American Hotel Income Properties REIT LP (“

AHIP”,

or the “

Company”) (TSX: HOT.UN, TSX: HOT.U, TSX:

HOT.DB. V), today announced its financial results for the three

months ended March 31, 2024.

All amounts presented in this news release are

in United States dollars (“U.S. dollars”) unless

otherwise indicated.

2024 FIRST QUARTER HIGHLIGHTS

- Diluted FFO per

unit (1) and normalized diluted FFO per unit (1) were $0.03 and

$0.02, respectively, for the first quarter of 2024, compared to

$0.11 and $0.07 for the same period of 2023.

- Occupancy (1) was

66.4% for the first quarter of 2024, an increase of 230 basis

points (“bps”) compared to 64.1% for the same period of 2023.

- ADR (1) decreased

0.8% to $131 for the first quarter of 2024, compared to $132 for

the same period of 2023.

- Revenue increased

1.6% to $66.5 million for the first quarter of 2024, compared to

$65.5 million for the same period in 2023.

- NOI and normalized

NOI (1) were $17.2 million and $17.3 million, respectively, for the

first quarter of 2024, decreases of 8.0% and 12.2%, respectively,

compared to $18.7 million and $19.7 million for the same period in

2023.

- AHIP had $25.5

million in available liquidity as at March 31, 2024, compared to

$27.8 million as at December 31, 2023. The available liquidity

of $25.5 million was comprised of an unrestricted cash balance of

$15.5 million and borrowing availability of $10.0 million under the

revolving credit facility.

“AHIP’s portfolio of premium branded select

service hotel properties continued to demonstrate strong demand

metrics in 2024.” said Jonathan Korol, CEO. “Portfolio RevPAR

and occupancy increased by 2.4% and 230 bps respectively compared

to Q1 2023. Excluding hotels with disrupted operations in the first

quarter of 2023, RevPAR decreased by 1.6% compared to the same

period in the prior year. Preliminary results for April show an

improvement with an increase in RevPAR of approximately 5%

excluding hotels with disrupted operations in 2023. Costs related

to macroeconomic conditions remain elevated, with higher insurance

premiums and elevated labor and operating costs resulting in

pressures to hotel operating margins.”

Mr. Korol added: “AHIP’s Board and management

team are taking a number of actions across the business in recent

quarters to preserve cash, enhance financial stability and protect

long term value for our unitholders. As previously disclosed, these

actions include the recently completed, amendment and extension of

our revolving credit facility, reduction and deferral of hotel

management fees, and temporary suspension of the distribution. In

2024, we are currently executing a plan to address 2024 debt

obligations with asset sales and loan refinancings. These steps are

expected to strengthen our liquidity and balance sheet to ensure we

are positioned to benefit when the industry operating and

macroeconomic environment improves. We will continue to monitor

conditions and operating performance, while considering further

strategic opportunities to deliver value over the long term.”

2024 FIRST QUARTER REVIEW

FINANCIAL AND OPERATIONAL

HIGHLIGHTS

For the three months ended March 31, 2024,

occupancy increased 230 bps to 66.4%, compared to the same period

in the prior year. The increase in occupancy was partially offset

by a slight decrease of 0.8% in ADR. Overall, improved occupancy

resulted in an increase of 2.4% in RevPAR, compared to the same

period in 2023.

The improved RevPAR is attributable to higher

demand for the extended stay and select service properties. This is

primarily due to improved performance of properties disrupted in

2023 by the weather-related damage and renovation at three hotels,

as well as the disposition of properties with lower-than-average

portfolio RevPAR. Excluding the hotels disrupted in the first

quarter of 2023 and properties sold since the first quarter of

2023, ADR and occupancy decreased by less than 1.0%, and RevPAR

decreased by 1.6%, compared to the same period in the prior

year.

The ability to control and manage daily rates is

a key advantage of the lodging sector, which has enabled AHIP to

achieve growth in RevPAR, partially mitigating the effects of

rising labor costs and general inflationary pressures across the

portfolio.

NOI, NOI MARGIN

(1) AND DILUTED FFO PER UNIT

(1)

NOI and normalized NOI (1) were $17.2 million

and $17.3 million, respectively, for the three months ended March

31, 2024, decreases of 8.0% and 12.2%, respectively, compared to

NOI of $18.7 million and normalized NOI of $19.7 million for the

same period in 2023. NOI margin was 25.9% in the current quarter, a

decrease of 270 bps compared to the same period in 2023. The

decreases in NOI and NOI margin were due to higher operating

expenses as a result of general cost inflation and higher property

insurance premiums. General inflation resulted in increased labor

costs and higher costs of operating supplies. The increase in the

annual premium for property insurance effective June 1, 2023 is

approximately $3.5 million.

Diluted FFO per unit and normalized diluted FFO

per unit (1) were $0.03 and $0.02 for the first quarter of 2024,

respectively, compared to diluted FFO per unit of $0.11 and

normalized diluted FFO per unit of $0.07 for the same period in

2023. Normalized diluted FFO per unit in the current quarter

excluded non-recurring expected insurance proceeds of $1.1 million

as a result of weather-related property damage at several hotel

properties in late December 2022. The decrease in normalized

diluted FFO per unit was due to lower NOI and higher finance costs

in the current quarter, compared to the same period in 2023.

LEVERAGE AND LIQUIDITY

|

KPIs |

Q1 2024 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

|

Debt-to-GBV (1) |

52.2% |

51.9% |

51.1% |

51.6% |

52.0% |

|

Debt-to-TTM EBITDA (1) |

10.5x |

10.6x |

10.1x |

9.8x |

9.6x |

Debt to gross book value as at March 31,

2024 was 52.2%, an increase of 30 bps compared to December 31,

2023. Debt to TTM EBITDA as at March 31, 2024 was 10.5x, an

increase of 0.9x compared to March 31, 2023. The increase in Debt

to TTM EBITDA was mainly due to the decrease in NOI.

