NXT Energy Solutions Announces 2022 Year-End Results

01 Avril 2023 - 4:00AM

NXT Energy Solutions Inc. ("NXT" or the "Company") (TSX: SFD;

OTCQB: NSFDF) today announced the Company's financial and operating

results for the quarter and year ended December 31, 2022 as well as

significant subsequent events. All dollar amounts herein are in

Canadian Dollars unless otherwise identified.

Financial and Operating

Highlights

Key financial and operational highlights are

summarized below:

- January 25, 2023, the Company closed a Private Placement by

issuing 8,510,000 common shares, at $0.195 per common shares, for

aggregate gross proceeds of approximately $1,659,450, less issuance

costs of $1,170;

- During December 2022 a rights offering and the first tranche of

the private placement contributed $0.43 million of cash;

- In January, the Board of Directors formally empowered a

Management Committee of the Board to assume the CEO’s duties;

- The Management Committee is working closely with senior

management to bring to fruition near-term potential contracts in

Africa and Asia Minor;

- cash at December 31, 2022 was $0.26 million;

- net working capital was $(1.681) million at December 31,

2022;

- the Company recorded SFD®-related revenues of $nil;

- a net loss of $1.47 million was recorded for Q4-22, including

stock-based compensation expense ("SBCE") and amortization expense

of $0.47 million;

- a net loss of $6.73 million was recorded for YE-22, including

SBCE and amortization expense of $1.98 million;

- net loss per common share for Q4-22 was $0.02 basic and $0.02

diluted;

- net loss per common share for YE-22 was $0.10 basic and $0.10

diluted;

- cash flow used in operating activities was $0.70 million during

Q4-22 and $2.93 million during YE-22;

- general and administrative ("G&A") expenses decreased by

$0.03 million (3%) in Q4-22 as compared to Q4-21; and

- G&A expenses increased by $0.55 million (17%) in YE-22 as

compared to YE-21.

On January 6, 2023 the Company announced the

grant of 2,050,000 incentive stock options at a price of $0.216 to

employees, officers and directors. These incentive stock options

will vest upon receipt of cash for SFD® services performed: 1/3

upon collection of US$6.5 million, 1/3 upon the collection of the

next US$7.0 million and the final 1/3 upon collection of an

additional US$7.5 million.

Summary highlights of NXT's 2022 financial

statements (with comparative figures to 2021) are noted below. All

selected and referenced financial information noted below should be

read in conjunction with the Company's 2022 audited consolidated

Financial Statements, the related Management's Discussion and

Analysis ("MD&A").

(All in Canadian $)

