Energy Fuels Announces C$7.1 Million Private Placement

04 Juin 2012 - 2:05PM

Marketwired Canada

NOT FOR DISTRIBUTION TO US NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED

STATES

Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company") is pleased to

announce that it has entered into an agreement with Dundee Securities Ltd. as

lead agent on behalf of a syndicate of agents including Haywood Securities Inc.,

Scotiabank and Versant Partners Inc. (the "Agents") under which the Agents have

agreed to offer for sale, on a best efforts private placement basis,

approximately 30,870,000 non-transferrable subscription receipts of the Company

("Subscription Receipts") at a price of C$0.23 per Subscription Receipt for

total gross proceeds of approximately C$7,100,100 (the "Offering"). The Agents

have been granted the option (the "Option") to sell up to an additional 15% of

the Offering, exercisable in whole or in part at any time up to 48 hours before

the closing of the Offering which is scheduled for on or about June 21, 2012

(the "Closing Date").

Each Subscription Receipt shall be exchangeable for one unit of the Company (a

"Unit") upon satisfaction of the Escrow Release Conditions (defined below). Each

Unit shall consist of one common share (a "Share") of the Company and one-half

of one common share purchase warrant ("Warrant"). Each whole Warrant shall

entitle the holder thereof to acquire one additional Share of the Company at a

price of C$0.265 for a period of 36 months following the Closing Date. The

Warrants will not be listed for trading.

The Company intends to use the net proceeds of the Offering for working capital

and general corporate purposes related to the operations of the U.S. based

mining assets that are being acquired from Denison Mines Corp., as press

released on May 24, 2012 (the "Transaction"). The gross proceeds of the Offering

(the "Escrowed Funds"), shall be deposited in escrow on the Closing Date. The

Escrowed Funds will be released from escrow to the Company immediately prior to

the closing of the Transaction and receipt of all required third party and

regulatory approvals (the "Escrow Release Conditions"). In the event that the

Escrow Release Conditions are not satisfied on or before July 31, 2012, the

Escrowed Funds together with accrued interest earned thereon will be returned to

the holders of the Subscription Receipts and the Subscription Receipts will be

cancelled.

In connection with the Offering, the Agents will receive a cash commission equal

to 6.0% of the gross proceeds raised pursuant to the Offering (inclusive of the

Option), 50% of which will be payable upon the Closing Date and the balance will

be payable upon the satisfaction of the Escrow Release Conditions.

All securities issued in connection with the Offering will be subject to a

statutory four month hold period. The Offering is subject to a number of

conditions, including, without limitation, receipt of all regulatory approvals.

About Energy Fuels: Energy Fuels Inc. is a uranium and vanadium mineral

development company. The Company recently acquired Titan Uranium Inc., including

the Sheep Mountain Project in the Crooks Gap District of Wyoming. The Company

also received a Final Radioactive Materials License from the State of Colorado

for the proposed Pinon Ridge Uranium and Vanadium Mill in March 2011. The mill

will be the first uranium mill constructed in the United States in over 30

years.

With about 61,000 acres of highly prospective uranium and vanadium properties

located in the states of Colorado, Utah, Arizona, Wyoming, and New Mexico, and

exploration properties in Saskatchewan's Athabasca Basin totaling approximately

32,000 additional acres, the Company has a full pipeline of additional

development prospects. Energy Fuels, through its wholly-owned subsidiaries,

Energy Fuels Resources Corporation, Titan Uranium Inc., and Magnum Uranium

Corp., has assembled this property portfolio along with a first class management

team, including highly skilled technical mining and milling professionals based

in Lakewood and Naturita, Colorado and Kanab, Utah.

This news release and the information contained herein does not constitute an

offer of securities for sale in the United States. The securities have not been

and will not be registered under the United States Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from such registration requirements.

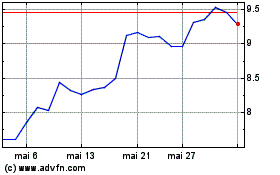

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024