AuEx Ventures, Inc.: New Long Canyon Drill Hole Returns 0.154 Opt Over 210 Feet

20 Juillet 2010 - 4:00PM

Marketwired

AuEx Ventures, Inc. ("AuEx" or the "Company") (TSX: XAU) is pleased

to report new gold intercepts from drilling completed northeast of

the known resource area at the Company's 49% owned Long Canyon gold

exploration project located within the Pequop Gold District in Elko

County, Nevada. These intercepts include hole LC444 with 0.154

ounces per ton gold over 210 feet, hole LC462 with 0.259 ounces per

ton gold over 65 feet, and hole LC459 with 0.175 ounces per ton

gold over 88.5 feet. These holes are all infill to the previously

reported large step-outs and suggest significant resource expansion

potential in the NE sector resulting from these continued large

grade thickness intercepts of classic, oxidized, Carlin-style gold

mineralization.

---------------------------------------------------------------------------

Inter- Inter-

cept cept

Hole ID From To Length Au From To Length Au

---------------------------------------------------------------------------

(feet) (feet) (feet) (oz/t) (metres) (metres) (metres) (g/t)

---------------------------------------------------------------------------

LC443C 391.0 474.0 83 0.175 119.2 144.5 25.3 5.98

---------------------------------------------------------------------------

incl 451.5 457.0 5.5 0.619 137.6 139.3 1.7 21.20

---------------------------------------------------------------------------

LC444C 617.0 827.0 210 0.154 188.1 252.1 64.0 5.27

---------------------------------------------------------------------------

incl 776.0 794.0 18 0.473 236.5 242.0 5.5 16.19

---------------------------------------------------------------------------

LC459C 326.0 414.5 88.5 0.175 99.4 126.3 27.0 5.99

---------------------------------------------------------------------------

including 351.5 371.0 19.5 0.317 107.1 113.1 5.9 10.86

---------------------------------------------------------------------------

LC462C 457.0 522.0 65 0.259 139.3 159.1 19.8 8.87

---------------------------------------------------------------------------

including 501.0 517.0 16 0.531 152.7 157.6 4.9 18.17

---------------------------------------------------------------------------

LC466C 437.0 492.0 55 0.054 133.2 150.0 16.8 1.84

---------------------------------------------------------------------------

LC476C 447.0 515.0 68 0.152 136.2 157.0 20.7 5.21

---------------------------------------------------------------------------

including 477.0 504.0 27 0.292 145.4 153.6 8.2 10.01

---------------------------------------------------------------------------

LC477C 563.0 604.0 41 0.247 171.6 184.1 12.5 8.46

---------------------------------------------------------------------------

LC478C 422.0 495.0 73 0.150 128.6 150.9 22.3 5.14

---------------------------------------------------------------------------

including 437.0 442.0 5 0.642 133.2 134.7 1.5 22.00

---------------------------------------------------------------------------

LC480 450.0 565.0 115 0.073 137.2 172.2 35.1 2.49

---------------------------------------------------------------------------

including 510.0 535.0 25 0.204 155.4 163.1 7.6 6.97

---------------------------------------------------------------------------

and 875.0 1020.0 145 0.035 266.7 310.9 44.2 1.20

---------------------------------------------------------------------------

LC488C 517.0 527.0 10 0.029 157.6 160.6 3.0 1.01

---------------------------------------------------------------------------

LC492 340.0 345.0 5 0.045 103.6 105.2 1.5 1.54

---------------------------------------------------------------------------

LC495C 353.0 368.0 15 0.121 107.6 112.2 4.6 4.15

---------------------------------------------------------------------------

and 381.0 398.5 17.5 0.208 116.1 121.5 5.3 7.11

---------------------------------------------------------------------------

LC500C 371.0 418.0 47 0.150 113.1 127.4 14.3 5.14

---------------------------------------------------------------------------

LC505C 348.5 367.5 19 0.052 106.2 112.0 5.8 1.79

---------------------------------------------------------------------------

LC516 870.0 1005.0 135 0.081 265.2 306.3 41.1 2.78

---------------------------------------------------------------------------

including 940.0 960.0 20 0.310 286.5 292.6 6.1 10.61

---------------------------------------------------------------------------

True widths of the mineralized intervals will be determined by geologic

modeling. The intercept calculations use a cut-off grade of 0.30 g/t gold.

Results less than 1 g/t are not reported in this press-release table. "C"

indicates core holes.

Drill holes LC460-461, LC465, LC467C, LC468-470, LC472-LC473,

LC475, LC479, LC481C, LC482-483, LC486-LC487, LC489-490, LC494,

LC496-LC497, LC499, LC501, LC503-LC504, LC507-LC508 and LC512-LC514

had no reportable intercepts. A drill hole location map is attached

and posted on the Company's website. To view the map, please click

on the following link:

http://media3.marketwire.com/docs/xau719.pdf

Ronald L. Parratt, Certified Professional Geologist, is the

Company's designated Qualified Person for this news release.

