Enterprise Group, Inc. (“Enterprise,” or “the Company”) (TSX:E), a

consolidator of services to the energy sector; focused primarily on

infrastructure services and specialized equipment rental, today

released its

2017 Corporate Update from CEO

Leonard D. Jaroszuk.

Activity levels significantly increased

over 2017

As the Company looks ahead to what is shaping up

to be an exceptional 2018, it is important to note how we got here.

Surveys have shown that serious investors look at management as a

main measure of purchase decisions. Given Enterprise’s corporate

actions to deal with the resource downturn that began in 2014-15,

management not only took decisive action, but built a company that

is now leaner and stronger.

- Strict cost controls; including reduced work weeks and rotating

schedules.

- Able to maintain service levels while improving margins.

- Vigilant to strategic sales, M&A, JV and other partnership

opportunities

- Expand and diversify smaller client base to mitigate risk

- Company returned to profitability Q3/17

- Positive cash flow over the entire course of the downturn

- Debt reduction through the downturn from $54m at Dec 31st, 2014

to $22.6m at Sept 30th, 2017

Probably most impressive is that E shares,

currently trading at $0.33 have a solid breakup of approximately

$0.85 cents.

Further, as a result of the Company’s improved

financial metrics, our reduced debt, which management looks to

reduce further, gives not only strength, but that most important

corporate characteristics: Options. To grow, to acquire or to

expand operations and influence in current markets and beyond.

It’s Important to Have Exceptional Business

partners.

Our savvy and experienced management team

includes the highly dedicated folks at our subsidiary partners.

Their input and expertise ensures Enterprise realizes its vision

and remain key to our growth and consistent increase in shareholder

value.

The social and economic benefits of

infrastructure, whether it is soldering a tiny motherboard to a

control panel or building a five-level traffic interchange in Tokyo

should not be discounted by investors. Having grown the Company

through the 2015-2017 resource downturn, in which we were unfairly

painted with the ‘low oil price’ brush, we are closing many

substantial new contracts and corporate growth plans are aggressive

and robust.

Management Actions Drive Numbers that Prove the

Point

Investors’ need look no further than E’s

recent Q3 numbers. In all of

2017, as with entire period since the downturn, Enterprise has been

cashflow positive. In Q3 2017, the Company returned to

profitability and is optimistic for 2018.

Enterprise is not the same Company that went

into the 2015 resource downturn.

Through strategic plans including asset sales,

ongoing cost cutting and judicious business decisions we are

leaner, more pivotal and have added diversity to our client base.

With all of these initiatives, the Company mitigates the risk of

dealing with a limited number of large companies: And consistently

adding to shareholder value.

The reality is that our business mix of

providing specialized industrial rentals and infrastructure

solutions and technologies gives Enterprise the flexibility to meet

and more often than not exceed customers’ requirements.

The fact that we also design and build specialty

equipment for our clients—15 patents in place with more

coming—means that we can be immediately responsive and relevant to

address our private or Government customers’ unique needs, whether

resource-centric or straight public infrastructure.

We are always on the lookout for accretive

assets that complement or expand our current businesses.

Bottom Line? Shares up 23% YTD 2017. Several Options

Developing for 2018 Growth

- Revenue for the nine months ended September 30, 2017, of

$26,989,358 increased by $6,592,419 or 32% compared to the prior

period.

- YTD Margins increased to 29%

- YTD EBITDA increased to $4.5 million from $2.2 million for same

period 2016

|

Consolidated: |

Three months September 30,

2017 |

Three months September 30, 2016

restated (2)(3) |

Nine months September 30,

2017 |

Nine months September 30, 2016

restated (2)(3) |

| Revenue |

$ 11,039,666 |

|

$6,551,285 |

|

$26,989,358 |

|

$20,396,939 |

|

| Gross margin |

$3,184,050 |

|

$1,507,420 |

|

$6,653,631 |

|

$4,542,340 |

|

| Gross margin % |

|

29% |

|

|

23 |

% |

|

25 |

% |

|

22 |

% |

| EBITDA (1) |

$2,605,947 |

|

$796,499 |

|

$4,473,939 |

|

$2,241,134 |

|

| Net income (loss) and

comprehensive income (loss) |

$328,933 |

|

$581,816 |

|

$(1,308,998 |

) |

$(3,244,576 |

) |

| EPS |

$0.01 |

|

$0.01 |

|

$(0.02 |

) |

$(0.06 |

) |

- Identified and defined under “Non-IFRS Measures”.

- In July 2016, the Company closed a transaction to divest

substantially all the assets of TCB. The net operations of TCB,

including the prior period, are presented as a single amount in the

consolidated statements of loss and comprehensive loss.

- In December 2016, the Company decided to cease all operations

relating to single pass tunneling. The net operations of this line

of business, including the prior period, are presented as a single

amount in the consolidated statements of loss and comprehensive

loss.

On a personal note (as well as our Management

team), I would like to thank our shareholders for the support they

have shown as we transition from what was a challenging period to

what we believe is an extended period of exceptional growth

potential.

About Enterprise Group, Inc.Enterprise Group,

Inc. is a consolidator of construction services companies operating

in the energy, utility and transportation infrastructure

industries. The Company’s focus is primarily construction services

and specialized equipment rental. The Company’s strategy is to

acquire complementary service companies in Western Canada,

consolidating capital, management, and human resources to support

continued growth. More information is available at the Company’s

website www.enterprisegrp.ca. Corporate filings can be found

on www.sedar.com

For questions or additional information,

please contact: Leonard Jaroszuk: President & CEO, or

Desmond O’Kell: Senior Vice-President contact@enterprisegrp.ca

780-418-4400

Forward Looking InformationCertain statements

contained in this news release constitute forward-looking

information. These statements relate to future events or the

Company’s future performance. The use of any of the words "could",

"expect", "believe", "will", "projected", "estimated" and similar

expressions and statements relating to matters that are not

historical facts are intended to identify forward-looking

information and are based on the Company's current belief or

assumptions as to the outcome and timing of such future events.

Actual future results may differ materially. The Company's Annual

Information Form and other documents filed with securities

regulatory authorities (accessible through the SEDAR website

www.sedar.com) describe the risks, material assumptions and other

factors that could influence actual results and which are

incorporated herein by reference. The Company disclaims any

intention or obligation to publicly update or revise any

forward-looking information, whether as a result of new

information, future events or otherwise, except as may be expressly

required by applicable securities laws.

Non-IFRS MeasuresThe Company uses International

Financial Reporting Standards (“IFRS”). EBITDAS is not a

measure that has any standardized meaning prescribed by IFRS and is

therefore referred to as a non-IFRS measure. This news

release contains references to EBITDAS. This non-IFRS measure

used by the Company may not be comparable to a similar measure used

by other companies. Management believes that in addition to

net income, EBITDAS is a useful supplemental measure as it provides

an indication of the results generated by the Company’s principal

business activities prior to consideration of how those activities

are financed or how the results are taxed. EBITDAS is

calculated as net income excluding depreciation, amortization,

interest, taxes and stock based compensation.

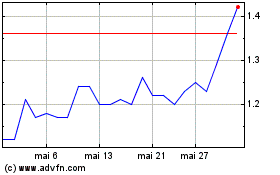

Enterprise (TSX:E)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Enterprise (TSX:E)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025