Melcor REIT Announces $13.5 Million of Property Acquisitions and Bought Deal of $20.2 Million of Trust Units

16 Avril 2014 - 10:31PM

Marketwired Canada

NOT FOR DISTRIBUTION IN THE UNITED STATES OR OVER UNITED STATES WIRE SERVICES

Melcor Real Estate Investment Trust (TSX:MR.UN) (the "REIT") announced today

that its board of trustees has approved the acquisition of two multi-tenant

retail properties (together, the "Acquisitions") representing approximately

54,126 square feet of gross leasable area ("GLA") for an aggregate purchase

price of approximately $13.50 million (exclusive of closing and transaction

costs). The Acquisitions consist of (i) an 11,540 square foot retail complex

developed by Melcor Developments Ltd. ("Melcor"), with construction completed in

early 2013, and located in Airdrie, Alberta ("Kingsview Market Phase Three");

and (ii) a 42,586 square foot retail community strip centre substantially

redeveloped in 2009 and located in Regina, Saskatchewan ("Market Mall"). The

Acquisitions are to be acquired from Melcor, the REIT's external asset manager

and property manager.

Darin Rayburn, Chief Executive Officer of the REIT, commented:

"We are pleased to announce this acquisition agreement with Melcor as it

represents the first transactions through our proprietary acquisition pipeline

and the continued execution of our growth strategy. Our primary objectives are

to grow our income-producing assets portfolio and build value for our investors,

and we continue to do that. Upon completion of this transaction, our portfolio

GLA will have increased by 15% since our initial public offering. Our proven

acquisition capability will serve us well in the future as we continue to vend

in proprietary properties and look at opportunistic third party acquisitions. We

are particularly pleased that this vend in will be immediately accretive on a

leverage neutral basis and is a model we can use going forward."

The REIT also announced today that it has entered into an agreement to sell to a

syndicate of underwriters co-led by RBC Capital Markets and CIBC, on a bought

deal basis, 1,900,000 trust units ("Units") at a price of $10.65 per Unit (the

"Offering Price") for gross proceeds to the REIT of $20,235,000 (the

"Offering"). The REIT has granted the underwriters an option (the

"Over-Allotment Option"), exercisable for a period of 30 days following the

closing of the Offering, to purchase up to an additional 285,000 Units (being

approximately 15% of the aggregate number of Units offered) to cover

over-allotments, if any. The Offering is expected to close on or about May 7,

2014.

Net proceeds of the Offering (after deducting the underwriting fee and estimated

offering expenses) are intended to be used by the REIT to partially fund the

purchase price for the Acquisitions, to reduce the indebtedness under the REIT's

revolving credit facility, for future acquisitions and for general trust

purposes.

The Units will be offered in Canada pursuant to a short form prospectus to be

filed with the securities commissions and other similar regulatory authorities

in each of the provinces and territories of Canada, pursuant to National

Instrument 44-101 - Short Form Prospectus Distributions, and will be eligible

for sale in the United States by way of private placement.

The Offering is subject to certain conditions, including, but not limited to,

receipt of all necessary regulatory approvals, including the approval of the

Toronto Stock Exchange. The Acquisitions are subject to certain conditions and

there can be no assurance that either of the Acquisitions will be completed on

their terms or at all. The REIT continues to actively pursue acquisition and

investment opportunities.

Overview of the Acquisitions

The REIT intends to satisfy approximately $7.4 million of the purchase price of

the Acquisitions by the issuance of 694,836 Class B LP Units (the "Class B

Issuance"), each with an issue price equal to the Offering Price. On the closing

of the Acquisitions, which is anticipated to occur shortly following the closing

of the Offering, it is expected that Melcor will hold an approximate 48.1%

effective interest in the REIT through ownership of 10,225,634 Class B LP Units

of the Partnership (or an approximate 47.5% effective interest in the REIT if

the Over-Allotment Option is exercised in full).

Following the closing of the Acquisitions, the REIT intends to obtain

approximately $8.11 million of new mortgage financing in respect of Kingsview

Market Phase Three and Market Mall, with the proceeds of such mortgage financing

used to further reduce the indebtedness under the REIT's revolving credit

facility. Based on current underlying bond yields, it is expected that such

mortgages will have a weighted average interest rate of approximately 3.35% on

closing and maturity dates of May 2019.

Both the Acquisitions and the Class B Issuance constitute a "related party

transaction" under Multilateral Instrument 61-101 - Protection of Minority

Shareholders in Special Transactions ("MI 61-101"). Pursuant to a decision of

the Ontario Securities Commission dated March 25, 2014, the REIT has been

granted exemptive relief from certain of the "related party transaction"

requirements of MI 61-101 such that, subject to certain conditions, the REIT is

exempt from the minority approval and valuation requirements for related party

transactions that would have a value of less than 25% of the REIT's market

capitalization, if the Class B LP Units held by Melcor and/or any subsidiary

thereof are included in the calculation of the REIT's market capitalization.

Description of Acquisition Properties

The Acquisition Properties consist of two retail properties, one located in the

Calgary, Alberta region, and one located in Regina, Saskatchewan; with

approximately 54,126 square feet of GLA. The following is a description of the

Acquisition Properties:

Kingsview Market Phase Three, Yankee Valley Road & Kingsview Boulevard Airdrie,

Alberta

Kingsview Market Phase Three, located in Airdrie, Alberta, a suburb of Calgary,

is an 11,540 square foot multi-tenant retail complex developed by Melcor, with

construction completed in early 2013. This is an additional phase of Kingsview

Market, a retail centre containing 36,003 square feet of GLA, purchased by the

REIT at the time of the IPO. As at April 1, 2014, the property was 100% leased,

and was occupied by seven tenants.

