which will be accessible via the options below:

Join on your computer or mobile app Click here to join

the meeting

Or call in (audio only) +1

647-749-9154, 914477492# Canada, Toronto

Phone Conference ID: 914 477 492#

The Company’s full results will be posted on its Investor

Relations page and on www.sedar.com. A video message from Mr.

Kellam will also be posted on the Company’s website.

TABLE 1 The following table sets

out selected historical consolidated financial information for the

periods noted.

For the periods ended June 30, 2022 and

2021

April 1 to June 30,

2022

April 1 to June 30, 2021

January 1 to June 30,

2022

January 1 to June 30, 2021

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

(Restated)

(Restated)

Revenues

$

68,103

$

55,207

$

137,360

$

117,568

Gross profit

20,442

15,842

40,766

34,635

Gross profit, as a percentage of

revenues

30.0 %

28.7 %

29.7 %

29.5 %

Selling, general and administrative

expenses (1)

13,781

14,323

27,425

29,227

As a percentage of revenues

20.2 %

25.9 %

20.0 %

24.9 %

Adjusted EBITDA

9,478

7,292

18,926

16,579

As a percentage of revenues

13.9 %

13.2 %

13.8 %

14.1 %

Net income for the period

3,757

636

7,470

2,396

Adjusted net income

3,757

1,319

7,470

4,534

As a percentage of revenues

5.5 %

2.4 %

5.4 %

3.9 %

Basic earnings per share

$

0.09

$

0.01

$

0.17

$

0.05

Diluted earnings per share

$

0.08

$

0.01

$

0.16

$

0.05

Adjusted net income per share,

basic

$

0.09

$

0.03

$

0.17

$

0.10

Adjusted net income per share,

diluted

$

0.08

$

0.03

$

0.16

$

0.10

Weighted average number of common

shares outstanding, basic

44,062,831

43,926,019

44,062,831

43,926,019

Weighted average number of common

shares outstanding, diluted

46,501,606

46,174,209

46,529,426

45,750,869

(1) SG&A and deferred income tax expense include the impact

of the IFRS Interpretations Committee’s agenda decision regarding

configuration or customization costs in a cloud computing

arrangement. Prior periods have been retrospectively restated to

derecognize previously capitalized costs in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors.

Refer to note 3 of the condensed interim consolidated financial

statements for the period ended June 30, 2022 for further details

on the impact of the amended accounting standard.

TABLE 2 The following table

provides reconciliations of net income to EBITDA and of net income

to Adjusted EBITDA for the periods noted.

EBITDA and Adjusted EBITDA

reconciliation

For the periods ended June 30, 2022 and

2021

April 1 to June 30,

2022

April 1 to June 30, 2021

January 1 to June 30,

2022

January 1 to June 30, 2021

(in thousands of Canadian dollars,

unaudited)

(Restated)

(Restated)

Net income for the period (1)

$

3,757

$

636

$

7,470

$

2,396

Interest expense, net

1,343

1,716

2,598

3,128

Amortization of transaction costs

86

176

173

321

Current income tax expense

1,522

1,126

2,660

1,672

Deferred income tax (recovery) expense

(1)

(47)

(642)

440

(663)

Depreciation of property, plant and

equipment

781

776

1,561

1,582

Amortization of intangible assets (1)

403

418

811

863

Depreciation of the ROU Asset

1,633

2,168

3,213

4,407

EBITDA

$

9,478

$

6,374

$

18,926

$

13,706

Restructuring expenses

—

918

—

4,325

Other income

—

—

—

(1,452)

Adjusted EBITDA

$

9,478

$

7,292

$

18,926

$

16,579

(1) SG&A and deferred income tax expense include the impact

of the IFRS Interpretations Committee’s agenda decision regarding

configuration or customization costs in a cloud computing

arrangement. Prior periods have been retrospectively restated to

derecognize previously capitalized costs in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors.

Refer to note 3 of the condensed interim consolidated financial

statements for the period ended June 30, 2022 for further details

on the impact of the amended accounting standard.

TABLE 3 The following table

provides reconciliations of net (loss) income to Adjusted net

(loss) income and a presentation of Adjusted net (loss) income per

share for the periods noted.

