TERREBONNE, QC, June 13, 2012 /CNW Telbec/ - For the three-month

period ended April 30, 2012, ADF GROUP INC. ("ADF" or the

"Corporation") recorded revenues of $12.5 million compared with

$13.2 million for the same period last year. The gross margin as a

percentage of revenues stood at 14.7% compared with 23.5% in the

first quarter of the previous year. This decrease, which started in

the third quarter of the 2012 fiscal year, is explained by the

different mix of the projects currently underway. Income before

interest, income taxes, depreciation and amortization (EBITDA)

amounted to $0.9 million, compared with $2.1 million the previous

year. The Corporation recorded a slight profit of $0.1 million

(0.00$ per share) during the first quarter ended April 30, 2012,

compared with a net income of $1.1 million ($0.03 per share) in the

same period the previous year. ADF closed the first quarter of the

2013 fiscal year with working capital of $42.3 million, of which

$23.6 million in short-term available liquidities (cash, cash

equivalents and short-term investments), As at April 30, 2012, ADF

Group's short-term available liquidities exceeded its total debt by

$18.1 million, whereas the current ratio stood at 4.44:1. ADF

Group's order backlog stood at $43 million on April 30, 2012,

compared with $48 million on January 31, 2012. This decrease is

mostly attributable to the gradual execution of contracts, net of

contract changes and new contracts. Mr. Jean Paschini, Chairman of

the Board and Chief Executive Officer indicated that "the results

for the first quarter followed a similar trend as observed in the

past quarters, reflecting a still difficult economic environment in

our markets. Although ADF Group has maintained a sound performance

overall, we are not satisfied with these results. We are very keen

on pursuing our goals to provide the Corporation with all the

necessary tools to seize the opportunities that arise in this

challenging context and to position ADF Group advantageously for

the next economic upturn, while seeking to limit exposure to risks

associated with our market segments." Mr. Paschini added that the

Corporation is currently analyzing the possibility of setting up a

fabrication plant in the United States, which would provide ADF

access to the US public infrastructure market for which growth is

expected in the coming years. On April 11, 2012, the Corporation's

Board of Directors approved the payment of a semi-annual dividend.

Consequently, on May 17, 2012, ADF Group paid a semi-annual

dividend of $0.01 per share to shareholders of record as at April

30, 2012. Annual Meeting of Shareholders ADF Group's Annual Meeting

of Shareholders will take place this morning, June 13, 2012 at

11:00 am at the Hilton Montreal/Laval Hotel in Laval. About ADF

Group Inc. ADF Group Inc. is a North American leader in the design

and engineering of connections, fabrication and installation of

complex steel structures, heavy steel built-ups, as well as in

miscellaneous and architectural metals for the non residential

construction industry. ADF Group Inc. is one of the few players in

the industry capable of handling highly technically complex mega

projects on fast-track schedules in the commercial, institutional,

industrial and public sectors. Forward-Looking Information This

press release contains forward-looking statements reflecting ADF

objectives and expectations. These statements are identified by the

use of verbs such as "expect" as well as by the use of future or

conditional tenses. By their very nature these types of statements

involve risks and uncertainty. Consequently, reality may differ

from ADF's expectations. Non-IFRS Measures EBITDA is not a

performance measure recognized by IFRS standards, and is not likely

to be comparable to similar measures presented by other issuers.

Management, as well as investors, consider this to be useful

information to assist them in assessing the Corporation's

profitability and ability to generate funds to finance its

operations. All amounts are in Canadian dollars, unless otherwise

indicated.

