TERREBONNE, QC, Dec. 9 /CNW/ -- Highlights: -- Revenues of $40.3

million for the nine months ended October 31, 2010. -- Gross margin

of 29.6% of revenues for the nine-month period ended October 31,

2010 compared with 27.1% at the same date last year. -- Net

earnings of $0.6 million for the quarter ended October 31, 2010 and

$2.7 million for the nine-month period ended at the same date. --

Available liquidities (including cash, cash equivalents and short

term investments) of $20.3 million as at October 31, 2010 exceeded

the total debt by $11 million. TERREBONNE, QC, Dec. 9 /CNW Telbec/

- ADF GROUP INC. ("ADF" or the "Corporation") (ticker symbol:

DRX/TSX) closed the third quarter ended October 31, 2010, with

revenues of $13.7 million compared with $15.8 million for

the same quarter of the previous fiscal year. This decrease is

primarily attributable to the different revenue mix and the

increase in the Canadian dollar in relation to the U.S. dollar. For

the nine-month period ended October 31, 2010, revenues totalled

$40.3 million compared with $51.3 million for the same

period last year. Gross margin as a percentage of revenues rose

from 24.9% in the third quarter of fiscal 2010 to 25.5% in the

third quarter of fiscal 2011. For the nine-month period ended

October 31, 2010, the gross margin represented 29.6% of revenues

versus 27.1% last year. "This performance is attributable to the

quality of the contracts awarded to ADF — the complexity of which

notably carries strong added value — combined with the investments

made over the past two years to optimize our facilities, and the

know-how of our personnel" said Jean Paschini, Chairman of the

Board and Chief Executive Officer. The third-quarter earnings

before interest, taxes, depreciation and amortization ("EBITDA")

amounted to $2.1 million, or 15% of revenues compared with $3.3

million or 21% of revenues in the third quarter of the previous

fiscal year. For the first nine months of the current fiscal year,

EBITDA totalled $7.7 million, or 19% of revenues versus $10.9

million or 21% of revenues last year. ADF Group closed the quarter

with net earnings of $0.6 million or $0.02 per share (basic

and diluted), compared with net earnings of $1.4 million or

$0.04 per share (basic and diluted) in the same period of the

previous year. For the first nine months ended October 31, 2010,

net earnings amounted to $2.7 million or $0.08 per share (basic and

diluted) compared with net earnings of $5.5 million or $0.15

per share (basic and diluted) in the same period a year earlier.

Besides a lower business volume and unfavourable currency

fluctuations, this decrease is explained by an increase in the

effective tax rate. For information purposes, the higher effective

tax rate had a negative impact of $0.01 on third-quarter earnings

per share (basic and diluted), although it did not affect the

Corporation's cash outflows. Operating activities generated cash

flows of $6.5 million since the beginning of the current

fiscal year, contributing to maintain ADF Group in an excellent

financial position. As at October 31, 2010, ADF Group had a

working capital of $39.2 million for a current ratio of 3.45:1

and total cash (including cash, cash equivalents and short-term

investments) of $20.3 million. The Corporation's available

short-term liquidities exceeded its total interest-bearing debt by

$11 million. "ADF Group's business environment was practically

the same in the third quarter than in the first half of fiscal

2011. We were faced with the slow economic recovery in the United

States and the strength of the Canadian dollar against the U.S.

dollar. Despite this challenging context, ADF Group remained

profitable and financially solid" said Mr. Paschini. Outlook As at

October 31, 2010, ADF's order backlog amounted to

$83 million, compared with $137 million on the same date

in 2009. It should be noted that ADF's order backlog as at

October 31, 2010 does not entirely reflect the revenues likely

to be recognized in upcoming quarters, as it includes a portion

only of the contractual changes brought to existing orders at the

request of customers during the previous months. Thus, based on

ADF's order backlog as at October 31, 2010 and the contractual

changes underway, the Corporation estimates that it will be busy

with profitable work for the next 12 to 15 months at least.

