FC Private Equity Realty Management Corp. (“

Firm

Capital") and Telsec Property Corporation

(“

Telsec" and, together with Firm Capital, the

“

Offerors”), both long term investors in Melcor

Real Estate Investment Trust (TSX: MR.UN) (“

Melcor

REIT”), reiterate Firm Capital’s previous call to

unitholders of Melcor REIT (“

Unitholders”) to VOTE

AGAINST the recently announced going private transaction led by

Melcor Developments Ltd. (“

Melcor Developments”),

the founder, 55% owner, and the external manager of Melcor REIT

(the “

Take Under Offer”).

As detailed in each of Firm Capital and Telsec’s

press releases dated September 18, 2024, and October 15, 2024,

respectively, the Offerors believe the loss of Unitholder value is

the direct result of the neglect of trustee oversight and

problematic governance that is only overshadowed by the Take Under

Offer, which the Offerors believe represents one of the most

egregious cases of failed governance controls by a group of

Canadian trustees in recent years.

In order to assist the Offerors to block the

Take Under Offer and hold management of Melcor REIT accountable,

the Offerors are pleased to announce that they will offer (the

“Tender Offer”) to acquire up to 1,296,316

participating trust units of Melcor REIT (the “Trust

Units”) from holders thereof other than Melcor

Developments and any related party of Melcor REIT or Melcor

Developments (“Minority Unitholders”) at a price

of $4.95 per Trust Unit, payable in cash (the

“Tender Price”). Each depositing

Minority Unitholder whose Trust Units are taken up and paid for

must be a holder of such Trust Units as of the record date for the

Meeting (defined below). The Tender Price represents a premium of

approximately 46% to the last closing price of the Trust Units

before the announcement of the Take Under Offer and, unlike the

Tender Offer, provides Unitholders an opportunity to liquidate

their ownership in Melcor REIT without waiting for the Unitholder

vote to approve the Take Under Offer. The Tender Offer is

not a formal or exempt take-over bid under Canadian securities laws

and regulations and is limited to a maximum of 1,296,316 Trust

Units.

If the Take Under Offer is defeated, the

Offerors are prepared to use their expanded holdings to hold

management accountable for their actions and to help ensure the

future success of Melcor REIT for the benefit of all Unitholders.

To that end, the Offerors have had an opportunity to review a copy

of the “Background to the Arrangement” in Melcor REIT’s management

information circular to be mailed to Unitholders in connection with

the Meeting and believe there are substantial, unexplained

irregularities in the events and processes leading up to the

announcement of the Take Under Offer, which it intends to pursue

after the defeat of the Take Under Offer.

The Tender Offer is open for acceptance by

Minority Unitholders on a rolling “first come, first served” basis

until 5:00 p.m. (Eastern Time) on November 18, 2024, unless the

Tender Offer is extended, varied or withdrawn. Deposited

Trust Units may be withdrawn at any time prior to the time they are

taken up by the Offerors.

Full details of the Tender Offer will be

included in the offer letter and any ancillary documentation

thereto (the “Tender Offer

Documents”) made available to Unitholders. The Tender

Offer is subject to certain terms and conditions as set out in the

Tender Offer Documents which, unless waived, must be satisfied. In

particular, the Offer Documents provide that each depositing

Minority Unitholder whose Trust Units are taken up and paid for

must appoint representatives of the Offerors as its nominees and

proxies, for the upcoming special meeting of Melcor REIT scheduled

to be held on November 26, 2024, and any adjournments or

postponements thereof (the “Meeting”). The Tender

Offer is not subject to any financing condition and the Offerors

confirm that they have sufficient cash resources to pay for all

Trust Units subject to the Tender Offer.

Firm Capital and Telsec’s Advisors

The Offerors have engaged Norton Rose Fulbright

Canada LLP as legal advisor and Shorecrest Group Ltd. as proxy

advisor and depositary and information agent.

About Firm Capital

FC Private Equity Realty Management Corp. is a

leading real estate private equity investment firm in Toronto,

Canada.

About Telsec

Telsec Property Corporation is a leading real

estate developer in Calgary, Canada with commercial flex

industrial, retail, office, and residential property for lease and

sale.

Unitholder Questions

For further information regarding the Tender

Offer, please contact:

Shorecrest Group

Ltd.North American Toll-Free: 1-888-637-5789Calls outside North

America: 647-931-7454Email: contact@shorecrestgroup.com

Additional Information

The information contained in this press release

does not and is not meant to constitute a solicitation of a proxy

within the meaning of applicable securities laws. Notwithstanding

the foregoing, the Offerors are voluntarily providing the

disclosure required under section 9.2(4) of National Instrument

51-102 – Continuous Disclosure Obligations in accordance with

securities laws applicable to public broadcast solicitations.

Any solicitation made by the Offerors in advance

of the Meeting is, or will be, as applicable, made by the Offerors,

and not by or on behalf of management of Melcor REIT. All costs

incurred for any solicitation will be borne by the Offerors,

provided that, subject to applicable law, the Offerors may seek

reimbursement from Melcor REIT for out-of-pocket expenses,

including proxy solicitation expenses and legal fees.

