Slate Office REIT (TSX: SOT.UN) (the “REIT”), an owner and

operator of high-quality workplace real estate, announced today

that it is amending and updating the REIT’s slate of management

nominees to be considered for election at its upcoming annual

meeting of unitholders scheduled to be held on May 3, 2024

(including any postponement or adjournment thereof, the “Meeting”),

and as such is providing certain information supplemental to that

contained in its management information circular dated March 20,

2024 (the “REIT Circular”).

Background to Trustee Resignation and Updated Nominees for

Election

In February 2023, the REIT entered into a settlement agreement

with G2S2 Capital Inc. (“G2S2”), the sole shareholder of Armco

Alberta Inc. (“Armco”), both entities affiliated with current

trustee George Armoyan. In connection with that initial settlement

agreement, the parties agreed to appoint G2S2 Chairman George

Armoyan and his designated nominee – Jean-Charles Angers – to the

board of trustees of the REIT (the “Board”) effective immediately

following the entering into of such settlement agreement.

Subsequently, in January 2024, in connection with securing G2S2’s

support for an amendment to the REIT’s declaration of trust and

G2S2 agreeing to provide credit support for certain obligations

that the REIT had undertaken, G2S2 required that the settlement

agreement be amended to provide for a reduction in the size of the

Board to six trustees (previously agreed in the original settlement

agreement to be eight), of which two trustees would be nominees of

Slate Asset Management L.P. (Blair Welch and Brady Welch) and two

would be nominees of G2S2 (George Armoyan and Jean-Charles

Angers).

Since the date of the initial settlement agreement, the nominees

of G2S2 have continued to be George Armoyan and Jean-Charles

Angers. In connection with the Meeting, and on the recommendation

of the Compensation, Governance and Nominating Committee (the

“Governance Committee”), the Board approved a slate of six nominees

for election by the unitholders at the Meeting, which slate was to

be comprised of Samuel Altman, Jean-Charles Angers, George Armoyan,

Lori-Ann Beausoleil, Blair Welch and Brady Welch. Accordingly, the

REIT Circular delivered to unitholders prior to the date hereof

included such slate for consideration by the unitholders.

Subsequent to the delivery and filing of the REIT’s materials

related to the Meeting (including the REIT Circular, form of proxy

and voting instruction form), the REIT received notice (the

“Notice”) from Armco of its intention to nominate two additional

individuals – Brian Luborsky and Scott Dorsey – for election as

trustees at the Meeting, and G2S2 and Armco have since filed a

dissident information circular (the “G2S2 Circular”) and form of

proxy in respect of those nominations, including a recommendation

to unitholders that votes be withheld in respect of the election of

two of the independent trustees – Jean-Charles Angers and Lori-Ann

Beausoleil – at the Meeting.

Following receipt of the Notice, Lori-Ann Beausoleil advised the

Board that she is declining to stand for re-election to the Board

and tendered her resignation as a trustee of the REIT effective May

2, 2024 and, thus, will not be standing for re-election at the

Meeting. Following unsuccessful attempts by the REIT to come to a

cooperative outcome with Mr. Armoyan, and in light of the

resignation of one of the Board's nominees for election at the

Meeting, on the recommendation of the Governance Committee, the

Board resolved to nominate Scott Dorsey in place of Ms. Beausoleil

and to add Mr. Dorsey to the REIT’s slate of management nominees to

be considered for election as trustees at the Meeting. Mr. Dorsey

is also one of the individuals put forward by Armco.

Mr. Dorsey has consented to being nominated by the REIT and

acting as a trustee of the REIT, if elected at the Meeting.

Accordingly, all references in the REIT Circular which refer to the

names of the trustees being put forward for election, should be

read to refer to Mr. Dorsey, rather than Ms. Beausoleil, as the

context requires.

About New Nominee – Scott Dorsey

Scott Dorsey founded and has served as the managing director of

Marckenz Group Limited since 2008. Mr. Dorsey has spent over 30

years in the investment banking industry with leading Canadian and

international firms. Prior to founding Marckenz, Mr. Dorsey spent

12 years at Scotia Capital, serving in roles including industry

head of the communications, media and technology investment banking

group and managing director of the mergers and acquisitions group.

Prior to joining Scotia Capital, Mr. Dorsey was a vice president in

mergers and acquisitions at Rothschild Canada and began his career

at Merrill Lynch. Mr. Dorsey holds a Bachelor of Mathematics in

Computer Science from the University of Waterloo and a Masters of

Business Administration from the University of Western Ontario. Mr.

