Storm Exploration Inc. (TSX:SEO)

Consolidated Highlights

Thousands of Cdn$,

except volumetric Three Months Three Months Six Months Six Months

and per share to June 30, to June 30, to June 30, to June 30,

amounts 2010 2009 2010 2009

----------------------------------------------------------------------------

FINANCIAL

Gas sales 20,504(1) 14,026 40,979(1) 35,633

NGL sales 8,054 2,028 15,443 3,904

Oil sales 1,198(1) 2,611(1) 2,447(1) 4,880(1)

Royalty income 21 47 78 114

----------------------------------------------------------------------------

Production revenue 29,777(1) 18,712(1) 58,947(1) 44,531(1)

----------------------------------------------------------------------------

Funds from

operations (2) 20,356 8,460 37,957 22,180

Per share

- basic ($) 0.43 0.18 0.81 0.48

Per share

- diluted ($) 0.42 0.18 0.79 0.47

Net income 6,105 (2,192) 9,145 (942)

Per share

- basic ($) 0.13 (0.05) 0.19 (0.02)

Per share

- diluted ($) 0.13 (0.05) 0.19 (0.02)

Capital

expenditures, net

of dispositions (43,702) 3,843 (6,863) 35,334

Debt, including

working capital

deficiency(3) 46,572 93,473 46,572 93,473

Weighted average

common shares

outstanding

(000s)

Basic 47,056 46,553 46,982 45,888

Diluted 47,928 47,637 47,854 46,959

Common shares

outstanding (000s)

Basic 47,202 46,554 47,202 46,554

Fully diluted 49,899 49,012 49,899 49,012

----------------------------------------------------------------------------

----------------------------------------------------------------------------

OPERATIONS

Oil equivalent (6:1)

----------------------------------------------------------------------------

Barrels of oil

equivalent (000s) 858 742 1,609 1,502

Barrels of oil

equivalent per day 9,423 8,153 8,888 8,296

Average selling

price (Cdn$ per

Boe) 34.60(1) 25.81(1) 36.51(1) 30.21(1)

Gas production

----------------------------------------------------------------------------

Thousand cubic

feet (000s) 4,316 3,839 8,084 7,752

Thousand cubic

feet per day 47,434 42,185 44,663 42,831

Average selling

price (Cdn$ per

Mcf) 4.75 3.65 5.07 4.60

NGL Production

----------------------------------------------------------------------------

Barrels (000s) 125 49 233 97

Barrels per day 1,372 533 1,290 538

Average selling

price (Cdn$ per

barrel) 64.52 41.77 66.15 40.11

Oil Production

----------------------------------------------------------------------------

Barrels (000s) 13 54 28 112

Barrels per day 146 589 154 620

Average selling

price (Cdn$ per

barrel) 83.87(1) 57.76(1) 82.92(1) 53.22(1)

Wells drilled

----------------------------------------------------------------------------

Gross 1.0 0.0 10.0 4.0

Net 1.0 0.0 8.7 2.8

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Includes results of hedging activities.

(2) Funds from operations and funds from operations per share are non-GAAP

measurements. See MD&A

(3) Excludes unrealized asset/liability related to financial instruments.

President's Message

Second Quarter 2010 Highlights

- On June 9, 2010, Storm entered into an Arrangement Agreement whereby ARC will

acquire all of the existing and outstanding common shares of Storm in exchange

for either 0.57 of an ARC unit or, subject to adjustment, 0.201733 an ARC

Resources Ltd. exchangeable share. In addition, for each Storm common share,

shareholders will receive 0.3333 of a share in Storm Resources Ltd. (a new,

separate junior exploration and production company to be listed on the TSX-V),

0.1333 of a Storm Resources Ltd. Warrant, and a cash amount of $1.00 per Storm

share. Storm Resources Ltd. will be staffed with certain members of Storm's

management team with the primary asset being Storm's undeveloped land position

in the Horn River Basin. The shareholder meeting to approve the transaction is

scheduled for August 16, 2010 with closing to follow on August 17, 2010.

- Production in the second quarter averaged 9,423 Boe per day (16% oil and NGL),

a 16% increase from production of 8,153 Boe per day (14% oil and NGL) in the

second quarter of last year. This is a per-share increase of 14% using basic

shares outstanding at quarter end. Oil and NGL production increased 35% over the

same period to average 1,518 barrels per day which was due to the addition of a

liquids extraction ("refridge") plant at Parkland in mid-December 2009.

- During the quarter, one horizontal gas well (1.0 net) was successfully drilled

in our Montney discovery at Parkland and two horizontal Montney gas wells (1.35

net) were completed and tied in.

- Cash flow for the quarter was $20.4 million or $0.42 per diluted share, an

increase of 133% from $0.18 per diluted share in the prior year second quarter.

The year-over-year increase in cash flow was due to higher production, increased

oil and NGL pricing, hedging gains, lower operating costs and reduced royalties

due to British Columbia's Deep Royalty Credit Program for horizontal wells.

- The second quarter cash flow netback of $23.74 per Boe represents an increase

of 108% from the cash flow netback of $11.40 per Boe in the year earlier period.

The wellhead price per Boe increased by $8.79 which was due to hedging gains

plus higher oil and NGL production and pricing. In addition, total cash costs,

which include production costs, interest, transportation and general and

administrative costs, declined by $2.15 per Boe from the year earlier period to

average $7.79 per Boe in the second quarter. Production costs were $3.58 per Boe

in the quarter, a decline of 36% from the previous year.

- Net income for the quarter was $6.1 million, or $0.13 per diluted share, an

increase from the net loss of $0.05 per diluted share in the prior year period.

This was primarily due to a cash flow netback per Boe with charges for

depletion, depreciation and accretion, at $15.40 per Boe, being 7% higher than

the same period last year.

- Storm's oil sands leases at Surmont, Alberta were sold on June 10, 2010 for

gross proceeds totaling $53.75 million.

- Capital investment totaled $10.1 million in the quarter before the Surmont

disposition. Including the Surmont disposition, bank debt net of working capital

was reduced by $43.7 million and ended the quarter at $46.6 million, or 0.6

times annualized second quarter cash flow. Storm's revolving bank credit

facility is $140 million.

Boe Presentation - For the purpose of calculating unit revenues and costs,

natural gas is converted to a barrel of oil equivalent ("Boe") using six

thousand cubic feet ("Mcf") of natural gas equal to one barrel of oil unless

otherwise stated. Boe may be misleading, particularly if used in isolation. A

Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All Boe measurements and

conversions in this report are derived by converting natural gas to oil in the

ratio of six thousand cubic feet of gas to one barrel of oil. Mboe means 1,000

Boe.

CORE AREA REVIEW

Parkland/Fort St. John Area, North East British Columbia

This area includes our Montney discovery and is the largest of Storm's core

areas, with net production averaging 7,939 Boe per day in the second quarter.

Current production from this area is approximately 8,100 Boe per day with 7,900

Boe per day from the Parkland property.

During the second quarter, activity was focused on the Parkland property and

included drilling one horizontal Montney well (1.0 net) into the upper sands,

plus completing and pipeline connecting two horizontal Montney wells (1.35 net)

which are also producing from the upper sands. Production rates on the new

horizontals averaged 4.2 Mmcf per day of raw gas per horizontal in the first 30

days of production.

In the second half of 2010, six to eight horizontals (4.7 to 5.4 net) are

expected to be drilled in the Montney formation at our Parkland property which

includes two more earning horizontals on the four section farm-in that was

entered into during the first quarter. In addition to this, one to two more

vertical Montney step-outs (1.0 to 1.6 net) will be drilled as part of our focus

on expanding the area where proved plus probable reserves have been assigned.

