July 17, 2020 -- InvestorsHub NewsWire -- via Seeking

Alpha

Jul. 16, 2020 6:00 PM ET|About: Data443 Risk Mitigation, Inc. (ATDS), Includes: ADBE, CHKP, CRWD, FB, FTNT

- Hottest video app ZOOM (ZM: NASDAQ) signs

up and now offering ATDS Cyber Security. ZOOM Puts ATDS link at top

of first page

- First NFL team, Miami Dolphins,

signs up for ATDS because it is the safest security app available.

Wave of other teams expected to follow as well as other major

league teams

- New Data Privacy laws such as the EU

GDPR and California CCPA are

fueling unprecedented demand for Cyber Security and COVID-19 driven

remote work is further fueling demand

- Open Source software model is “free” and has been enormous

growth driver in countless successful software enterprises such as

YouTube, RHAT, FB, TWTR, GOOG, NFLX, MSFT, ADBE, ORCL

- ATDS now on over 30,000 web sites with a reach to millions of

end users

- Sales increased from zero in 2018 to over $1.4 million in 2019,

and estimated 2020 sales projected at over $5 million. First

quarter 2020 was $477,877 versus $142,971 for same period 2019.

Exponential growth!

- ATDS shares have been EXTREMELY OVERSOLD down from $1.90 in

last 12 months by convertible note holders whose only goal was to

liquidate at any price and with no regard to share price. The

company has now struck a deal to halt the

aggressive selling

- BioResearchAlert finds ATDS shares undiscovered and undervalued

with current market cap of only $1.8 million and share price of 2

cents. Current market comps point to current ATDS share value over

$.40 per share and significantly higher as current growth rate

continues to accelerate

Summary

Data443 Rik Mitigation (ATDS:

OTC) is a solid and fast-growing cyber security company that

has seen its shares falling from $1.09 in the past 12 months to 1

cent within the past week. The company has been growing, but

convertible note holders have been liquidating without regard to

price and have consequently created an extremely undervalued

opportunity for investors.

Recently, ATDS has announced major news that has attracted

substantial buying resulting in share price reversing and rising to

over 2 cents with projections and target exceeding 40 cents for the

near term and substantially higher in coming months and years.

ZOOM (ZM: NASDAQ) is the most popular and fastest growing video

conferencing app leaving all others in the dust and has seen its

shares fly from $76 per share earlier this year to over $260 per

share this week.

ATDS traded 59 million shares yesterday just beginning what

appears to be a major reversal and breakout to a target of 40 cents

seeking fair market valuations based on actual industry comps.

Countless examples point to the enormous success of the “open

source” model for software apps where apps offered to users for

free have the potential to mushroom the number of users in a short

time and create value from additional offerings such as premium

upgrades or ad-free services. Examples are numerous and include

well-known names such as YouTube, RHAT, FB, TWTR, GOOG, NFLX, MSFT,

ADBE, ORCL. Each has their own unique product, but “open source” or

“free” apps is one of the primary drivers of huge growth.

Data443 Risk Mitigation (OTCPK:

ATDS) is the first to combine the growing need for new Data

Privacy with free “open source” solutions to attract a large number

of users. Underlying value to investors and to potential suitors

increases as the number of users grows, even if they are free.

WordPress powers over 1,000,000,000 websites globally and operates

its own app store like Apple and Google. In 2016, 1.5 Billion

plugins were downloaded from the WordPress.org repository alone.

Data443 has seen active users of its GDPR Framework for

WordPress go from less than 5,000 to over 30,000 in less than 1

year! ZOOM now offers DATA443 and the Miami Dolphins adoption opens

the door to the entire NFL and other sports leagues. The Company

expects to continue to expand its open source overrings

significantly this year.

The following February 23, 2020 article explains the undervalued

share price and the current market comps indicating substantially

higher valuations with the potential for unusually large gains:

Market comparisons based on actual sales demonstrate that ATDS

shares are exceptionally undervalued and when share prices catch up

with the market through investors becoming aware of this disparity,

the price has the potential to increase over 6,000% from current

levels.

With the recent increase in sales and projected strong growth

from new laws requiring the services of ATDS, and with the drastic

reduction in the number of shares reduced from 9.5 billion to about

153 million, it appears that the stage is now set for ATDS to

achieve higher prices that have the potential to challenge and even

set new highs for 2020 and 2021.

Goldman Small Cap Research published

bullish report on

ATDS.

Enviable Corporate Success Has Been Overlooked

"ATDS offers what is the longest running DRM platform for

mobile. Moreover, in its open source solution, ATDS boasts over

30,000 users---this number rivals and exceeds some of the largest

and leading companies in the space. Clearly, many are ripe for

conversion to paying customers and thousands are trusted

relationships---a highly valuable and hidden asset. New

cloud-based, multi-functional and integrated offerings are slated

to be introduced following a series of customer tests. This new

integrated platform could generate $1500/mo/per customer seeking

comprehensive data and privacy solutions," commented Goldman.