As at March 31, 2024, AHIP had $25.5 million in

available liquidity, compared to $27.8 million as at

December 31, 2023. The available liquidity of $25.5 million

was comprised of an unrestricted cash balance of $15.5 million and

borrowing availability of $10.0 million under the revolving credit

facility. AHIP has an additional restricted cash balance of $33.5

million as at March 31, 2024.

AHIP has 70.6% of its debt at fixed interest

rates following the expiry of the interest rate swaps on its senior

credit facility on November 30, 2023. The notional value of the

interest rate swaps was $130.0 million which expired on November

30, 2023. As a result of this expiry, at the current average

secured overnight financing rate (“SOFR”) of 5.3%, the

incremental annual interest expense is estimated to be

approximately $5.2 million for the twelve months ended November 30,

2024. The actual increase in interest expense will be dependent on

future SOFR.

CAPITAL RECYCLING

In March 2024, AHIP completed the strategic

dispositions of non-core hotel properties in Harrisonburg, Virginia

and Cranberry Township, Pennsylvania for gross proceeds of $8.55

million and $8.25 million respectively. The combined sales price

for these properties represents a blended cap rate of 8.6% on 2023

annual hotel EBITDA, after adjusting for an industry standard 4%

furniture, fixtures, and equipment reserve. Under the terms of the

revolving credit facility, 50% of the net proceeds from the sale of

these two hotel properties, which is approximately $0.8 million,

will be used to pay down outstanding amounts under the term loans

in the second quarter of 2024.

In March and April 2024, AHIP entered into

agreements to dispose of two non-core hotel properties in Amarillo,

Texas for $9.3 million and $8.3 million, respectively, subject to

customary adjustments at closing. The dispositions are currently

expected to close in the third quarter of 2024. AHIP intends to use

the proceeds from these dispositions to pay down debt.

AHIP will continue to execute its strategy to

divest assets to reduce debt and is currently marketing a selected

number of additional properties which are expected to demonstrate

value above the current unit trading price.

SAME PROPERTY KPI

The following table summarizes key performance

indicators (“KPIs”) for the portfolio for the five

most recent quarters with a comparison to the same period in the

prior year.

|

KPIs |

Q1 2024 |

Q4 2023 |

Q3 2023 |

Q2 2023 |

Q1 2023 |

|

ADR |

$132 |

$127 |

$133 |

$133 |

$133 |

|

Change compared to same period in prior year - %

increase/(decrease) |

(0.8%) |

- |

2.7% |

5.3% |

11.4% |

|

Occupancy |

67.3% |

66.9% |

71.6% |

74.4% |

66.3% |

|

Change compared to same period in prior year - bps

increase/(decrease) |

100 |

(83) |

(223) |

(5) |

53 |

|

RevPAR |

$89 |

$85 |

$95 |

$99 |

$88 |

|

Change compared to same period in prior year - %

increase/(decrease) |

1.1% |

(1.3%) |

(0.4%) |

4.5% |

12.3% |

|

NOI Margin |

26.9% |

26.1% |

30.5% |

33.3% |

29.4% |

|

Change compared to same period in prior year - bps decrease |

(250) |

(514) |

(275) |

(212) |

(19) |

Same property ADR in the current quarter is

$132, largely consistent with the same period of 2023. Same

property occupancy increased by 100 bps to 67.3% in the current

quarter compared to 66.3% the same periods in 2023. The increase in

occupancy is primarily attributable to higher demand for the

extended stay and select service properties.

Same property NOI margin decreased by 250 bps to

26.9% for the first quarter of 2024, compared to the same period in

2023. The decrease in the same property NOI margin was mainly due

to higher operating expenses as a result of cost inflation,

escalated labor costs, and higher property insurance premiums. The

labor environment is improving although labor is expected to remain

a challenge in 2024 with increased turnover and hourly wage

costs.

SELECTED INFORMATION

|

|

|

Three months ended March 31 |

|

(thousands of dollars, except per Unit

amounts) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

| Revenue |

|

66,489 |

|

|

65,458 |

|

| Income from operating

activities |

|

7,569 |

|

|

9,418 |

|

| Loss and comprehensive

loss |

|

(8,109 |

) |

|

(1,600 |

) |

| NOI |

|

17,190 |

|

|

18,738 |

|

| NOI Margin (1) |

|

25.9 |

% |

|

28.6 |

% |

| |

|

|

|

| Hotel EBITDA (1) |

|

15,673 |

|

|

16,602 |

|

| Hotel EBITDA Margin (1) |

|

23.6 |

% |

|

25.4 |

% |

| EBITDA (1) |

|

13,320 |

|

|

14,044 |

|

| EBITDA Margin (1) |

|

20.0 |

% |

|

21.5 |

% |

| |

|

|

|

| Cashflow from operating

activities |

|

43 |

|

|

13,094 |

|

| Distributions declared per

unit - basic and diluted |

|

- |

|

|

0.045 |

|

| Distributions declared to

unitholders - basic |

|

- |

|

|

3,546 |

|

| Distributions declared to

unitholders - diluted |

|

- |

|

|

4,026 |

|

| Dividends declared to Series C

holders |

|

1,099 |

|

|

1,000 |

|

| |

|

|

|

| FFO diluted (1) |

|

2,334 |

|

|

9,801 |

|

| FFO per unit - diluted

(1) |

|

0.03 |

|

|

0.11 |

|

| Normalized FFO per unit -

diluted (1) |

|

0.02 |

|

|

0.02 |

|

| |

|

|

|

| AFFO diluted (1) |

|

(668 |

) |

|

7,081 |

|

| AFFO per unit - diluted

(1) |

|

(0.01 |

) |

|

0.08 |

|

| (1) See

“Non-IFRS and Other Financial Measures” |

|

SELECTED INFORMATION

|

(thousands of dollars) |

|

March 31,2024 |

|

December 31,2023 |

|

|

|

|

|

|

Total assets |

|

929,771 |

|

|

954,887 |

|

| Total liabilities |

|

705,975 |

|

|

721,937 |

|

| Total non-current

liabilities |

|

527,201 |

|

|

529,178 |

|

| Term loans and revolving

credit facility |

|

567,602 |

|

|

599,873 |

|

| |

|

|

|

| Debt to gross book value

(1) |

|

52.2 |

% |

|

51.9 |

% |

| Debt to EBITDA (times)