On the four section farm-in, the first earning horizontal was drilled in March,

completed with 8 fracture treatments in July, and has averaged 6.2 Mmcf per day

of gross raw gas since commencing production on July 16. Rigs are currently

drilling the next two earning horizontals with completion and tie in of both

being planned for early in the fourth quarter. Storm earns a 60% working

interest in the farm-in lands by paying 100% of the cost to drill, complete, and

tie in eight horizontal wells, and by paying 100% of the cost to drill two

vertical wells. All earning wells must be drilled before October 31, 2011. No

reserves were assigned to these lands in the 2009 year-end reserve evaluation.

The Upper Montney formation at Parkland is 80 to 110 metres thick and has been

sub-divided into the upper sands and the lower sands (see presentation on

Storm's website for type log illustration).

- In the upper sands of the Upper Montney formation, Discovered Petroleum

Initially in Place ("DPIIP")(1) is 1,331 Bcf of gross raw gas (928 Bcf net to

Storm) based on a productive area of 36.3 gross sections (23.5 net sections)

which includes the farm-in lands discussed above. In the 2009 year-end reserve

evaluation, 29.5 net proven plus probable undrilled horizontals were recognized

while, within the DPIIP area, there is potential for a total of 76 net undrilled

horizontals assuming a density of four horizontals per section. Currently, there

are 22 horizontal wells producing from the upper sands and first-year rates have

averaged approximately 2.4 Mmcf per day of raw gas (equal to 450 Boe per day of

total sales per well). Production rates have gradually improved as completions

have evolved from five fracture treatments on the early horizontals to nine

fracture treatments on the most recent horizontals. Fracture treatment size has

remained constant at 125 tons of sand per stage for the horizontals drilled in

the upper sands.

- In the lower sands, no reserves have been booked. The lower sands have been

separately completed and tested in six vertical wells with final test rates

ranging from 0.2 to 1.7 Mmcf per day. The completed vertical wells show that an

area of 9.5 gross sections (7.8 net) is potentially productive with estimated

net pay of 22 to 37 metres (3% sandstone scale cut-off) and average porosity of

5.8%. At four horizontals per section, there is potential for 31 net undrilled

horizontals in the lower sands in the productive area. The first horizontal in

the lower sands was drilled, completed with seven 50 ton fracs, and tied in for

a total cost of $4.5 million. No evidence of interference was observed during

the completion with the offsetting horizontal producing from the upper sands

which is 50 to 75 metres away laterally (based on pressure data and production

monitoring). Production commenced from this horizontal on April 15 and, over the

first 30 days, production averaged 1.4 Mmcf per day gross raw gas and has

declined to a current rate of 0.8 Mmcf per day. We are planning to drill a

second horizontal into the lower sands later in 2010 or early in 2011 (dependent

on discretionary cash flow), which will be completed with nine larger 75 ton

fracs to improve the production rate. No reserves were assigned to the lower

sands in the 2009 year-end reserve evaluation.

Discovered Petroleum Initially in Place ("DPIIP") - Is defined in the COGEH

handbook as the quantity of hydrocarbons that are estimated to be in place

within a known accumulation. Original Gas in Place ("OGIP") is a more commonly

used industry term when referring to gas accumulations. DPIIP is divided into

recoverable and unrecoverable portions, with the estimated future recoverable

portion classified as reserves and contingent resources. There is no certainty

that it will be economically viable or technically feasible to produce any

portion of this DPIIP except for those portions identified as proved or probable

reserves.

The combined capacity at our two Parkland facilities is now 53 Mmcf per day with

current throughput being 49 Mmcf per day of gross raw gas (90% average working

interest). A second electric drive compressor was installed at the 3-9

facility/refridge in July at a cost of $2.3 million which increased throughput

from 23 to 25 Mmcf per day of gross raw gas (10 Mmcf per day gas drive

compressor that was operational is now a 'spare'). In order to accommodate

future growth, an expansion of the 3-9 facility will be required in 2011 which

will likely include installing a second refridge facility plus additional

compression.

Financial results from our Parkland property showed further improvement in the

second quarter with an operating cost of $3.24 per Boe and a field netback of

$22.48 per Boe (before hedging gains). Production averaged 7,743 Boe per day

including 1,264 barrels per day of condensate and NGL (32 barrels per Mmcf of

raw gas). During the second quarter, condensate and NGL recoveries at the 3-9

facility with the refridge plant averaged 46 barrels per Mmcf of raw gas.

Horn River Basin ("HRB"), North East British Columbia

Storm's undeveloped land position in the HRB is prospective for Devonian shale

gas in the Muskwa, Otter Park, and Evie/Klua formations and currently includes

88 gross sections at a 40% working interest (23,110 net acres), with Storm Gas

Resource Corp. ("SGR") owning the remaining 60% working interest. One gross

section (40% working interest) was acquired at a Crown land sale during the

second quarter. Our land position combined with Storm's 22% equity ownership

position in SGR, gives us 53% exposure to this unconventional shale gas play.

Storm's initial efforts will be focused on proving commerciality and developing

the Muskwa and Otter Park shales within a 19 section core project area (7.6 net

sections). This area is the most prospective based on gross shale thickness

which averages 95 metres over this area (Muskwa and Otter Park only) and could

ultimately be developed with as many as 43 horizontals which would be 1,600 to

1,800 metres in length and completed with 12 or more fracture stimulations

(4,000 m3 fluid, 400 T sand per stimulation). Gross DPIIP within this core

project area is estimated to be 1.8 TCF of raw gas in the Muskwa and Otter Park

shales which is based on 95 metres average gross pay, 90 metres average net pay,

average porosity of 4.2%, gas content of 61 scf per ton, and an average

reservoir pressure of 26,000 kPa (internal estimates prepared by Storm

management). Two vertical wells (0.8 net) have been completed and tested in the

Devonian shales within this core project area, one of the vertical wells has

been cored, and there is 3-D seismic coverage over the entire core project area.

The core data and completion results from both vertical wells are very similar

to what has been reported by other operators in the area.

One horizontal well is planned for this summer (spud late August), with

completion planned for this fall. Possibly two more horizontals (0.8 net) will

be drilled this winter and completed in the summer of 2011. We are also working

at understanding and resolving a number of operational difficulties including

processing and transporting high temperature gas, sand production, source water,

and water disposal which could have a material impact on the total capital

required for larger scale development of the Muskwa and Otter Park shales. The

estimated cost to drill a horizontal well is $4 million while completion with 12

fracture stimulations is estimated to be $9 to $10 million. The cost for

associated infrastructure with 20 Mmcf per day of raw gas capacity to test

commerciality of the shales is $10 million which includes a wellsite facility,

gathering and sales pipelines, and a dehydration/compression facility. First gas

sales from a successful horizontal well is possible in early 2011 but, it is

likely to be later in 2011 before we have enough production data from one or

more horizontal wells and can determine the potential economics associated with

larger scale development.

Other Areas

In the second quarter, production from the Grande Prairie area of North West

Alberta averaged 1,089 Boe per day and production from the Cabin-Kotcho-Junior

area of North East British Columbia averaged 358 Boe per day.

In the Junior area of North East British Columbia, Storm has 33 net sections

which have potential to be developed with horizontal wells in the Jean Marie

formation. This is based on mapping and proximity to offsetting horizontals

which are producing from the Jean Marie formation. Two horizontal locations have

been licenced to test the economics associated with larger scale development,

and will be drilled when Storm has sufficient discretionary cash flow available,

which is primarily dependent on natural gas prices. The estimated cost to drill,

complete, and tie in a horizontal well is expected to be $2.1 million and, based

on offsetting wells, first-year rates are expected to average 800 to 1,400 Mcf/d

with 1.0 to 1.5 Bcf of recoverable raw gas per horizontal. Initial drilling

density would be one horizontal well per section.

