Energy Fuels to Focus on Lower Cost Uranium Production

18 Octobre 2012 - 1:00AM

Marketwired Canada

Energy Fuels Inc. (TSX:EFR) ("Energy Fuels" or the "Company") today announced

that, following an evaluation of its operations and various production sources,

the Company will shift its short-term focus toward lower cost sources of U3O8

production within its asset portfolio. Specifically, Energy Fuels will

concentrate on mining its lower cost, high-grade breccia pipes in northern

Arizona and on processing alternate feed materials at the White Mesa Mill which

have no associated mining cost.

As a result of this revised production strategy, Energy Fuels will be placing

the Beaver and Daneros properties on the Colorado Plateau on standby over the

course of the first quarter of FY 2013. In addition, the Company will cease

mining at the Pandora property on the Colorado Plateau during the second quarter

of FY 2013, pending the depletion of its identified uranium and vanadium

resources. Energy Fuels will closely monitor market conditions and evaluate

reopening the Beaver and Daneros mines at the appropriate time. Core mining

expertise will be retained at these locations during the standby period.

For FY 2013, Energy Fuels expects production from the White Mesa Mill in

Blanding, Utah to be between 1,000,000 and 1,100,000 lbs. of U3O8 and between

2,000,000 and 2,200,000 lbs. of V2O5. Mining is expected to continue at the

Company's Arizona 1 property during the first three quarters of FY 2013. In

addition, mining is expected to commence at the Pinenut property in Arizona

during the second quarter of FY 2013. The White Mesa Mill is expected to

continue processing alternate feed materials during FY 2013.

Commenting on these developments, Energy Fuels' President and CEO Stephen Antony

said, "Energy Fuels is well-equipped to adjust our operations to address market

conditions. Within our portfolio of assets, we have lower cost sources of

production, such as the high-grade breccia pipe mines in the Arizona Strip and

the ability to process alternate feed materials at the White Mesa Mill for which

there is no mining cost. In addition, we have term contracts with multiple

utilities which enable the Company to sell significant quantities of U3O8 at a

substantial premium to the current spot price. These assets will play a

particularly important role in how we manage our business at this time, when the

current U3O8 spot price, in our view, does not reflect the strong fundamentals

of the uranium sector over the medium- to long-term. Although our Colorado

Plateau properties will be placed on standby for the time being, we will

maintain these assets with the ability to resume production in a timely fashion

upon commodity prices improving. In addition, we will continue to invest in

development projects that will keep Energy Fuels as the leading US uranium

producer, including the development of the Canyon mine in Arizona and the

continuation of permitting activities at our Sheep Mountain project in Wyoming."

About Energy Fuels: Energy Fuels is America's largest conventional uranium and

vanadium producer, supplying nearly a third of the uranium produced in the U.S.

The company operates the White Mesa Mill, which is the only conventional uranium

mill currently operating in the U.S., capable of processing 2,000 tons per day

of uranium ore. Energy Fuels has projects located throughout the Western U.S.,

including producing mines and mineral properties in various stages of permitting

and development.

This news release contains certain "Forward-Looking Statements" within the

meaning of Section 21E of the United States Securities Exchange Act of 1934, as

amended and "Forward-Looking Information" within the meaning of applicable

Canadian securities legislation. All statements, other than statements of

historical fact, included herein are forward-looking statements and

forward-looking information that involve various risks and uncertainties. There

can be no assurance that such statements will prove to be accurate, and actual

results and future events could differ materially from those anticipated in such

statements. Important factors that could cause actual results to differ

materially from the Company's expectations are disclosed in the Company's

documents filed from time-to-time with the British Columbia, Alberta and Ontario

Securities Commissions.

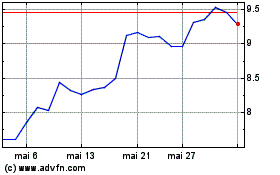

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juin 2024 à Juil 2024

Energy Fuels (TSX:EFR)

Graphique Historique de l'Action

De Juil 2023 à Juil 2024