High Arctic Energy Services Inc. (TSX: HWO) (the “Corporation” or

“High Arctic”) has released its’ third quarter financial and

operating results. The unaudited consolidated financial statements

and management discussion & analysis (“MD&A”) for the three

and nine months ended September 30, 2024 will be available on

SEDAR+ at www.sedarplus.ca, and on High Arctic’s website at

www.haes.ca. All amounts are denominated in Canadian dollars

(“CAD”), unless otherwise indicated.

Mike Maguire, Interim Chief Executive Officer

commented on the Corporation’s third quarter 2024 financial and

operating results:

“I am very pleased

that we completed the strategic re-organization of the Corporation

in the third quarter, returning a sizeable amount of capital to our

shareholders and spinning out the PNG Business to shareholders via

High Arctic Overseas Holdings Corp. listed on the TSX Venture

Exchange.

The acquisition and

integration of Delta Rental Services has delivered positive

adjusted EBITDA and cash generation. We have commenced cost

rationalization, particularly focussed on general and

administrative costs along with overhead cost reduction

initiatives. Combined with our equity investment in Team

Snubbing and owned real estate, High Arctic is positioned as an

attractive vehicle for future growth and

transactions.”

2024 THIRD QUARTER

HIGHLIGHTS

- Completed the re-organization of

High Arctic including the return of $37.8 million to shareholders

and the spin-out of the PNG Business as High Arctic Overseas

Holdings Corp., independently listed on the TSX Venture

Exchange.

- Increased revenue from operations

from $2.3 million to $8.0 million year to date on a comparative

basis as a result of the Delta Acquisition.

- Exited Q3 2024 with net positive

working capital of $4.9 million and access to $4.1 million of cash

at bank.

- Reconciled and took action to

reduce general and administrative costs, including a sizeable

reduction in board cost and director compensation.

- Progressed post-reorganization

transitional arrangements towards establishing dedicated

stand-alone leadership of the Corporation.

2024 THIRD QUARTER RESULTS

- Increased revenue from continuing

operations by $1,491 or 147% in the quarter when compared to

revenue of $1,015 from Q3 2023 as a result of the impact of the

Delta Acquisition on the 2024 results.

- Generated net income from

continuing operations of $125 in the quarter as compared to $498 in

Q3 2023. The decrease is primarily due to the 2023 $615 gain on

sale of the nitrogen business, $373 lower interest income with the

return of capital to shareholders, and $403 lower equity investment

income from Team Snubbing in the quarter.

- Achieved positive Adjusted EBITDA

from continuing operations of $383 in the quarter versus negative

Adjusted EBITDA for Q3 2023 of $700.

- Production Service’s 42% equity

investment share of Team Snubbing Services Inc. (“Team Snubbing”)

net income returned to positive earnings of $105 in the quarter

compared to a loss of $889 in Q2 2024 and earnings of $508 in the

comparative third quarter of 2023.

2024 YEAR TO DATE RESULTS

- Similar to the discrete quarter

results, High Arctic’s revenue from continuing operations increased

242% to $8,027 compared to revenue of $2,347 achieved in the first

nine months of 2023 as a result of the Delta Acquisition on 2024

results.

- Generated a net loss from

continuing operations of $1,402 in the quarter as compared to

$1,208 in Q3 2023. The higher loss, despite an improvement of

$1,323 in operating income, is primarily due to the 2023 $615 gain

on sale of the nitrogen business, $262 lower interest income with

the July 2024 return of capital to shareholders, and $745 lower

equity investment income from Team Snubbing in the year-to-date

period.

- Achieved strong oilfield services

operating margins from continuing operations of 50.6% for the nine

months in 2024.

- Production Service’s 42% equity

investment share of Team Snubbing Services Inc. net loss was $294

for the nine months ended September 30, 2024 as compared to

positive net income of $451 in the comparative period in 2023.

Regional expansion into Alaska has weighed on earnings during the

past twelve months.

- Cash from operating activities from

continuing operations was $487 in the quarter and a use of $42 for

the nine months ended September 30, 2024, an improvement for the

quarter as compared to the respective prior year comparatives of

$172 and $359.

- Significantly lowered the use of

funds flow from operations from continuing operating activities as

the nine months of 2024 generated a use of funds of $46 compared to

a use of funds of $957 for the nine months of 2023 driven by strong

operational performance from the Delta Acquisition partially offset

by the significant additional G&A expenses incurred in 2024 due

to the corporate reorganization initiatives.