At Umbach in North East British Columbia, one horizontal gas well (1.0 net) was

successfully drilled in July as part of a farm-in where Storm is paying 100% of

the cost to drill and complete in order to earn a 60% working interest. This

horizontal, combined with a vertical well drilled in the first quarter,

completed the earning phase of the farm-in and earned Storm 8,100 net acres. The

horizontal will be completed by mid-September with fracture treatments, each

with 100 T of sand.

INVESTMENTS

Storm Gas Resource Corp. ('SGR')

SGR is a private company formed in June 2007, to pursue unconventional gas

opportunities in the HRB and elsewhere. Storm's investment to date in SGR totals

$9.1 million and our share ownership position totals 2.5 million shares,

representing 22% ownership of SGR. Currently, SGR's land position in the HRB

totals 73.6 net sections (49,210 net acres). At the end of the first quarter of

2010, SGR's balance sheet showed a cash position of $27.0 million.

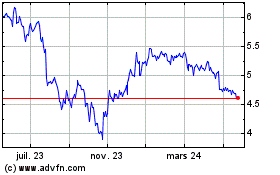

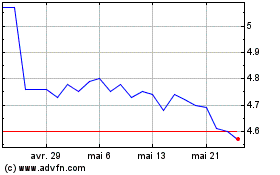

Chinook Energy Inc.

Storm owns 4.5 million shares of Chinook Energy Inc ("Chinook") which is a TSX

listed oil and gas exploration and production company (symbol 'CKE') based in

Calgary with operations focused in Tunisia and Western Canada. Chinook is the

result of a business combination between Iteration Energy Ltd. and Storm

Ventures International Inc. ("SVI") which was completed on June 29, 2010. Storm

had previously owned 4.5 million shares of SVI, a private Alberta-based oil and

gas exploration and production company. Chinook has current production of

approximately 16,700 Boe per day and a deep inventory of repeatable drilling

opportunities in both Western Canada and Tunisia. SVI issued approximately 52.1

million common shares and paid $225-million to acquire all of the issued and

outstanding common shares of Iteration. After giving effect to the combination,

Chinook has approximately 213.8 million common shares outstanding on a

non-diluted basis.

Bridge Energy Norge ASA ('Bridge')

On April 7, 2010, SVI's United Kingdom North Sea assets were combined with a

private company and Bridge was formed and subsequently listed as a public

company on the Oslo Stock Exchange. Bridge has production of approximately 1,500

Boe per day, is advancing several development opportunities in the UK sector of

the North Sea, and has a number of exploratory leads in the Norwegian sector of

the North Sea which offer longer-term upside. SVI received 28,776,000 common

shares of Bridge which were distributed to SVI shareholders and resulted in

Storm receiving approximately 1,050,000 common shares of Bridge.

Bellamont Exploration Ltd. ('Bellamont')

Storm holds 5.08 million shares of Bellamont as a result of a disposition of

non-core properties in the Grande Prairie area to Bellamont for proceeds

totaling $17.15 million which included $14 million cash plus 5.08 million shares

of Bellamont valued at $0.62 per share.

ARRANGEMENT AGREEMENT WITH ARC

Pursuant to the terms of the Arrangement Agreement ("Arrangement") entered into

between ARC and Storm on June 9, 2010, Storm shareholders will receive in

exchange for each common voting share or common non-voting share:

i. At their election, 0.57 of an ARC unit; or 0.201733 of an exchangeable share

of ARC Resources Ltd. (which number of exchangeable shares is based on the

anticipated exchange ratio for such exchangeable shares to ARC units as of

closing and is subject to adjustment to reflect the actual exchange ratio);

provided that Storm shareholders who are non-residents of Canada or tax-exempt

shareholders will not be entitled to elect to receive exchangeable shares.

ii. 0.3333 of a common share of Storm Resources Ltd. ("Storm Resources") which

was previously identified as "ExploreCo" in the Information Circular (the

"Circular") relating to the Arrangement.

iii. 0.1333 of a common share purchase warrant of Storm Resources which was

previously identified as an "ExploreCo Warrant" in the Circular relating to the

Arrangement. A whole warrant allows a Storm shareholder to acquire one share of

Storm Resources at the estimated net asset value ("NAV") as determined at

closing and is exercisable for a period of 15 business days after closing.

iv. Subject to adjustment, a cash payment of $1.00 per share at closing, which

represents the proceeds of the Surmont asset sale.

Assuming an estimated net asset value of approximately $1.47 per Storm share for

the Storm Resources assets as detailed in the press release dated June 9, 2010,

the total value of the consideration to be received under the Arrangement

represents a premium of approximately 25% to the closing trading price of $11.50

per Storm share on June 9 (using the ARC Trust unit price of $20.89 on June 9)

the last trading day prior to announcement of the Arrangement.

Storm shareholders will receive equity ownership in an entity with significantly

increased liquidity (based on daily trading volume), an immediate income stream

through monthly trust distributions (current yield approximately 5.8 per cent),

and a higher oil/liquids weighting (46 per cent based on first quarter

production) that mitigates the impact of natural gas price volatility. ARC's

portfolio of large-in-place resource properties preserves a similar level of

upside potential for Storm shareholders and also offers diversification into

different resource play types. In the Dawson area, ARC will have over 9 TCF of

GIP in the Montney to exploit including Storm's Parkland Montney field. At Ante

Creek (Montney) and Pembina (Cardium), ARC has seen encouraging results from

their initial horizontals and both properties offer the benefit of a much higher

oil and liquids weighting. Additionally, Storm shareholders will retain the

significant upside exposure associated with the Horn River Basin unconventional

shales through ownership in Storm Resources.

Storm Resources Ltd. is a new junior exploration and production company to be

led by Brian Lavergne as President and CEO, Don McLean as VP Finance and CFO,

and Rob Tiberio as VP Operations and COO along with other members of the Storm

senior management team. The primary asset to be transferred to the new entity is

undeveloped lands totaling approximately 117,200 net acres in the Horn River

Basin, Cabin/Kotcho/Junior and Umbach areas in northeastern British Columbia

plus undeveloped land in the Red Earth area of Alberta. In addition, Storm

Resources will retain Storm's share ownership positions in Storm Gas Resource

Corp, Bellamont Exploration Ltd., Bridge Energy Norge ASA and Chinook Energy

Inc. Storm Resources will also receive, subject to adjustment, cash of $5

million under the Arrangement, will have no debt, and will be able to spend $6.5

million drilling and completing wells on the undeveloped lands prior to the

closing of the Arrangement.

The Storm Resources Warrants will be exercisable until 15 business days after

closing of the transaction and will be priced at the estimated net asset value

of Storm Resources on the date of the Storm shareholder meeting. One whole

warrant allows a Storm shareholder to acquire one share of Storm Resources at

the estimated NAV as determined at closing and is exercisable for a period of 15

business days after closing as outlined in the press release of July 29, 2010.