|

|

|

Q4-22 |

|

|

Q4-21 |

|

|

2022 |

|

|

2021 |

|

|

Operating results: |

|

|

|

|

|

SFD®-related revenues |

$ |

- |

|

$ |

(10,123 |

) |

$ |

- |

|

$ |

3,134,250 |

|

|

SFD®-related costs, net |

|

203,891 |

|

|

273,431 |

|

|

1,178,183 |

|

|

1,224,168 |

|

|

General & administrative expenses |

|

813,771 |

|

|

841,577 |

|

|

3,736,431 |

|

|

3,189,857 |

|

|

Amortization and other expenses |

|

442,097 |

|

|

445,144 |

|

|

1,768,727 |

|

|

1,776,484 |

|

|

|

|

1,459,759 |

|

|

1,560,152 |

|

|

6,683,341 |

|

|

6,190,509 |

|

|

Net loss |

|

(1,469,549 |

) |

|

(1,573,587 |

) |

|

(6,733,076 |

) |

|

(3,123,799 |

) |

|

|

|

|

|

|

|

Loss per common share: |

|

|

|

|

|

Basic |

$ |

(0.02 |

) |

$ |

(0.02 |

) |

$ |

(0.10 |

) |

$ |

(0.05 |

) |

|

Diluted |

$ |

(0.02 |

) |

$ |

(0.02 |

) |

$ |

(0.10 |

) |

$ |

(0.05 |

) |

|

|

|

|

|

|

| Common shares outstanding as

at end of the period |

|

68,949,109 |

|

|

65,250,710 |

|

|

68,949,109 |

|

|

65,250,710 |

|

| Weighted average of common

shares outstanding for the period: |

|

|

|

|

|

Basic |

|

65,602,875 |

|

|

64,658,380 |

|

|

65,602,875 |

|

|

64,658,380 |

|

|

Diluted |

|

65,602,875 |

|

|

64,658,380 |

|

|

65,602,875 |

|

|

64,658,380 |

|

|

|

|

|

|

|

|

Cash provided by (used in): |

|

|

|

|

|

Operating activities |

$ |

(704,187 |

) |

$ |

75,612 |

|

$ |

(2,934,003 |

) |

$ |

(1,033,173 |

) |

|

Financing activities |

|

413,790 |

|

|

(66,289 |

) |

|

389,217 |

|

|

875,428 |

|

|

Investing activities |

|

- |

|

|

(186,245 |

) |

|

550,000 |

|

|

(274,049 |

) |

|

Effect of foreign rate changes on cash |

|

(20,008 |

) |

|

(2,175 |

) |

|

368 |

|

|

(497 |

) |

|

Net cash outflow |

|

(310,405 |

) |

|

(179,097 |

) |

|

(1,994,418 |

) |

|

(432,291 |

) |

|

Cash and cash equivalents, beginning of the period |

|

573,842 |

|

|

2,436,952 |

|

|

2,257,855 |

|

|

2,690,146 |

|

|

Cash and cash equivalents, end of the period |

|

263,437 |

|

|

2,257,855 |

|

|

263,437 |

|

|

2,257,855 |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

263,437 |

|

|

2,257,855 |

|

|

263,437 |

|

|

2,257,855 |

|

|

Short-term investments |

|

- |

|

|

550,000 |

|

|

- |

|

|

550,000 |

|

|

Total cash and short-term investments |

|

263,437 |

|

|

2,807,855 |

|

|

263,437 |

|

|

2,807,855 |

|

|

|

|

|

|

|

|

Net working capital balance |

|

(1,681,003 |

) |

|

2,816,482 |

|

|

(1,681,003 |

) |

|

2,816,482 |

|

NXT's 2022 financial and operating results have

been filed in Canada on SEDAR at www.sedar.com, and will soon be

available in the USA on EDGAR at www.sec.gov/edgar, as well as on

NXT's website at www.nxtenergy.com.About NXT Energy

Solutions Inc.

NXT Energy Solutions Inc. is a Calgary-based

technology company whose proprietary SFD® survey system utilizes

quantum-scale sensors to detect gravity field perturbations in an

airborne survey method which can be used both onshore and offshore

to remotely identify traps and reservoirs with hydrocarbon and

geothermal exploration potential. The SFD® survey system enables

our clients to focus their exploration decisions concerning land

commitments, data acquisition expenditures and prospect

prioritization on areas with the greatest potential. SFD® is

environmentally friendly and unaffected by ground security issues

or difficult terrain and is the registered trademark of NXT Energy

Solutions Inc. NXT Energy Solutions Inc. provides its clients with

an effective and reliable method to reduce time, costs, and risks

related to exploration.

Contact Information

For investor and media inquiries please contact:

| Eugene Woychyshyn |

| Vice President of Finance &

CFO |

| 302, 3320 – 17th AVE SW |

| Calgary, AB, T3E 0B4 |

| +1 403 206 0805 |

| nxt_info@nxtenergy.com |

| www.nxtenergy.com |

| |

Forward-Looking

Statements

Certain information provided in this press

release may constitute forward-looking information within the

meaning of applicable securities laws. Forward-looking information

typically contains statements with words such as "anticipate",

"believe", "estimate", "will", "expect", "plan", "schedule",

"intend", "propose" or similar words suggesting future outcomes or

an outlook. Forward-looking information in this press release

includes, but is not limited to, information regarding: Rights

Offering, business negotiations, opportunities, discussions,

including the timing thereof and business strategies. Although the

Company believes that the expectations and assumptions on which the

forward-looking statements are based are reasonable, undue reliance

should not be placed on the forward-looking statements because the

Company can give no assurance that they will prove to be correct.

Since forward-looking statements address future events and

conditions, by their very nature they involve inherent risks and

uncertainties. Actual results could differ materially from those

currently anticipated due to a number of factors and risks.

Additional risk factors facing the Company are described in its

most recent Annual Information Form for the year ended December 31,

2022 and MD&A for the three and twelve month periods ended

December 31, 2022, which have been filed electronically by means of

the System for Electronic Document Analysis and Retrieval (“SEDAR”)

located at www.sedar.com. The forward-looking statements contained

in this press release are made as of the date hereof, and except as

may be required by applicable securities laws, the Company assumes

no obligation to update publicly or revise any forward-looking

statements made herein or otherwise, whether as a result of new

information, future events or otherwise.

Non-GAAP Measures

This news release contains disclosure respecting

non-GAAP performance measures including net working capital which

does not have a standardized meaning prescribed by US GAAP and may

not be comparable to similar measures presented by other entities.

This measure is included to enhance the overall understanding of

NXT’s ability to assess liquidity at a point in time. Readers are

urged to review the section entitled "Non-GAAP Measures” in NXT’s

MD&A for the three and twelve month periods ended December 31,

2022 which is available under NXT's profile on SEDAR at

www.sedar.com, for a further discussion of such non-GAAP measures.

The financial information accompanying this news release was

prepared in accordance with US GAAP unless otherwise noted.

Management's discussion and analysis of financial results and the

audited consolidated financial statements and notes for the twelve

months ended December 31, 2022, are available through the Internet

in the Investor Relations section of www.nxtenergy.com or under

NXT's SEDAR profile at www.sedar.com.

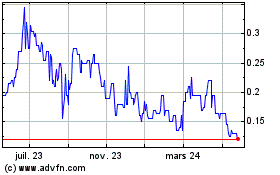

NXT Energy Solutions (TSX:SFD)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

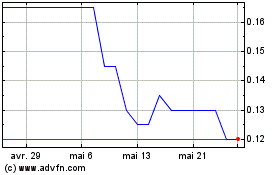

NXT Energy Solutions (TSX:SFD)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024