____________________________________________________________________

| CONFERENCE CALL WITH INVESTORS | | | |To discuss ADF Group's

results for the first quarter ended April 30,| | 2012, | | | | June

13, 2012 at 10:00 a.m. (Montreal time) | | | |To participate in the

conference call, please dial 1-888-231-8191 a | | few minutes

before the start of the call. | | | | For those unable to

participate, a taped rebroadcast will be | | available from

Wednesday, June 13, 2012 at 1:00 p.m. | | until midnight June 20,

2012, by dialing 1-855-859-2056;access | | code83424725. | | | |

The conference call (audio) will also be available at | |

www.adfgroup.com | | | | Members of the media are invited to listen

in. |

|____________________________________________________________________|

CONSOLIDATED STATEMENT OF INCOME(unaudited) Three-Month Periods

Ended April 30, 2012 2011 (In thousands of Canadian dollars and in

dollars per share) $ $ Revenues 12,464 13,229 Cost of goods sold

10,634 10,123 Gross Margin 1,830 3,106 Selling and administrative

expenses 1,729 1,892 Financial revenues (45) (95) Financial

expenses 44 60 Foreign exchange gain (76) (755) 1,652 1,102 Income

before income tax expense 178 2,004 Income tax expense 87 923 Net

income for the period 91 1,081 Earnings per share Basic per share

0.00 0,03 Diluted per share 0.00 0,03 Average number of outstanding

shares (in thousands) 32,464 32,775 Average number of outstanding

diluted shares (in thousands) 32,928 33,390 CONSOLIDATED STATEMENTS

OF COMPREHENSIVE INCOME(unaudited) Three-Month Periods Ended April

30, 2012 2011 (In thousands of Canadian dollars) $ $ Net income for

the period 91 1,081 Other comprehensive income: Exchange

differences on translation of foreign operations (a) (366) (1,495)

Comprehensive income for the period (275) (414) (a) Net of hedging

activities and $12,000 in related income tax for the three-month

period ended April 30, 2012 (nil for the three-month period ended

April 30, 2011). CONSOLIDATED STATEMENTS OF CHANGES IN

SHAREHOLDERS' EQUITY(unaudited) Accumulated Other Capital

Contributed Comprehensive Retained Stock Surplus Income Income

Total (In thousands of Canadian dollars) $ $ $ $ $ Balance,

February 1, 2011 70,032 5,740 (1,477) 18,739 93,034 Net income - -

- 1,081 1,081 for the year Other - - (1,495) - (1,495)

comprehensive income Comprehensive - - (1,495) 1,081 (414) income

for the period Share-based - 59 - - 59 compensation Dividends - - -

(328) (328) Balance, April 30, 2011 70,032 5,799 (2,972) 19,492

92,351 Accumulated Other Capital Contributed Comprehensive Retained

Stock Surplus Income Income Total (In thousands of Canadian

dollars) $ $ $ $ $ Balance, February 1, 2012 69,086 6,368 (1,586)

19,895 93,763 Net income - - - 91 91 for the period Other - - (366)

- (366) comprehensive income Comprehensive - - (366) 91 (275)

income for the period Share-based - 11 - - 11 compensation Options

1 - - - 1 exercised Dividends - - - (325) (325) Balance, April 30,

2012 69,087 6,379 (1,952) 19,661 93,175 CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION As at April 30, 2012 January 31, 2012

(unaudited) (audited) (In thousands of Canadian dollars) $ $ ASSETS

Current assets Cash and cash equivalents 18,209 18,976 Short-term

investments 5,440 5,562 Accounts receivable 14,171 14,189 Holdbacks

on contracts 4,231 5,082 Work in progress 7,858 5,263 Inventories

3,985 3,613 Prepaid expenses and other current assets 676 782

Derivative financial instruments 66 - Total current assets 54,636

53,467 Non-current assets Property, plant and equipment 44,396

45,089 Intangible assets 2,630 2,618 Other non-current assets 2,801

2,796 Deferred income tax assets 4,178 4,549 Total assets 108,641

108,519 LIABILITIES Current liabilities Accounts payable and other

current liabilities 6,399 5,551 Income tax liabilities 21 77

Deferred revenues 3,360 2,618 Derivative financial instruments 29

75 Current portion of long-term debt 2,492 2,526 Total current

liabilities 12,301 10,847 Non-current liabilities Long-term debt

3,015 3,676 Deferred income tax liabilities 150 233 Total

liabilities 15,466 14,756 SHAREHOLDERS' EQUITY Retained income

19,661 19,895 Accumulated other comprehensive income (1,952)