In the above results discussion, the three

months ended September 30, 2024 may be referred to as the “quarter”

or “Q3 2024” and the comparative three months ended September 30,

2023 may be referred to as “Q3 2023”. References to other quarters

may be presented as “QX 20XX” with X/XX being the quarter/year to

which the commentary relates. Additionally, the nine months ended

September 30, 2024 may be referred to as “YTD” or “YTD 2024”.

References to other nine-month periods ended September 30 may be

presented as “YTD 20XX” with XX being the year to which the

nine-month period ended September 30 commentary relates. All

amounts are expressed as thousands of Canadian dollars.

RESULTS OVERVIEW

The following is a summary of select financial

information of the Corporation:

|

|

Three months endedSeptember 30 |

|

Nine months endedSeptember 30 |

|

|

(thousands of Canadian Dollars, except per share amounts) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Operating results from continuing operations: |

|

|

|

|

|

Revenue – continuing operations |

2,506 |

|

1,015 |

|

8,027 |

|

2,347 |

|

|

Net income (loss) - continuing operations |

125 |

|

498 |

|

(1,402 |

) |

(1,208 |

) |

|

Per share (basic & diluted) (1) |

0.01 |

|

0.04 |

|

(0.11 |

) |

(0.10 |

) |

|

Oilfield services operating margin - continuing operations (2) |

1,335 |

|

634 |

|

4,064 |

|

1,394 |

|

|

Oilfield services operating margin as a % of revenue (2) |

53.30% |

|

62.50% |

|

50.60% |

|

59.40% |

|

|

EBITDA - continuing operations (2) |

528 |

|

362 |

|

(705 |

) |

(1,393 |

) |

|

Adjusted EBITDA - continuing operations (2) |

383 |

|

(700 |

) |

662 |

|

(2,031 |

) |

|

Operating income (loss) - continuing operations (2) |

1 |

|

(1,317 |

) |

(2,432 |

) |

(3,755 |

) |

|

Cash flow from continuing operations: |

|

|

|

|

|

Cash flow from (used in) continuing operating activities |

487 |

|

172 |

|

(42 |

) |

359 |

|

|

Per share (basic & diluted) (1) |

0.04 |

|

0.01 |

|

0 |

|

0.03 |

|

|

Funds flow from (used in) continuing operating activities (2) |

640 |

|

(331 |

) |

(46 |

) |

(957 |

) |

|

Per share (basic & diluted) (1) |

0.05 |

|

(0.03 |

) |

0.00 |

|

(0.08 |

) |

|

2024 Return of capital/2023 dividends (3) |

37,842 |

|

730 |

|

37,842 |

|

2,190 |

|

|

Capital expenditures |

630 |

|

80 |

|

1,445 |

|

505 |

|

|

|

|

|

|

|

As at |

|

(thousands of Canadian Dollars, except per share amounts and common

shares outstanding) |

|

|

|

|

Sept 30,2024 |

|

Dec 31,2023 |

|

|

Financial position: |

|

|

|

|

|

|

|

|

Working capital (2) |

|

|

|

|

4,933 |

|

62,985 |

|

|

Cash and cash equivalents |

|

|

|

|

4,106 |

|

50,331 |

|

|

Total assets |

|

|

|

|

32,977 |

|

123,137 |

|

|

Long-term debt (non-current) |

|

|

|

|

3,222 |

|

3,352 |

|

|

Shareholders’ equity |

|

|

|

|

23,083 |

|

99,332 |

|

|

Per share (basic) (1) |

|

|

|

|

1.87 |

|

8.16 |

|

|

Per share (fully diluted) (1) |

|

|

|

|

1.85 |

|

7.81 |

|

|

Common shares outstanding (4) |

|

|

|

|

12,448,166 |

|

12,280,568 |

|

|

(1) |

The number of common shares used in calculating net loss per share,

cash flow from (used in) operating activities, funds flow from

operating activities per share, dividend payments per share, and

shareholders’ equity per share is determined as explained in Note

13 of the Financial Statements (continuing operations). |

| (2) |

Readers are cautioned that Oilfield services operating margin,

EBITDA (Earnings before interest, tax, depreciation, and

amortization), Adjusted EBITDA, Operating income (loss), Funds flow

from operating activities and Working capital do not have

standardized meanings prescribed by IFRS – see the “Non IFRS

Measures” section in this MD&A for calculations of these

measures. |

| (3) |

2023 figures are cash dividends declared. |

| (4) |

Pursuant to the de facto four-to-one consolidation of the

Corporation’s outstanding common shares effective August 12, 2024,

the number of common shares outstanding and all per-share amounts

have been retroactively adjusted to effect the stock

consolidation. |

| |

|

Operating Results

Rental Services segment (previously

“Ancillary Services”)