Adjusted net income

reconciliation

For the periods ended June 30, 2022 and

2021

April 1 to June 30,

2022

April 1 to June 30, 2021

January 1 to June 30,

2022

January 1 to June 30, 2021

(in thousands of Canadian dollars, except

share and per share amounts, unaudited)

(Restated)

(Restated)

Net income for the period (1)

$

3,757

$

636

$

7,470

$

2,396

Restructuring expenses

—

918

—

4,325

Other income

—

—

—

(1,452)

Tax effect of the above adjustments

—

(235)

—

(735)

Adjusted net income

$

3,757

$

1,319

$

7,470

$

4,534

Adjusted net income per share,

basic

$

0.09

$

0.03

$

0.17

$

0.10

Adjusted net income per share,

diluted

$

0.08

$

0.03

$

0.16

$

0.10

(1) SG&A and deferred income tax expense include the impact

of the IFRS Interpretations Committee’s agenda decision regarding

configuration or customization costs in a cloud computing

arrangement. Prior periods have been retrospectively restated to

derecognize previously capitalized costs in accordance with IAS 8

Accounting Policies, Changes in Accounting Estimates and Errors.

Refer to note 3 of the condensed interim consolidated financial

statements for the period ended June 30, 2022 for further details

on the impact of the amended accounting standard.

About DATA Communications Management Corp.

DCM is a marketing and business communications partner that

helps companies simplify the complex ways they communicate and

operate, so they can accomplish more with fewer steps and less

effort. For over 60 years, DCM has been serving major brands in

vertical markets including financial services, retail, healthcare,

energy, other regulated industries, and the public sector. We

integrate seamlessly into our clients’ businesses thanks to our

deep understanding of their needs, transformative tech-enabled

solutions, and end-to-end service offering. Whether we’re running

technology platforms, sending marketing messages, or managing print

workflows, our goal is to make everything surprisingly simple.

Additional information relating to DATA Communications

Management Corp. is available on www.datacm.com, and in the

disclosure documents filed by DATA Communications Management Corp.

on the System for Electronic Document Analysis and Retrieval

(SEDAR) at www.sedar.com.

FORWARD-LOOKING STATEMENTS

Certain statements in this press release constitute

“forward-looking” statements that involve known and unknown risks,

uncertainties and other factors which may cause the actual results,

performance, objectives or achievements of DCM, or industry

results, to be materially different from any future results,

performance, objectives or achievements expressed or implied by

such forward-looking statements. When used in this press release,

words such as “may”, “would”, “could”, “will”, “expect”,

“anticipate”, “estimate”, “believe”, “intend”, “plan”, and other

similar expressions are intended to identify forward-looking

statements. These statements reflect DCM’s current views regarding

future events and operating performance, are based on information

currently available to DCM, and speak only as of the date of this

press release. These forward-looking statements involve a number of

risks, uncertainties and assumptions and should not be read as

guarantees of future performance or results, and will not

necessarily be accurate indications of whether or not such

performance or results will be achieved. Many factors could cause

the actual results, performance, objectives or achievements of DCM

to be materially different from any future results, performance,

objectives or achievements that may be expressed or implied by such

forward-looking statements. The principal factors, assumptions and

risks that DCM made or took into account in the preparation of

these forward-looking statements include: the COVID-19 Pandemic has

adversely affected, and may continue to adversely effect, our

business, operating results and financial condition and this

continuing adverse effect could be material; there is limited

growth in the traditional printing business, which may impact our

ability to grow our sales or even maintain historical levels of

sales of printed business communications documents; increases in

the cost of, and supply constraints related to, paper, ink and

other raw material inputs used by DCM, as well as increases in

freight costs, may adversely impact the availability of raw

materials and our production, revenues and profitability; our

ability to continue as a going concern is dependent upon

management’s ability to meet forecast revenue and profitability

targets for at least the next twelve months in order to comply with

our financial covenants under its credit facilities or to obtain

financial covenant waivers from our lenders if necessary; we may

not be successful in obtaining capital to fund our business plans

on satisfactory terms (or at all), including, without, limitation,

with respect to investments in digital innovation (such as the

development and successful marketing and sale of new digital

capabilities), capital expenditures, and potential acquisitions;