(1,586) 17,709 18,309 Capital stock 69,087 69,086 Contributed

surplus 6,379 6,368 Total shareholders' equity 93,175 93,763 Total

liabilities and shareholders' equity 108,641 108,519 CONSOLIDATED

STATEMENTS OF CASH FLOWS(unaudited) Three-Month Periods Ended April

30, 2012 2011 (In thousands of Canadian dollars) $ $ OPERATING

ACTIVITIES Net income for the period 91 1,081 Non-cash items:

Amortization of property, plant and 792 equipment 747 Amortization

of intangible assets 89 89 Unrealized gain on derivative (226)

financial instruments (112) Non-cash exchange loss (gain) 161 (244)

Share-based compensation 11 59 Income tax expense 87 923 Financial

revenues (45) (95) Financial expenses 44 60 Net income adjusted for

non-cash items 1,073 2,439 Changes in non-cash working capital

items (1) (790) 2,961 Income tax expense paid (152) (368) Cash

flows from (used in) operating activities 131 5,032 INVESTING

ACTIVITIES Disposal (acquisition) of short-term investments 62

(2,905) Net acquisition of property, plant and equipment (64) (29)

Acquisition of intangible assets (101) (88) Reduction in other

non-current assets (5) 1 Interest received 59 77 Cash flows from

(used in) investing activities (49) (2,944) FINANCING ACTIVITIES

Repayment of long-term debt (613) (600) Issuance of subordinate

voting shares 1 - Interest paid on the interest rate swap (6) (9)

Interest paid (44) (53) Cash flows from (used in) financing

activities (662) (662) Impact of fluctuations in foreign exchange

rate on cash (187) (709) Net (decrease) increase in cash and cash

equivalents (767) 717 Cash and cash equivalents, beginning of

period 18,976 18,677 Cash and cash equivalents, end of period

18,209 19,394 (1) Detail the components of the "Changes in non-cash

working capital items": Periods Ended April 30, 2012 2011 (In

thousands of Canadian dollars) $ $ Accounts receivable (116) (749)

Holdbacks on contracts 785 5 Income tax 77 (12) Work in progress

(2,693) (166) Inventories (372) (58) Prepaid expenses and other

current assets 106 273 Accounts payable and other current

liabilities 645 233 Deferred revenues 778 3,435 Changes in non-cash

working capital items (790) 2,961 For the

purpose of the consolidated statements of cash flows, cash and cash

equivalents in the amount of $18,209,000 as at April 30, 2012 and

$19,394,000 as at April 30, 2011 were only composed of cash.

SEGMENTED INFORMATION The Corporation operates in the

non-residential construction sector, primarily in the United States

and Canada. Its operations include the connections design and

engineering, fabrication and installation of complex steel

structures, heavy steel built-ups, as well as miscellaneous and

architectural metalwork. Periods Ended April 30, 2012 2011 (In

thousands of Canadian dollars) $ $ Revenues Canada 2,521 225 United

States 9,943 13,004 12,464 13,229 As at April 30, 2012 January 31,

2012 (In thousands of Canadian dollars) $ $ Property, Plant and

Equipment Canada 43,737 44,410 United States 659 679 44,396 45,089

All intangible assets and investment tax credits included under

"Other non-current assets" at April 30, 2012 and January 31, 2012

originated from Canada. During the three-month period ended April

30, 2012, two clients accounted for 84% of the Corporation's

revenues (one client accounted for 94% of the revenues during the

three-month period ended April 30, 2011), and therefore were the

only ones that accounted for more than 10% of revenues. ADF

GROUP INC. CONTACT: Source: ADF Group Inc.Contact: Jean Paschini,

Chairman of the Board of Directors and Chief

ExecutiveOfficerJean-Francois Boursier, CA, Chief Financial

OfficerTelephone: (450) 965-1911 / 1 (800) 263-7560Web Site:

www.adfgroup.com

Copyright

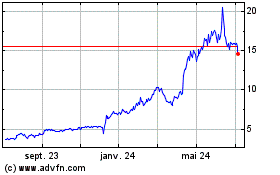

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

ADF (TSX:DRX)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024