|

|

Three months endedSept 30 |

|

Nine months endedSept 30 |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Revenue |

2,506 |

|

1,015 |

|

8,027 |

|

2,347 |

|

|

Oilfield services expense |

(1,171 |

) |

(381 |

) |

(3,963 |

) |

(953 |

) |

|

Oilfield services operating margin(1) |

1,335 |

|

634 |

|

4,064 |

|

1,394 |

|

|

Operating margin (%) |

53.3% |

|

62.5% |

|

50.6% |

|

59.4% |

|

|

(1) |

See “Non-IFRS Measures” |

| |

|

The Rental Services segment consists of High

Arctic’s oilfield rental equipment in Canada centred upon pressure

control equipment and equipment supporting the high-pressure

stimulation of oil and gas wells in the WCSB.

The significant increase in revenue for the

three- and nine-month periods ended September 30, 2024 versus the

comparable periods in 2023 is a direct result of the contribution

from the Delta business that was acquired in late 2023.

Specifically, revenues increased $1,491 or 147% in the quarter when

compared to Q3 2023 and increased $5,680 or 242% when compared to

year-to-date revenues from 2023. Operating margins of 53.3% and

50.6% for the three and nine months ended September 30, 2024,

respectively, are approximately nine percent lower to the

comparable periods in 2023 due to the impact of the Delta

Acquisition as Delta utilizes some third-party rental equipment in

its operations, increasing operating expenses.

Production Services segment The

Production Services segment operations consist of High Arctic’s

idled snubbing units in Colorado, U.S., and its equity investments

in the Seh’ Chene Partnership and Team Snubbing in Canada. Though

the Seh’ Chene Partnership has experienced limited business

activity since the 2022 Canadian sales transactions, the

partnership is still active and the Corporation together with its

partner look to reposition its customer offerings and explore other

avenues for business activity.

Liquidity and capital resources Liquidity

and capital resources

|

|

Three months endedSept 30 |

|

Nine months endedSept 30 |

|

|

(thousands of Canadian Dollars) |

2024 |

|

2023 |

|

2024 |

|

2023 |

|

|

Cash provided by (used in) continued operations: |

|

|

|

|

|

Operating activities |

487 |

|

172 |

|

(42 |

) |

359 |

|

|

Investing activities |

(461 |

) |

1,155 |

|

(1,276 |

) |

28,798 |

|

|

Financing activities |

(37,382 |

) |

(1,336 |

) |

(37,640 |

) |

(3,012 |

) |

|

Effect of exchange rate changes on cash |

67 |

|

142 |

|

1,186 |

|

25 |

|

|

Increase (decrease) in cash from continuing operations |

(37,289 |

) |

133 |

|

(37,772 |

) |

26,170 |

|

|

(thousands of Canadian Dollars, unless otherwise noted) |

|

|

As at Sept 30, 2024 (2) |

|

As at Dec 31, 2023 |

|

|

Current assets |

|

|

8,375 |

|

79,438 |

|

|

Working capital(1) |

|

|

4,933 |

|

62,985 |

|

|

Working capital ratio(1) |

|

|

2.4:1 |

|

4.8:1 |

|

|

Cash and cash equivalents |

|

|

4,106 |

|

50,331 |

|

|

Net cash(1) |

|

|

709 |

|

46,804 |

|

|

(1) |

See “Non-IFRS Measures” |

| (2) |

Continuing operations |

| |

|

Operating Activities In Q3

2024, cash from operating activities from continuing operations was

$487, as compared with $172 from operating activities from

continuing operations in Q3 2023. Funds flow from operating

activities from continuing operations totaled $640 in the quarter,

versus funds used of $331 for Q3 2023 (see “Non-IFRS Measures”). In

Q3 2024, changes in non-cash operating working capital from

continuing operations totaled an outflow of $153 versus an inflow

of $503 in Q3 2023.