"Although we remain cautious in light of current market conditions,

we are confident as to ADF Group's outlook for the short, medium

and long term. We are witnessing increased activity in the

non-residential construction sector in Western Canada where we have

teamed up with a partner in order to set up an operational centre.

In the United States, we believe it will take some time for the

industry's activity to return to a more normal level. With this in

mind, we will keep our focus on our vision of value creation and

niche positioning by bidding exclusively on projects meeting our

strict criteria in terms of differentiation, profit margins and

cash flow generation, and that fully leverage our expertise. It is

by pursuing this strategy that we managed to maintain a good

profitability and preserve an excellent financial position during

the worst economic crisis of the past 80 years. Likewise, our

strategy will best serve the interests of our shareholders when our

markets recover, especially since the investments we have made in

recent years — in the midst of the economic turmoil — have enhanced

our lead over the competition and our ability not only to meet the

highest criteria in our industry, but to set new standards"

concluded Mr. Jean Paschini. About ADF Group Inc. ADF Group Inc. is

a North American leader in the connections design and engineering,

fabrication and installation of complex steel structures, heavy

built-ups, as well as miscellaneous and architectural metals for

the non-residential construction industry. ADF is one of the few

players in the industry capable of handling highly technically

complex mega projects, as well as projects subject to fast-track

schedules, in the commercial, institutional, industrial and public

sectors. Forward-Looking Information This press release contains

forward-looking statements reflecting ADF Group's objectives and

expectations. These statements are identified by the use of verbs

such as "expect" as well as by the use of future or conditional

tenses. By their very nature these types of statements involve

risks and uncertainty. Consequently, reality may differ from ADF's

expectations. Non-GAAP Measures EBITDA is a financial measure not

prescribed by Canadian generally accepted accounting principles

("GAAP") and is not likely to be comparable to similar measures

presented by other issuers. Management, as well as investors,

consider this to be useful information to assist them in assessing

the Corporation's profitability and ability to generate funds to

finance its operations. All amounts are in Canadian dollars.

____________________________________________________________________

| CONFERENCE CALL WITH INVESTORS | | | | To discuss ADF Group's

results | | for the third quarter and first nine months ended

October 31, 2010 | | | | Thursday, December 9, 2010 at 10:00 a.m.

(Montreal time) | | | | To participate in the conference call,

please dial 1-866-865-3087| | a few minutes before the start of the

call. | | For those unable to participate, a taped rebroadcast will

be | | available from | | Thursday, December 9, 2010 at 1:00 p.m.

until midnight Wednesday, | | December 15, 2010, by dialing | |

1-800-642-1687; access code 27883045. | | | | The conference call

(audio) will also be available at | | www.cnw.ca, | | and archived

for a 90-day period. | | | | | | Members of the media are invited

to listen in. |

|____________________________________________________________________|

CONSOLIDATED STATEMENTS OF EARNINGS AND COMPREHENSIVE INCOME Three

Months Nine Months Periods Ended October 31, 2010 2009 2010 2009

(In thousands of $ except $ per-share amounts) $ $ $ Revenues

13,687 15,769 40,295 51,269 Cost of goods sold 10,192 11,837 28,369

37,367 Gross margin before foreign 3,495 exchange variation 3,932

11,926 13,902 Gain on foreign exchange (517) (120) (842) (1,446)

