Melcor REIT Concludes “Go Shop” Period and Sells Grande Prairie Property

25 Février 2025 - 3:09PM

Melcor Real Estate Investment Trust (Melcor REIT - TSX: MR.UN)

today announced the expiration of the “go shop” period provided in

the previously-announced arrangement agreement dated November 24,

2024 (the “Arrangement

Agreement”). Melcor REIT further announced that

the REIT has completed the sale of Melcor Crossing in Grande

Prairie, AB, which was listed for sale in March 2024. Melcor

Crossing is a multi-building open retail power centre containing

283,000 square feet of gross leasable area developed on a 33.3-acre

site. The property sold for $48.0 million ($170/sf), resulting in

net cash proceeds of $16.3 million after closing costs, working

capital adjustments and mortgage repayment. Cash proceeds will be

used to pay down the backstop loan agreement, in accordance with

its terms, with the remaining proceeds used to pay down the line of

credit. A preliminary analysis prepared by the REIT indicates the

sale could result in recapture of tax depreciation, resulting in

additional taxable income to be allocated to unitholders. For an

estimate of how this might impact taxable income, please refer to

the REIT’s management information circular dated October 25, 2024

available on SEDAR+ at www.sedarplus.ca.

Go-Shop Expiry

The 90 day “go-shop” period (the “Go-Shop

Period”) provided for in the previously announced

Arrangement Agreement expired at 11:59 p.m. MT on February 24, 2025

with no superior proposal having been received.

Pursuant to the terms of the Arrangement Agreement, Melcor

Developments Ltd. (“Melcor”) has committed to

acquire its unowned equity interest (approximately 45%) in Melcor

REIT Limited Partnership (“REIT LP”) for $5.50 per

unit in cash consideration (the “REIT LP Sale”).

Melcor’s unowned equity interest in REIT LP comprises all REIT LP’s

outstanding Class A LP Units (approximately 13.0 million units). In

accordance with the arrangement (the

“Arrangement”), the REIT will use the proceeds

from the REIT LP Sale to repurchase and cancel all of the REIT’s

outstanding participating trust units (“Trust

Units”). The Arrangement Agreement amends and restates the

original arrangement agreement (the “Original Arrangement

Agreement”) entered into among the REIT, Melcor and Melcor

REIT GP Inc. on September 12, 2024.

Following the announcement of the Arrangement, and in accordance

with the terms of the Arrangement Agreement, the REIT initiated a

"go-shop" process with its financial advisor, BMO Capital Markets

(“BMO”), by soliciting third-party interest in

submitting an acquisition proposal that is superior to the

Arrangement. The Go-Shop Period was in addition to the 30-day

go-shop period that expired in October 2024 in connection with the

Original Arrangement Agreement.

As the Go-Shop Period has ended, the "no-shop" provisions in the

Arrangement Agreement are now in effect. These provisions limit the

REIT and its representatives from initiating or engaging in

discussions or negotiations regarding any alternative acquisition

proposal, subject to customary “fiduciary out” provisions, pursuant

to which, among other things, the REIT may, subject to certain

requirements, engage with a person that submits a bona fide

unsolicited Acquisition Proposal (as such term is defined in the

Arrangement Agreement) which constitutes, or could reasonably be

expected to constitute or lead to, a Superior Proposal (as such

term is defined in the Arrangement Agreement) if consummated in

accordance with its terms.

The Arrangement remains subject to the satisfaction of customary

closing conditions, including obtaining the required approvals

(“Unitholder Approval”) from the holders of Trust

Units and special voting units of the REIT at the special meeting

to consider the Arrangement, scheduled to be held on April 11, 2025

(the “Meeting”), and receiving court approval. It

is anticipated that the Arrangement will be completed in the second

quarter of 2025. The Management Information Circular (the

“Circular”) and related materials for the Meeting

will be available under the REIT’s profile on SEDAR+ at

www.sedarplus.ca.

About Melcor REITMelcor REIT is an

unincorporated, open-ended real estate investment trust. Melcor

REIT owns, acquires, manages and leases quality retail, office and

industrial income-generating properties in western Canada. Its

portfolio is currently made up of interests in 34 properties

representing approximately 2.8 million square feet of gross

leasable area located across Alberta and in Regina, Saskatchewan.

For more information, please visit www.melcorREIT.ca.

Forward Looking Statements

This news release includes forward-looking information within

the meaning of applicable Canadian securities laws. In some cases,

forward-looking information can be identified by the use of words

such as “may”, “will”, “should”, “expect”, “intend”, “plan”,

“anticipate”, “believe”, “estimate”, “predict”, “potential”,

“continue”, and by discussions of strategies that involve risks and

uncertainties, certain of which are beyond Melcor's and the REIT’s

control. In this news release, forward-looking information

includes, among other things, statements relating to expectations

with respect to the timing and outcome of the Arrangement and the

anticipated benefits of the Arrangement to the parties and their

respective security holders, the timing of the Meeting and the

results thereof, the likelihood of receipt of a superior proposal,

the use of proceeds from the sale of Melcor Crossing, and the tax

implications of the Melcor Crossing sale, including recapture of

tax depreciation and estimated taxable income allocated to

unitholders. The forward-looking information is based on certain

key expectations and assumptions made by each of Melcor and the

REIT, including with respect to the structure of the Arrangement

and all other statements that are not historical facts. The timing

and completion of the Arrangement is subject to customary closing

conditions, termination rights and other risks and uncertainties

including, without limitation, required regulatory, court, and

unitholder approvals. Although management of each of Melcor and the

REIT believe that the expectations reflected in the forward-looking

information are reasonable, there can be no assurance that any

transaction, including the Arrangement, will occur or that it will

occur on the timetable or on the terms and conditions contemplated

in this news release. The Arrangement could be modified,

restructured or terminated. Readers are cautioned not to place

undue reliance on forward-looking information. Additional

information on these and other factors that could affect Melcor and

the REIT are included in reports on file with Canadian securities

regulatory authorities and may be accessed through the SEDAR+

website (www.sedarplus.ca).

By its nature, such forward-looking information necessarily

involves known and unknown risks and uncertainties that may cause

actual results, performance, prospects and opportunities in future

periods of Melcor and the REIT to differ materially from those

expressed or implied by such forward-looking statements.

Furthermore, the forward-looking statements contained in this news

release are made as of the date of this news release and neither

Melcor, nor the REIT nor any other person assumes responsibility

for the accuracy and completeness of any forward-looking

information, and no one has any obligation to update or revise any

forward-looking information, whether as a result of new

information, future events or such other factors which affect this

information, except as required by law.

Contact Information:

Investor Relations

Tel: 1.780.945.4795

ir@melcorREIT.ca

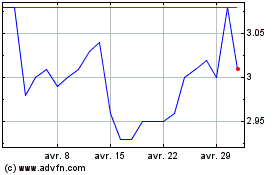

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Melcor Real Estate Inves... (TSX:MR.UN)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025