(1) |

|

10.5 |

|

|

10.6 |

|

| Interest coverage ratio

(times) (1) |

|

1.8 |

|

|

1.9 |

|

| |

|

|

|

| Term loans and revolving

credit facility: |

|

|

|

| Weighted average interest

rate |

|

5.79 |

% |

|

4.95 |

% |

| Weighted average term to

maturity (years) |

|

2.1 |

|

|

2.2 |

|

| |

|

|

|

| Number of rooms |

|

7,662 |

|

|

7,917 |

|

| Number of properties |

|

68 |

|

|

70 |

|

| Number

of restaurants |

|

14 |

|

|

14 |

|

|

(1) See “Non-IFRS and Other Financial Measures” |

|

|

|

2024 FIRST QUARTER OPERATING

RESULTS

|

|

|

Three months ended March 31 |

|

(thousands of dollars) |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

| ADR (1) |

|

131 |

|

|

132 |

|

| Occupancy (1) |

|

66.4 |

% |

|

64.1 |

% |

| RevPAR

(1) |

|

87 |

|

|

85 |

|

|

|

|

|

|

|

Revenue |

|

66,489 |

|

|

65,458 |

|

| |

|

|

|

| Operating expenses |

|

36,389 |

|

|

35,526 |

|

| Energy |

|

2,990 |

|

|

3,222 |

|

| Property maintenance |

|

4,219 |

|

|

3,524 |

|

|

Property taxes, insurance and ground lease before IFRIC 21 |

|

5,701 |

|

|

4,448 |

|

| Total expenses |

|

49,299 |

|

|

46,720 |

|

|

|

|

|

|

| NOI |

|

17,190 |

|

|

18,738 |

|

| NOI

Margin % (1) |

|

25.9 |

% |

|

28.6 |

% |

| |

|

|

|

| IFRIC 21 property taxes

adjustment |

|

892 |

|

|

699 |

|

|

Depreciation and amortization |

|

8,729 |

|

|

8,621 |

|

|

Income from operating activities |

|

7,569 |

|

|

9,418 |

|

|

|

|

|

|

| Other expenses |

|

17,411 |

|

|

12,427 |

|

| Current income tax

expense |

|

87 |

|

|

16 |

|

| Deferred income tax

recovery |

|

(1,820 |

) |

|

(1,425 |

) |

|

|

|

|

|

| Loss

and comprehensive loss |

|

(8,109 |

) |

|

(1,600 |

) |

| (1) See

“Non-IFRS and Other Financial Measures” |

INITIATIVES TO STRENGTHEN FINANCIAL

POSITION AND PRESERVE UNITHOLDER VALUE

The Board of Directors (the “Board”), together

with management, have implemented a plan to strengthen AHIP’s

financial position and to preserve unitholder value. Initiatives,

both planned and underway, are outlined below.

PLAN TO ADDRESS NEAR TERM LOAN

MATURITIES

AHIP is in the process of executing its plan to

address the Company’s near-term debt maturities in 2024, while

creating modest improvements in ADR, RevPAR and leverage

metrics.

The commercial mortgage-backed securities

(“CMBS”) loan maturities are $22.3 million in the second quarter of

2024, and $58.7 million in the fourth quarter of 2024.

To address the Q2 2024 CMBS loan maturity of

$22.3 million, AHIP completed the disposition of one non-core hotel

property and refinanced the balance of the loan in March 2024,

specifically:

- AHIP completed the

strategic disposition of a hotel property in Harrisonburg, Virginia

for $8.55 million. The net proceeds were used to partially satisfy

the non-recourse mortgage debt; and

- AHIP completed the

CMBS refinancing for the remaining three assets secured against

this loan with gross proceeds of $17.5 million prior to initial

capital reserves contribution of approximately $5.0 million. The

term of this new CMBS loan is five years at a fixed annual interest

rate of 7.8%.

To address the Q4 2024 CMBS loan maturities of

$58.7 million, AHIP intends to dispose of four non-core properties

and refinance the balance of the loan, specifically:

- In March and April

2024, AHIP entered into agreements to dispose of two non-core hotel

properties in Amarillo, Texas for $9.3 million and $8.3 million,

respectively. The dispositions are expected to close in the third

quarter of 2024. In addition, AHIP is currently marketing non-core

hotel properties in each of Amarillo and Dallas, Texas; and

- AHIP expects to

refinance a $24.9 million CMBS loan secured against four hotel

properties in Florida and North Carolina before its maturity date

in the fourth quarter of 2024.

NORTHEAST PORTFOLIO III CMBS

LOAN

During the first quarter of 2024, AHIP notified

the loan servicer for the AHIP Northeast Portfolio III CMBS Loan

(“Loan Portfolio” or “CMBS Loan”) of an imminent change in

circumstances which resulted in the master servicer issuing a

notice of default as well as a notice of acceleration and demand

for payment on April 19, 2024. AHIP is negotiating a transfer and

cooperation agreement with the special servicer, which is expected

to result in the consensual transfer of the collateralized hotels

by AHIP to the master servicer in the second quarter of 2024. This

Loan Portfolio is secured by four hotels: a Fairfield Inn &

Suites and a Hampton Inn located in White Marsh, MD, a Homewood

Suites located in Egg Harbor Township, NJ and a SpringHill Suites

located in Brookhaven, NY (collectively, the “Hotels” or “Assets”).

The principal amount of this non-recourse CMBS Loan as of March 31,

2024 was $51.0 million and AHIP is current on principal and

interest payments. AHIP expects to cease recognizing revenue and

expenses, relating to the Hotels, on the effective date of the

transfer and cooperation agreement. The CMBS Loan and Assets will

remain on AHIP’s balance sheet until the Hotels have been

transferred to or sold by the special servicer.

