Athabasca Minerals Earns Record $0.171 EPS for Fiscal 2012

20 Mars 2013 - 2:01PM

Marketwired Canada

Athabasca Minerals Inc. (the "Corporation" or "Athabasca") (TSX VENTURE:ABM) is

pleased to announce the filing of its Q4 financial results for the three months

and year-ended November 30, 2012. During the fiscal year ended November 30,

2012, Athabasca:

-- Net income of $4,710,409 during fiscal 2012, an increase of $1,929,618

or 69.4% over fiscal 2011 net income of $2,780,791;

-- experienced a 36.9% increase in tonneage from the Susan Lake pit;

-- opened three Corporate owned aggregate operations;

-- began operating its own crushing spread for processing of aggregates;

and

-- made significant steps related to its Firebag property frac sand

deposit.

In conjunction with these major accomplishments, the Corporation generated

record revenue and earnings, the Susan Lake pit recorded the second largest

amount of annual aggregate demand in its history, and the Corporation received

cash proceeds exceeding $600,000 from its work camp land use agreement. In

addition, a new potential aggregate source has been discovered north of the

Susan Lake pit, where the Corporation has identified a deposit containing

granite and dolomite with the potential to supply oil sands and infrastructure

projects in the Fort McMurray area.

The Corporation reports operating and financial results as follows:

-- Aggregate tonnes sold during Q4 2012 were 7.3% greater than during Q4

2011 (3,124,134 vs. 2,911,686 tonnes);

-- Revenue in the amount of $4,301,229 compared with $3,390,705 during Q4

2011, an increase of 26.9%;

-- Net income of $1,160,601 during Q4 2012, a decrease of $149,300 or 11.4%

under Q4 2011 net income of $1,309,901;

-- 2012 fiscal year tonnes sold were 10,936,767 compared to 7,758,612

tonnes in fiscal 2011.

"A profitable fourth quarter completed Athabasca's highly successful fiscal

2012. During the past year the Corporation has grown significantly, has

restructured its bank financing, and made capital investments which will allow

for increased future activity. In addition, we have advanced the Firebag

property frac sand deposit, and continue to evaluate and explore industrial

minerals critical to the oil sands and infrastructure projects in Western

Canada. The tempo for aggregate demand was seen to decelerate over the course of

fiscal 2012. Entering fiscal 2013, Q1 aggregate tonneage sales at Susan Lake

were less than its Q1 record set in 2012, but were still well above its Q1 2011

level. We feel the experience gained during the early operations at the Kearl

pit have allowed us to further develop plans for future operations at the pit.

We anticipate increased production of commercial grade aggregate and

improvements in efficiencies as we move forward towards achieving daily

operations," reported Dom Kriangkum, President & CEO.

During the fourth quarter Athabasca experienced higher than normal aggregate

operating expenses due primarily to unexpected challenges with opening the

Corporate owned and operated aggregate pit at Kearl. The operating expenses of

$1,328,540 were 102.1% above that in Q4 2011. Expenses were higher than expected

primarily due to challenges experienced bringing the Kearl pit into production

that were enhanced due to the winter conditions that were experienced. After a

work stoppage lasting a few months, crushing activity at Kearl pit has recently

resumed. Although start up costs have exceeded initial estimates, the relative

cost of aggregate operations at Corporate owned pits is expected to be

advantageous over sub-contracting the crushing as increased aggregate production

and efficiency improvements are realized.

Firebag property frac sand update

The Corporation made application in March 2013 to the Alberta Government for an

80 acre parcel of land contained on a portion of the Corporation's existing

12,800 hectare mineral lease referred to as the Firebag property, in conjunction

with an earlier land package application near Fort McMurray, adjacent to a

regional rail line. With this application, the Corporation intends to develop

this initial 80 acre parcel for mining of frac sand, and haul for processing at

the land package under application.

The Corporation intends to later develop a larger area of an additional 500

acres which will require an EIA as frac sand depletes from the initial 80 acre

parcel. In addition, the Corporation has commissioned an NI 43-101 report

covering a total of 500 acres at the Firebag property frac sand deposit.