For the nine months ended September 30, 2024,

cash used in operating activities from continuing operations was

$42, as compared with $359 of cash flow from operating activities

from continuing operations in 2023. Funds used in operating

activities from continuing operations totaled $46 for the nine

months ended September 30, 2024, versus a use of funds of $957 for

the same period in 2023. Over the nine months ended September 30,

2024, changes in non-cash operating working capital from continuing

operations totaled an inflow of $4 versus $1,316 for the comparable

period in 2023.

The general increase in cash from operating

activities from continuing operations for both the three and nine

months ended September 30, 2024, when compared to the same periods

in 2024, was largely the result of the positive impact on the

business from the Delta Acquisition, partially offset by higher

G&A costs related to the Corporation’s reorganization that was

completed in the quarter.

Investing Activities During the

quarter, the Corporation’s cash spent on investing activities from

continuing operations totaled $461, compared to $1,155 generated

from investing activities for the same period the year prior mainly

due to proceeds from asset sales of $1,350 in 2023. In addition to

sustaining and growth capital spending related to its rental

business, the Corporation’s Q3 2024 investing activity also

included spending on new information systems and information

technology infrastructure necessary to support the Canadian

business going forward after the completion of the Arrangement.

Year-to-date spending through September 30, 2024 totaled $1,445 on

these same projects.

Financing Activities During the

quarter, the Corporation’s cash used in financing activities from

continuing operations was an elevated $37,382, primarily a result

of the $37,842 return of capital distribution High Arctic paid to

its shareholders in the quarter. In addition, Team Snubbing began

making its scheduled repayments in the quarter on the note

receivable amounts owed to High Arctic. These payments totaled $589

in the quarter (Q3 2023 - nil). The Corporation also paid $43 (Q3

2023: $544) towards principal payments on its mortgage financing

(see “Long-term debt” below) and $86 in lease liability payments

(Q3 2023: $62).

For the nine months ended 2024, the

Corporation’s cash used in financing activities from continuing

operations was also an elevated amount totaling $37,640. The

reasons for the elevated amount of cash used in financing

activities from continuing operations are the same as above with

additional mortgage and lease payments for nine months increasing

the total amount of cash used.

Long-term debt

|

(thousands of Canadian Dollars) |

|

|

As at Sept 30, 2024 |

|

As at Dec 31, 2023 |

|

|

Current |

|

|

175 |

|

175 |

|

|

Non-current |

|

|

3,222 |

|

3,352 |

|

|

Total |

|

|

3,397 |

|

3,527 |

|

The Corporation has mortgage financing secured

by lands and buildings owned by High Arctic located within Alberta,

Canada. The mortgage has a remaining initial term of under three

years with a fixed interest rate of 4.30% with payments occurring

monthly. The Corporation’s mortgage financing contains certain

non-financial covenants requiring lenders’ consent including

changes to the underlying business. At September 30, 2024, the

Corporation was compliant with all covenants associated with the

mortgage financing.

OutlookWith the spinoff of the

PNG business complete, the resultant High Arctic operations now

consist of a high-margin equipment rental business centered upon

pressure control and well stimulation, a minority interest in

Canada’s largest oilfield snubbing services business, Team Snubbing

and industrial properties at Clairmont and Whitecourt in Alberta.

With the current equipment rental business generating steady funds

flow from operations combined with the Corporation’s working

capital position, High Arctic is positioned to begin executing on

an exciting new chapter in its corporate history.

The 2024 transformational developments returned

capital to shareholders and enabled a reset of the Corporation’s

strategic direction. High Arctic looks to grow its Canadian

business and position itself to benefit from positive industry

developments. These developments are principally underpinned by

upstream activity dynamics to meet, and then sustain, growing oil

and natural gas export capacity. This capacity expansion is evident

in the commercial start-up of the TransMountain oil pipeline

expansion during 2024 and the widely-anticipated LNG expansion in

2025 through tidewater access.

The Corporation has begun executing on its

strategic business plan as it has recently made selective

investments in its rental business and has started the process of

identifying new leadership and potential acquisition candidates for

High Arctic.