ATDS Represents an M&A Prospect

Goldman concludes, "Revenue could approach $1.8M for 2019 and

possibly $5M in 2020-the first full year that its three

acquisitions will generate revenue and organic growth is

demonstrated. This excludes potential 2H20 M&A. Based on these

forecasts, ATDS is undervalued relative to current prices and its

peer group on a pre-revenue basis. Furthermore, once additional

M&A is executed, these figures will likely have to be revised

upward. In the meantime, ATDS could be viewed as an attractive

takeover candidate. It has a large open- source user base, broad

customer base, and low relative industry valuation. An acquirer

could buy ATDS and grab tech and market share for a fraction of the

industry's valuations. Thus, opportunistic investors may view

prices represent an attractive entry point."

Current Market Comps – Price to Sales Ratio Based on

Last 12 Month Sales

Splunk - SPLK 6.75 to 1

CheckPoint – CHKP 8 to 1

CrowdStrike – CRWD 25.5 to 1

OKTA – OKTA 25 to 1

Fortinet – FTNT 8 to 1

Zscaler – ZS 23 to 1

ProofPoint – PFPT 6.3 to 1

Average Price to sales Ratio = 11.8

Current ATDS market cap is $1,530,000 with share price of $.01.

Based on reported 2019 revenues of $1.4 million and projected 2020

sales of $5 million, with current Price to Sales ratio of 11.8 to

1, ATDS shares are projected to trade at $.40 in 2020.

Business Highlights for the Third Quarter of

2019:

ATDS Expands Sales

During Q1-2020 Data443 has onboarded 9 new sales and marketing

professionals and has a continuous growing inbound funnel of

professional and capable staff team members going through the

application and assessment process at the company. “During hiring,

we look for many things – in addition to the basics of course -

attitude, the ability to respond to and execute change and quickly

cycle between product lines are major considerations for anyone

joining our team. Our methodology is being applied across all of

our product lines, so the expectations and requirements apply to

those as well.”, added Mr. Bruni.

The recently announced Global

Privacy Manager™ by Data443 product is built on the award

winning data classification platform ClassiDocs™ and Data443’s

WordPress GDPR Framework, which is currently powering more than

30,000 businesses worldwide for the EU’s GDPR Privacy Law will be

rolled out immediately. The combined platform automatically

searches the data residing in cloud application, databases,

servers, and endpoints used by businesses to discover, classify and

map customer data.

“The new sales and marketing methodology are already garnering

results for the organization and we are excited to expand the

program to the other product lines. This approach enables us to be

more responsive and dynamic to changing market and customer demands

– while managing costs and investment in direct to our financial

models. This highly algorithmic approach is more appropriate for

our business and today’s market conditions – giving us more

accurate and timely information on the return of our efforts. These

provide the foundation for our next evolution of the product line

into consumer-facing capabilities which will be marketed directly

and with partners to be announced at a later time.” said

Remillard.

Fresh Comp

One quick look at a recent $210

million funding for $2.7 billion Cyber Security company

called OneTrust further supports ATDA undervaluation and 2 tables

illustrate the advantages held by ATDS over OneTrust.

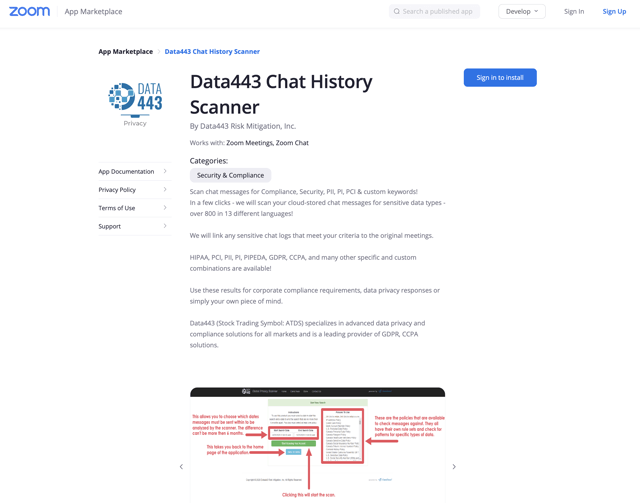

ZOOM now offers DATA443 solutions to all of its users and

lists DATA443 at top of first page:

Cloud-Based Data Storage, Protection, and Workflow

Automation Platform

Personal and Corporate Privacy and Compliance Scanner

for Group Video and WebinarsExposes Data443 Brand and Product Line

to Millions of New Potential Clients

RESEARCH TRIANGLE PARK, NORTH CAROLINA, July 14, 2020 (GLOBE

NEWSWIRE) -- Data443 Risk Mitigation, Inc. (“Data443” or the

“Company”) (OTCPK:

ATDS), a leading data security and privacy software company,

today released to the general public its latest advance in its

cloud Global

Privacy Manager product line – Data443

Chat History Scanner - powered by the

Company’s award winning ClassiDocs™.

