Wesdome Gold Mines Ltd. (TSX: WDO) (“Wesdome” or the “Company”)

today announces results from the initial sill development on the

Falcon 7 Zone at the Company’s wholly-owned Eagle River Mine near

Wawa, Ontario.

Falcon 7 Zone

The Falcon 7 Zone was discovered in 2019 and now initial sill

development has been completed on the 622 and 635 levels in

preparation for mining in Q4. Chip sampling and test holes during

the initial development confirms earlier exploration drill results

by returning high gold grades over continuous strike length

(Figures 1 - 5). The 2020 mineral reserves for the Falcon 7 were

136,344 tonnes grading 19.7 g/t Au totalling 86,177 ounces.

Expansion and definition drilling are ongoing.

Historically, mineralization of the Eagle River Mine has been

hosted in the mine diorite; however, the Falcon 7 Zone is hosted in

volcanic rocks west of the intrusion. Hence, the discovery and

subsequent development of the Falcon 7 Zone is important to the

Company as it highlights the prospectivity of the volcanic rocks

both to the east and west to host additional gold mineralization

beyond the currently existing footprint of the Eagle River Mine.

Consequently, near-mine exploration is continuing and is focusing

on the adjacent Falcon 300 Zone; further exploration work targets

the westerly along strike extension of the Falcon structure where

limited drilling has returned several encouraging results in

volcanic rocks.

Highlights of the recent development are found below, detailed

assay results are listed in Tables 1 and 2.

622 Level – Chip sampling yielded 54.3 grams of gold per tonne

(g/t Au) (uncapped) and 37.9 g/t Au (capped at 125 g/t Au) over an

average thickness of 2.1 metres (m) over a continuous strike length

of 75.6 m.

- Sill 622-720-311 Line#L31: 178.5 g/t

Au (99.6 g/t Au capped) over 2.0 m.

- Sill 622-720-311 Line #L03: 92.8 g/t

Au (62.4 g/t Au capped) over 6.2 m.

635 Level – Chip sampling yielded 67.3 g/t Au (uncapped) and

34.3 g/t Au (capped) over an average thickness of 1.9 m over 61.0

m.

- Sill 635-720-L04W: 168.8 g/t Au (88.2 g/t Au capped) over 2.0

m.

- Sill 635-720-L03W: 265.6 g/t Au (71.2 g/t Au capped) over 1.5

m.

Mr. Duncan Middlemiss, President and CEO commented," We are

pleased with the development of the Falcon 7 Zone that will bring

to Eagle another high-grade mining front at a reserve grade of

almost 20 g/t. We expect to start production activities in the 4th

quarter and going forward, Falcon will comprise a significant

portion of the mill feed at Eagle River. Further, the discovery and

imminent production from the Falcon 7 Zone reaffirms the potential

of the surrounding volcanic rocks to host sizeable deposits of gold

mineralization and I remain encouraged with our ongoing surface

exploration outside of the mine diorite.”

The stated goal of the Company is to increase production of the

Eagle River Mine to approximately 100,000 oz per year. To achieve

this goal consistently over the next years, operations within the

mine need to be spread out so bottle necks can be avoided. The

Falcon 7 Zone development is an important aspect of this

operational planning as it is situated away from the main mining

area at depth thereby providing a separate work area away from

heavier mine traffic.

The underground development at Falcon on the western extent of

the mine also provides an opportunity to target by drilling the

structures west of the mine diorite in a region of the mine that

has historically had very little attention. In the event of a

successful exploration campaign the development in this area would

provide easy access.

TECHNICAL DISCLOSURE

Samples are transported in sealed bags to the Eagle River Mine

assay office in Wawa, Ontario. Samples are analyzed for gold using

standard fire assay technique with gravimetric finish. The

performance of the Wesdome Laboratory is monitored through the

implementation of a quality assurance - quality control (QA-QC)

program designed to follow industry best practices. Wesdome inserts

blanks and certified reference standards into the sample sequence

for quality control at the laboratory. The QA/QC procedure is

described in more detail in the 2016 Technical Report filed on

SEDAR on March 17, 2016

The technical content of this release has been compiled,

reviewed, and approved by Michael Michaud, P.Geo., Vice President,

Exploration of the Company and a "Qualified Person" as defined in

National Instrument 43-101 -Standards of Disclosure for Mineral

Projects.

