Slate Office REIT Announces Closing of Debenture Over-Allotment Option in Connection With Its Previously Announced C$130.0 Million Bought Deal Offering

17 Décembre 2021 - 2:27PM

Slate Office REIT (TSX: SOT.UN) (the “REIT”), an owner and operator

of office real estate, announced today that it has successfully

closed the issuance of an additional C$9.2 million aggregate

principal amount of 5.50% extendible convertible unsecured

subordinated debentures (the “Debentures”) pursuant to the partial

exercise of the Debenture over-allotment option granted by the REIT

to the syndicate of underwriters in connection with the REIT’s

previously announced offering of C$75.0 million aggregate principal

amount of Debentures and 1,225,000 subscription receipts of the

REIT (“Subscription Receipts”) at a price of C$4.90 per

Subscription Receipt for gross proceeds of approximately C$55.0

million (collectively, the “Offering”), which closed on November

19, 2021.

The Offering was conducted on a bought deal basis by a syndicate

of underwriters led by RBC Capital Markets and BMO Capital Markets.

The Debentures and Subscription Receipts are listed on the Toronto

Stock Exchange under the ticker symbols SOT.DB.A and SOT.R,

respectively.

Together with the previously announced C$5.8 million private

placement (the “Private Placement”) to Slate Asset Management L.P.,

which is expected to close subject to and concurrent with closing

of the proposed acquisition of the issued and outstanding shares of

Yew Grove REIT plc (an Irish-incorporated real estate investment

trust that is dual-listed on Euronext Dublin (Ireland) and the AIM

market of the London Stock Exchange), for cash consideration of

€1.017 per share (the “Proposed Acquisition” as further described

in the REIT’s November 19, 2021 press release), the total gross

proceeds of the Offering, including the partial exercise of the

Debenture over-allotment option, and Private Placement are expected

to be approximately C$145.0 million. It is intended that the net

proceeds of the Offering and Private Placement will be used to

partially finance the Proposed Acquisition.

About Slate Office REIT (TSX: SOT.UN)

Slate Office REIT is an owner and operator of office real

estate. The REIT owns interests in and operates a portfolio of 32

strategic and well-located real estate assets across Canada's major

population centres and includes two assets in downtown Chicago,

Illinois. 61% of the REIT’s portfolio is comprised of government or

credit rated tenants. The REIT acquires quality assets and creates

value for unitholders by applying hands-on asset management

strategies to grow rental revenue, extend lease term and increase

occupancy. Visit slateofficereit.com to learn more.

About Slate Asset ManagementSlate Asset

Management is a global alternative investment platform focused on

real estate. We focus on fundamentals with the objective of

creating long-term value for our investors and partners. Slate’s

platform spans a range of investment strategies, including

opportunistic, value add, core plus and debt investments. We are

supported by exceptional people and flexible capital, which enables

us to originate and execute on a wide range of compelling

investment opportunities. Visit slateam.com to learn more.

Statements required by the Irish Takeover

RulesThe trustees of the REIT accept responsibility for

the information contained in this announcement. To the best of the

knowledge and belief of the trustees of the REIT (who have taken

all reasonable care to ensure that this is the case) the

information contained in this announcement is in accordance with

the facts and does not omit anything likely to affect the import of

such information.

Forward-Looking StatementsCertain information

herein constitutes “forward-looking information” as defined under

Canadian securities laws which reflect management’s expectations

regarding objectives, plans, goals, strategies, future growth,

results of operations, performance, business prospects and

opportunities of the REIT. Some of the specific forward-looking

statements contained herein include, but are not limited to,

statements with respect to the intention of the REIT to complete

the closing of the Proposed Acquisition, the Private Placement and

the related transactions contemplated herein on the terms and

conditions described herein, the closing date of the Private

Placement and the use of proceeds of the Offering and the Private

Placement. The words “plans”, “expects”, “does not expect”,

“scheduled”, “estimates”, “intends”, “anticipates”, “does not

anticipate”, “projects”, “believes”, or variations of such words

and phrases or statements to the effect that certain actions,

events or results “may”, “will”, “could”, “would”, “might”,

“occur”, “be achieved”, or “continue” and similar expressions

identify forward-looking statements. Such forward-looking

statements are qualified in their entirety by the inherent risks

and uncertainties surrounding future expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SOT-AD

For Further InformationInvestor Relations+1 416

644 4264ir@slateam.com

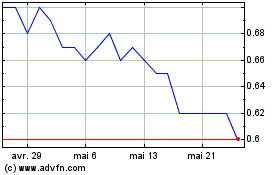

Slate Office REIT (TSX:SOT.UN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Slate Office REIT (TSX:SOT.UN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024