Gross margin 4,012 4,052 12,768 15,348 Selling and administrative

1,426 expenses 656 4,177 2,965 Earnings before undernoted 2,586

items: 3,396 8,591 12,383 Amortization Amortization of property,

758 plant and equipment 686 2,265 2,017 Amortization of intangible

86 assets 84 251 238 844 770 2,516 2,255 Earnings before financial

charges (interest income) and income taxes 1,742 2,626 6,075 10,128

Financial charges (interest 24 income) (48) 38 (263) Earnings

before income taxes 1,718 2,674 6,037 10,391 Income taxes Current

171 108 352 283 Future 917 1,186 2,979 4,643 1,088 1,294 3,331

4,926 Net earnings and 630 comprehensive income 1,380 2,706 5,465

Basic earnings per share 0.02 0.04 0.08 0.15 Diluted earnings per

share 0.02 0.04 0.08 0.15 Average number of outstanding 32,997

shares (in thousands) 35,322 33,936 35,498 Average number of

outstanding 33,595 diluted shares (in thousands) 36,187 34,624

36,323 CONSOLIDATED STATEMENTS OF RETAINED EARNINGS Three Months

Nine Months Periods Ended October 31, 2010 2009 2010 2009 (In

thousands of $) $ $ $ $ Retained earnings, beginning of 11,875

5,857 9,799 1,772 period Net earnings 630 1,380 2,706 5,465

Retained earnings, end of period 12,505 7,237 12,505 7,237

CONSOLIDATED STATEMENTS OF CONTRIBUTED SURPLUS Three Months Nine

Months Periods Ended October 31, 2010 2009 2010 2009 (In thousands

of $) $ $ $ $ Contributed surplus, beginning of period 4,903 2,653

3,371 2,175 Stock-based compensation 31 89 219 216 Exercise of

options - (5) (94) (29) Excess of the book value over the

acquisition cost of redeemed subordinate voting shares 507 415

1,945 790 Contributed surplus, end of period 5,441 3,152 5,441

3,152 CONSOLIDATED BALANCE SHEETS At October 31, 2010 At January

31, 2010 (Audited) (In thousands of $) $ $ ASSETS Current Cash and

cash equivalents 12,712 5,770 Short-term investments 7,596 11,652

Accounts receivable 24,744 14,850 Income taxes 66 442 Holdbacks on

contracts 667 2,692 Investment tax credits 536 536 Work in progress

428 1,574 Inventories 3,574 3,093 Prepaid expenses 615 334

Derivative financial 703 832 instruments Future income tax assets

3,488 3,182 55,129 44,957 Holdbacks on long-term 2,876 1,297

contracts Investment tax credits 2,065 2,065 Property, plant and

42,811 42,760 equipment Intangible assets 2,599 2,590 Other assets

253 247 Future income tax assets 5,622 9,452 111,355 103,368

LIABILITIES Current Accounts payable 3,118 1,955 Accrued charges

1,146 994 Salaries and fringe 896 1,732 benefits payable Deferred

revenues 8,219 2,242 Derivative financial 66 - instruments Current

portion of 2,516 2,422 long-term debt 15,961 9,345 Long-term debt

6,818 4,645 Future income tax 554 713 liabilities 23,333 14,703

Shareholders' equity Retained earnings 12,505 9,799 Accumulated

other comprehensive income 144 144 12,649 9,943 Capital stock

69,931 75,351 Contributed surplus 5,442 3,371 88,022 88,665 111,355

103,368 CONSOLIDATED STATEMENTS OF CASH FLOWS Three Months Nine

Months Periods Ended October 31, 2010 2009 2010 2009 (In thousands

of $) $ $ $ $ OPERATING ACTIVITIES Net earnings 630 1,380 2,706

5,465 Adjustments for: Amortization of property, plant and

equipment 758 686 2,265 2,017 Amortization of intangible assets 86

84 251 238 Gain on disposal of property, plant and equipment - -

(52) - Change in the fair value of derivative financial instruments

(127) 689 195 (2,839) Non-cash exchange loss 166 2 128 1,178

Interest capitalized on long-term debt 3 5 11 15 Stock-based

compensation 31 89 219 216 Future income taxes 917 1,186 2,979

4,643 Net earnings adjusted for non-monetary items 2,464 4,121

8,702 10,933 Changes in non-cash operating items Accounts

receivable 543 (2,499) (9,894) (7,524) Short-term and long-term

holdbacks on contracts (853) 135 446 949 Income taxes 57 109 376

(137) Work in progress 419 127 1,146 (654) Inventories 105 335

(481) 381 Prepaid expenses 270 311 (281) 38 Accounts payable,

accrued charges, salaries and fringe benefits payable (991) (2,331)

479 (7,249) Deferred revenues 4,518 (1,321) 5,977 (441) 4,068

(5,134) (2,232) (14,637) 6,532 (1,013) 6,470 (3,704) INVESTING

ACTIVITIES Disposal (acquisition) of short-term investments 14 -

4,056 (6,400) Acquisition of property, plant and equipment (111)