The NAV per share of Storm Resources will be determined as being the lower of:

- the valuation of undeveloped land and pipeline interest using the methodology

set out in Storm's press release of June 9, 2010, plus the market value of

listed securities immediately prior to closing of the Arrangement, an assessment

of the value of Storm Resources' interest in privately owned Storm Gas Resource

Corp., plus cash to be transferred to Storm Resources on closing of the

Arrangement; all divided by the number of Storm Resources shares immediately

after closing (example attached which is updated to August 10, 2010; or,

- the value per share for Storm Resources implied by the volume weighted average

price per Storm share and ARC trust unit for the twenty trading days prior to

the closing of the Arrangement (July 19 to August 16, 2010), as adjusted for

other components of consideration to be received by Storm shareholders under the

Arrangement. Thus, to determine the per- share value of Storm Resources, the

volume weighted average share price for Storm for the twenty day period will be

reduced by 0.57 of the volume weighted average price of an ARC Trust Unit for

the same period, and further reduced by the cash payment of $1 per share,

subject to adjustment, to Storm shareholders on closing (example attached which

uses the period of July 19 and August 11, 2010).

In addition, and pending approval of Storm's shareholders, management and

insiders of Storm Resources have committed to acquire 2.3 million shares of

Storm Resources at the same price per share as the exercise price for the Storm

Resources Warrants. Proceeds from the arrangement warrants and the management

private placement will be used to fund the activities of Storm Resources over

the next 12 months.

Working Capital Shares Outstanding

----------------------------------------------------------------------------

Transferred from Storm

at closing (1) $5.0 to $11.5 million 16.633 million

Management private

placement (1) (3) $7.7 million 2.300 million

Storm Resources Warrants (2) (3) $22.2 million 6.653 million

Shares issued to ARC as part

of the Arrangement Agreement (3) 0.658 million

----------------------------------------------------------------------------

Total $35.1 to $41.4 million 26.244 million

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Per Arrangement, $5.0 million cash (subject to adjustment) plus $6.5

million allowable capital expenditures on ExploreCo assets (if spending

is less than or more than $6.5 million, the cash going to ExploreCo at

closing will be adjusted by the difference).

(2) Assuming private placement to management is fully subscribed.

(3) Assuming Storm Resources Warrants issued pursuant to Arrangement are

fully subscribed.

(4) Using the value per share for Storm Resources of $3.33 per share which

is based on the implied volume weighted average price per Storm share

and price per ARC trust unit for the trading days from July 19 to

August 11, 2010.

Storm Resources plans to invest up to $43 million over the next 12 months, which

includes $12 million allocated for the acquisition of producing assets and

undeveloped land plus $31 million for drilling, completions, facilities, and

tie-ins. The drilling program will include up to seven gross wells (4.4 net)

which includes two horizontal wells (1.2 net) at Umbach, two horizontal wells

(2.0 net) in the Jean Marie formation at Junior, and two horizontal wells (0.8

net) plus one vertical delineation well (0.4 net) in the Muskwa/Otter Park

shales in the Horn River Basin.

OUTLOOK

Storm remains on track to meet guidance for 2010 which consists of:

- Capital investment of $85 million to $90 million which will include drilling

19 gross wells (15.8 net).

- Exit production, or production for the final quarter of 2010, of approximately

9,500 to 9,800 Boe per day.

- Operating costs for the year averaging $4.50 per Boe.

- General and administrative costs for the year of $1.30 per Boe.

- A corporate royalty rate of approximately 13% to 15% which includes the effect

of British Columbia's royalty incentive programs.

The majority of capital investment will be funded with cash flow which is

estimated to be approximately $75 million in 2010, assuming commodity prices

over the remainder of the year average $3.75 per GJ at AECO for natural gas and

Cdn $75.00 per barrel for oil at Edmonton.

Based on field estimates, corporate production in July was approximately 9,300

Boe per day and third quarter production is expected to average 9,300 to 9,600

Boe per day. Capital investment in the third quarter is expected to be

approximately $25 million and will include drilling one horizontal well at

Umbach (1.0 net), three horizontal Montney wells at Parkland (3.0 net) including

two farm-in horizontals, one vertical step-out at Parkland (1.0 net), and one

horizontal in the HRB (0.4 net).

It has been more than six years since 'Storm 3' started out with production of

900 Boe per day. Although significant upside remains in our Montney pool at

Parkland, it was difficult for us to ignore the potential benefits offered by

the transaction with ARC given the current market environment, especially for a

producer like Storm with a high natural gas weighting. ARC's size and higher

oil/liquids weighting offers a safe harbor for our shareholders and the depth

and quality of opportunities offered by ARC's asset base preserves a similar

level of upside exposure for Storm shareholders. Looking ahead, the large land

position we have accumulated that is prospective for Devonian shale gas in the

Horn River Basin provides us with exposure to a very large resource, however,

exploitation of these shales will be significantly more difficult as a result of

various operational challenges and the continued volatility in natural gas

prices. We look forward to reporting on our progress in Storm Resources (or

'Storm 4') after the transaction with ARC has closed.

Sincerely,

Brian Lavergne, President and Chief Executive Officer

August 12, 2010

Storm Resources Ltd. Share Price Based on Implied Trading Price - Updated to

August 11, 2010

The volume weighted average price ("VWAP") will be used for Storm's share price

and ARC's unit price for the twenty trading days commencing on July 19 and

ending on the Meeting Date of August 16, 2010.

Using the trading days to date (July 19, 2010 to August 11, 2010), ARC's VWAP is

$20.18 per trust unit and Storm's VWAP is $13.61 per share.

----------------------------------------------------------------------------

Storm share price $13.61

Less 0.57 times ARC unit price ($11.50)

Less cash distribution to Storm shareholders ($ 1.00)

----------------------------------------------------------------------------

Implied Storm Resources Ltd. net asset value,

per existing Storm share $ 1.11

----------------------------------------------------------------------------

Implied Storm Resources Ltd. net asset value,

after consolidation (0.3333 Storm Resources Ltd.

share per existing Storm share) $ 3.33

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Storm Resources Ltd. Share Price Based on Net Asset Value Using Methodology

Detailed in Press Release Dated June 9, 2010 and Updated to August 11, 2010

Updated to include: public company share prices, revised SGR share price and

Storm Resources shares to be issued to ARC as part of the Arrangement.

$ Million

----------------------------------------------------------------------------

Horn River Basin undeveloped land (22,850 net acres,

$737/acre includes capital spent to date and cost of

land acquired after December 1, 2009 (1) 16.8

Junior undeveloped land (30,480 net acres, $85/acre

from Seaton-Jordan) (1) 2.6

Umbach undeveloped land (9,487 net acres, $192/acre) (1) 1.8

Other areas undeveloped land (54,368 net acres, $89/acre) (1) 4.8

50% interest in pipeline at Junior 1.0

Chinook Energy Inc. shares (2) 10.4

Storm Gas Resource Corp shares (3) 13.9

Bellamont Exploration Ltd. Shares (4) 2.8

Bridge Energy Norge ASA (5) 2.3

Spending on Storm Resources Ltd. assets prior to closing

(if spending is less than or more than $6.5 million,

the cash proceeds received at closing will be

adjusted by the difference) 6.5

Cash proceeds received at closing 5.0

----------------------------------------------------------------------------

Storm Resources Ltd. net asset value 67.9

Value of shares issued to ARC as part of Arrangement (6) (2.9)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Storm Resources Ltd. net asset value after

accounting for shares to ARC 65.0

Fully diluted Storm Exploration shares 49.9 million

Storm Resources Ltd. net asset value per Storm

exploration share (pre-consolidation) $1.30

Number of Storm Resources Ltd. shares issued

to Storm Exploration shareholders 16.633 million

----------------------------------------------------------------------------

Net asset value per Exploreco/Storm Resources Ltd.

share (post-consolidation) $3.91

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Undeveloped land value from Seaton-Jordan evaluation December 1, 2009

plus actual cost of any land acquired after December 1, 2009 plus

actual capital invested since inception in drilling, completions,

seismic, and road construction (Seaton-Jordan values: HRB $5.67 MM,

Junior $2.59 MM, Umbach $0, Other $4.8 MM).