What it is:

- Effortlessly scan your recorded chat history logs for privacy,

financial, security and other sensitive information types

- Test different languages and sensitive data types against

recordings to detect anomalies

- Detect policy breaches by your staff or other vendors on

webinars or group meetings

- Remove recordings, webinars or other content that violates

policy

- Available for free to all subscribers; premium version to

follow at reasonable cost

Why it matters:

- Online meeting platforms have exploded in popularity during the

recent pandemic, with significant room to grow.

- Roughly two-thirds of U.S. workers who have been working from

home prefer to continue working remotely as much as possible even

when pandemic restrictions lift, according to a recent Gallup

poll.1

- Exposes Data443 brand and all other products to millions of end

users and customers

- Leading charge in the burgeoning online data storage and

management space, providing the Company with significant market

penetration

1 https://www.wsj.com/articles/seven-rules-of-zoom-meeting-etiquette-from-the-pros-11594551601?mod=searchresults&page=1&pos=2

Management Commentary:

Jason Remillard, CEO of Data443, commented, “Today’s

announcement is another key accomplishment for Data443, and

continues the development of our Global Privacy Manager product

segment that includes a plethora of products that ensure corporate

compliance and personal privacy online – for both consumers and

businesses alike. This effort has taken months of work by our

dedicated engineering staff, securing certification from the

vendor, and enabling us to deliver another world-first product to

the marketplace.”

“The combination of compliance requirements, massive data

collection and storage of both consumer and commercial information,

without the ability to scan, parse and understand this data in a

massively growing virtual environment, continues to be a

significant risk for organizations of any size. By creating the

Data443 Chat History Scanner, we saw a “blue ocean” opportunity in

creating a simple, quick and easy way to meet these challenges,

while aligning Data443 with the global leader in online video

communications.

“Being on the first page of security and compliance products in

the App Store is another notch in our belt as we continue to

deliver products for a wide range of SaaS information providers on

many platforms. Being distributed and available on multiple

providers is part of our new approach to expand our business and

reach new potential customers,” concluded Mr. Remillard

Conclusion

Data 443 is ranked in the top 15 U.S. based Cyber Security

companies by Black Book Market Research and provides services to

big name clients like Hewlett Packard, Ripple, MicroSoft, Twitter,

Facebook and Linkedin. Sales started at zero and were $1.4 million

for 2019 and projected to hit $5 million in 2020. With an

aggressive and smart acquisition program adding to sales and with

strong organic internal sales growth, ATDS is expected to achieve

strong sales growth and become a takeover target for the cash rich,

sales hungry, software giants. There are about 153 million shares

outstanding and the potential exists for prices at many multiples

of today’s price and possibly even record highs in 2021. Displaying

a strong vote of confidence, CEO, Jason Remillard, stepped up

and negotiated

a deal with convertible debt holders amounting to around

$4 million that has now been extended between 6 months and one year

and thereby eliminates those potential shares from ever hitting the

market.

2019 revenues were driven by sales for 6 months from only one

product and only 1 quarter of the second product, while 2020 sales

are being driven by the ENTIRE YEAR OF SALES FROM ALL 3 PRODUCTS

PLUS ACQUISITIONS.

Goldman Research recently rated ATDS as a Speculative Buy

with a price target of $3.65.

With current market Sales to Price ratio of 11.8 to 1, if ATDS

executes as they are currently doing and delivers 2020 sales of $5

million, it is reasonable to expect ATDS share price to achieve

$.40 in 2020 and as growth accelerates share price has the

potential to rapidly increase over $1.00. Recent adoption by ZOOM

and the NFL confirms projections of rapid high growth.

Legal Disclaimer:

Except for the historical information presented herein, matters

discussed in this release contain forward-looking statements that

are subject to certain risks and uncertainties that could cause

actual results to differ materially from any future results,

performance or achievements expressed or implied by such

statements. The Information contains forward-looking statements,

i.e. statements or discussions that constitute predictions,

expectations, beliefs, plans, estimates, or projections as

indicated by such words as ''expects,'' ''will,'' ''anticipates,''

and ''estimates''; therefore, you should proceed with extreme

caution in relying upon such statements and conduct a full

investigation of the Information and the Profiled Issuer as well as

any such forward-looking statements.

SOURCE: Seeking Alpha

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Graphique Historique de l'Action

De Jan 2025 à Fév 2025

DATA443 Risk Mitigation (PK) (USOTC:ATDS)

Graphique Historique de l'Action

De Fév 2024 à Fév 2025