all of our outstanding indebtedness under our bank credit facility

is subject to floating interest rates, and therefore is subject to

fluctuations in interest rates; our credit agreements governing our

senior indebtedness contain numerous restrictive covenants that

limit us with respect to certain business matters, including,

without limitation, our ability to incur additional indebtedness,

re-pay certain indebtedness, pay dividends, make investments, sell

or otherwise dispose of assets and merge or consolidate with

another entity; we may not be able to successfully implement our

digital growth strategy on a timely basis or at all; competition

from competitors supplying similar products and services, some of

whom have greater economic resources than us and are

well-established suppliers; and our operating results are sensitive

to economic conditions, which can have a significant impact on us,

and uncertain economic conditions may have a material adverse

effect on our business, results of operations and financial

condition, including, without limitation, our ability to realize

the benefits expected from restructuring and business

reorganization initiatives, reducing costs, and reducing and paying

our long-term debt. Additional factors are discussed elsewhere in

this press release and under the headings "Liquidity and capital

resources" and “Risks and Uncertainties” in DCM’s management’s

discussion and analysis and in DCM’s other publicly available

disclosure documents, as filed by DCM on SEDAR (www.sedar.com).

Should one or more of these risks or uncertainties materialize, or

should assumptions underlying the forward-looking statements prove

incorrect, actual results may vary materially from those described

in this press release as intended, planned, anticipated, believed,

estimated or expected. Unless required by applicable securities

law, DCM does not intend and does not assume any obligation to

update these forward-looking statements.

NON-IFRS MEASURES

This press release includes certain non-IFRS measures as

supplementary information. Except as otherwise noted, when used in

this press release, EBITDA means earnings before interest and

finance costs, taxes, depreciation and amortization and Adjusted

EBITDA means EBITDA adjusted for restructuring expenses, and

one-time business reorganization costs. Adjusted net income (loss)

means net income (loss) adjusted for restructuring expenses,

onetime business reorganization costs, and the tax effects of those

items. Adjusted net income (loss) per share (basic and diluted) is

calculated by dividing Adjusted net income (loss) for the period by

the weighted average number of common shares of DCM (basic and

diluted) outstanding during the period. Adjusted EBITDA as a

percentage of revenues means Adjusted EBITDA divided by revenues

and Adjusted net income (loss) as a percentage of revenues means

adjusted net income (loss) divided by revenue, in each case for the

same period. In addition to net income (loss), DCM uses non-IFRS

measures and ratios, including Adjusted net income (loss), Adjusted

net income (loss) per share, Adjusted net income (loss) as a

percentage of revenues, EBITDA, Adjusted EBITDA and Adjusted EBITDA

as a percentage of revenues to provide investors with supplemental

measures of DCM’s operating performance and thus highlight trends

in its core business that may not otherwise be apparent when

relying solely on IFRS financial measures. DCM also believes that

securities analysts, investors, rating agencies and other

interested parties frequently use non-IFRS measures in the

evaluation of issuers. DCM’s management also uses non-IFRS measures

in order to facilitate operating performance comparisons from

period to period, prepare annual operating budgets and assess its

ability to meet future debt service, capital expenditure and

working capital requirements. Adjusted net income (loss), Adjusted

net income (loss) per share, EBITDA and Adjusted EBITDA are not

earnings measures recognized by IFRS and do not have any

standardized meanings prescribed by IFRS. Therefore, Adjusted net

income (loss), Adjusted net income (loss) per share, EBITDA and

Adjusted EBITDA are unlikely to be comparable to similar measures

presented by other issuers.

Investors are cautioned that Adjusted net income (loss),

Adjusted net income (loss) per share, EBITDA and Adjusted EBITDA

should not be construed as alternatives to net income (loss)

determined in accordance with IFRS as an indicator of DCM’s

performance. For a reconciliation of net income (loss) to EBITDA

and a reconciliation of net income (loss) to Adjusted EBITDA, see

Table 3 in the most recent Management's Discussion & Analysis

filed on www.sedar.com. For a reconciliation of net income (loss)

to Adjusted net income (loss) and a presentation of Adjusted net

income (loss) per share, see Table 4 in the Company's most recent

Management's Discussion & Analysis filed on www.sedar.com.