(2) Storm Ventures International Inc. was renamed Chinook Energy Inc. and

began trading on the Toronto Stock Exchange on July 6, 2010. 4.5

million shares valued using the closing share price of $2.30 on

August 11.

(3) 2.5 million shares of Storm Gas Resource Corp. valued at $5.58 per

share, using $737/acre for HRB lands, $25.1 MM estimated cash June

30,2010 and actual purchase price for remaining lands (same

methodology as used with Storm Resources Ltd. including same HRB

land value).

(4) 5.08 million shares of Bellamont Exploration Ltd. valued using the

closing share price of $0.56 on August 11.

(5) 1.053 million shares of Bridge Energy Norge ASA, which are listed on

the Oslo Stock Exchange and valued using August 11, 2010 closing share

price of NOK 13.0 or Canadian $2.20 per share (0.1696 exchange).

(6) $2.9 million of Storm Resources Ltd. shares to ARC as part of the

Arrangement.

Estimated Per-Share Net Asset Value of Storm Gas Resource Corp.

$ million

----------------------------------------------------------------------------

Horn River Basin undeveloped land (49,210 net acres @ $737/acre) $ 36.268

Other areas undeveloped land (12,515 net acres) $ 0.975

Cash (estimated June 30, 2010) $ 25.100

----------------------------------------------------------------------------

SGR net asset value $ 62.340

----------------------------------------------------------------------------

MM shares outstanding 11.18

----------------------------------------------------------------------------

SGR net asset value per share $ 5.58

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Management's Discussion and Analysis

Set out below is management's discussion and analysis ("MD&A") of financial and

operating results for Storm Exploration Inc. ("Storm" or the "Company") for the

three and six months ended June 30, 2010. It should be read in conjunction with

the unaudited consolidated financial statements for the three and six months

ended June 30, 2010, the audited consolidated financial statements for the year

ended December 31, 2009 and other operating and financial information included

in this report. In addition, readers are directed to the discussion below

regarding Forward-Looking Statements, Boe Presentation and Non-GAAP

Measurements.

This management's discussion and analysis is dated August 12, 2010.

PLAN OF ARRANGEMENT WITH ARC ENERGY TRUST

On June 9, 2010, the Company announced its participation in a plan of

arrangement (the "Plan") with ARC Energy Trust ("ARC"), ARC Resources Ltd. and

1541229 Alberta Ltd. Under the Plan, ARC will acquire Storm with Storm

shareholders receiving units of ARC Energy Trust and/or exchangeable shares in

ARC Resources Ltd., cash in the amount of approximately $1.00 per common share

and shares in 1541229 Alberta Ltd., renamed Storm Resources Ltd. ("SRL"). Under

the Plan, ARC will acquire Storm's operating business and SRL will acquire

Storm's undeveloped lands and its corporate investments. Information regarding

the Plan was provided in press releases dated June 9, 2010, July 29, 2010 and

August 11, 2010, and in the Information Circular dated July 16, 2010 which was

distributed to shareholders and posted on SEDAR.

INTRODUCTION AND LIMITATIONS

Basis of Presentation - Financial data presented below have largely been derived

from the Company's unaudited consolidated financial statements for the three and

six months ended June 30, 2010, prepared in accordance with Canadian Generally

Accepted Accounting Principles ("GAAP"). Accounting policies adopted by the

Company are set out in Note 2 to the unaudited consolidated financial statements

for the three and six months ended June 30, 2010 and in Note 2 to the Company's

audited consolidated financial statements for the year ended December 31, 2009.

The reporting and the measurement currency is the Canadian dollar. Unless

otherwise indicated, tabular financial amounts, other than per share and per Boe

amounts, are in thousands.

Forward-Looking Statements - Certain information set forth in this document,

including management's assessment of Storm's future plans and operations,

contains forward-looking information (within the meaning of applicable Canadian

securities legislation). Such statements or information are generally

identifiable by words such as "anticipate", "believe", "intend", "plan",

"expect", "estimate", "budget", "outlook", "forecast" or other similar words and

include statements relating to or associated with individual wells, regions or

projects. Any statements regarding the following are forward-looking statements:

- future crude oil or natural gas prices;

- future production levels;

- future revenues or costs or revenues or costs per commodity unit;

- future capital expenditures and their allocation to specific exploration and

development activities;

- future drilling of new wells;

- future earnings;

- future asset acquisitions or dispositions;

- future sources of funding for capital program;

- future debt levels;

- availability of committed credit facilities;

- development plans;

- ultimate recoverability of reserves or resources;

- expected finding and development costs and operating costs;

- estimates on a per-share basis;

- dates or time periods by which certain geographical areas will be developed;

- changes to any of the foregoing; and

- the effect on financial reporting in future periods resulting from the

adoption of International Financial Reporting Standards on January 1, 2011.

Statements relating to "reserves" or "resources" are forward-looking statements,

as they involve the implied assessment, based on estimates and assumptions, that

the reserves and resources described exist in the quantities predicted or

estimated, and can be profitably produced in the future.

The forward-looking statements are subject to known and unknown risks and

uncertainties and other factors which may cause actual results, levels of

activity and achievements to differ materially from those expressed or implied

by such statements. Such factors include the material risks described in Storm's

Annual Information Form and as incorporated by reference in the December 31,

2009 MD&A under "Risk Assessment" and the material assumptions disclosed in the

"Production and Revenue" section hereof under the headings "Production Profile

and Per-Unit Prices" and "Royalties"; under "Production Costs"; "Field

Netbacks", "Interest", "General and Administrative Costs" and "Future Income

Taxes"; under the "Investment and Financing" section hereof, under the headings

"Working Capital", "Capital Expenditures", "Bank Debt, Liquidity and Capital

Resources", "Investments", "Future Income Taxes", "Asset Retirement Obligation",

"Share Capital" and "Contractual Obligations"; industry conditions, volatility

of commodity prices, currency fluctuations, imprecision of reserve estimates,

environmental risks, competition from other industry participants, the lack of

availability of qualified personnel or management, stock market volatility and

ability to access sufficient capital from internal and external sources. All of

these caveats should be considered in the context of current economic

conditions, in particular reduced commodity prices, which are outside the

control of the Company. Readers are advised that the assumptions used in the

preparation of such information, although considered reasonable at the time of

preparation, may prove to be imprecise and, as such, undue reliance should not

be placed on forward-looking statements. Storm's actual results, performance or

achievement, could differ materially from those expressed in, or implied by,

these forward-looking statements. Storm disclaims any intention or obligation to

publicly update or revise any forward-looking statements, whether as a result of

new information, future events or otherwise, except as required under securities

law. References to forward-looking information are made elsewhere in this

report. The forward-looking statements contained herein are expressly qualified

by this cautionary statement. Assessment of the effect of forward-looking

statements has to be made in the context of the Plan of Arrangement entered into

by the Company and ARC and other parties, which will result in the sale of the

Company to ARC which will own the operating assets of the Company in the future.

Boe Presentation - For the purpose of calculating unit revenues and costs,

natural gas is converted to a barrel of oil equivalent ("Boe") using six

thousand cubic feet ("Mcf") of natural gas equal to one barrel of oil unless

otherwise stated. Boe may be misleading, particularly if used in isolation. A

Boe conversion ratio of six Mcf to one barrel ("Bbl") is based on an energy

equivalency conversion method primarily applicable at the burner tip and does

not represent a value equivalency at the wellhead. All Boe measurements and

conversions in this report are derived by converting natural gas to oil in the

ratio of six thousand cubic feet of gas to one barrel of oil.

