Sprott Asset Management LP (“Sprott”) today announced the launch of

the Sprott Copper Miners ETF (Nasdaq: COPP) (the “ETF” or “COPP”),

the only1 U.S.-listed ETF to provide pure-play2 exposure to large,

mid- and small-cap copper miners that supply a critical material

necessary for the energy transition. The ETF is the most recent

addition to Sprott’s suite of critical materials-focused ETFs and

is Sprott’s second copper mining fund, joining the Sprott Junior

Copper Miners ETF (COPJ), which launched in February 2023.

“Global commitments to meet net-zero emissions by 2050 are

reliant upon copper-intensive electrification initiatives, such as

expanding power grids, building clean energy infrastructure like

wind turbines and solar panels, and manufacturing more electric

vehicles,” said John Ciampaglia, CEO of Sprott Asset Management.

“Despite growing investor interest in copper as the energy

transition gains momentum, it’s been challenging for investors to

gain targeted exposure to copper miners. We’re pleased to offer a

focused opportunity to invest in copper miners through this

ETF.”

The Sprott Copper Miners ETF seeks to

provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Copper Miners™ Index (NSCOPP™). The Index is designed

to track the performance of a selection of global securities in the

copper industry, including copper producers, developers and

explorers.

COPP is part of Sprott’s energy transition ETF suite, which is

focused on the investment opportunity of the critical materials

needed to generate, transmit and store cleaner energy. The suite

now comprises:

|

Sprott Energy Transition Materials ETF |

Nasdaq: SETM |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Energy Transition Materials™ Index (NSETM™). The Index

is designed to track the performance of a selection of global

securities in the energy transition materials industry. |

|

Sprott Uranium Miners ETF |

NYSE Arca: URNM |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the North

Shore Global Uranium Mining Index (URNMX). The Index is designed to

track the performance of companies that devote at least 50% of

their assets to the uranium mining industry, which may include

mining, exploration, development and production of uranium, or

holding physical uranium, owning uranium royalties or engaging in

other non-mining activities that support the uranium mining

industry. |

|

Sprott Junior Uranium Miners ETF |

Nasdaq: URNJ |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Junior Uranium Miners™ Index (NSURNJ™), which is

designed to track the performance of mid-, small- and micro-cap

companies in uranium mining-related businesses. |

|

Sprott Copper Miners ETF |

Nasdaq: COPP |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Copper Miners™ Index (NSCOPP™), which is designed to

track the performance of a selection of global securities in copper

mining-related businesses. |

|

Sprott Junior Copper Miners ETF |

Nasdaq: COPJ |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Junior Copper Miners™ Index (NSCOPJ™), which is

designed to track the performance of mid-, small- and micro-cap

companies in copper mining-related businesses. |

|

Sprott Lithium Miners ETF |

Nasdaq: LITP |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Lithium Miners™ Index (NSLITP™). The Index is designed

to track the performance of a selection of global securities in the

lithium industry, including lithium producers, developers and

explorers. |

|

Sprott Nickel Miners ETF |

Nasdaq: NIKL |

Seeks to provide investment results that, before fees and expenses,

correspond generally to the total return performance of the Nasdaq

Sprott Nickel Miners™ Index (NSNIKL™). The Index is designed

to track the performance of a selection of global securities in the

nickel industry, including nickel producers, developers and

explorers. |

|

Sprott Physical Uranium Trust |

TSX: U.U ($US), U.UN ($CA) |

Seeks to provide a secure, convenient and exchange-traded

investment alternative for investors interested in holding physical

uranium. |

1 Based on Morningstar’s universe of Natural Resources Sector

Equity ETFs as of 3/5/2024.2 The term “pure-play” relates directly

to the exposure that the Fund has to the total universe of

investable, publicly listed securities in the investment

strategy.

About Sprott Asset Management LPSprott Asset

Management is a wholly-owned subsidiary of Sprott Inc. (“Sprott”).

Sprott is a global leader in precious metals and critical materials

investments. We are specialists. Our in-depth knowledge, experience

and relationships separate us from the generalists. Our investment

strategies include Exchange Listed Products, Managed Equities and

Private Strategies. Sprott has offices in Toronto, New York,

Connecticut and California, and the company’s common shares are

listed on the New York Stock Exchange and the Toronto Stock

Exchange under the symbol (SII). For more information, please visit

www.sprott.com.

