Stack Capital Holding Hopper Strikes Deal With Commonwealth Bank – Australia’s #1 Financial Institution

24 Mai 2023 - 7:00PM

Stack Capital Group Inc., (TSX:STCK and TSX:STCK.WT) is pleased to

announce that Hopper, Inc. (“Hopper”), an existing portfolio

holding, has partnered with Commonwealth Bank (“CommBank”)

(ASX:CBA), Australia’s largest financial institution, making it

easier for CommBank customers to book flights, accommodation, and

car rentals – both domestically and internationally – while saving

money.

Building on the success of Hopper’s existing

partnership with Capital One (NYSE:COF), which has been in place

for the past 18 months, this announcement with CommBank represents

a key milestone in Hopper’s efforts to expand its partnerships

globally with market-leading financial institutions.

Hopper will deliver an end-to-end travel offering for CommBank

credit card customers, complete with world-class flexibility and

disruption products to improve the traveller experience; and will

provide CommBank customers with access to the lowest prices on 300

airlines, 2 million hotels, and 100 car rental companies.

“Another incredible partnership announcement for

Hopper, this time with Commonwealth Bank, the #1 financial

institution and credit card issuer in Australia. Hopper continues

to demonstrate the ability to syndicate its innovative travel

fintech products and inventory, through Hopper Cloud, to some of

the world’s leading travel platforms and financial institutions”,

said Jeff Parks, CEO of Stack Capital. “We look forward to more

announcements of this type from Hopper in the future, which will

fuel continued growth within the business.”

To access a copy of the Hopper announcement

please click here.

About Stack Capital

Stack Capital is an investment holding company

and its business objective is to invest in equity, debt and/or

other securities of growth-to-late-stage private businesses.

Through Stack Capital, shareholders have the opportunity to gain

exposure to the diversified private investment portfolio;

participate in the private market; and have liquidity due to the

listing of the Common Shares and Warrants on the TSX. At the same

time, the public structure also allows the Company to focus its

efforts on maximizing long-term performance through a portfolio of

high growth businesses, which are not widely available to most

Canadian investors. SC Partners Ltd. (the "Manager") has taken the

initiative in creating the Company and acts as the Company's

administrator and is responsible to source and advise with respect

to all investments for the Company.

About Hopper

Hopper is the world's fastest-growing

mobile-first travel marketplace, focused on helping customers save

money and travel better. The Hopper app has nearly 100 million

downloads and continues to capture market share around the world.

By leveraging massive amounts of data and machine learning, the

company has developed several unique fintech solutions that address

everything from pricing volatility to trip disruptions. Through its

B2B initiative, Hopper Cloud, the company is syndicating its

travel fintech products and inventory, providing companies that

aspire to sell travel a differentiated consumer experience and

offering. Hopper has increased its revenue 2.5X year-over-year and

sells around $6 billion in travel and travel fintech annually. To

find out more about Hopper, visit Hopper.com.

About Commonwealth Bank

Commonwealth Bank of Australia provides

integrated financial services to customers in Australia, New

Zealand, and internationally. It operates through Retail Banking

Services, Business Banking, Institutional Banking and Markets, and

New Zealand segments. The company offers transaction, savings, and

foreign currency accounts; term deposits; personal and business

loans; overdrafts; equipment finance; credit cards; international

payment and trade; and private banking services, as well as home

and car loans. It also provides retail, premium, business,

offshore, and institutional banking services; and funds management,

superannuation, and share broking products and services, as well as

car, health, life, income protection, and travel insurance. The

company offers advisory services for high-net-worth individuals;

equities trading and margin lending services; debt capital,

transaction banking, working capital, and risk management services;

and international and foreign exchange services. The company was

founded in 1911 and is based in Sydney, Australia.

For more information, please visit our website

at www.stackcapitalgroup.com or contact:Brian ViveirosVP, Corporate

Development, and Investor

Relations647.280.3307brian@stackcapitalgroup.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/c1d4db62-ed7f-4907-93af-818e87c0fff5

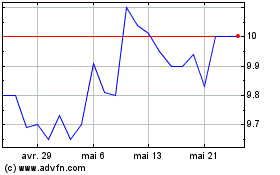

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024