AMENDMENT OF THE MASTER HOTEL MANAGEMENT

AGREEMENT WITH REDUCED AND DEFERRED FEES

On September 30, 2023, with a retroactive

effective date of July 1, 2023, AHIP entered into a third amendment

to its master hotel management agreement with One Lodging

Management LLC (an affiliate of Aimbridge Hospitality LLC) (the

“Amendment”), with an estimated annual savings for the first three

years following the amendment of approximately $3.7 million.

In accordance with the Amendment, the management

fee on certain hotel properties has been reduced or deferred. The

reduction of management fees is estimated to provide approximately

$0.3 million of cash savings per annum, and the deferral of

management fees is estimated to provide approximately $3.4 million

of cash savings on average per annum from July 1, 2023 to June 30,

2026. The fees in the years 2027 through 2032 will be slightly

higher to offset the fee deferral in the first three years. The

cash savings in the first quarter of 2024 were $0.8 million, and

the cumulative savings since the effective date of the Amendment

were $3.0 million.

For further details, see a copy of the amendment

to the master hotel management agreement, which has been filed

under AHIP’s profile on SEDAR+ at www.sedarplus.com.

TEMPORARY SUSPENSION OF U.S. DOLLAR

DISTRIBUTION

From February 2022 to October 2023, AHIP’s

distribution policy provided for the payment of regular monthly

U.S. dollar distributions at an annual rate of $0.18 per unit

(monthly rate of $0.015 per unit). On November 7, 2023, AHIP

announced a temporary suspension of monthly distributions. The

Board and management made this decision based on the considerations

of recent and forecast operating results, industry and economic

conditions, interest rates for debt refinancing, the general

financing environment, and future compliance with the adjusted FFO

payout ratio covenant in the Sixth Amendment.

The amendment of the distribution policy reduces

cash payments by $14.2 million annually, which improves AHIP’s

balance sheet and liquidity, supporting the long-term enhancement

of unitholder value. The Board and management will continue to

review AHIP’s distribution policy on a quarterly basis.

FINANCIAL INFORMATION

This news release should be read in conjunction

with AHIP’s unaudited condensed consolidated interim financial

statements, and management’s discussion and analysis for the three

months ended March 31, 2024 and 2023, that are available on AHIP’s

website at www.ahipreit.com, and under AHIP’s profile on SEDAR+ at

www.sedarplus.com.

Q1 2024 CONFERENCE CALL

Management will host a webcast and conference

call at 8:00 a.m. Pacific time on Wednesday, May 8, 2024, to

discuss the financial and operational results for the three months

ended March 31, 2024 and 2023.

To participate in the conference call,

participants should register online via AHIP’s website. A dial-in

and unique PIN will be provided to join the call. Participants are

requested to register a minimum of 15 minutes before the start of

the call. An audio webcast of the conference call may be accessed

on AHIP’s website at www.ahipreit.com.

ABOUT AMERICAN HOTEL INCOME PROPERTIES REIT

LP

American Hotel Income Properties REIT LP (TSX:

HOT.UN, TSX: HOT.U, TSX: HOT.DB.V), or AHIP, is a limited

partnership formed to invest in hotel real estate properties across

the United States. AHIP’s portfolio of premium branded,

select-service hotels are located in secondary metropolitan markets

that benefit from diverse and stable demand. AHIP hotels operate

under brands affiliated with Marriott, Hilton, IHG and Choice

Hotels through license agreements. AHIP’s long-term objectives are

to build on its proven track record of successful investment,

deliver monthly U.S. dollar denominated distributions to

unitholders, and generate value through the continued growth of its

diversified hotel portfolio. More information is available at

www.ahipreit.com.

NON-IFRS AND OTHER FINANCIAL

MEASURES

Management believes the following non-IFRS

financial measures, non-IFRS ratios, capital management measures

and supplementary financial measures are relevant measures to

monitor and evaluate AHIP’s financial and operating performance.

These measures and ratios do not have any standardized meaning

prescribed by IFRS and are therefore unlikely to be comparable to

similar measures presented by other issuers. These measures and

ratios are included to provide investors and management additional

information and alternative methods for assessing AHIP’s financial

and operating results and should not be considered in isolation or

as a substitute for performance measures prepared in accordance

with IFRS.

NON-IFRS FINANCIAL

MEASURES:

FFO: FFO measures operating

performance and is calculated in accordance with Real Property

Association of Canada’s (“REALPAC”) definition. FFO – basic is

calculated by adjusting loss and comprehensive income (loss) for

depreciation and amortization, gain or loss on disposal of

property, IFRIC 21 property taxes, fair value gain or loss,

impairment of property, deferred income tax, and other applicable

items. FFO – diluted is calculated as FFO – basic plus the

interest, accretion, and amortization on convertible debentures if

convertible debentures are dilutive. The most comparable IFRS

measure to FFO is income (loss) and comprehensive income (loss),

for which a reconciliation is provided in this news release.

AFFO: AFFO is defined as a

recurring economic earnings measure and calculated in accordance

with REALPAC’s definition. AFFO – basic is calculated as FFO –

basic less maintenance capital expenditures. AFFO – diluted is

calculated as FFO – diluted less maintenance capital expenditures.

The most comparable IFRS measure to AFFO is income (loss) and

comprehensive income (loss), for which a reconciliation is provided

in this news release.

Normalized FFO: calculated as

FFO adjusting for non-recurring items. For the three months ended

March 31, 2024 and 2023, normalized FFO is calculated as FFO

excluding the non-recurring insurance proceeds of $1.1 million and

$3.3 million, respectively, for property damage claims related to

the weather-related damage at several hotel properties in late

December 2022. The most comparable IFRS measure to normalized FFO

is income (loss) and comprehensive income (loss), for which a

reconciliation is provided in this news release.

