Stack Capital Group Inc. Reports 2023 Year End Results

07 Mars 2024 - 1:45PM

Stack Capital Group Inc., (“Stack Capital” or the “Company”) (TSX:

STCK and STCK.WT) today announced its financial results for the

year ended December 31, 2023. Stack Capital reports all amounts in

Canadian Dollars unless otherwise stated.

Company Commentary:

- As at December 31, 2023, Book Value

per Share (BVpS) of the Company was $10.91, compared with $11.30 as

at September 30, 2023.

- During Q4, currency fluctuations

resulted in a $0.19 drag to BVpS. As of today, the US dollar has

recovered, thereby reversing the $0.19 decrease in BVpS.

- Stack Capital increased its

exposure to Locus Robotics through a share-swap transaction issuing

273,501 Stack Capital common shares, at $11.30 per share, which

closed on March 4, 2024.

- The Company’s cash position as at

December 31, 2023, was $25.1 million or $2.80 per share.

- To date, the Company has completed

eight investments contributing $8.13 per share as at December 31,

2023, into the following:

- SpaceX (space exploration &

communications)

- Omio, Inc. (travel &

leisure)

- Hopper, Inc. (travel &

leisure)

- Locus Robotics, Inc.

(robotics)

- Newfront Insurance, Inc. (insurance

& benefits)

- Prove Identity, Inc.

(cyber-security)

- Bolt Financial, Inc.

(e-commerce)

- Varo Money, Inc. (neo-banking)

- During Q4-2022, the Company

announced a normal course issuer bid to buy back its outstanding

common shares which it believes to be undervalued. During 2023,

201,900 common shares were repurchased at an average price of $6.49

per share.

- During 2023, the Company invested

additional capital into Omio, an existing portfolio company. This

subsequent Omio investment is already up 40% from the purchase

date.

“I believe that this is one of the most exciting

times to invest in growth and late-stage private markets, and Stack

is ready to capitalize given its advantageous cash position of $25

million. With the IPO market beginning to show signs of re-opening,

we believe that high-quality private companies will be some of the

first to list. We’re optimistic that some of our existing portfolio

companies fit that profile, and represent excellent candidates for

future liquidity events,” said Jeff Parks, CEO of Stack

Capital.

Q4-2023 Highlights

- As at December 31, 2023, the Book

Value of the Company was $97.7 million, and the Book Value per

Share was $10.91. A detailed summary of Book Value per Share is as

follows:

|

Breakdown of Book Value per Share as at December 31,

2023: |

|

|

Cash |

$ |

2.80 |

|

|

Investment – SpaceXi |

|

1.34 |

|

|

Investment – Omio, Inc.ii |

|

1.22 |

|

|

Investment – Hopper Inc. |

|

1.19 |

|

|

Investment – Locus Robotics, Inc. |

|

1.18 |

|

|

Investment – Newfront Insurance, Inc. |

|

1.18 |

|

|

Investment – Prove Identity Inc.iii |

|

1.13 |

|

|

Investment – Bolt Financial, Inc. |

|

0.55 |

|

|

Investment – Varo Money, Inc. |

|

0.33 |

|

|

Net other assets |

|

(0.01 |

) |

|

Book Value per Share |

$ |

10.91 |

|

i the Company invested in units of FNEX Ventures

LLC – Series 103 which is primarily invested into Space Exploration

Technologies Corp. (“SpaceX”).ii the Company invested in shares of

GoEuro Corp. which carries on business as Omio. iii the fair value

of Prove Identity Inc. includes an unrealized deferred gain of

$939,349.

- SpaceX achieved a valuation of $180

billion from a secondary tender offer run by SpaceX resulting in an

increase in Stack Capital’s Book Value per Share by $0.19.

- Stack Capital adjusted Bolt

Financials’ valuation down by $0.34 for the year ended December 31,

2023 due to recently updated financial information provided by Bolt

Financial.

- Prove raised $40 million from

MassMutual and Capital One in its latest series of funding to focus

on the next phase of growth.