Dorsey currently sits on several other private company boards of

directors.

From 2019 to 2023, Mr. Dorsey served as CEO of Sim Digital, one

of Canada’s largest service providers to the feature film and

television industry. Sim’s studio leasing business leased a

portfolio of more than 600,000 square feet of stage space, located

in Ontario and British Columbia, to film and television industry

clients. Mr. Dorsey is currently overseeing the proposed

development of a 15-acre site in Mississauga, Ontario, to

ultimately build as much as one million square feet of premium

studio and ancillary space to lease to the film and television

industry.

Mr. Dorsey is independent within the meaning of applicable

Canadian securities laws and has advised the REIT that he does not

currently beneficially own, control and/or direct any units of the

REIT.

The below sets forth certain additional information regarding

Mr. Dorsey, which supplements the information contained in the REIT

Circular under the heading “Business of the Meeting – Election of

Trustees – Nominees for Election”:

Scott Dorsey Ontario, CA

Age: 59

Status: Independent

Trustee Since:

N/A

Areas of Expertise:

Finance & Audit/Capital Markets,

Real Estate/Office, Senior Leadership:

CEO/Senior Officer of Public or Private Company, International

Business Experience, Risk Management

Mr. Scott Dorsey has served as the

managing director of Marckenz Group Limited since 2008. Mr. Dorsey

has spent over 30 years in the investment banking industry with

leading Canadian and international firms. Prior to founding

Marckenz, Mr. Dorsey spent 12 years at Scotia Capital, serving in

roles including industry head of the communications, media and

technology investment banking group and managing director of the

mergers and acquisitions group. Prior to joining Scotia Capital,

Mr. Dorsey was a vice president in mergers and acquisitions at

Rothschild Canada and began his career at Merrill Lynch. Mr. Dorsey

holds a Bachelor of Mathematics in Computer Science from the

University of Waterloo and a Masters of Business Administration

from the University of Western Ontario. Mr. Dorsey currently sits

on several other private company boards of directors.

From 2019 to 2023, Mr. Dorsey served as

CEO of Sim Digital, one of Canada’s largest service providers to

the feature film and television industry. Sim’s studio leasing

business leased a portfolio of more than 600,000 square feet of

stage space, located in Ontario and British Columbia, to film and

television industry clients. Mr. Dorsey is currently overseeing the

proposed development of a 15-acre site in Mississauga Ontario, to

ultimately build as much as one million square feet of premium

studio and ancillary space to lease to the film and television

industry.

Board/Committee Membership

Public Board Membership

N/A

N/A

N/A

Board & Committee

Attendance During 2023

Board of

-

Audit

Committee

-

Investment

Committee

-

Governance

Committee

-

Special

Committee

-

Total Trustees

Attendance

-

Number of Units, Deferred Units (DUs), and

Special Voting Units Beneficially Owned, Controlled or Directed

Year

Units

DUs

Special Voting Units

Total Number of Units and DUs

Market Value

Date at which Unit Ownership

Guideline is to be met

2023

-

-

-

-

-

N/A

REIT Management’s Recommendations

The REIT is confident in the skills and experience of its

revised slate of management nominees for election at the Meeting,

which includes the re-election of two trustees previously put

forward by G2S2 and Armco (George Armoyan and Jean-Charles Angers),

the election of one new independent nominee (Samuel Altman), along

with Blair Welch, Brady Welch and new trustee nominee Scott

Dorsey.

Accordingly, the REIT recommends that unitholders vote

FOR the election of its six management

nominees for election as trustees at the Meeting.

Voting, Proxies and Revocation of Proxies

The withdrawal of Ms. Beausoleil and proposed nomination of

Mr. Dorsey in her stead will not affect the validity of the WHITE

form of proxy or voting instruction form previously delivered to

unitholders in connection with the Meeting, nor any proxy votes

already submitted in respect of the other trustee nominees or in

respect of the other resolutions to be put to unitholders for

approval at the Meeting. Management will not be issuing a new

form of proxy or voting instruction form to reflect the change to

the slate of nominees described herein. The WHITE form of proxy

previously distributed provides management (or such other person

designated as proxyholder therein) with discretionary authority to

vote on amendments or variations to matters coming before the

Meeting. The REIT will disregard any votes cast for or withheld in

respect of the election of Ms. Beausoleil as a trustee of the REIT

at the Meeting. Unitholders who have not yet voted are encouraged

to use the REIT’s WHITE form of proxy that has previously been

delivered to them for the purposes of the Meeting.