Normalized NOI: calculated as

NOI adjusting for non-recurring items. For the three months ended

March 31, 2024 and 2023, normalized NOI included the non-recurring

insurance proceeds of $0.1 million and $1.0 million, respectively,

for business interruption claims related to the weather-related

damage at several hotel properties in late December 2022. The most

comparable IFRS measure to normalized NOI is NOI, for which a

reconciliation is provided in this news release.

Hotel EBITDA: calculated by

adjusting NOI for management fees for hotel. The most comparable

IFRS measure to hotel EBITDA is NOI, for which a reconciliation is

provided in this news release.

EBITDA: calculated by adjusting

NOI for management fees for hotel and general administrative

expenses. The sum of management fees for hotel and general

administrative expenses is equal to corporate and administrative

expenses in the Financial Statements. The most comparable IFRS

measure to EBITDA is NOI, for which a reconciliation is provided in

this news release.

Debt: calculated as the sum of

term loans and revolving credit facility, the face value of

convertible debentures, unamortized portion of debt financing

costs, lease liabilities and unamortized portion of mark-to-market

adjustments. The most comparable IFRS measure to debt is total

liabilities, for which a reconciliation is provided in this news

release.

Gross book value: calculated as

the sum of total assets, accumulated depreciation and impairment on

property, buildings and equipment, and accumulated amortization on

intangible assets. The most comparable IFRS measure to gross book

value is total assets, for which a reconciliation is provided in

this news release.

Interest expense: calculated by

adjusting finance costs for gain/loss on debt settlement,

amortization of debt financing costs, accretion of debenture

liability, amortization of debenture costs, dividends on series B

preferred shares and amortization of mark-to-market adjustments,

accretion of management fee because interest expense excludes

certain non-cash accounting items and dividends on preferred

shares. The most comparable IFRS measure to interest expense is

finance costs, for which a reconciliation is provided in this news

release.

NON-IFRS RATIOS:

FFO per unit – basic/diluted:

calculated as FFO – basic/diluted divided by weighted average

number of units outstanding - basic/diluted respectively for the

reporting periods.

Normalized FFO per unit –

basic/diluted: calculated as normalized FFO –

basic/diluted divided by weighted average number of units

outstanding - basic/diluted respectively for the reporting

periods.

AFFO per unit – basic/diluted: calculated as

AFFO – basic/diluted divided by weighted average number of units

outstanding - basic/diluted respectively for the reporting

periods.

NOI margin: calculated as NOI

divided by total revenue.

Hotel EBITDA margin: calculated as hotel EBITDA

divided by total revenue.

EBITDA margin: calculated as

EBITDA divided by total revenue.

CAPITAL MANAGEMENT

MEASURES:

Debt to gross book value:

calculated as debt divided by gross book value. Debt to gross book

value is a primary measure of capital management and leverage.

Debt to EBITDA: calculated as

debt divided by the trailing twelve months of EBITDA. Debt to

EBITDA measures the amount of income generated and available to pay

down debt before covering interest, taxes, depreciation, and

amortization expenses.

Interest coverage ratio:

calculated as EBITDA divided by interest expense for the trailing

twelve months. The interest coverage ratio is a measure of AHIP’s

ability to service the interest requirements of its outstanding

debt.

SUPPLEMENTARY FINANCIAL

MEASURES:

Occupancy is a major driver of room revenue as

well as food and beverage revenues. Fluctuations in occupancy are

accompanied by fluctuations in most categories of variable hotel

operating expenses, including housekeeping and other labor costs.

ADR also helps to drive room revenue with limited impact on other

revenues. Fluctuations in ADR are accompanied by fluctuations in

limited categories of hotel operating expenses, such as franchise

fees and credit card commissions, since variable hotel operating

expenses, such as labor costs, generally do not increase or

decrease correspondingly. Thus, increases in RevPAR attributable to

increases in occupancy typically reduce EBITDA and EBITDA margins,

while increases in RevPAR attributable to increases in ADR

typically result in increases in EBITDA and EBITDA margins.

Occupancy: calculated as total

number of hotel rooms sold divided by total number of rooms

available for the reporting periods. Occupancy is a metric commonly

used in the hotel industry to measure the utilization of hotels’

available capacity.

Average daily rate (“ADR”):

calculated as total room revenue divided by total number of rooms

sold for the reporting periods. ADR is a metric commonly used in

the hotel industry to indicate the average revenue earned per

occupied room in a given time period.

Revenue per available room

(“RevPAR”): calculated as occupancy multiplied by ADR for

the reporting periods.

Same property occupancy, ADR, RevPAR,

revenue, expense, NOI and NOI margin: measured for

properties owned by AHIP for both the current reporting periods and

the same periods in 2023. In Q1 2023 and Q2 2023, the same property

ADR, occupancy, RevPAR and NOI margin calculations excluded three

hotel properties, which is comprised of one hotel in respect of

which AHIP is in a managed foreclosure process as of March 31,

2024, as well as the Residence Inn Neptune and Courtyard Wall in

New Jersey as these two hotels had limited availability due to

remediation and rebuilding after the weather-related damage in late

December 2022. In Q1 2024, the same property ADR, occupancy, RevPAR

and NOI margin calculations excluded the same three hotel

properties mentioned in the immediately preceding sentence for

comparison purposes. In Q3 2023 and Q4 2023, the same property ADR,

occupancy, RevPAR and NOI margin calculations excluded one hotel in

respect of which AHIP is in a managed foreclosure process as of

March 31, 2024.