- Stack Capital’s investment in a

secondary transaction of Omio resulted in a Book Value per Share

increase of $0.08 during Q4-2024, illustrating Stack’s ability to

acquire shares at an attractive price.

- Given Stack Capital has the

majority of its assets in US dollars, the Company experienced a

decrease in its Book Value per Share of $0.19 in Q4-2023 due to the

weakened US dollar. Since year-end, the US dollar has strengthened;

as such, as of today, Stack Capital has recovered more than $0.19

in BVpS.

About Stack Capital

Stack Capital is an investment holding company

and its business objective is to invest in equity, debt and/or

other securities of growth-to-late-stage private businesses.

Through Stack Capital, shareholders have the opportunity to gain

exposure to a diversified private investment portfolio; participate

in the private market; and have liquidity due to the listing of the

Common Shares and Warrants on the TSX. At the same time, the public

structure also allows the Company to focus its efforts on

maximizing long-term performance through a portfolio of high growth

businesses, which are not widely available to most Canadian

investors. SC Partners Ltd. (the “Manager”) has taken the

initiative in creating the Company and acts as the Company's

administrator and is responsible to source and advise with respect

to all investments for the Company.

For more information, please visit our

website at www.stackcapitalgroup.com

or contact:Brian ViveirosVP, Corporate

Development, and Investor

Relations647.280.3307brian@stackcapitalgroup.com

Non-IFRS Financial Measures

This press release may make reference to the

following financial measures which are not recognized under

International Financial Reporting Standards (“IFRS”), and which do

not have a standard meaning prescribed by IFRS:

- Book Value - the

aggregate fair value of the assets of the Company on the referenced

date, less the aggregate carrying value of the liabilities,

excluding any deferred taxes or unrealized deferred gains or losses

if applicable, of the Company; and

- Book Value per Share

(BVpS) - the Book Value on the referenced day divided by

the aggregate number of Common Shares that are outstanding on such

day.

The Company’s Book Value and Book Value per

Share is a measure of the performance of the Company as a whole.

The Company’s method of determining this financial measure may

differ from other issuers’ methods and, accordingly, this amount

may not be comparable to measures used by other issuers. This

financial measure is not a performance measure as defined under

IFRS and should not be considered either in isolation of, or as a

substitute for, net earnings per share prepared in accordance with

IFRS.

Cautionary Note Regarding

Forward-Looking Information

This press release contains forward-looking

information. Such forward-looking statements or information are

provided for the purpose of providing information about

management’s current expectations and plans relating to the future.

Readers are cautioned that reliance on such information may not be

appropriate for other purposes. Any such forward-looking

information may be identified by words such as “proposed”,

“expects”, “intends”, “may”, “will”, and similar expressions.

Forward-looking information contained or referred to in this press

release includes, but may not be limited to the business of Stack

Capital and the risks associated therewith, including those

identified in the Annual Information Filing under the heading “Risk

Factors”.

Forward-looking statements or information are

based on a number of factors and assumptions which have been used

to develop such statements and information, but which may prove to

be incorrect. Although Stack Capital believes that the expectations

reflected in such forward-looking statements or information are

reasonable, undue reliance should not be placed on forward-looking

statements because Stack Capital can give no assurance that such

expectations will prove to be correct. Factors that could cause

actual results to differ materially from those described in such

forward-looking information include, but are not limited to, the

ability to capitalize on investment opportunities. The

forward-looking information in this press release reflects the

current expectations, assumptions and/or beliefs of Stack Capital

based on information currently available to Stack Capital.

Any forward-looking information speaks only as

of the date on which it is made and, except as may be required by

applicable securities laws, Stack Capital disclaims any intent or

obligation to update any forward-looking information, whether as a

result of new information, future events, or results or otherwise.

The forward-looking statements or information contained in this

press release are expressly qualified by this cautionary

statement.

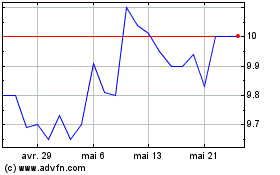

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Stack Capital (TSX:STCK)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024