Drilling activity currently underway at Long Canyon includes 5

drill rigs conducting primarily resource definition and resource

expansion mostly in the northeastern portion of the deposit. To

date more than 99,000 feet (30,000 meters) of drilling has been

completed of a planned 149,000 feet (45,000 meters). Current work

also includes a 6 inch core program to source material for further

metallurgical test work. This material will supplement four, 15 ton

samples which were recovered from outcrop earlier this year. All of

this material will be used for further column leach testing to

confirm gold recoveries. Metallurgical test work completed to date

indicates that mineralization is treatable using conventional gold

recovery techniques.

The growing Long Canyon gold deposit consists of multiple,

sub-parallel northeast-directed zones of oxidized Carlin-style gold

mineralization aggregating 800 to 1,000 feet (240 to 300 meters) in

width with a current strike length of approximately 1.70 miles (2.7

km) that remains open to extension. Mineralization outcrops in the

central portion of the deposit, plunges shallowly to the northeast

and is amenable to open pit mining. In addition, significant

untested exploration potential is still apparent within the 12,000

acre property based on geological mapping and surface sampling.

As reported to AuEx by Fronteer Gold, 51% owner and operator,

all drill samples were collected following standard industry

practice and assayed by ALS Chemex of Reno, Nevada. Gold results

were determined using standard fire assay techniques on a 30 gram

sample with an atomic absorption finish. Samples exceeding 5 grams

per tonne gold were re-assayed using a gravimetric finish and the

values received were reported in the averages. QA/QC included the

insertion of numerous standards and blanks into the sample stream,

and a check assaying program that is underway at another

laboratory. A table containing all drill results to date using a

0.3 gram/tonne cutoff is posted on the Company's website. All data,

as reported to the Company by Fronteer and disclosed in this press

release, including sampling, analytical and test data, have been

reviewed by the Company's qualified person Mr. Eric M. Struhsacker,

M.Sc., and Certified Professional Geologist as recognized by the

American Institute of Professional Geologists. Further details

concerning the Long Canyon property are described in the Company's

National Instrument 43-101 report filed on Sedar and posted on the

Company's website at www.auex.com.

AuEx Ventures, Inc. is a TSX listed precious metals exploration

company that has a current portfolio of twenty one exploration

projects in Nevada/Utah, one project in Spain and four projects in

Argentina. The Company controls about 167,000 acres of unpatented

mining claims and fee land in Nevada. Fifteen of the projects are

in joint venture or exploration earn-in agreements with eight

companies. The Company applies the extensive Nevada exploration

experience and high-end technical skills of its founders to search

for and acquire new precious metal exploration projects that are

then offered for joint venture.

AuEx Ventures, Inc.

Ronald L. Parratt, President and CEO

This release includes certain statements that may be deemed to

be "forward-looking statements" within the meaning of the U.S.

Private Securities Litigation Reform Act of 1995. All statements in

this release, other than statements of historical facts, that

address future production, reserve potential, exploration and

development activities and events or developments that the Company

expects, are forward-looking statements. Although the management of

AuEx believes the expectations expressed in such forward-looking

statements are based on reasonable assumptions, such statements are

not guarantees of future performance, and actual results or

developments may differ materially from those in the

forward-looking statements. Factors that could cause actual results

to differ materially from those in forward-looking statements

include market prices, exploration and development successes,

continued availability of capital and financing, and general

economic, market or business conditions. Please see our public

filings at www.sedar.com for further information. This press

release uses the terms "indicated resources" and "inferred

resources", which are calculated in accordance with the Canadian

National Instrument 43-101 and the Canadian Institute of Mining and

Metallurgy Classification system. We advise investors that while

those terms are recognized and required by Canadian regulations,

the U.S. Securities and Exchange Commission does not recognize

them. U.S. investors are cautioned not to assume that any part or

all of mineral deposits in these categories will ever be converted

into reserves. In addition, "Inferred resources" have a great

amount of uncertainty as to their existence, and great uncertainty

as to their economic and legal feasibility. It cannot be assumed

that all or any part of an Inferred Mineral Resource will ever be

upgraded to a higher category. Under Canadian rules, estimates of

Inferred Mineral Resources may not form the basis of feasibility or

pre-feasibility studies, except in rare cases. U.S. investors are

cautioned not to assume that part or all of an inferred resource

exists, or is economically or legally minable.

Contacts: AuEx Ventures, Inc. Ronald L. Parratt 775-337-1545

rparratt@auex.com www.auex.com

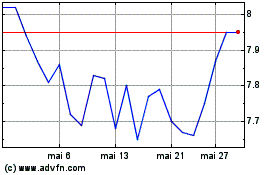

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Mai 2024 à Juin 2024

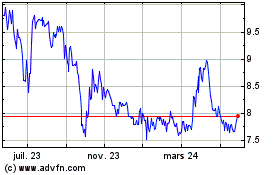

GoldMoney (TSX:XAU)

Graphique Historique de l'Action

De Juin 2023 à Juin 2024