NON-IFRS RECONCILIATION

The following table reconciles FFO to income (loss) and

comprehensive income (loss), the most comparable IFRS measure as

presented in the financial statements:

|

|

Three months ended March 31 |

|

(thousands of dollars, except per unit

amounts) |

2024 |

|

|

2023 |

|

|

|

|

|

| Loss and comprehensive

loss |

(8,109 |

) |

|

(1,600 |

) |

| Adjustments: |

|

|

| Income attributable to

non-controlling interest |

(1,099 |

) |

|

(1,000 |

) |

| Depreciation and

amortization |

8,729 |

|

|

8,621 |

|

| Write-off of property,

building and equipment |

- |

|

|

3,892 |

|

| Gain on sale of

properties |

(242 |

) |

|

- |

|

| IFRIC 21 property taxes

adjustment |

892 |

|

|

699 |

|

| Change in fair value of

interest rate swap contracts |

- |

|

|

1,091 |

|

| Change in fair value of

warrants |

(120 |

) |

|

(1,570 |

) |

| Impairment of cash-generating

units |

4,103 |

|

|

- |

|

|

Deferred income tax recovery |

(1,820 |

) |

|

(1,425 |

) |

|

|

|

|

| FFO basic (1) |

2,334 |

|

|

8,708 |

|

| Interest, accretion and

amortization on convertible debentures |

- |

|

|

1,093 |

|

|

|

|

|

| FFO

diluted (1) |

2,334 |

|

|

9,801 |

|

| |

|

|

| FFO per unit – basic (1) |

0.03 |

|

|

0.11 |

|

| FFO per unit – diluted

(1) |

0.03 |

|

|

0.11 |

|

|

|

|

|

| Non-recurring

items: |

|

|

| Other

income |

(1,102 |

) |

|

(3,342 |

) |

|

|

|

|

| Measurements excluding

non-recurring items: |

|

|

|

Normalized FFO diluted (1) |

1,232 |

|

|

6,459 |

|

|

Normalized FFO per unit – diluted (1) |

0.02 |

|

|

0.07 |

|

|

|

|

|

| Weighted average number of

units outstanding: |

|

|

| Basic (000’s) |

79,045 |

|

|

78,800 |

|

| Diluted

(000’s) (2) |

79,930 |

|

|

89,466 |

|

|

(1) |

See “Non-IFRS and Other Financial Measures”. |

| (2) |

The calculation of FFO diluted,

FFO per unit – diluted, normalized FFO diluted, normalized FFO per

unit – diluted, weighted average number of units outstanding -

diluted for the three months ended March 31, 2024, excluded the

convertible debentures because they were anti-dilutive. The

calculation of FFO diluted, FFO per unit – diluted, normalized FFO

diluted, normalized FFO per unit – diluted, weighted average number

of units outstanding - diluted for the three ended March 31, 2023,

included the convertible debentures because they were

dilutive. |

RECONCILIATION OF FFO TO

AFFO

|

|

Three months ended March 31 |

|

(thousands of dollars, except per Unit

amounts) |

2024 |

|

|

2023 |

|

|

|

|

|

| FFO basic (1) |

2,334 |

|

|

8,708 |

|

| FFO diluted (1) |

2,334 |

|

|

9,801 |

|

|

Maintenance capital expenditures |

(3,002 |

) |

|

(2,720 |

) |

|

|

|

|

| AFFO basic (1) |

(668 |

) |

|

5,988 |

|

| AFFO diluted (1) |

(668 |

) |

|

7,081 |

|

| AFFO per unit - basic (1) |

(0.01 |

) |

|

0.08 |

|

| AFFO

per unit - diluted (1) |

(0.01 |

) |

|

0.08 |

|

|

|

|

|

| Measurements excluding

non-recurring items: |

|

|

| AFFO diluted (1) |

(1,770 |

) |

|

3,739 |

|

| AFFO

per unit - diluted (1) |

(0.02 |

) |

|

0.04 |

|

|

(1) |

See “Non-IFRS and Other Financial Measures” |

DEBT TO GROSS BOOK VALUE

|

|

|

|

|

|

(thousands of dollars) |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

Debt |

|

675,014 |

|

|

688,585 |

|

| Gross

Book Value |

|

1,292,654 |

|

|

1,326,070 |

|

|

Debt-to-Gross Book Value |

|

52.2 |

% |

|

51.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

(thousands of dollars) |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

| Term loans and revolving

credit facility |

|

620,074 |

|

|

633,298 |

|

| 2026 Debentures (at face

value) |

|

50,000 |

|

|

50,000 |

|

| Unamortized portion of debt

financing costs |

|

3,764 |

|

|

4,065 |

|

| Lease liabilities |

|

1,188 |

|

|

1,239 |

|

|

Unamortized portion of mark-to-market adjustments |

|

(12 |

) |

|

(17 |

) |

|

Debt |

|

675,014 |

|

|

688,585 |

|

|

|

|

|

|

|

|

|

|

|

|

(thousands of dollars) |

|

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

| Total Assets |

|

929,771 |

|

|

954,887 |

|

| Accumulated depreciation and

impairment |

|

357,465 |

|

|

365,970 |

|

|

on property, buildings and equipment |

|

|

|

|

Accumulated amortization on intangible assets |

|

5,418 |

|

|

5,213 |

|

|

Gross Book Value |

|

1,292,654 |

|

|

1,326,070 |

|

|

|

|

|

|

DEBT TO EBITDA

|

|

|

|

|

|

|

|

(thousands of dollars) |

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

| Debt |

675,014 |

|

|

688,585 |

|

| EBITDA

(trailing twelve months) |

64,008 |

|

|

64,732 |

|

|

Debt-to-EBITDA (times) |

10.5x |

|

|

10.6x |

|

INTEREST COVERAGE RATIO

|

|

|

|

|

|

|

|

(thousands of dollars) |

March 31, 2024 |

|

|

December 31, 2023 |

|

|

|

|

|

|

|

|

| EBITDA (trailing twelve

months) |

64,008 |

|

|

64,732 |

|

|

Interest Expense (trailing twelve months) |

35,774 |

|

|

33,725 |

|

|

Interest Coverage Ratio (times) |

1.8x |

|

|

1.9x |

|

The reconciliation of NOI to hotel EBITDA and

EBITDA is shown below:

|

|

|

|

|

|

Three months ended March 31 |

|

(thousands of dollars) |

2024 |

|

|

2023 |

|

|

|

|

|

| NOI |

17,190 |

|

|

18,738 |

|

|

Management fees |

(1,517 |

) |

|

(2,136 |

) |

|

Hotel EBITDA |

15,673 |

|

|

16,602 |

|

| |

|

|

| General

administrative expenses |

(2,353 |

) |

|

(2,558 |

) |

|

EBITDA |

13,320 |

|

|

14,044 |

|

The reconciliation of NOI to normalized NOI is

shown below:

|

|

Three months ended March 31 |

|

|

(thousands of dollars) |

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

| NOI |

17,190 |

|

|

18,738 |

|

|

Business interruption insurance proceeds |

92 |

|

|

1,000 |

|

|

Normalized NOI |

17,282 |

|

|

19,738 |

|

The reconciliation of finance costs to interest

expense is shown below:

|

|

Three months ended March 31 |

|

(thousands of dollars) |

2024 |

|

|

2023 |

|

|

|

|

|

| Finance costs |

11,048 |

|

|

8,692 |

|

| Loss on debt settlement |

(11 |

) |

|

- |

|

| Amortization of debt financing

costs |

(665 |

) |

|

(355 |

) |

| Accretion of Debenture

liability |

(263 |

) |

|

(242 |

) |

| Amortization of Debenture

costs |

(113 |

) |

|

(100 |

) |

| Dividends on Series B

preferred shares |

- |

|

|

(21 |

) |

|

Interest Expense |

9,996 |

|

|

7,974 |

|

For information on the most directly comparable

IFRS measures, composition of the measures, a description of how

AHIP uses these measures, and an explanation of how these measures

provide useful information to investors, please refer to AHIP’s

management discussion and analysis for the three months ended March

31, 2024 and 2023, available on AHIP’s website at www.ahipreit.com,

and under AHIP’s profile on SEDAR+ at www.sedarplus.com.

FORWARD-LOOKING INFORMATION

Certain statements in this news release may

constitute “forward-looking information” and “financial outlook”

within the meaning of applicable securities laws. Forward-looking

information and financial outlook generally can be identified by

words such as “anticipate”, “believe”, “continue”, “expect”,

“estimates”, “intend”, “may”, “outlook”, “objective”, “plans”,

“should”, “will” and similar expressions suggesting future outcomes

or events. Forward-looking information and financial outlook

include, but are not limited to, statements made or implied

relating to the objectives of AHIP, AHIP’s strategies to achieve

those objectives and AHIP’s beliefs, plans, estimates, projections

and intentions and similar statements concerning anticipated future

events, results, circumstances, performance, or expectations that

are not historical facts. Forward-looking information and financial

outlook in this news release includes, but is not limited to,

statements with respect to: AHIP management’s expectation as to the

impacts on AHIP’s business of the seasonal nature of the lodging

industry, inflation (including on labor and materials costs),

competition, overall economic cycles, weather conditions; AHIP’s

expectations with respect to the timing and amount of insurance

proceeds for weather related damage and lost income in respect of

four properties; AHIP’s leverage and liquidity strategies and

goals; AHIP’s expectations with respect to the performance of its

hotel portfolio, including specific segments thereof; AHIP’s

expectations with respect to inflation, labor supply, labor costs,

interest rates, consumer spending, new hotel construction and other

market financial and macroeconomic conditions in 2024 and beyond

and the expected impacts thereof on AHIP’s financial position and

performance, including on ADR, occupancy, RevPAR, NOI, NOI margins

and cash flows; AHIP’s strategic initiatives and the intended

outcomes thereof, including improved liquidity, addressing

near-term debt maturities and providing AHIP with financial

stability and protecting long-term value for unitholders; AHIP’s

expectations with respect to the macroeconomic and operating

environment, including certain specific expectations for the 2024

fiscal year; AHIP continuing to execute its strategy to divest

assets and reduce debt; AHIP’s planned property dispositions,

including the expected terms and timing thereof and the financial

impact thereof on AHIP and AHIP’s expectation that the sale of such

properties will demonstrate value above the current unit trading

price; AHIP’s expectation that it will enter into a cooperation and

transfer agreement with the special servicer for the AHIP Northeast

Portfolio III CMBS Loan and will transfer the Hotels secured

thereby to the special loan servicer in Q2 2024, and the expected

impact thereof on AHIP’s financial position;; AHIP’s intended

strategies for near-term debt maturities, including planned sales

of assets and loan refinancing; the possibility that AHIP may

utilize non-recourse foreclosure processes where loan value at

maturity is greater than the ability to refinance the loan and

market value of the hotel; AHIP’s expectations as to the financial

impact of the expired of interest rate swaps for certain term

loans, which will be dependent on SOFR; the estimated savings as a

result of reductions and deferrals of management fees under the

master hotel management agreement as well as increased fees in

certain future years when deferred fees become payable; the

estimated savings from the temporary suspension of cash

distributions and expectation that such amendment to the

distribution policy will strengthen AHIP’s balance sheet and

liquidity and support long-term enhancement of unitholder value;

the statement that the Board and management will continue to review

AHIP’s distribution policy on a quarterly basis; and AHIP’s stated

long-term objectives.

Although the forward-looking information and

financial outlook contained in this news release are based on what

AHIP’s management believes to be reasonable assumptions, AHIP

cannot assure investors that actual results will be consistent with

such information. Forward-looking information is based on a number

of key expectations and assumptions made by AHIP, including,

without limitation: inflation, labor shortages, and supply chain

disruptions will negatively impact the U.S. economy, U.S. hotel

industry and AHIP’s business; AHIP will continue to have sufficient

funds to meet its financial obligations; AHIP will be able generate

sufficient funds to meet any paydown obligations under the new LTV

covenants set forth in the Sixth Amendment; AHIP’s strategies with

respect to completion of capital projects, liquidity, addressing

near-term debt maturities, divestiture of non-core assets and

acquisitions will be successful and achieve their intended effects;