A copy of the WHITE form of proxy can be found under the REIT’s

issuer profile on SEDAR+ at www.sedarplus.ca. In the absence of

specific instructions to the contrary, at the Meeting the nominees

of management identified on the form of proxy or voting instruction

form delivered by or on behalf of the REIT will vote FOR the election of each of Samuel Altman,

Jean-Charles Angers, George Armoyan, Scott Dorsey, Blair Welch and

Brady Welch as trustees of the REIT for the ensuing year.

Unitholders are urged to read the REIT Circular together with

this press release and return their completed WHITE form of proxy

or voting instruction form as soon as possible, and in any event

not later than 11:30 a.m. (Eastern Daylight Time) on May 1, 2024,

or, if the Meeting is adjourned or postponed, 48 hours (excluding

Saturdays, Sundays and statutory holidays) before any adjourned or

postponed meeting, in accordance with the instruction set out in

such WHITE form of proxy or voting instruction form.

For further information about how to vote, refer to the section

of the REIT Circular entitled “Proxy and Voting Information” and

the WHITE form of proxy or voting instruction form previously

delivered to you. If you have already voted using a blue proxy

distributed by G2S2, you may vote again using the REIT’s WHITE form

of proxy or voting instruction form and any later dated proxy will

automatically revoke an earlier dated proxy. While the REIT

recommends that unitholders disregard the blue proxy distributed by

G2S2, if you plan to vote using such blue proxy, the REIT

recommends voting FOR Samuel

Altman, Jean-Charles Angers, George Armoyan, Scott Dorsey, Blair

Welch and Brady Welch, and WITHHOLD in

respect of Brian Luborsky. Unitholders who have already

completed and provided forms of proxy or voting instruction forms

and wish to revoke such proxies or voting instructions in light of

the information provided in this press release should refer to the

sections of the REIT Circular entitled “Proxy and Voting

Information – Revocation of Proxies”, in the case of registered

unitholders, and “Proxy and Voting Information – Advice to

Beneficial Unitholders”, in the case of beneficial unitholders, for

further information.

A copy of the REIT Circular continues to be available under the

REIT’s issuer profile on SEDAR+ at www.sedarplus.ca and on the

REIT’s website at www.slateofficereit.com.

About Slate Office REIT (TSX: SOT.UN)

Slate Office REIT is a global owner and operator of high-quality

workplace real estate. The REIT owns interests in and operates a

portfolio of strategic and well-located real estate assets in North

America and Europe. The majority of the REIT’s portfolio is

comprised of government and high-quality credit tenants. The REIT

acquires quality assets at a discount to replacement cost and

creates value for unitholders by applying hands-on asset management

strategies to grow rental revenue, extend lease term and increase

occupancy. Visit slateofficereit.com to learn more.

Forward-Looking Statements

Certain information herein constitutes “forward-looking

information” as defined under Canadian securities laws which

reflect management’s expectations regarding objectives, plans,

goals, strategies, future growth, results of operations,

performance, business prospects and opportunities of the REIT. The

words “plans”, “expects”, “does not expect”, “scheduled”,

“estimates”, “intends”, “anticipates”, “does not anticipate”,

“projects”, “believes”, or variations of such words and phrases or

statements to the effect that certain actions, events or results

“may”, “will”, “could”, “would”, “might”, “occur”, “be achieved”,

or “continue” and similar expressions identify forward-looking

statements. Such forward-looking statements are qualified in their

entirety by the inherent risks and uncertainties surrounding future

expectations.

Forward-looking statements are necessarily based on a number of

estimates and assumptions that, while considered reasonable by

management as of the date hereof, are inherently subject to

significant business, economic and competitive uncertainties and

contingencies. When relying on forward-looking statements to make

decisions, the REIT cautions readers not to place undue reliance on

these statements, as forward-looking statements involve significant

risks and uncertainties and should not be read as guarantees of

future performance or results, and will not necessarily be accurate

indications of whether or not the times at or by which such

performance or results will be achieved. A number of factors could

cause actual results to differ, possibly materially, from the

results discussed in the forward-looking statements. Additional

information about risks and uncertainties is contained in the

filings of the REIT with securities regulators.

SOT-SA

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240419269000/en/

Investor Relations +1 416 644 4264 ir@slateam.com

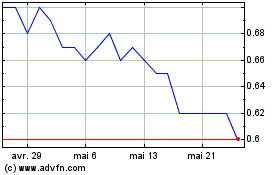

Slate Office REIT (TSX:SOT.UN)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Slate Office REIT (TSX:SOT.UN)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024