Key Tenants Area Leased Percentage of Lease Expiry

(sq. ft.) Total GLA Date

Bank of Montreal 3,388 29.32% January 2024

MIO Stone Grill and Sushi 2,132 18.45% May 2023

Starbucks 1,589 13.75% June 2023

Market Mall, 303-359 Albert Road, Regina, Saskatchewan

Market Mall is a retail community strip centre situated on a 2.37-acre site,

containing 42,586 square feet of GLA and surface parking for 152 vehicles (3.57

stalls per 1,000 square feet). The building, constructed in 1981, was

substantially redeveloped by Melcor in 2009. As at April 1, 2014, the property

was 100% leased, and was occupied by fourteen tenants.

Key Tenants Area Leased Percentage of Lease Expiry

(sq. ft.) Total GLA Date

Regina Public Library 11,625 27.3% June 2027

Altus Group 10,460 24.6% April 2019

Regina Duplicate Bridge

Club 4,000 9.4% July 2018

This press release shall not constitute an offer to sell or the solicitation of

an offer to buy, nor shall there be any sale of, the securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful. The

Units have not been registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States absent registration

or an applicable exemption from the registration requirements.

About Melcor REIT

Melcor REIT is an unincorporated, open-ended real estate investment trust.

Melcor REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties with exposure to high growth Canadian

markets. Its portfolio is currently made up of interests in 30 properties

representing approximately 1.76 million square feet of gross leasable area

located across Alberta and in Regina, Saskatchewan and Kelowna, British

Columbia. For more information, please visit www.melcorREIT.ca.

Forward-Looking Statements

This press release contains "forward-looking information" as defined under

applicable Canadian securities law ("forward-looking information" or

"forward-looking statements") which reflect management's expectations regarding

objectives, plans, goals, strategies, future growth, results of operations,

performance, business prospects and opportunities of the REIT. Statements other

than statements of historical fact contained in this press release may be

forward-looking information. Some of the specific forward-looking statements in

this press release include, but are not limited to, statements with respect to:

the closing of the Offering and the Acquisitions and the expected terms and

closing dates thereof; the REIT's intended use of proceeds of the Offering; the

REIT's plans for financing the Acquisitions, including expected interest rates

for new property-level mortgages and the issuance of Class B LP Units to Melcor;

the impact of the Acquisitions on the REIT's AFFO per Unit, payout ratio, GLA

and similar operating or financial metrics; the REIT's pursuit of acquisition

and investment opportunities; and expectations, projections or other

characterizations of future events or circumstances and the future economic

performance of the REIT. The REIT has based these forward-looking statements on

its current expectations and assumptions about future events, which may prove to

be incorrect.

When relying on forward looking statements to make decisions, readers are

cautioned not to place undue reliance on these statements, as forward-looking

statements involve significant risks and uncertainties, should not be read as

guarantees of future performance or results and do not take into account the

effect of transactions or other items announced or occurring after the

statements are made. All forward-looking information in this press release

speaks as of the date of this press release. A number of factors could cause

actual results to differ materially from the results discussed in the

forward-looking statements. The REIT does not undertake any obligation to update

any such forward-looking information, whether as a result of new information,

future events or otherwise, except as required by applicable law.

Non-IFRS Measures

Adjusted funds from operations ("AFFO") is a key measures of performance used by

real estate businesses. However, such measure is not recognized under

International Financial Reporting Standards as issued by the International

Accounting Standards Board and as adopted by the Canadian Institute of Chartered

Accountants in Part I of The Canadian Institute of Chartered Accountants

Handbook - Accounting, as amended from time to time ("IFRS") and does not have a

standardized meaning prescribed by IFRS. Management believes that AFFO is a

supplemental measure of a Canadian real estate investment trust's performance

and the REIT believes that it is a relevant measure of the ability of the REIT

to earn and distribute cash returns to investors in Units and to evaluate the

REIT's performance.

"AFFO" is defined as FFO (as defined below) subject to certain adjustments,

including: (i) amortization of fair value mark-to-market adjustments on

mortgages acquired; (ii) interest rate subsidy amounts received; (iii)

amortization of deferred financing and leasing costs; (iv) adjusting for any

differences resulting from recognizing property revenues on a straight-line

basis; and (v) deducting a reserve for normalized maintenance capital

expenditures, tenant inducements and leasing costs, as determined by the REIT.

Other adjustments may be made to AFFO as determined by the trustees of the REIT

in their discretion.

"FFO" is defined as net income in accordance with IFRS, excluding most non-cash

expenses, namely: (i) fair value adjustments to investment properties; (ii)

gains (or losses) from sales of investment properties; (iii) amortization of

tenant incentives; (iv) fair value adjustments, interest expense and other

effects of redeemable units classified as liabilities; (v) acquisition costs

expensed as a result of the purchase of a property being accounted for as a

business combination; and (vi) deferred income tax expense.

FFO and AFFO should not be construed as alternatives to net income or cash flow

from operating activities determined in accordance with IFRS as indicators of

the REIT's performance. The REIT's method of calculating FFO and AFFO may differ

from other issuers' methods and accordingly may not be comparable to measures

used by other issuers.

FOR FURTHER INFORMATION PLEASE CONTACT:

Melcor Real Estate Investment Trust

Business Contact

Darin Rayburn

Chief Executive Officer

780.423.6931

info@melcorREIT.ca

Melcor Real Estate Investment Trust

Investor Relations

Jonathan Chia, CA

Chief Financial Officer

780.423.6931

ir@melcorREIT.ca

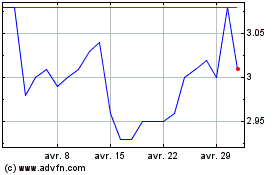

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024