American Hotel Income Properties REIT LP (“

AHIP”

or the “

Company”) (TSX: HOT.UN, TSX: HOT.U, TSX:

HOT.DB.U) announced today that it has entered into an agreement

with a syndicate of underwriters (the

“

Underwriters”) led by CIBC Capital Markets and

BMO Capital Markets to issue to the public on a bought deal basis,

subject to regulatory approval, US$50,000,000 aggregate principal

amount of convertible unsecured subordinated debentures at a price

of US$1,000 per debenture with a coupon of 6.00% per annum (the

“

Debentures”). The Debentures will mature on

December 31, 2026 and are convertible at the option of the holder

into limited partnership units of AHIP (each, a

“

Unit” or collectively “

Units”)

at US$4.95 per Unit (the “

Conversion Price” and

collectively with all other terms, the

“

Offering”).

AHIP has also granted to the Underwriters an

over-allotment option to purchase up to US$5,000,000 aggregate

principal amount of additional Debentures, representing 10% of the

size of the Offering. The over-allotment option is exercisable in

whole or in part anytime for a period of up to 30 days following

closing of the Offering to cover over-allotments, if any, and for

market stabilization purposes.

The Debentures will be convertible at the option

of the holder into Units at any time prior to maturity at the

Conversion Price, which represents an approximate 30% premium to

the current market price of the Units (based on an exchange rate

of 1.2495 on November 10, 2021). The Conversion Price of the

Debentures also represents a conversion rate of

approximately 202.0203 Units for each US$1,000 principal

amount of Debentures, subject to adjustment in accordance with the

trust indenture governing the Debentures.

The Debentures will bear interest at a rate of

6.00% per annum and will be payable semi-annually on June 30 and

December 31 until maturity on December 31, 2026, with the first

payment commencing on June 30, 2022. The Debentures will not be

redeemable by AHIP prior to December 31, 2024. On or after December

31, 2024, but prior to December 31, 2025, the Debentures will be

redeemable, in whole or in part, at a price equal to par plus

accrued and unpaid interest, at AHIP’s option, provided that the

volume-weighted average trading price of the Units on the Toronto

Stock Exchange (the “TSX”) is not less than 125%

of the Conversion Price. On and after December 31, 2025 and prior

to the maturity date, the Debentures will be redeemable, in whole

or in part, at a price equal to par plus accrued and unpaid

interest, at AHIP’s option.

AHIP intends to use the net proceeds from the

Offering, together with cash on hand, to fund the intended

redemption of the Company’s outstanding convertible unsecured

subordinated debentures due on June 30, 2022, with an aggregate

principal amount outstanding of US$48,875,000, trading on the TSX

under the trading symbol “HOT.DB.U” (the “2022

Debentures”). Any additional net proceeds resulting from

an exercise of the over-allotment option will be used, in lieu of

cash on hand, to fund the aforementioned intended redemption of the

2022 Debentures, with any remainder used to partially pay down the

Company’s revolving credit facility.

The closing of the Offering is expected to occur

on or about November 26, 2021. The Offering is subject to customary

regulatory approvals, including the TSX. The Debentures will be

offered in each of the provinces of Canada by way of a short form

prospectus (the “Prospectus”) to be filed with

securities regulators in all provinces of Canada and may also be

offered by way of private placement in the United States.

Upon completion of the Offering, it is AHIP’s

intention to send a notice of redemption, effective December 31,

2021 (the “Redemption Date”), in respect of all of

the outstanding 2022 Debentures, for an aggregate redemption price

equal to the sum of the outstanding aggregate principal amount of

the 2022 Debentures of US$48,875,000 and all accrued and unpaid

interest thereon up to, but excluding, the Redemption Date. The

2022 Debentures will cease to bear interest from and after the

Redemption Date. The redemption of the 2022 Debentures will be

effected in accordance with the terms of the trust indenture dated

June 9, 2017, between the Company and Computershare Trust Company

of Canada.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or an

applicable exemption from the registration requirements. This press

release shall not constitute an offer to sell or the solicitation

of an offer to buy nor shall there be any sale of the securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful.

ABOUT AMERICAN HOTEL INCOME PROPERTIES

REIT LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.U), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP's 78 premium branded, select-service hotels

are located in secondary metropolitan markets that benefit from

diverse and stable demand. AHIP hotels operate under brands

affiliated with Marriott, Hilton, IHG and Choice Hotels through

license agreements. The Company's long-term objectives are to

increase the value of hotel properties through operating

excellence, active asset management and investing in value-added

capital expenditures, expand the hotel portfolio through selective

acquisitions on an accretive basis, and increase unitholder value

and distributions to unitholders. More information is available at

www.ahipreit.com.

FORWARD-LOOKING INFORMATION

Certain statements contained in this news

release may constitute forward-looking information as defined under

applicable securities laws. Forward-looking information is often,

but not always, identified by the use of words such as

“anticipate”, “plan”, “expect”, “may”, “will”, “intend”, “should”,

and similar expressions. Forward-looking information involves known

and unknown risks, uncertainties and other factors that may cause

actual results or events to differ materially from those

anticipated in such forward-looking information. Forward-looking

information in this news release includes, without limitation

statements with respect to: the closing of the Offering or the

over-allotment option and the intended use of proceeds therefrom;

the expected terms of the Debentures; the expected closing date for

the Offering and the approval of the TSX; the intended redemption

of the 2022 Debentures and expected timing thereof; and AHIP’s

long-term objectives.

Forward-looking information is based on a number

of key expectations and assumptions made by AHIP, including,

without limitation: a reasonably stable North American economy and

stock market; the continued strength of the U.S. lodging industry;

the ability to successfully complete the Offering; the receipt of

all necessary approvals for the Offering; the ability to

successfully complete the redemption of the 2022 Debentures; and

the value of the U.S. dollar. Although the forward-looking

information contained in this news release is based on what AHIP’s

management believes to be reasonable assumptions, AHIP cannot

assure investors that actual results will be consistent with such

information.

Forward-looking information reflects current

expectations of AHIP’s management regarding future events and

operating performance as of the date of this news release. Such

information involves significant risks and uncertainties, should

not be read as guarantees of future performance or results, and

will not necessarily be accurate indications of whether or not such

results will be achieved. Actual results could differ materially

from those currently anticipated due to a number of factors and

risks. These include, without limitation, the Offering may be

terminated upon certain stated events; regulatory and other

approvals for the Offering may not be obtained; AHIP may not have

sufficient funds to complete the redemption of the 2022 Debentures,

as well as those risk factors that can be found under “Risk

Factors” in AHIP’s Annual Information Form dated March 15, 2021 and

under “Risks and Uncertainties” in AHIP’s Management’s Discussion

and Analysis dated November 9, 2021, both of which are available on

SEDAR at www.sedar.com.

The forward-looking statements contained herein

represent AHIP’s expectations as of the date of this news release,

and are subject to change after this date. AHIP assumes no

obligation to update or revise any forward-looking statements

whether as a result of new information, future events or otherwise,

except as required by applicable law.

For further information, please

contact:

Jonathan KorolChief

Executive OfficerEmail: jkorol@ahipreit.com

Travis BeattyChief

Financial OfficerEmail: tbeatty@ahipreit.com

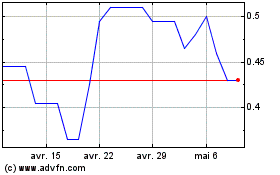

American Hotel Income Pr... (TSX:HOT.U)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

American Hotel Income Pr... (TSX:HOT.U)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025