Any proxies solicited by the Offerors may be

solicited in reliance upon the public broadcast exemption to the

solicitation requirements under applicable Canadian corporate and

securities laws, conveyed by way of public broadcast, including

press release, speech or publication, and by any other manner

permitted under applicable Canadian securities laws. In addition,

solicitation may be made by mail, telephone, facsimile, email or

other electronic means as well as by newspaper or other media

advertising and in person by representatives of the Offerors in

accordance with Canadian securities laws and regulations. All costs

incurred for such solicitation will be borne by the Offerors. The

Offerors have also retained Shorecrest Group Ltd. as their proxy

advisor and depositary and information agent under the Tender

Offer. Shorecrest Group Ltd. will receive a fee for its services

plus ancillary payments and disbursements. To the extent any

proxies are solicited by the Offerors in connection with the

Meeting (other than those attached to Trust Units taken up and paid

for by the Offerors), they may be revoked by an instrument in

writing by the Unitholder giving the proxy or by its duly

authorized officer or attorney, or in any other manner permitted by

law or set out in the declaration of trust of Melcor REIT.

Other than in respect of the going private

transaction, none of the Offerors nor, to their knowledge, any of

their associates or affiliates, have any material interest, direct

or indirect, in any transaction since the commencement of Melcor

REIT’s most recently completed financial year, or in any proposed

transaction which has materially affected or will materially affect

Melcor REIT or any of its subsidiaries. None of the Offerors nor,

to their knowledge, any of their associates or affiliates, have any

material interest, direct or indirect, by way of beneficial

ownership of securities or otherwise, in any matter to be acted

upon at any upcoming Unitholders’ meeting (including the Meeting),

other than as set out herein.

Based upon publicly available information,

Melcor REIT’s registered office and head office is located at 900,

10310 Jasper Av., Edmonton, Alberta, T5J 1Y8, Canada. A copy of

this press release may be obtained on Melcor REIT's SEDAR+ profile

at www.sedarplus.com.

Cautionary Statement Regarding Forward-Looking

Information

Certain statements contained in this press

release, including without limitation statements regarding taking

up and paying for Trust Units deposited under the Tender Offer, the

Offerors’ assessment of the consequences of what it believes to be

governance failings at Melcor REIT, as well as the Offerors’

assessment of Melcor REIT’s future prospects, contain

“forward-looking information” and are prospective in nature.

Statements containing forward-looking information are not based on

historical facts, but rather on current expectations and

projections about future events, and are therefore subject to risks

and uncertainties that could cause actual results to differ

materially from the future outcomes expressed or implied by the

statements containing forward-looking information. Often, but not

always, statements containing forward-looking information can be

identified by the use of forward-looking words such as “plans”,

“expects”, “intends”, “anticipates”, or variations of such words

and phrases or statements that certain actions, events or results

“may”, “could”, “should”, “would”, “might”, or “will” be taken,

occur or be achieved. Although the Offerors believe that the

expectations reflected in statements containing forward-looking

information herein made by it (and not, for greater certainty, any

forward-looking statements attributable to Melcor REIT) are

reasonable, such statements involve risks and uncertainties, and

undue reliance should not be placed on such statements. Material

factors or assumptions that were applied in formulating the

forward-looking information contained herein include the assumption

that the business and economic conditions affecting Melcor REIT’s

operations will continue substantially in the current state,

including, without limitation, with respect to industry conditions,

general levels of economic activity, continuity and availability of

personnel, local and international laws and regulations, foreign

currency exchange rates and interest rates, inflation, taxes, that

there will be no unplanned material changes to Melcor REIT’s

operations, and that Melcor REIT’s public disclosure record is

accurate in all material respects and is not misleading (including

by omission). The Offerors caution that the foregoing list of

material factors and assumptions is not exhaustive. Many of these

assumptions are based on factors and events that are not within the

control of the Offerors and there is no assurance that they will

prove correct. Important facts that could cause outcomes to differ

materially from those expressed or implied by such forward-looking

information include, among other things, actions taken by Melcor

REIT in respect of the Tender Offer, the content of subsequent

public disclosures by Melcor REIT, the failure to satisfy the

conditions to the Tender Offer, general economic conditions,

legislative or regulatory changes and changes in capital or

securities markets. These are not necessarily all of the important

factors that could cause actual results to differ materially from

those expressed in any of the Offerors’ forward-looking

information. Other unknown and unpredictable factors could also

impact outcomes. Statements containing forward-looking information

in this press release are based on Offerors’ beliefs and opinions

at the time the statements are made, and there should be no

expectation that such forward-looking information will be updated

or supplemented as a result of new information, estimates or

opinions, future events or results or otherwise, and the Offerors

disclaim any obligation to do so, except as required by applicable

law.

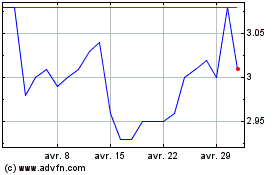

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025