Premium Brands Holdings Corporation (“Premium Brands” or the

“Company”) (TSX: PBH), a leading producer, marketer and distributor

of branded specialty food products, is pleased to announce it has

entered into an agreement with a syndicate of underwriters co-led

by CIBC Capital Markets, National Bank Financial, BMO Capital

Markets and Scotiabank (collectively, the “Underwriters”), pursuant

to which the Company will issue on a “bought-deal” basis, subject

to regulatory approval, $150,000,000 aggregate principal amount of

convertible unsecured subordinated debentures (the “Debentures”) at

a price of $1,000 per Debenture (the “Offering”). The Company has

also granted the Underwriters an over-allotment option to purchase

up to an additional $22,500,000 aggregate principal amount of

Debentures, on the same terms, exercisable in whole or in part at

any time for a period of up to 30 days following closing of the

Offering, to cover over-allotments, if any. If the over-allotment

option is exercised in full, the total gross proceeds to be raised

under the Offering will be $172,500,000.

The Company intends to redeem in full the

approximately $172,500,000 aggregate principal amount of its 4.65%

convertible unsecured debentures, due April 30, 2025 (the “4.65%

Debentures”) outstanding in accordance with the indenture governing

such debentures.

The Company intends to use the net proceeds of the

Offering initially to repay indebtedness under its credit

facilities which will then be available to be drawn, as required,

to fund the redemption of the 4.65% Debentures, for future

acquisitions, capital projects, and/or general corporate

purposes.

The Debentures will bear interest from the date of

issue at 5.50% per annum, payable semi-annually in arrears on March

31 and September 30 each year, commencing September 30, 2025, and

will have a maturity date of March 31, 2030 (the “Maturity

Date”).

The Debentures will be convertible at the holder's

option at any time prior to the close of business on the earlier of

the Maturity Date and the business day immediately preceding the

date specified by the Company for redemption of the Debentures into

common shares of the Company (“Common Shares”) at a conversion

price of $126.15 per Common Share, being a conversion rate

of 7.9271 Common Shares for each $1,000 principal amount of

Debentures.

Closing of the Offering is expected to occur on or

about March 19, 2025. The Offering is subject to normal regulatory

approvals, including approval of the Toronto Stock Exchange.

The Debentures will be offered in each of the

provinces and territories of Canada by way of a short form

prospectus, and may be offered in the United States to “qualified

institutional buyers” pursuant to Rule 144A under the United States

Securities Act of 1933, as amended.

ABOUT PREMIUM BRANDS

Premium Brands owns a broad range of leading

specialty food manufacturing and differentiated food distribution

businesses with operations across Canada and the United States.

For further information, please contact George

Paleologou, President and CEO or Will Kalutycz, CFO at (604)

656-3100.

www.premiumbrandsholdings.com

The securities to be offered have not been and will

not be registered under the United States Securities Act of 1933,

as amended, or under any state securities laws, and may not be

offered, sold, directly or indirectly, or delivered within the

United States of America and its territories and possessions or to,

or for the account or benefit of, United States persons except in

certain transactions exempt from the registration requirements of

such Act. This release does not constitute an offer to sell or a

solicitation to buy such securities in the United States, Canada or

in any other jurisdiction where such offer is unlawful.

Forward Looking Statements

This press release may contain forward looking

statements with respect to the Company, including, without

limitation, statements regarding its business operations, strategy

and financial performance and condition, plans and objectives of or

involving the Company. This forward looking information includes,

but is not limited to, the Company’s expectations regarding the

Offering (including the anticipated timing and use of proceeds from

the Offering). While management believes that the expectations

reflected in such forward looking statements are reasonable and

represent the Company’s internal expectations and belief as of

March 5, 2025, there can be no assurance that such expectations

will prove to be correct as such forward looking statements involve

unknown risks and uncertainties beyond the Company’s control which

may cause its actual performance and results in future periods to

differ materially from any estimates or projections of future

performance or results expressed or implied by such forward looking

statements.

Forward looking statements generally can be

identified by the use of the words “may”, “could”, “should”,

“would”, “will”, “expect”, “intent”, “plan”, “estimate”, “project”,

“anticipate”, “believe”, or “continue”, or the negative thereof or

similar variations.

Some of the factors that could cause actual results

to differ materially from the Company’s expectations are referenced

in the Risks and Uncertainties section in the Company’s MD&A

for the 13 and 39 Weeks ended September 28, 2024.

Assumptions used by the Company to develop forward

looking statements contained or incorporated by reference in this

press release are based on information currently available to it.

Readers are cautioned that this information is not exhaustive.

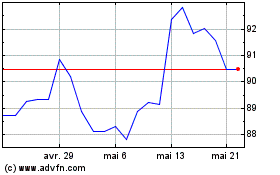

Premium Brands (TSX:PBH)

Graphique Historique de l'Action

De Fév 2025 à Mar 2025

Premium Brands (TSX:PBH)

Graphique Historique de l'Action

De Mar 2024 à Mar 2025