The Firebag property covers a total area of 12,800 hectares on which Athabasca

holds a 100% interest in mineral leases, is accessible via Highway 63 and is

near water and power sources. Independent testing has confirmed that the silica

sand contained in this region is suitable for use in hydraulic fracing for the

oil and gas industry. The Alberta Government granted the Corporation Alberta

Metallic and Industrial Minerals Leases covering the 12,800 hectares in August

2011.

Q4 (Three months ended November 30)

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Q4 November Q4 November

30, 2012 30, 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Aggregate management fees $ 3,311,716 $ 3,390,705

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net aggregate sales $ 989,513 $ nil

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total revenue $ 4,301,229 $ 3,390,705

----------------------------------------------------------------------------

----------------------------------------------------------------------------

3,124,134 2,911,686

Total aggregate tonnes sold tonnes tonnes

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income from aggregate operations $ 612,729 $ 997,013

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (including lodging land use

agreement) $ 1,160,601 $ 1,309,901

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic income per common share $ 0.042 $ 0.048

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Year-ended November 30

----------------------------------------------------------------------------

----------------------------------------------------------------------------

2012 2011

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Aggregate management fees $ 11,682,347 $ 8,691,784

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net aggregate sales $ 3,040,328 $ nil

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Total revenue $ 14,722,675 $ 8,691,784

----------------------------------------------------------------------------

----------------------------------------------------------------------------

10,936,767 7,758,612

Total aggregate tonnes sold tonnes tonnes

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income from aggregate operations $ 3,692,390 $ 2,274,712

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Net income (including lodging land use

agreement) $ 4,710,409 $ 2,780,791

----------------------------------------------------------------------------

----------------------------------------------------------------------------

Basic income per common share $ 0.171 $ 0.103

----------------------------------------------------------------------------

----------------------------------------------------------------------------

The complete financial statements for Athabasca for the year-ended November 30,

2012 and Management's Discussion & Analysis for the same period are available

for viewing on the Corporation's website at www.athabascaminerals.com

(http://www.athabascaminerals.com) and on SEDAR at www.sedar.com

(http://www.sedar.com).

About Athabasca Minerals

Athabasca Minerals Inc. is a resource company involved in the management,

exploration and development of aggregate projects. These activities include

contracts work, aggregate pit management, new aggregate development and

acquisitions of sand and gravel operations. The Corporation also has industrial

mineral land holdings in the vicinity of Fort McMurray and Peace River, Alberta

for the purpose of locating and developing sources of industrial minerals and

aggregates essential to high growth economic development.

This news release contains forward-looking statements that involve risks and

uncertainties. Forward-looking statements or information are based on current

expectations, estimates and projections that involve a number of risks and

uncertainties which could cause actual results to differ materially from those

anticipated by the Corporation. The forward-looking statements or information

contained in this news release are made as of the date hereof and the

Corporation does not undertake any obligation to update publicly or revise any

forward-looking statements or information, whether as a result of new

information, future events or otherwise, unless so required by applicable

securities laws.

The securities of Athabasca have not been, nor will be, registered under the

United States Securities Act of 1933, as amended, and may not be offered or sold

within the United States or to, or for the account or benefit of, U.S. persons

absent U.S. registration or an applicable exemption from U.S. registration

requirements. This release does not constitute an offer for sale of securities

in the United States.

FOR FURTHER INFORMATION PLEASE CONTACT:

Boardmarker Group

Dean Stuart

403-517-2270

dean@boardmarker.net

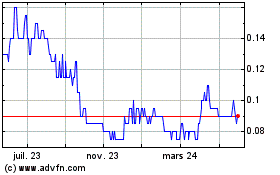

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Déc 2024 à Jan 2025

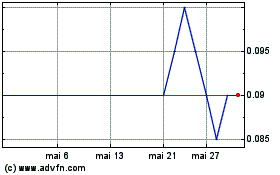

Aben Minerals (TSXV:ABM)

Graphique Historique de l'Action

De Jan 2024 à Jan 2025