Condensed interim consolidated

statements of financial position

(in thousands of Canadian dollars,

unaudited)

June 30, 2022

December 31, 2021

$

$

(Restated)

Assets

Current assets

Cash and cash equivalents

$

775

$

901

Trade receivables

56,812

51,567

Inventories

17,182

12,133

Prepaid expenses and other current

assets

2,324

2,580

Income taxes receivable

318

860

77,411

68,041

Non-current assets

Other non-current assets

582

625

Deferred income tax assets

4,906

5,465

Restricted cash

—

515

Property, plant and equipment

7,209

8,416

Right-of-use assets

34,694

33,476

Pension assets

1,864

2,531

Intangible assets

3,231

4,042

Goodwill

16,973

16,973

$

146,870

$

140,084

Liabilities

Current liabilities

Trade payables and accrued liabilities

$

35,570

$

37,589

Current portion of credit facilities

15,656

11,743

Current portion of lease liabilities

6,800

6,123

Provisions

788

3,280

Income taxes payable

2,591

841

Deferred revenue

2,756

3,269

64,161

62,845

Non-current liabilities

Provisions

1,055

1,196

Credit facilities

22,818

24,556

Lease liabilities

33,696

32,976

Pension obligations

6,086

7,499

Other post-employment benefit plans

3,019

2,971

$

130,835

$

132,043

Equity

Shareholders’ equity / (Deficiency)

Shares

$

256,478

$

256,478

Warrants

869

881

Contributed surplus

2,951

2,791

Translation reserve

186

173

Deficit

(244,449)

(252,282)

$

16,035

$

8,041

$

146,870

$

140,084

Condensed interim consolidated

statements of operations

(in thousands of Canadian dollars, except

per share amounts, unaudited)

For the three months ended

June 30, 2022

For the three months ended June

30, 2021

$

$

(Restated)

Revenues

$

68,103

$

55,207

Cost of revenues

47,661

39,365

Gross profit

20,442

15,842

Expenses

Selling, commissions and expenses

7,244

6,137

General and administration expenses

6,537

8,186

Restructuring expenses

—

918

13,781

15,241

Income before finance costs, other

income and income taxes

6,661

601

Finance costs

Interest expense on long term debt and

pensions, net

779

1,088

Interest expense on lease liabilities

564

628

Amortization of transaction costs

86

176

1,429

1,892

Other income

Government grant income

—

2,411

Income before income taxes

5,232

1,120

Income tax expense

Current

1,522

1,126

Deferred

(47)

(642)

1,475

484

Net Income for the period

$

3,757

$

636

Other comprehensive income:

Items that may be reclassified

subsequently to net income

Foreign currency translation

26

(28)

26

(28)

Items that will not be reclassified to

net income

Re-measurements of pension and other

post-employment benefit obligations

3

205

Taxes related to pension and other

post-employment benefit adjustment above

(1)

(44)

2

161

Other comprehensive income for the

period, net of tax

$

28

$

133

Comprehensive income for the

period

$

3,785

$

769

Basic earnings per share

$

0.09

$

0.01

Diluted earnings per share

$

0.08

$

0.01

Condensed interim consolidated

statements of operations

(in thousands of Canadian dollars, except

per share amounts, unaudited)

For the six months ended June

30, 2022

For the six months ended June 30,

2021

$

$

(Restated)

Revenues

$

137,360

$

117,568

Cost of revenues

96,594

82,933

Gross profit

40,766

34,635

Expenses

Selling, commissions and expenses

14,292

12,803

General and administration expenses

13,133

16,424

Restructuring expenses

—

4,325

27,425

33,552

Income before finance costs, other

income and income taxes

13,341

1,083

Finance costs

Interest expense on long term debt and

pensions, net

1,470

1,806

Interest expense on lease liabilities

1,128

1,322

Amortization of transaction costs

173

321

2,771

3,449

Other income

Government grant income

—

4,319

Other income

—

1,452

Income before income taxes

10,570

3,405

Income tax expense

Current

2,660

1,672

Deferred

440

(663)