(1,060) (2,264) (1,782) Acquisition of intangible assets (60) (98)

(260) (563) Decrease in other assets (10) (60) (6) (56) (167)

(1,218) 1,526 (8,801) FINANCING ACTIVITIES Issuances of subordinate

voting shares 4 10 168 57 Issuance of long-term debt - - 4,370 -

Repayment of long-term debt (625) (217) (1,692) (1,684) Redemption

of subordinate voting shares (950) (2,234) (3,736) (3,687) (1,571)

(2,441) (890) (5,314) Impact of fluctuations in foreign exchange

rate on cash (42) 7 (164) (233) Net cash inflows (outflows) 4,752

(4,665) 6,942 (18,052) Cash and cash equivalents, beginning of

period 7,960 9,103 5,770 22,490 Cash and cash equivalents, end of

period (1) 12,712 4,438 12,712 4,438 Supplemental cash flow

information Income taxes paid 102 2 393 206 Interest (paid)

received (32) (6) 5 107 Non-cash financing and investing

activities: Property, plant and equipment given in exchange for new

equipment - - 139 - 1. At October 31, 2010, cash and cash

equivalents were composed of $12,712,000 in cash ($4,416,000 in

cash and $22,000 in cash equivalents as at October 31, 2009.)

SEGMENTED INFORMATION The Corporation operates in the

non-residential construction sector, primarily in North America.

Its operations include the connections design and engineering,

fabrication and installation of complex steel structures, heavy

built-ups, as well as miscellaneous and architectural metals. Three

Months Nine Months Periods ended October 31, 2010 2009 2010 2009

(In thousands of $) $ $ $ $ Revenues — Canada 4 1,413 567 9,106 —

United States 13,683 14,356 39,728 42,163 13,687 15,769 40,295

51,269 At October 31, 2010 At January 31,2010 (Audited) (In

thousands of $) $ $ Property, plant and equipment — Canada 42,705

42,620 — United States 106 140 42,811 42,760 During the nine-month

period ended October 31, 2010, 89% of the Corporation's revenues

were recorded with one client (72% with four clients during the

same period in 2009, each of which accounted for more than 10% of

revenues.). However, revenues were recorded on five distinct

contracts with one client during fiscal year 2011. To view this

news release in HTML formatting, please use the following URL:

http://www.cnw.ca/en/releases/archive/December2010/09/c3673.html

table border="0" valign="top"trtd valign="top"

align="left"Source: /td td valign="top" align="left"bADF Group

Inc./b/td/tr trtd valign="top" align="left" /td td

valign="top" align="left"br//td/tr trtd valign="top"

align="left"Contact: /td td valign="top" align="left"bJean

Paschini/b, Chairman of the Board and Chief Executive Officerbr/

bJean-François Boursier,/bCA, Chief Financial Officerbr//td/tr trtd

valign="top" align="left" /td td valign="top"

align="left"br//td/tr trtd valign="top"

align="left"Telephone: /td td valign="top"

align="left"(450) 965-1911 / 1 (800) 263-7560br//td/tr trtd

valign="top" align="left"Web Site: /td td valign="top"

align="left"a cr="true"

href="http://www.adfgroup.com"www.adfgroup.com/abr//td/tr trtd

valign="top" align="left" /td td valign="top"

align="left"br//td/tr trtd valign="top"

align="left"bMedia:/b /td td valign="top" align="left"Mathieu

Beaudoin, Morin Relations Publiquesbr/ Tel. 514-289-8688, ext.

225br/ Cell. : 514-473-4649br/ br/ orbr/ br/ Charles Durivage,

Morin Relations Publiquesbr/ Tel. 514-289-8688, ext. 223br/ Cell. :

514-894-4186/td/tr/table

Copyright

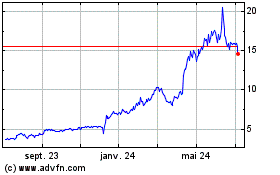

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024