Faraday Copper Corp. (“

Faraday” or the

“

Company”) (TSX:FDY) (OTCQX:CPPKF) is pleased to

announce it has entered into an agreement with Ventum Financial

Corp (formerly known as PI Financial) as co-lead underwriter and

joint bookrunner, on its own behalf and on behalf of a syndicate of

underwriters including Canaccord Genuity Corp. and TD Securities

Inc. as co-lead underwriters and joint bookrunners (collectively,

the “Underwriters”), pursuant to which the Underwriters have agreed

to purchase, on a bought deal basis, 25,000,000 common shares in

the capital of the Company (the “Common Shares”) at a price of

C$0.80 per Common Share for gross proceeds to the Company of

C$20,000,000 (the “Underwritten Offering”).

The Company will grant the Underwriters an

option to purchase up to an additional 3,750,000 Common Shares (the

“Over-Allotment Option Common Shares” and together with the Common

Shares, the “Offered Securities”) to cover over-allotments, if any,

and for market stabilization purposes at a price of C$0.80 per

Over-Allotment Option Common Share for additional gross proceeds of

up to C$3,000,000 (the “Over-Allotment Option” and together with

the Underwritten Offering, the “Offering”), exercisable in whole or

in part, at any time on or prior to the date that is 30 days

following the Closing Date (as defined herein).

The Company intends to use the net proceeds from

the Offering for exploration and development of its Copper Creek

Project, located in Arizona, U.S., and for general working capital

purposes.

The Common Shares will be issued by way of a

prospectus supplement that will be filed in all provinces and

territories of Canada, other than Quebec, under the Company’s base

shelf prospectus dated October 21, 2022. The Common Shares may also

be sold in the United States on a private placement basis pursuant

to an exemption from the registration requirements of the United

States Securities Act of 1933, as amended (the “U.S. Securities

Act”), and other jurisdictions outside of Canada provided that no

prospectus filing or comparable obligation arises.

The Offering is scheduled to close on or about

May 30, 2024 (the “Closing Date”) and is subject to certain

conditions including, but not limited to, the receipt of all

necessary regulatory and other approvals including the approval of

the Toronto Stock Exchange and the securities regulatory

authorities.

The securities offered in the Offering have not

been, and will not be, registered under the U.S. Securities Act or

any U.S. state securities laws, and may not be offered or sold in

the United States or to, or for the account or benefit of, United

States persons absent registration or any applicable exemption from

the registration requirements of the U.S. Securities Act and

applicable U.S. state securities laws. This news release shall not

constitute an offer to sell or the solicitation of an offer to buy

securities in the United States, nor shall there be any sale of

these securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful.

About Faraday Copper

Faraday Copper is a Canadian exploration company

focused on advancing its flagship copper project in Arizona, U.S.

The Copper Creek project is one of the largest undeveloped copper

projects in North America with significant district scale

exploration potential. The Company is well-funded to deliver on its

key milestones and benefits from a management team and board of

directors with senior mining company experience and expertise.

Faraday trades on the TSX under the symbol “FDY”.

For additional information please contact:

Stacey Pavlova, CFAVice President, Investor

Relations & CommunicationsFaraday Copper Corp.E-mail:

info@faradaycopper.com Website: www.faradaycopper.com

To receive news releases by e-mail, please

register using the Faraday website at www.faradaycopper.com.

Cautionary Note on Forward Looking

Statements

Some of the statements in this news release,

other than statements of historical fact, are “forward-looking

statements” and are based on the opinions and estimates of

management as of the date such statements are made and are

necessarily based on estimates and assumptions that are inherently

subject to known and unknown risks, uncertainties and other factors

that may cause actual results, level of activity, performance or

achievements of Faraday to be materially different from those

expressed or implied by such forward-looking statements. Such

forward-looking statements and forward-looking information

specifically include, but are not limited to, statements concerning

the expected quantum and timing of closing the Offering and the

intended use of proceeds.

Although Faraday believes the expectations

expressed in such forward-looking statements are based on

reasonable assumptions, such statements should not be in any way

construed as guarantees of future performance and actual results or

developments may differ materially. Accordingly, readers should not

place undue reliance on forward-looking statements or

information.

Factors that could cause actual results to

differ materially from those in forward-looking statements include

without limitation: market prices for metals; the conclusions of

detailed feasibility and technical analyses; lower than expected

grades and quantities of resources; receipt of regulatory approval;

receipt of shareholder approval; mining rates and recovery rates;

significant capital requirements; price volatility in the spot and

forward markets for commodities; fluctuations in rates of exchange;

taxation; controls, regulations and political or economic

developments in the countries in which Faraday does or may carry on

business; the speculative nature of mineral exploration and

development, competition; loss of key employees; rising costs of

labour, supplies, fuel and equipment; actual results of current

exploration or reclamation activities; accidents; labour disputes;

defective title to mineral claims or property or contests over

claims to mineral properties; unexpected delays and costs inherent

to consulting and accommodating rights of Indigenous peoples and

other groups; risks, uncertainties and unanticipated delays

associated with obtaining and maintaining necessary licenses,

permits and authorizations and complying with permitting

requirements, including those associated with the Copper Creek

property; and uncertainties with respect to any future acquisitions

by Faraday. In addition, there are risks and hazards associated

with the business of mineral exploration, development and mining,

including environmental events and hazards, industrial accidents,

unusual or unexpected formations, pressures, cave-ins, flooding and

the risk of inadequate insurance or inability to obtain insurance

to cover these risks as well as “Risk Factors” included in

Faraday’s disclosure documents filed on and available at

www.sedarplus.ca.

This news release does not constitute an offer

to sell or a solicitation of an offer to buy any securities in any

jurisdiction to any person to whom it is unlawful to make such an

offer or solicitation in such jurisdiction. This news release is

not, and under no circumstances is to be construed as, a

prospectus, an offering memorandum, an advertisement or a public

offering of securities in Faraday in Canada, the United States or

any other jurisdiction. No securities commission or similar

authority in Canada or in the United States has reviewed or in any

way passed upon this news release, and any representation to the

contrary is an offence.

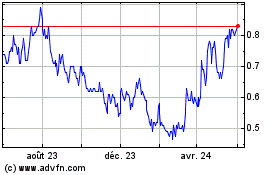

Faraday Copper (TSX:FDY)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

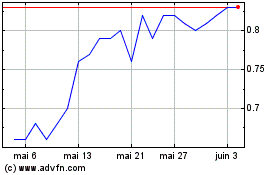

Faraday Copper (TSX:FDY)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025