COVID-19

The health and safety of our employees,

contractors, vendors, and consultants is the Company’s top

priority. In response to the COVID-19 pandemic, Wesdome has adopted

all public health guidelines at its mine operations and corporate

offices. In addition, our internal COVID-19 Taskforce continues to

monitor developments and implement policies and programs intended

to protect those who are engaged in business with the Company.

Through care and planning, to date the Company

has successfully maintained operations; however, there can be no

assurance that this success will continue despite our best efforts.

Future conditions may warrant reduced or suspended production

activities which could negatively impact our ability to maintain

projected timelines and objectives. Consequently, the Company’s

actual future production and production guidance is subject to

higher levels of risk than usual. We are continuing to monitor the

situation closely and will provide updates as they become

available.

ABOUT WESDOME

Wesdome is Canadian focused with two producing

underground gold mines. The Company’s strategy is to build Canada’s

next intermediate gold producer, producing 200,000+ ounces from two

mines in Ontario and Québec. The Eagle River Underground Mine in

Wawa, Ontario is currently producing gold at a rate of 92,000 –

105,000 ounces per year. The Kiena Complex is a fully permitted

mine with a 930-metre shaft and 2,000 tonne-per-day mill, and a

restart of operations was announced on May 26, 2021. The Company

has completed a PFS in support of the production restart decision.

Wesdome is actively exploring both underground and on surface

within the mine area and more regionally at both the Eagle River

and Kiena Complex. The Company also retains meaningful exposure to

the Moss Lake gold deposit, located 100 kilometres west of Thunder

Bay, Ontario through its equity position in Goldshore Resources

Inc. The Company has approximately 140.0 million shares issued and

outstanding and trades on the Toronto Stock Exchange under the

symbol “WDO”.

For further information, please

contact:

| Duncan

Middlemiss |

or |

Lindsay

Carpenter Dunlop |

| President and CEO |

|

VP Investor Relations |

| 416-360-3743 ext. 2029 |

|

416-360-3743 ext. 2025 |

| duncan.middlemiss@wesdome.com |

|

lindsay.dunlop@wesdome.com |

220 Bay Street, Suite 1200Toronto, ON, M5J

2W4Toll Free: 1-866-4-WDO-TSXPhone: 416-360-3743, Fax:

416-360-7620Website: www.wesdome.com

This news release contains “forward-looking information”, which

may include, but is not limited to, statements with respect to the

future financial or operating performance of the Company and its

projects. Often, but not always, forward-looking statements can be

identified by the use of words such as “plans”, “expects”, “is

expected”, “budget”, “scheduled”, “estimates”, “forecasts”,

“intends”, “anticipates”, or “believes” or variations (including

negative variations) of such words and phrases, or statements that

certain actions, events or results “may”, “could”, “would”, “might”

or “will” be taken, occur or be achieved. Forward-looking

statements involve known and unknown risks, uncertainties, and

other factors, which may cause the actual results, performance or

achievements of the Company to be materially different from any

future results, performance or achievements expressed or implied by

the forward-looking statements. Forward-looking statements

contained herein are made as of the date of this press release, and

the Company disclaims any obligation to update any forward-looking

statements, whether as a result of new information, future events

or results, or otherwise. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. The Company undertakes no