Non-GAAP Measurements - Within management's discussion and analysis, references

are made to terms which are not recognized under GAAP in Canada. Specifically,

"funds from operations", "funds from operations per share", "field netbacks",

"cash costs" and "recycle ratio" as well as any "per Boe" amounts, do not have

any standardized meaning as prescribed by GAAP in Canada and are regarded as

non-GAAP measures. It is likely that these non-GAAP measurements may not be

comparable to the calculation of similar amounts for other entities. In

particular, funds from operations is not intended to represent, or be equivalent

to, cash flow from operating activities calculated in accordance with Canadian

GAAP which appears on the Company's consolidated statements of cash flows. Funds

from operations and similar non-GAAP terms are used to benchmark operations

against prior periods and peer group companies. Non-GAAP funds from operations

is also used to determine debt to cash flow ratios for the purposes of

establishing interest costs under the Company's banking agreement.

A reconciliation of funds from operations to cash flows from operating

activities is as follows:

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Cash flow from operating activities $ 18,110 $ 9,092 $ 31,799 $ 23,725

Net change in non-cash working

capital items 2,246 (632) 6,158 (1,545)

----------------------------------------------------------------------------

Non-GAAP funds from operations $ 20,356 $ 8,460 $ 37,957 $ 22,180

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-GAAP funds from operations per share is calculated using the weighted

average number of common shares outstanding consistent with the calculation of

net income per share. Non-GAAP field netbacks equals total revenue net of

hedging gains or losses, plus royalty income, less royalties paid, production

and transportation costs, calculated on a Boe basis for the reporting period.

Non-GAAP cash flow netback equals field netback less interest and general and

administrative costs, also calculated on a Boe basis. Total Boe is calculated by

multiplying the daily production by the number of days in the reporting period.

Non-GAAP cash costs per Boe are the total of production costs, transportation

costs, interest and general and administrative costs. Recycle ratio is

calculated by dividing the field netback by finding costs.

OPERATIONAL AND FINANCIAL RESULTS

Production and Revenue

Average Daily Production

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Natural gas (Mcf/d) 47,434 42,185 44,663 42,831

Natural gas liquids (Bbls/d) 1,372 533 1,290 538

Crude oil (Bbls/d) 146 589 154 620

----------------------------------------------------------------------------

Total (Boe/d) 9,423 8,153 8,888 8,296

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total Boe production for the second quarter of 2010 increased by 16% when

compared to the second quarter of 2009 and increased by 13% when compared to the

immediately prior quarter. Increased drilling activity in the first and second

quarters of 2010 resulted in the year-over-year and quarter-over-quarter uplift

in production. In particular, natural gas liquids production showed a

considerable increase in the first and second quarters of 2010. In part, the

increase is due to investment in facilities at Parkland late in 2009, which has

resulted in a higher liquids capture for the Company. In addition, about 330

Bbls of condensate, previously included with oil production has, effective

January 1, 2010, been included in natural gas liquids production. The

disposition of 220 Boe per day, primarily light oil, late in 2009, also

contributed to the decrease in oil production. Production increases came from

the Company's core Parkland area.

Daily production per million shares outstanding in the second quarter of 2010

averaged 200 Boe, compared to 175 Boe in the second quarter of 2009, an increase

of 14%.

For the six months ended June 30, 2010, production increased by 7% when compared

to the equivalent period in 2009, or an increase of 4% per million shares

outstanding for each period.

Production Profile and Per-Unit Prices

Three Months to June 30, 2010 Three Months to June 30, 2009

----------------------------------------------------------------------------

Average Selling Average Selling

Percentage of Price Before Percentage of Price Before

Total Boe Transportation Total Boe Transportation

Production Costs Production Costs

----------------------------------------------------------------------------

Natural gas - Mcf 84% $ 4.05 86% $ 3.65

Natural gas

liquids - Bbl 15% $ 64.52 7% $ 41.77

Crude oil - Bbl 1% $ 73.43 7% $ 63.63

----------------------------------------------------------------------------

Per Boe $ 30.93 $ 26.23

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Per-unit prices do not include adjustments for hedging gains or losses.

Six Months to June 30, 2010 Six Months to June 30, 2009

----------------------------------------------------------------------------

Average Selling Average Selling

Percentage of Price Before Percentage of Price Before

Total Boe Transportation Total Boe Transportation

Production Costs Production Costs

----------------------------------------------------------------------------

Natural gas - Mcf 84% $ 4.75 86% $ 4.60

Natural gas

liquids - Bbl 15% $ 66.15 7% $ 40.11

Crude oil - Bbl 1% $ 75.79 7% $ 56.49

----------------------------------------------------------------------------

Per Boe $ 34.81 $ 30.55

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Per-unit prices do not include adjustments for hedging gains or losses.

Storm's production base is largely natural gas and associated liquids. In

addition, Storm's prospect inventory is largely focused on liquids rich natural

gas and, based on exploitation of the Company's existing asset base, in the

short and medium term crude oil will not materially increase as a percentage of

total Boe production. Growth in gas production year-over-year and

quarter-over-quarter came largely from the Parkland area in British Columbia, in

particular from the Company's Montney discovery.

Storm's gas production in Alberta and British Columbia is sold at prices which

reflect both the benchmark AECO daily index pricing and Station 2 daily index

pricing. Prices for natural gas fell throughout 2009, until the final months

when a modest improvement became apparent, which continued into the first

quarter of 2010. However, since April 2010, prices for natural gas have fallen

considerably due in part to high storage levels, weak industrial demand and

continued high production levels. The widely recognized benchmark average AECO

index price for the second quarter of 2010 was $3.66 per GJ, compared to $3.47

per GJ for the second quarter of 2009, and to $5.08 per GJ for the immediately

preceding quarter. In addition, for the second quarter of 2010, the average

Station 2 daily index price, which applied to approximately 46% of Storm's gas

production in the quarter, was about 5% lower than the average AECO index price.

Storm's corporate average realized price per Mcf for natural gas for the second

quarter of 2010 was higher than the equivalent AECO index price due to high heat

content natural gas produced from the Montney formation at Parkland.

Pricing by quarter in 2009 and into 2010 was as follows:

----------------------------------------------------------------------------

Storm AECO C Station 2

Realized Price Monthly Average Daily Average

($/Mcf)(1) ($/GJ)(1) ($/GJ)(1)

----------------------------------------------------------------------------

Q2 2009 $ 3.65 $ 3.47 $ 3.06

Q3 2009 $ 3.30 $ 2.87 $ 2.75

Q4 2009 $ 5.03 $ 4.01 $ 4.24

Q1 2010 $ 5.56 $ 5.08 $ 4.53

Q2 2010 $ 4.05 $ 3.66 $ 3.47

----------------------------------------------------------------------------

(1) Storm realized price is measured in Mcf; Index prices in GJ.

(2) Per-unit prices do not include adjustments for hedging gains or losses.

Production by Area - Boe/d

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Fort St. John/Parkland - BC 7,939 6,016 7,370 6,060

Grande Prairie - AB 1,089 1,470 1,094 1,535

Cabin-Kotcho-Junior - BC 358 620 386 649

Other 37 47 38 52

----------------------------------------------------------------------------

Total 9,423 8,153 8,888 8,296

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The above table sets out the average production from each of Storm's main

producing areas. For the three months ended June 30, 2010, Parkland production

increased by 32% year over year, while Grande Prairie production fell by 26%,

reflecting the focus of Storm's investment program. For the six month period,

Parkland production increased by 22% and Alberta production fell by 29%.

