Xtract One Technologies Inc. (TSX: XTRA) (OTCQX: XTRAF) (FRA: 0PL)

(“Xtract One” or the “Company”) a leading technology-driven threat

detection and security solution that prioritizes the patron access

experience by leveraging artificial intelligence (AI), today

announced its annual results for the year ended July 31, 2024. All

information is in Canadian dollars unless otherwise indicated.

“What a year it’s been! With record results

across the board, we continue to make progress towards

profitability through operational execution and higher top line

growth,” stated Peter Evans, Chief Executive Officer of Xtract One.

“Revenue for the year was $16.4 million – quadruple that of last

year – while our combined backlog rose to $26.8 million, reflecting

strong demand across all vertical markets. We’re positioning the

Company for continued expansion going forward as we are seeing

growing interest from all types of customers – stadiums and arenas

to schools, business centers, and factories – putting us on track

for even greater performance in fiscal 2025.”

“To add further momentum to this success, the

recent introduction of Xtract One Gateway will significantly expand

our addressable market, and win rate in those markets, by improving

the Company’s competitive positioning. Xtract One Gateway will

allow high-traffic facilities like schools, convention centers, and

commercial properties to quickly screen patrons who may have

laptops, tablets or other large metallic objects while still

accurately detecting weapons. As the only product on the market

with these capabilities, it’s clearly transformational for us and

the industry.”

Fiscal 2024 Annual

Highlights

- Record revenue of $16.4 million for

the year ended July 31, 2024 versus $4.1 million in the prior

fiscal year

- Gross profit margin of 63% for the

year ended July 31, 2024 versus 60% in the prior fiscal year

- Total contract value of new

bookings1 was $29.8 million for the year ended July 31, 2024 as

compared to $15.0 million during the prior fiscal year

- Platform contractual backlog was

$13.8 million at the end of fiscal 2024 as compared to $4.1 million

at the end of fiscal 2023. This excludes an additional $13.0

million of agreements pending installation1 at the end of fiscal

2024 versus $10.4 million at the end of fiscal 2023

- Loss and comprehensive loss was

$11.1 million for the year ended July 31, 2024 as compared to $16.3

million for the prior year

- Subsequent to July 31, 2024, the

Company launched Xtract One Gateway, with advanced bi-directional

configurable screening and proprietary sensors, for precise weapons

detection at locations where users carry a medium volume of

personal items such as laptops

Fourth Quarter Highlights

- Record quarterly revenue of $5.6

million for the three months ended July 31, 2024 versus $1.8

million in the prior year period

- Gross profit margin of 65% for the

fourth quarter versus 70% in the prior year period

- Total contract value of new

bookings1 was $5.6 million for the three months ended July 31, 2024

as compared to $5.2 million for the prior year period

- Loss and comprehensive loss was

$2.4 million for the three months ended July 31, 2024 as compared

to $3.3 million for the same period in fiscal 2023

This press release should be read in conjunction

with the Company’s Annual Consolidated Financial Statements,

prepared in accordance with International Financial Reporting

Standards (“IFRS”) and the Company’s Management’s Discussion and

Analysis for the years ended July 31, 2024 and 2023, which can be

found under the Company’s profile on SEDAR+ at

www.sedarplus.ca.

Conference Call Details

Xtract One will host a conference call to

discuss its results on October 25, 2024 at 10:00 am ET. Peter

Evans, CEO and Director, and Karen Hersh, CFO and Corporate

Secretary, will provide an overview of the financial results along

with management’s outlook for the business, followed by a

question-and-answer period.

The webcast and presentation will be accessible

on the Company’s website. The webcast can be accessed here and the

telephone number for the conference call is 844-481-3016

(412-317-1881 for international callers).

About Xtract One

Technologies

Xtract One Technologies is a leading

technology-driven provider of threat detection and security

solutions leveraging AI to deliver seamless and secure experiences.

The Company makes unobtrusive weapons and threat detection systems

that enable facility operators to prioritize and deliver improved

“Walk-right-In” experiences while providing unprecedented safety.

Xtract One's innovative portfolio of AI-powered Gateway solutions

excels at allowing facilities to discreetly screen and identify

weapons and other threats at points of entry and exit without

disrupting the flow of traffic. With solutions built to serve the

unique market needs for schools, hospitals, arenas, stadiums,

manufacturing, distribution, and other customers, Xtract One is

recognized as a market leader delivering the highest security in

combination with the best individual experience. For more

information, visit www.xtractone.com or connect on Facebook, X, and

LinkedIn.