estimated savings from the amendment to the master hotel management

agreement are based on assumptions about future hotel revenues and

certain expenses; capital projects will be completed on time and on

budget; AHIP will complete its currently planned divestitures and

loan refinancings on the terms currently contemplated and in

accordance with the timing currently contemplated; AHIP will enter

into a cooperation and transfer agreement with the special servicer

for the AHIP Northeast Portfolio III CMBS Loan and will transfer

the Hotels secured thereby to the special loan servicer in Q2 2024,

and impact thereof on AHIP’s financial position will be consistent

with management’s expectations, and such transactions will be

completed on a non-recourse basis; AHIP will receive insurance

proceeds in an amount consistent with AHIP’s estimates in respect

of its weather-damaged properties; AHIP will continue to have good

relationships with its hotel brand partners; capital markets will

provide AHIP with readily available access to equity and/or debt

financing on terms acceptable to AHIP, including the ability to

refinance maturing debt as it becomes due on terms acceptable to

AHIP; AHIP’s future level of indebtedness and its future growth

potential will remain consistent with AHIP’s current expectations;

the useful lives and replacement cost of AHIP’s assets being

consistent with management’s estimates thereof; AHIP will be able

to successfully integrate properties acquired into its portfolio,

if any; the U.S. REIT will continue to qualify as a real estate

investment trust for U.S. federal income tax purposes; the impact

of the current economic climate and the current global financial

conditions on AHIP’s operations, including AHIP’s financing

capability and asset value, will remain consistent with AHIP’s

current expectations; there will be no material changes to tax

laws, government and environmental regulations adversely affecting

AHIP’s operations, financing capability, structure or

distributions; conditions in the international and, in particular,

the U.S. hotel and lodging industry, including competition for

acquisitions, will be consistent with the current economic climate;

and AHIP will achieve its long term objectives.

Forward-looking information and financial

outlook involve significant risks and uncertainties and should not

be read as guarantees of future performance or results as actual

results may differ materially from those expressed or implied in

such forward-looking information and financial outlook, accordingly

undue reliance should not be placed on such forward-looking

information or financial outlook. Those risks and uncertainties

include, among other things, risks related to: AHIP may not achieve

its expected performance levels in 2024 and beyond; inflation,

labor shortages, supply chain disruptions; AHIP’s insurance claims

with respect to its weather damaged properties may be denied in

whole or in part; AHIP’s brand partners may impose revised service

standards and capital requirements which are adverse to AHIP; PIP

renovations may not commence or complete in accordance with

currently expected timing and may suffer from increased material

costs; AHIP’s strategic initiatives with respect to liquidity,

addressing near-term debt maturities and providing AHIP with

financial stability may not be successful and may not achieve their

intended outcomes; AHIP’s strategies for divesting assets to reduce

debt may not be successful; AHIP may not complete its currently

planned divestures and loan refinancings on the terms currently

contemplated or in accordance with the timing currently

contemplated, or at all; AHIP’s planned dispositions, once

completed, may not demonstrate value above the current unit trading

price; savings from the amendments to the master hotel management

agreement may be less than expected; AHIP may not be successful in

reducing its leverage; there is no guarantee that monthly

distributions will be reinstated, and if reinstated, as to the

timing thereof or what the amount of the monthly distribution will

be; the suspension of monthly distributions is expected to

negatively impact the market price of AHIP’s Units and debentures;

AHIP may not be able to refinance debt obligations as they become

due or may do so on terms less favorable to AHIP than under AHIP’s

existing loan agreements; AHIP has not replaced its interest rate

swaps, which is expected to create continued increased interest

expense; AHIP may not enter into a cooperation and transfer

agreement with the special servicer for the AHIP Northeast

Portfolio III CMBS Loan on the terms currently contemplated or in

accordance with the timing currently contemplated, or at all, and

the financial impact of such transactions, if completed, may not be

consistent with management’s expectations, and such transactions

may not be able to be completed on a non-recourse basis; the actual

financial impact on AHIP of entering into an agreement with the

special servicer for the Loan Portfolio to transfer control of such

portfolio to a receiver, including on AHIP’s financial position,

cashflows, NOI and capital expenditure obligations, and anticipated

timing of the completion of the underlying transactions may not be

consistent with management’s expectations and such transactions may

not complete in accordance with the expected timing; general

economic conditions and consumer confidence; the growth in the U.S.

hotel and lodging industry; prices for the Units and debentures;

liquidity; tax risks; ability to access debt and capital markets;

financing risks; changes in interest rates; the financial condition

of, and AHIP’s relationships with, its external hotel manager and

franchisors; real property risks, including environmental risks;

the degree and nature of competition; ability to acquire accretive

hotel investments; ability to integrate new hotels; environmental

matters; and changes in legislation. Additional information about

risks and uncertainties is contained in this new release and in

AHIP’s most recently filed AIF, a copy of which is available on

SEDAR+ at www.sedarplus.com.

To the extent any forward-looking information

constitutes a “financial outlook” within the meaning of applicable

securities laws, such information is being provided to investors to

assist in their understanding of: expected proceeds of insurance in

respect of AHIP’s weather-damaged properties; estimated potential

cash savings from the amendment to the master hotel management

agreement and temporary suspension of distributions; the estimated

financial impact on AHIP of increased insurance premiums; the

estimated financial impact on AHIP of increased interest costs

associated with the expiry of interest swaps for certain term loans

and the refinancing of certain loans; and management’s expectations

for certain aspects of AHIP’s financial performance for the

remainder of 2024.

The forward-looking information and financial

outlook contained herein is expressly qualified in its entirety by

this cautionary statement. Forward-looking information and

financial outlook reflect management's current beliefs and are

based on information currently available to AHIP. The

forward-looking information and financial outlook are made as of

the date of this news release and AHIP assumes no obligation to

update or revise such information to reflect new events or

circumstances, except as may be required by applicable law.

For additional information, please

contact:

Investor Relationsir@ahipreit.com

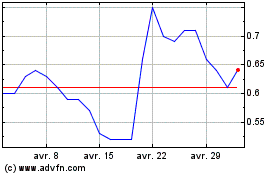

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

American Hotel Income Pr... (TSX:HOT.UN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024