obligation to update forward-looking statements if circumstances,

management’s estimates or opinions should change, except as

required by securities legislation. Accordingly, the reader is

cautioned not to place undue reliance on forward-looking

statements. The Company has included in this news release certain

non-IFRS performance measures, including, but not limited to, mine

operating profit, mining and processing costs and cash costs. Cash

costs per ounce reflect actual mine operating costs incurred during

the fiscal period divided by the number of ounces produced. These

measures are not defined under IFRS and therefore should not be

considered in isolation or as an alternative to or more meaningful

than, net income (loss) or cash flow from operating activities as

determined in accordance with IFRS as an indicator of the Company’s

financial performance or liquidity. The Company believes that, in

addition to conventional measures prepared in accordance with IFRS,

certain investors use this information to evaluate the Company's

performance and ability to generate cash flow

Table 1 - Sill Development Chip Sample Results – Falcon

7 Zone – 622 Level

| |

622-720 Sill

(Falcon) |

| Insitu Thickness and

Grades (cut 125g/t) |

|

Line |

Thickness |

Uncut |

Cut 125 |

|

622-720-L03 |

6.20 |

92.79 |

62.38 |

|

622-720-L04 |

4.50 |

68.96 |

60.68 |

|

622-720-L05 |

3.40 |

27.68 |

14.46 |

|

622-720-L06 |

1.50 |

1.67 |

1.67 |

|

622-720-L07 |

1.50 |

23.14 |

23.14 |

|

622-720-L08 |

1.50 |

38.54 |

38.54 |

|

622-720-L09 |

1.50 |

97.55 |

52.87 |

|

622-720-L10 |

1.50 |

23.87 |

23.87 |

|

622-720-L11 |

1.50 |

35.69 |

35.69 |

|

622-720-L13 |

1.50 |

14.79 |

14.79 |

|

622-720-L14 |

1.50 |

32.60 |

27.89 |

|

622-720-L15 |

1.50 |

146.77 |

29.20 |

|

622-720-L16 |

1.50 |

4.00 |

4.00 |

|

622-720-L17 |

1.50 |

5.55 |

5.55 |

|

622-720-L18 |

1.80 |

65.72 |

54.40 |

|

622-720-L19 |

1.80 |

56.69 |

54.91 |

|

622-720-L20 |

1.60 |

0.84 |

0.84 |

|

622-720-L21 |

1.50 |

6.10 |

6.10 |

|

622-720-L24 |

2.20 |

106.87 |

60.23 |

|

622-720-L25 |

2.60 |

73.47 |

68.41 |

|

622-720-L26 |

1.80 |

13.52 |

13.52 |

|

622-720-L29 |

2.30 |

7.85 |

7.85 |

|

622-720-L30 |

1.50 |

17.99 |

17.99 |

|

622-720-L31 |

2.00 |

178.46 |

99.62 |

|

Average |

2.07 |

54.31 |

37.85 |

* The quoted average width is based on vein

material and gold mineralization in the adjacent host rock over a

1.5m minimum thickness.

Table 2 - Sill Development Chip Sample Results – Falcon

7 Zone – 635 Level

| |

635-720 Sill

(Falcon) |

| Insitu Thickness and

Grades (cut 125g/t) |

|

Line |

Thickness |

Uncut |

Cut 125 |

|

635-720-L01E |

1.50 |

9.12 |

9.12 |

|

635-720-L02E |

1.50 |

96.06 |

51.57 |

|

635-720-L03E |

1.50 |

11.57 |

11.57 |

|

635-720-L01W |

1.50 |

18.27 |

18.27 |

|

635-720-L02W |

1.50 |

176.17 |

66.97 |

|

635-720-L03W |

1.50 |

265.58 |

71.26 |

|

635-720-L04W |

2.00 |

168.81 |

88.24 |

|

635-720-L05W |

1.80 |

9.72 |

9.72 |

|

635-720-L06W |

1.50 |

154.26 |

50.26 |

|

635-720-L07W |

2.90 |

46.24 |

28.05 |

|

635-720-L08W |

1.60 |

17.16 |

17.16 |

|

635-720-L10W |

3.50 |

40.50 |

40.50 |

|

635-720-L13W |

2.60 |

10.00 |

10.00 |

|

635-720-L14W |

2.10 |

17.14 |

17.14 |

|

Average |

1.93 |

67.29 |

34.26 |

* The quoted average width is based on vein

material and gold mineralization in the adjacent host rock over a

1.5m minimum thickness.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8db51d9-9963-4889-a22f-217cc329b5ba

https://www.globenewswire.com/NewsRoom/AttachmentNg/c1a494d8-0bea-49e0-a628-3c2b55f86663

https://www.globenewswire.com/NewsRoom/AttachmentNg/9d0342fc-763a-43ab-8390-cd4d69aa3060

https://www.globenewswire.com/NewsRoom/AttachmentNg/72487e2a-9732-4824-93b0-16225a6c3c4c

PDF available:

http://ml.globenewswire.com/Resource/Download/a9d9e5a8-b67c-4cb2-9459-8d25208816e0

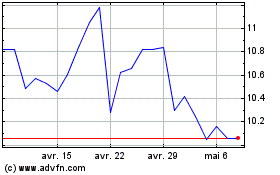

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Mar 2024 à Avr 2024

Wesdome Gold Mines (TSX:WDO)

Graphique Historique de l'Action

De Avr 2023 à Avr 2024