For further information, please contact:

Xtract One Inquiries: info@xtractone.com,

http://www.xtractone.com

Media Contact: Kristen Aikey, JMG Public

Relations, 212-206-1645, kristen@jmgpr.comInvestor

Relations: Chris Witty, Darrow Associates, 646-438-9385,

cwitty@darrowir.com

1 Supplementary

Financial MeasuresThe Company utilizes specific

supplementary financial measures in this earnings release to allow

for a better evaluation of the operating performance of the

Company’s business and facilitates meaningful comparison of results

in the current period with those in prior periods and future

periods. Supplementary financial measures do not have any

standardized meaning prescribed under IFRS and therefore may not be

comparable to measures presented by other companies. Supplementary

financial measures presented in this earnings release include

‘Agreements pending installation’ and ‘Total contract value of new

bookings.’ Agreements pending installation reflects total value of

signed contracts awarded to the Company that has not been installed

at the customer site. ‘Total contract value of new bookings’ is

comprised of all new contracts signed and awarded to the Company,

regardless of the performance obligations outstanding as of the end

of the reporting period. Total contract value is the aggregate

value of sales commitments from customers as at the end of the

reporting period without consideration of the Company’s completion

of the associated performance obligations outlined in each

contract.

Forward Looking Statements

This news release contains forward-looking

statements within the meaning of applicable securities laws that

are not historical facts. Forward-looking statements are often

identified by terms such as “will”, “may”, “should”, “anticipates”,

“expects”, “believes”, and similar expressions or the negative of

these words or other comparable terminology. All statements other

than statements of historical fact, included in this release are

forward-looking statements that involve risks and uncertainties.

There can be no assurance that such statements will prove to be

accurate and actual results and future events could differ

materially from those anticipated in such statements. Important

factors that could cause actual results to differ materially from

the Company’s expectations include but are not limited to the risks

detailed from time to time in the continuous disclosure filings

made by the Company with securities regulations. The reader is

cautioned that assumptions used in the preparation of any

forward-looking information may prove to be incorrect. Events or

circumstances may cause actual results to differ materially from

those predicted, as a result of numerous known and unknown risks,

uncertainties, and other factors, many of which are beyond the

control of the Company. The reader is cautioned not to place undue

reliance on any forward-looking information. Such information,

although considered reasonable by management at the time of

preparation, may prove to be incorrect and actual results may

differ materially from those anticipated. Forward-looking

statements contained in this news release are expressly qualified

by this cautionary statement. The forward-looking statements

contained in this news release are made as of the date of this news

release and the Company will update or revise publicly any of the

included forward-looking statements only as expressly required by

applicable law.

No securities exchange or commission has

reviewed or accepts responsibility for the adequacy or accuracy of

this release.

Consolidated Statements of Loss and

Comprehensive Loss for the Years Ended July 31, 2024 and

2023

The following table is extracted from the

Company’s consolidated financial statements and presented in

Canadian dollars to demonstrate the Statements of Loss and

Comprehensive loss for the years ended July 31, 2024 and 2023:

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

Revenue |

|

|

|

|

|

|

Platform revenue |

|

$ |

15,969,996 |

|

|

$ |

3,596,999 |

|

|

|

Xtract revenue |

|

|

388,011 |

|

|

|

514,245 |

|

|

|

Total revenue |

|

$ |

16,358,007 |

|

|

$ |

4,111,244 |

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

|

|

|

|

Platform cost of revenue |

|

$ |

5,858,611 |

|

|

$ |

1,383,623 |

|

|

|

Xtract cost of revenue |

|

|

241,377 |

|

|

|

242,724 |

|

|

|

Total cost of revenue |

|

$ |

6,099,988 |

|

|

$ |

1,626,347 |

|

|

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

10,258,019 |

|

|

$ |

2,484,897 |

|

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

Selling and marketing |

|

$ |

5,593,432 |

|

|

$ |

4,566,130 |

|

|

|

General and administration |

|

|

7,479,609 |

|

|

|

6,813,847 |

|

|

|

Research and development |

|

|

8,265,043 |

|

|

|

7,078,280 |

|

|

|

Loss on inventory write-down |

|

|

175,042 |

|

|

|

346,374 |

|

|

|

Loss on retirement of assets |

|

|

95,066 |

|

|

|

181,107 |

|

|

|

Total operating expenses |

|

$ |

21,608,192 |

|

|

$ |

18,985,738 |

|

|

|

|

|

|

|

|

|

|

|

Loss from operations |

|

|

(11,350,173 |

) |

|

|

(16,500,841 |

) |

|

|

|

|

|

|

|

|

|

|

Other income (loss) |

|

|

|

|

|

|

Unrealized gain on investments |

|

|

- |

|

|

|

58,333 |

|

|

|

Realized loss on investment |

|

|

- |

|

|

|

(55,082 |

) |

|

|

Interest and other income |

|

|

285,318 |

|

|

|

161,117 |

|

|

|

|

|

|

|

|

|

|

|

Loss and comprehensive loss for the year |

|

|

$ |

(11,064,855 |

) |

|

$ |

(16,336,473 |

) |

|

|

|

|

|

|

|

|

|

|

Weighted average number of shares |

|

|

203,820,258 |

|

|

|

176,664,492 |

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share |

|

$ |

(0.05 |

) |

|

$ |

(0.09 |

) |

|

| |

|

|

|

|

|

|

Consolidated Statements of Financial

Position as at July 31, 2024 and 2023

The following table is extracted from the

Company’s consolidated financial statements and presented in

Canadian dollars to demonstrate the Company’s financial position as

at July 31, 2024 and July 31, 2023:

|

|

|

July 31, 2024 |

|

July 31, 2023 |

|

Assets |

|

|

|

|

Current assets |

|

|

|

|

|

Cash and cash equivalents |

$ |

8,628,521 |

|

|

$ |

8,327,449 |

|

|

|

Receivables |

|

3,862,199 |

|

|

|

847,429 |

|

|

|

Prepaid expenses and deposits |

|

949,012 |

|

|

|

1,026,668 |

|

|

|

Current portion of deferred cost of revenue |

|

371,309 |

|

|

|

- |

|

|

|

Inventory |

|

3,688,246 |

|

|

|

1,602,971 |

|

|

|

|

|

|

|

|

|

|

|

17,499,287 |

|

|

|

11,804,517 |

|

|

|

|

|

|

|

|

Property and equipment |

|

2,135,956 |

|

|

|

2,063,817 |

|

|

Intangible assets |

|

4,465,755 |

|

|

|

4,843,700 |

|

|

Non-current portion of deferred cost of revenue |

|

496,868 |

|

|

|

- |

|

|

Right of use assets |

|

344,304 |

|

|

|

286,796 |

|

|

|

|

|

|

|

|

Total assets |

$ |

24,942,170 |

|

|

$ |

18,998,830 |

|

|

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

|

Accounts payable and accrued liabilities |

$ |

3,991,292 |

|

|

$ |

2,519,350 |

|

|

|

Current portion of deferred revenue |

|

3,443,524 |

|

|

|

968,509 |

|

|

|

Current portion of lease liability |

|

190,400 |

|

|

|

232,483 |

|

|

|

|

|

|

|

|

|

|

|

7,625,216 |

|

|

|

3,720,342 |

|

|

|

|

|

|

|

|

Non-Current liabilities |

|

|

|

|

|

Non-current portion of deferred revenue |

|

3,155,579 |

|

|

|

411,232 |

|

|

|

Non-current portion of lease liability |

|

190,526 |

|

|

|

124,358 |

|

|

|

|

|

|

|

|

|

|

$ |

10,971,321 |

|

|

$ |

4,255,932 |

|

|

|

|

|

|

|

|

Shareholders' equity |

|

|

|

|

|

Share capital |

$ |

144,372,452 |

|

|

$ |

135,823,337 |

|

|

|

Contributed surplus |

|

16,163,950 |

|

|

|

14,420,259 |

|

|

|

Accumulated deficit |

|

(146,565,553 |

) |

|

|

(135,500,698 |

) |

|

|

|

|

|

|

|

|

|

$ |

13,970,849 |

|

|

$ |

14,742,898 |

|

|

|

|

|

|

|

|

Total liabilities and shareholders' equity |

$ |

24,942,170 |

|

|

$ |

18,998,830 |

|

|

|

|

|

|

|

Consolidated Statements of Cash Flows for the Years

Ended July 31, 2024 and 2023

The following table is extracted from the

Company’s consolidated financial statements and presented in

Canadian dollars to demonstrate the Company’s cash flows for the

years ended July 31, 2024 and 2023:

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

Cash flow used in operating activities |

|

|

|

|

|

|

|

Loss and comprehensive loss for the year |

|

$ |

(11,064,855 |

) |

|

$ |

(16,336,473 |

) |

|

|

|

Adjustment for: |

|

|

|

|

|

|

|

|

Share-based compensation |

|

|

1,036,744 |

|

|

|

950,536 |

|

|

|

|

|

Depreciation |

|

|

1,303,571 |

|

|

|

923,764 |

|

|

|

|

|

Amortization |

|

|

805,900 |

|

|

|

805,900 |

|

|

|

|

|

Finance cost |

|

|

22,420 |

|

|

|

42,237 |

|

|

|

|

|

Loss on inventory |

|

|

175,042 |

|

|

|

346,374 |

|

|

|

|

|

Loss on retirement of assets |

|

|

95,066 |

|

|

|

181,107 |

|

|

|

|

|

Other income |

|

|

- |

|

|

|

(20,000 |

) |

|

|

|

|

Realized loss on investments |

|

|

- |

|

|

|

55,082 |

|

|

|

|

|

Unrealized gain on investments |

|

|

- |

|

|

|

(58,333 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(7,626,112 |

) |

|

|

(13,109,806 |

) |

|

|

|

Changes in non-cash working capital |

|

|

|

|

|

|

|

|

Receivables |

|

|

(3,014,770 |

) |

|

|

1,047,727 |

|

|

|

|

|

Prepaid expenses and deposits |

|

|

77,656 |

|

|

|

(358,018 |

) |

|

|

|

|

Inventory |

|

|

(4,522,739 |

) |

|

|

(2,198,583 |

) |

|

|

|

|

Deferred cost of revenue |

|

|

250,853 |

|

|

|

- |

|

|

|

|

|

Accounts payable and accrued liabilities |

|

|

1,471,942 |

|

|

|

(99,732 |

) |

|

|

|

|

Deferred revenue |

|

|

5,219,362 |

|

|

|

1,183,090 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash used in operating activities |

|

|

(8,143,808 |

) |

|

|

(13,535,322 |

) |

|

|

|

|

|

|

|

|

|

|

|

Cash flow used in investing activities |

|

|

|

|

|

|

|

Acquisition of intangible assets |

|

|

(427,955 |

) |

|

|

- |

|

|

|

|

Acquisition of right of use asset |

|

|

(1,800 |

) |

|

|

- |

|

|

|

|

Purchase of property and equipment |

|

|

- |

|

|

|

(32,539 |

) |

|

|

|

Disposal of investment - Gemina Labs |

|

|

- |

|

|

|

397,001 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash (used in) received from investing activities |

|

|

(429,755 |

) |

|

|

364,462 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash flow from financing activities |

|

|

|

|

|

|

|

Proceeds on issue of share capital, net of share issue costs |

|

9,256,062 |

|

|

|

15,583,660 |

|

|

|

|

Lease payments |

|

|

(381,427 |

) |

|

|

(362,672 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Cash received from financing activities |

|

|

8,874,635 |

|

|

|

15,220,988 |

|

|

|

|

|

|

|

|

|

|

|

|

Net increase in cash for the year |

|

$ |

301,072 |

|

|

$ |

2,050,128 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash beginning of the year |

|

|

8,327,449 |

|

|

|

6,277,321 |

|

|

|

|

|

|

|

|

|

|

|

|

Cash end of the year |

|

$ |

8,628,521 |

|

|

$ |

8,327,449 |

|

|

|

|

|

|

|

|

|

|

|

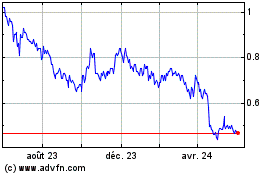

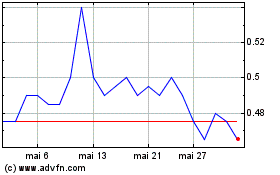

Xtract One Technologies (TSX:XTRA)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

Xtract One Technologies (TSX:XTRA)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025