3,100

1,009

Net income for the period

$

7,470

$

2,396

Other comprehensive income:

Items that may be reclassified

subsequently to net income

Foreign currency translation

13

(51)

13

(51)

Items that will not be reclassified to

net income

Re-measurements of pension and other

post-employment benefit obligations

482

1,461

Taxes related to pension and other

post-employment benefit adjustment above

(119)

(362)

363

1,099

Other comprehensive income for the

period, net of tax

$

376

$

1,048

Comprehensive income for the

period

$

7,846

$

3,444

Basic earnings per share

$

0.17

$

0.05

Diluted earnings per share

$

0.16

$

0.05

Condensed interim consolidated

statements of cash flows

(in thousands of Canadian dollars,

unaudited)

For the six months ended June

30, 2022

For the six months ended June 30,

2021

$

$

(Restated)

Cash provided by (used in)

Operating activities

Net income for the period

$

7,470

$

2,396

Items not affecting cash

Depreciation of property, plant and

equipment

1,561

1,582

Amortization of intangible assets

811

863

Depreciation of right-of-use-assets

3,213

4,407

Interest expense on lease liabilities

1,128

1,322

Share-based compensation expense

148

352

Pension expense

218

239

Loss on disposal of property, plant and

equipment

9

—

Provisions

—

4,325

Amortization of transaction costs

173

291

Accretion of non-current liabilities,

capitalized interest expense and accretion of debt modification

losses

120

(35)

Other post-employment benefit plans

expense

136

70

Income tax expense

3,100

1,009

18,087

16,821

Changes in working capital

(12,415)

3,989

Contributions made to pension plans

(482)

(483)

Contributions made to other

post-employment benefit plans

(88)

—

Provisions paid

(2,633)

(2,974)

Income taxes paid

(368)

(996)

2,101

16,357

Investing activities

Purchase of property, plant and

equipment

(419)

(357)

Purchase of intangible assets

—

(1,045)

Proceeds on disposal of property, plant

and equipment

56

—

(363)

(1,402)

Financing activities

Exercise of warrants

—

10

Decrease in restricted cash

515

—

Proceeds from credit facilities

7,800

—

Repayment of credit facilities

(5,918)

(7,355)

Repayment of promissory notes

—

(2,185)

Lease payments

(4,265)

(5,868)

(1,868)

(15,398)

Change in Cash and cash equivalents

during the period

(130)

(443)

Cash and cash equivalents – beginning

of period

$

901

$

578

Effects of foreign exchange on cash

balances

4

28

Cash and cash equivalents – end of

period

$

775

$

163

______________________________

1Note: EBITDA and Adjusted EBITDA

are not earnings measures recognized by International Financial

Reporting Standards (IFRS), do not have any standardized meanings

prescribed by IFRS and might not be comparable to similar financial

measures disclosed by other issuers. EBITDA and Adjusted EBITDA

should not be construed as alternatives to net income (loss)

determined in accordance with IFRS as an indicator of DCM’s

performance. For a description of the composition of EBITDA and

Adjusted EBITDA, why we believe such measures are useful to

investors and how we use those measures in our business, together

with a quantitative reconciliation of net income (loss) to EBITDA

and Adjusted EBITDA, respectively, see the information under the

heading “Non-IFRS Measures” and Table 3 of DCM’s management’s

discussion and analysis (MD&A) dated August 9, 2022 for the

period ended June 30, 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220809006028/en/

Mr. Richard Kellam President and Chief Executive Officer DATA

Communications Management Corp. Tel: (905) 791-3151

Mr. James E. Lorimer Chief Financial Officer DATA Communications

Management Corp. Tel: (905) 791-3151 ir@datacm.com

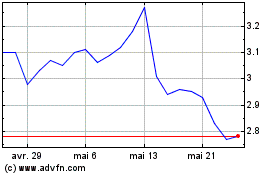

Data Communications Mana... (TSX:DCM)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Data Communications Mana... (TSX:DCM)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025