Production Revenue

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Natural gas $ 17,495 $ 14,026 $ 38,448 $ 35,633

Natural gas liquids 8,053 2,028 15,443 3,904

Crude oil 975 3,412 2,111 6,339

Royalty income 21 47 78 114

----------------------------------------------------------------------------

Revenue from product sales 26,544 19,513 56,080 45,990

Hedging gains (losses) 3,233 (801) 2,867 (1,459)

----------------------------------------------------------------------------

Total production revenue $ 29,777 $ 18,712 $ 58,947 $ 44,531

----------------------------------------------------------------------------

----------------------------------------------------------------------------

A reconciliation of revenue from product sales between the quarters ended

June 30, 2010 and 2009 is as follows:

Natural Gas Royalty

Natural Gas Liquids Crude Oil Income Total

----------------------------------------------------------------------------

Revenue from

product sales

- 2009 $ 14,026 $ 2,028 $ 3,412 $ 47 $ 19,513

Effect of

production changes

year over year 1,729 3,185 (2,567) (30) 2,317

Effect of changing

product prices

year over year 1,740 2,840 130 4 4,714

----------------------------------------------------------------------------

Revenue from

product sales - 2010 $ 17,495 $ 8,053 $ 975 $ 21 $ 26,544

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The year-over-year increase in revenues is largely due to increased production

and a 54% price increase in natural gas liquids.

Hedging

Crude Oil:

Storm entered into a fixed price sale contract in respect of 450 barrels of

crude oil per day, at a price of $83.45 per barrel for the period January 1 to

June 30, 2010. For the three and six months to June 30, 2010, the Company

recognized on the Consolidated Statements of Income and Retained Earnings, a

realized gain of $0.1 million and $0.2 million, respectively. Accounting for

crude oil derivative contracts follows mark-to-market rules.

Natural Gas:

For 2010, Storm entered into fixed price natural gas sales contracts for the

period January 1, 2010 to September 30, 2010. The Company realized a hedging

gain of $3.0 million on these contracts for the quarter ended June 30, 2010 and

a similar gain of $2.5 million for the six months to June 30, 2010. Contracts

outstanding at June 30, 2010 were as follows:

Volume Price Term

----------------------------------------------------------------------------

Collar - 7,000 GJ/day $ 5.00 to $5.70 July 2010 - September 2010

Swap - 5,000 GJ/day $5.20 July 2010 - September 2010

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The Company uses hedge accounting rules for these contracts and recognized an

unrealized hedging gain in the amount of $3.3 million on the Consolidated

Statements of Comprehensive Income and Accumulated Other Comprehensive Income in

respect of contracts outstanding at June 30, 2010.

Royalties

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Charge for period $ 2,661 $ 3,360 $ 7,118 $ 8,613

Royalties as a percentage of

Revenue from product sales

before hedging 10.0% 17.3% 12.7% 18.8%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Per Boe $ 3.10 $ 4.53 $ 4.42 $ 5.74

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Royalties are paid primarily to the provincial governments in Alberta and

British Columbia. The year-over-year reduction in the royalty rate is due to

expanded royalty incentive programs in both provinces.

Production Costs

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Charge for period $ 3,067 $ 4,160 $ 6,654 $ 8,621

Percentage of revenue from

product sales before hedging 11.6% 21.4% 11.9% 18.8%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Per Boe $ 3.58 $ 5.61 $ 4.14 $ 5.74

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Quarterly year-over-year per-Boe production costs fell by approximately 36%. The

introduction of the refridge plant at Parkland in late 2009, plus Storm's

constant focus on cost control, resulted in a steadily downward cost profile

over the last several quarters. In addition, the second quarter of 2010

benefited from adjustments of approximately $673,000 in respect of 2005 to 2008

non-operated facility operating costs amounting to $0.78 per Boe. Costs for the

quarter would otherwise have been $4.36 per Boe.

Storm's cash costs per Boe, which comprise production, transportation, interest

and general and administrative costs, amounted to $7.79 for the second quarter

of 2010, compared to $9.40 for the first quarter of 2010 and to $9.95 for the

second quarter of 2009.

For the six month periods to June 30, per Boe cash costs amounted to $8.54 in

2010 and $9.87 in 2009.

Transportation Costs

Three Three Six Six

Months Months Months Months

to to to to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Charge for period $ 1,429 $ 1,125 $ 2,706 $ 2,527

Percentage of revenue from

product sales before hedging 5.4% 5.8% 4.8% 5.5%

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Per Boe $ 1.67 $ 1.52 $ 1.68 $ 1.68

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total and per-unit transportation costs for the quarter increased slightly year

over year. The modest increase in the second quarter of 2010, compared to the

prior year, is due to higher transportation costs associated with trucking of

increased volumes of natural gas liquids at Parkland. Storm's low per-unit

production and transportation costs reflect Storm's high level of operatorship

as well as facility control and ownership and reasonable proximity to major

pipelines.

Field Netbacks

Details of field netbacks per commodity unit are as follows:

Three Months to June 30, 2010

----------------------------------------------------------------------------

Natural

Gas Natural

Crude Oil Liquids Gas Total

($/Bbl) ($/Bbl) ($/Mcf) ($/Boe)

----------------------------------------------------------------------------

Product sales $ 73.43 $ 64.52 $ 4.05 $ 30.93

Hedging gain realized 10.44 - 0.71 3.67

Royalty income 0.54 0.02 - 0.02

Royalties (9.14) (10.73) (0.27) (3.10)

Production costs (1) (6.93) - (0.69) (3.58)

Transportation (2.97) (5.64) (0.16) (1.67)

----------------------------------------------------------------------------

Field netback $ 65.37 $ 48.17 $ 3.64 $ 26.28

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three Months to June 30, 2009

----------------------------------------------------------------------------

Natural

Gas Natural

Crude Oil Liquids Gas Total

($/Bbl) ($/Bbl) ($/Mcf) ($/Boe)

----------------------------------------------------------------------------

Product sales $ 63.63 $ 41.77 $ 3.65 $ 26.23

Hedging loss realized (5.87) - - (0.42)

Royalty income 0.17 0.07 0.01 0.07

Royalties (9.23) (9.65) (0.62) (4.53)

Production costs (1) (7.76) - (0.98) (5.61)

Transportation (5.36) (3.73) (0.17) (1.52)

----------------------------------------------------------------------------

Field netback $ 35.58 $ 28.46 $ 1.89 $ 14.22

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six Months to June 30, 2010

----------------------------------------------------------------------------

Natural

Gas Natural

Crude Oil Liquids Gas Total

($/Bbl) ($/Bbl) ($/Mcf) ($/Boe)

----------------------------------------------------------------------------

Product sales $ 75.79 $ 66.15 $ 4.75 $ 34.81

Hedging gain realized 7.14 - 0.31 1.70

Royalty income 0.41 0.01 0.03 0.03

Royalties (7.92) (11.60) (0.52) (4.42)

Production costs (1) (7.17) - (0.80) (4.14)

Transportation (3.49) (5.32) (0.17) (1.68)

----------------------------------------------------------------------------

Field netback $ 64.76 $ 49.25 $ 3.60 $ 26.30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Six Months to June 30, 2009

----------------------------------------------------------------------------

Natural

Gas Natural

Crude Oil Liquids Gas Total

($/Bbl) ($/Bbl) ($/Mcf) ($/Boe)

----------------------------------------------------------------------------

Product sales $ 56.49 $ 40.11 $ 4.60 $ 30.55

Hedging loss realized (3.27) - - (0.24)

Royalty income 0.14 0.08 0.01 0.08

Royalties (8.35) (9.22) (0.87) (5.74)

Production costs (1) (7.68) - (1.00) (5.74)

Transportation (5.20) (3.81) (0.20) (1.68)

----------------------------------------------------------------------------

Field netback $ 32.13 $ 27.16 $ 2.54 $ 17.23

----------------------------------------------------------------------------

----------------------------------------------------------------------------

(1) Production costs for natural gas liquids are included with natural gas

costs.