Contact:Glen WilliamsManaging PartnerInvestor

and Institutional Client RelationsDirect: (416)

943-43945gwilliams@sprott.com

Dan GagnierGagnier CommunicationsDirect: (646)

569-5897sprott@gagnierfc.com

Important Disclosures

The Sprott Energy Transition ETFs are made up of the

following: Sprott Energy Transition Materials ETF (SETM), Sprott

Uranium Miners ETF (URNM), Sprott Junior Uranium Miners ETF (URNJ),

Sprott Copper Miners ETF (COPP), Sprott Junior Copper Miners ETF

(COPJ), Sprott Lithium Miners ETF (LITP) and Sprott Nickel Miners

ETF (NIKL). Before investing, you should consider each Fund’s

investment objectives, risks, charges and expenses. Each Fund’s

prospectus contains this and other information about the Fund and

should be read carefully before investing.

Prospectuses can be obtained by

calling 888.622.1813 or by

visiting https://sprottetfs.com/setm/prospectus,

https://sprottetfs.com/urnm/prospectus, https://sprottetfs.com/urnj/prospectus, https://sprottetfs.com/copp/prospectus,

https://sprottetfs.com/copj/prospectus,

https://sprottetfs.com/litp/prospectus or

https://sprottetfs.com/nikl/prospectus.

The Funds are not suitable for all investors. There are

risks involved with investing in ETFs, including the loss of money.

The Funds are non-diversified and can invest a greater portion of

assets in securities of individual issuers than a diversified fund.

As a result, changes in the market value of a single investment

could cause greater fluctuations in share price than would occur in

a diversified fund.

Exchange Traded Funds (ETFs) are bought and sold

through exchange trading at market price (not NAV) and are not

individually redeemed from the Fund. Shares

may trade at a premium or discount to their NAV in the secondary

market. Brokerage commissions will reduce returns. “Authorized

participants” may trade directly with the Fund, typically in blocks

of 10,000 shares.

Funds that emphasize investments in small/mid-cap companies will

generally experience greater price volatility. Diversification does

not eliminate the risk of experiencing investment losses. ETFs are

considered to have continuous liquidity because they allow for an

individual to trade throughout the day. A higher portfolio turnover

rate may indicate higher transaction costs and may result in higher

taxes when Fund shares are held in a taxable account. These costs,

which are not reflected in annual fund operating expenses, affect

the Fund’s performance.

Nasdaq®, Nasdaq Sprott Energy Transition Materials™ Index,

NSETM™, Nasdaq Sprott Junior Uranium Miners™ Index, NSURNJ™, Nasdaq

Sprott Copper Miners™ Index, NSCOPP™, Nasdaq Sprott Junior Copper

Miners™ Index, NSCOPJ™, Nasdaq Sprott Lithium Miners™ Index,

NSLITP™, Nasdaq Sprott Nickel Miners™ index and

NSNIKL™ are registered trademarks of Nasdaq, Inc. (which, with

its affiliates, is referred to as the “Corporations”) and are

licensed for use by Sprott Asset Management LP. The Product(s) have

not been passed on by the Corporations as to their legality or

suitability. The Product(s) are not issued, endorsed, sold, or

promoted by the Corporations. THE CORPORATIONS MAKE NO

WARRANTIES AND BEAR NO LIABILITY WITH RESPECT TO THE

PRODUCT(S).

ALPS Distributors, Inc. is the Distributor for the Sprott Funds

Trust and is a registered broker-dealer and FINRA Member. Sprott

Asset Management USA, Inc. is the Investment Adviser to the Sprott

ETFs.

ALPS Distributors, Inc. is not affiliated with Sprott Asset

Management LP.

© 2024 Sprott Inc. All rights reserved.

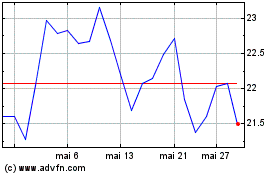

Sprott Physical Uranium (TSX:U.U)

Graphique Historique de l'Action

De Nov 2024 à Déc 2024

Sprott Physical Uranium (TSX:U.U)

Graphique Historique de l'Action

De Déc 2023 à Déc 2024