Premium Income Corporation Establishes At-The-Market Equity Program

09 Janvier 2024 - 2:03AM

(TSX: PIC.A; PIC.PR.A) – Premium Income Corporation (the “Fund”) is

pleased to announce it has established an at-the-market equity

program (“ATM Program”) that allows the Fund to issue shares of the

Fund to the public from time to time, at the Fund’s discretion,

effective until September 24, 2024, unless terminated prior to such

date by the Fund. Any Class A Shares or Preferred Shares sold in

the ATM Program will be sold through the Toronto Stock Exchange

(the “TSX”) or any other marketplace in Canada on which the Class A

Shares and Preferred Shares are listed, quoted or otherwise traded

at the prevailing market price at the time of sale. Sales of Class

A Shares and Preferred Shares through the ATM Program will be made

pursuant to the terms of an equity distribution agreement dated

January 8, 2024 (the “Equity Distribution Agreement”) with National

Bank Financial Inc. (the “Agent”).

Sales of Class A Shares and Preferred Shares

will be made by way of “at-the-market distributions” as defined in

National Instrument 44-102 Shelf Distributions on the TSX or on any

marketplace for the Class A Shares and Preferred Shares in Canada.

Since the Class A Shares and Preferred Shares will be distributed

at the prevailing market prices at the time of the sale, prices may

vary among purchasers during the period of distribution. The ATM

Program is being offered pursuant to a prospectus supplement dated

January 8, 2024 to the Fund’s short form base shelf prospectus

dated August 23, 2022. The maximum gross proceeds from the issuance

of the shares will be $80,000,000. Copies of the prospectus

supplement and the short form base shelf prospectus may be obtained

from your registered financial advisor using the contact

information for such advisor, or from representatives of the Agent

and are available on SEDAR+ at www.sedarplus.com.

The volume and timing of distributions under the

ATM Program, if any, will be determined at the Fund’s sole

discretion. The Fund intends to use the proceeds from the ATM

Program in accordance with the investment objectives and investment

strategies of the Fund, subject to the investment restrictions of

the Fund.

This ATM Program replaces the prior ATM program

established in September 2022 that has terminated in accordance

with its terms.

The Fund invests in a portfolio consisting

principally of common shares of Bank of Montreal, The Bank of Nova

Scotia, Canadian Imperial Bank of Commerce, National Bank of

Canada, Royal Bank of Canada and The Toronto-Dominion Bank. To

generate additional returns above the dividend income earned on the

Fund’s portfolio, the Fund may selectively write covered call and

put options in respect of some or all of the common shares in the

Fund’s portfolio. The Fund may also purchase securities of public

investment funds including exchange traded funds and other funds

managed by Mulvihill Capital Management Inc. (“Mulvihill”)

(provided that no more than 15% of the net asset value of the Fund

may be invested in securities of other Mulvihill funds), that

provide exposure to such common shares. The manager and investment

manager of the Fund is Mulvihill.

For further information, please contact Investor

Relations at 416.681.3966, toll free at 1.800.725.7172, email at

info@mulvihill.com or visit www.mulvihill.com

John Germain, Senior VP & CFO

Certain statements included in this news release

constitute forward-looking statements, including, but not limited

to, those identified by the expressions “intend”, “will” and

similar expressions to the extent they relate to the Fund. The

forward-looking statements are not historical facts but reflect the

Fund’s current expectations regarding future results or events.

These forward-looking statements are subject to a number of risks

and uncertainties that could cause actual results or events to

differ materially from current expectations. Although the Fund

believes that the assumptions inherent in the forward-looking

statements are reasonable, forward-looking statements are not

guarantees of future performance and, accordingly, readers are

cautioned not to place undue reliance on such statements due to the

inherent uncertainty therein. The Fund undertakes no obligation to

update publicly or otherwise revise any forward-looking statement

or information whether as a result of new information, future

events or other such factors which affect this information, except

as required by law.

A short form base shelf prospectus and

prospectus supplement containing important detailed information

about the securities being offered has been filed with securities

commissions or similar authorities in each of the provinces of

Canada. Copies of the short form base shelf prospectus may be

obtained from the Agent. Investors should read the short form base

shelf prospectus and the prospectus supplement before making an

investment decision.

Commissions, management fees and expenses all

may be associated with mutual fund investments. Please read the

prospectus before investing. Mutual funds are not guaranteed, their

values change frequently and past performance may not be

repeated.

The securities offered have not been registered

under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States absent registration or any

applicable exemption from the registration requirements. This news

release does not constitute an offer to sell or the solicitation of

an offer to buy securities nor will there be any sale of such

securities in any state in which such offer, solicitation or sale

would be unlawful.

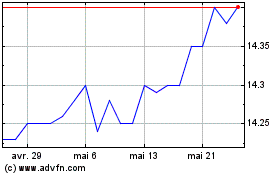

Premium Income (TSX:PIC.PR.A)

Graphique Historique de l'Action

De Oct 2024 à Nov 2024

Premium Income (TSX:PIC.PR.A)

Graphique Historique de l'Action

De Nov 2023 à Nov 2024