NON-IFRS MEASURESThis press

release contains references to certain financial measures that do

not have a standardized meaning prescribed by International

Financial Reporting Standards (“IFRS”) and may not be comparable to

the same or similar measures used by other companies. High Arctic

uses these financial measures to assess performance and believes

these measures provide useful supplemental information to

shareholders and investors. These financial measures are computed

on a consistent basis for each reporting period and include

Oilfield services operating margin, EBITDA (Earnings before

interest, tax, depreciation and amortization), Adjusted EBITDA,

Operating loss, Funds flow from operating activities, Working

capital and Net cash. These do not have standardized meanings.

These financial measures should not be

considered as an alternative to, or more meaningful than, net

income (loss), cash from operating activities, current assets or

current liabilities, cash and/or other measures of financial

performance as determined in accordance with IFRS.

For additional information regarding non-IFRS

measures, including their use to management and investors and

reconciliations to measures recognized by IFRS, please refer to the

Corporation’s MD&A, which is available online at

www.sedarplus.ca and through High Arctic’s website at

www.haes.ca.

FORWARD-LOOKING STATEMENTSThis

press release contains forward-looking statements. When used in

this document, the words “may”, “would”, “could”, “will”, “intend”,

“plan”, “anticipate”, “believe”, “seek”, “propose”, “estimate”,

“expect”, and similar expressions are intended to identify

forward-looking statements. Such statements reflect the

Corporation’s current views with respect to future events and are

subject to certain risks, uncertainties, and assumptions. Many

factors could cause the Corporation’s actual results, performance,

or achievements to vary from those described in this press

release.

Should one or more of these risks or

uncertainties materialize, or should assumptions underlying

forward-looking statements prove incorrect, actual results may vary

materially from those described in this press release as intended,

planned, anticipated, believed, estimated or expected. Specific

forward-looking statements in this press release include, among

others, statements pertaining to: general economic and business

conditions which will include, among other things, the outlook for

energy services; right sizing of the general and administrative

infrastructure; the performance of the Corporation’s investment in

Team Snubbing, and whether Team Snubbing can realize high

utilization in its Canadian operations and for its snubbing

packages in Alaska in 2024; demand for the Corporation’s Canadian

rental equipment in 2024, scaling the Canadian business, executing

on one or more corporate transactions; and estimated credit

risks.

With respect to forward-looking statements

contained in this press release, the Corporation has made

assumptions regarding, among other things, its ability to: maintain

its ongoing relationship with major customers; successfully market

its services to current and new customers; devise methods for, and

achieve its primary objectives; source and obtain equipment from

suppliers; successfully manage, operate, and thrive in an

environment which is facing much uncertainty; remain competitive in

all its operations; attract and retain skilled employees; obtain

equity and debt financing on satisfactory terms and manage its

liquidity risk.

The Corporation’s actual results could differ

materially from those anticipated in these forward-looking

statements as a result of the risk factors set forth above and

elsewhere in this press release, along with the risk factors set

out in the most recent Annual Information Form filed on SEDAR+ at

www.sedarplus.ca.

The forward-looking statements contained in this

press release are expressly qualified in their entirety by this

cautionary statement. These statements are given only as of the

date of this press release. The Corporation does not assume any

obligation to update these forward-looking statements to reflect

new information, subsequent events or otherwise, except as required

by law.

About High Arctic Energy

Services High Arctic is an energy services provider. High

Arctic provides pressure control equipment and equipment supporting

the high-pressure stimulation of oil and gas wells and other

oilfield equipment on a rental basis to exploration and production

companies, from its bases in Whitecourt and Red Deer, Alberta.

For further information, please

contact:

Lonn Bate Chief Financial

Officer P: 587-318-2218 P: +1 (800) 688 7143

High Arctic Energy Services Inc. Suite 2350, 330 –

5th Ave SW Calgary, Alberta, Canada T2P 0L4 website: www.haes.ca

Email: info@haes.ca

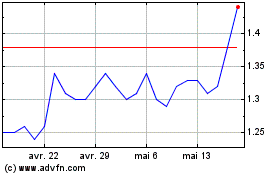

High Arctic Energy Servi... (TSX:HWO)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

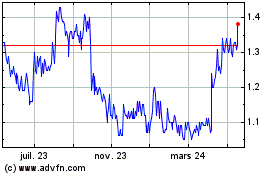

High Arctic Energy Servi... (TSX:HWO)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024