Field netbacks for the second quarter of 2010 increased by 85% year over year.

Revenue per Boe after hedging adjustments increased by 34% and direct costs fell

by 28%.

For the six months to June 30, 2010, field netbacks increased by 53% year over year.

Based on an all-in proved plus probable finding cost for the last three calendar

years of $11.99, Storm's recycle ratio (field netback divided by finding costs)

for the second quarter of 2010 was 2.2.

Interest

Three Three Six Six

Months to Months to Months to Months to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Charge for period $ 1,164 $ 824 $ 2,402 $ 1,402

Per Boe $ 1.36 $ 1.11 $ 1.49 $ 0.93

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Interest is paid on Storm's revolving bank facility. The Company normally

borrows using bankers' acceptances plus a stamping fee. Although the interest

rate paid on bankers' acceptances fell year over year, the stamping and other

fees payable by the Company increased considerably upon the renewal of the

Company's banking agreement, on May 1, 2009. Higher debt levels were also

responsible for the 41% year-over-year increase in borrowing costs. Proceeds on

sale of Storm's Surmont properties, in the amount of $53.75 million, were

received late in the quarter and had limited effect on average borrowings during

the quarter.

General and Administrative Costs

Three Three Six Six

Months to Months to Months to Months to

June 30, June 30, June 30, June 30,

Total Costs 2010 2009 2010 2009

----------------------------------------------------------------------------

Gross general and administrative

charge for period $ 1,437 $ 1,436 $ 3,293 $ 3,305

Capital and operating recoveries (422) (167) (1,321) (1,025)

----------------------------------------------------------------------------

Net general and administrative

costs for period $ 1,015 $ 1,269 $ 1,972 $ 2,280

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Three Three Six Six

Months to Months to Months to Months to

June 30, June 30, June 30, June 30,

Costs per Boe 2010 2009 2010 2009

----------------------------------------------------------------------------

Gross general and administrative

charge for period $ 1.68 $ 1.94 $ 2.05 $ 2.20

Capital and operating recoveries (0.50) (0.23) (0.82) (0.68)

----------------------------------------------------------------------------

Net general and administrative

for period $ 1.18 $ 1.71 $ 1.23 $ 1.52

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Gross general and administrative costs for the quarter and six months ended June

30, 2010, were largely unchanged when compared to the prior year. Higher field

activity levels, when compared to 2009, resulted in higher capital recoveries

with a corresponding reduction in net general and administrative costs per Boe

for the three and six months to June 30, 2010. Further, higher production in

2010 has resulted in lower per-Boe costs.

Storm does not capitalize general and administrative costs.

Stock-Based Compensation Costs

Three Three Six Six

Months to Months to Months to Months to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Charge for period $ 679 $ 405 $ 1,352 $ 801

Per Boe $ 0.79 $ 0.55 $ 0.84 $ 0.53

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Stock-based compensation costs are non-cash charges which reflect the estimated

value of stock options issued to Storm's directors and employees. The value of

the award is recognized as an expense over the period from the grant date to the

date of vesting of the award. The increase in the charge for the second quarter

and for the first half of 2010, compared to the prior year, is a result of stock

options being issued in 2009 and 2010 at a price higher than the historical

average price, net of certain prior year awards being fully expensed.

Depletion, Depreciation and Accretion

Three Three Six Six

Months to Months to Months to Months to

June 30, June 30, June 30, June 30,

2010 2009 2010 2009

----------------------------------------------------------------------------

Depletion and depreciation

charge for period $ 13,088 $ 10,587 $ 24,573 $ 21,754

Accretion charge for period 114 122 226 241

----------------------------------------------------------------------------

Total $ 13,202 $ 10,709 $ 24,799 $ 21,995

----------------------------------------------------------------------------

Per Boe $ 15.40 $ 14.43 $ 15.42 $ 14.65

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The increase in the total charge for depletion, depreciation and accretion for

the second quarter and first half of 2010 compared to the equivalent periods of

2009, is a consequence of higher production volumes, as the depletion component

of the charge is based on a cost per Boe.

The increase in the charge for depletion and depreciation per Boe for the second

quarter and first half of 2010 when compared to the equivalent periods of 2009

is 7% and 5%, respectively. The increase is attributable to proved oil and gas

reserves being added in 2009 at a cost higher than in prior periods. Accretion

is the increase for the reporting period in the present value of the Company's

asset retirement obligation, which is discounted using an interest rate of 8%.

Investment Loss

As described in Note 4 to the consolidated financial statements, Storm accounts

for its investment in Storm Gas Resource Corp. ("SGR") using the equity method,

in accordance with which the Company's pro rata share of changes in SGR's equity

is included in the determination of the Company's net income for the period. The

investment loss recorded in the second quarter of 2010 represents Storm's share

of changes in SGR's equity for the period.

Future Income Taxes

For the three months ended June 30, 2010, Storm recorded a provision for future

income taxes of $0.39 million compared to a recovery of future income taxes of

$0.95 million for the three months ended June 30, 2009 reflecting the Company's

return to profitability. For the six month period ended June 30, 2010, the

future income tax provision amounted to $2.49 million compared to a future

income tax recovery of $0.77 million for the same period of 2009. The statutory

combined federal and provincial rate applicable to income in 2010 is 28%,

compared to 29% for 2009.

At June 30, 2010, Storm had tax pools carried forward estimated to be $175

million. In addition, Storm has a capital loss in the amount of $9.7 million

available for application against future capital gains.

Net Income (Loss) and Net Income (Loss) Per Share

The Company generated net income of $6.1 million for the second quarter of 2010,

compared to a net loss of $2.2 million for the second quarter of 2009. For the

six months ended June 30, 2010, net income amounted to $9.1 million compared to

net loss of $0.9 million for the same period in the prior year.

Three Months to Three Months to Six Months to Six Months to

June 30, 2010 June 30, 2009 June 30, 2010 June 30, 2009

----------------------------------------------------------------------------

Per Per Per Per

diluted diluted diluted diluted

share share share share

----------------------------------------------------------------------------

Net income

(loss) $6,105 $0.13 $ (2,192) $(0.05) $9,146 $0.19 $(942) $ (0.02)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-GAAP Funds from Operations and Funds from Operations per Share

Three Months to Three Months to Six Months to Six Months to

June 30, 2010 June 30, 2009 June 30, 2010 June 30, 2009

----------------------------------------------------------------------------

Per Per Per Per

diluted diluted diluted diluted

share share share share

----------------------------------------------------------------------------

Funds from

operations $20,356 $0.42 $ 8,460 $0.18 $37,957 $0.79 $22,180 $0.47

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Non-GAAP funds from operations is not a measure recognized by GAAP in Canada,

although it is widely used by analysts and other financial statement users. It

is also used by the Company's bankers to measure debt to cash flow ratios, which

determines interest costs under the Company's banking agreement. The most

directly comparable measure under GAAP is cash flows from operating activities,

as set out below.

Cash Flows from Operating Activities and Cash Flows from Operating

Activities per Share

Three Months to Three Months to Six Months to Six Months to

June 30, 2010 June 30, 2009 June 30, 2010 June 30, 2009