Table of Contents

As filed with the Securities and Exchange Commission on February 14, 2014

No. 333-

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENCISION INC.

(Exact name of registrant as specified in its charter)

|

Colorado

|

|

84-1162056

|

|

(State or other jurisdiction of incorporation

|

|

(I.R.S. Employer Identification No.)

|

|

or organization)

|

|

|

|

|

|

|

6797 Winchester Circle

Boulder, Colorado 80301

(303) 444-2600

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Gregory J. Trudel

Chief Executive Officer and President

Encision Inc.

6797 Winchester Circle

Boulder, Colorado 80301

(303) 444-2600

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies of all communications, including communications sent to agent for service, should be sent to:

James H. Carroll

Faegre Baker Daniels LLP

1470 Walnut Street

Boulder, Colorado 80302

(303) 447-7700

Approximate date of commencement of proposed sale to the public:

From time to time after the effectiveness of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box:

o

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following box:

x

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.

o

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box.

o

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box.

o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

o

|

|

Accelerated filer

o

|

|

Non-accelerated filer

o

|

|

Smaller reporting company

x

|

|

|

|

(Do not check if a smaller reporting company)

|

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities

to be Registered

|

|

Amount

to be Registered(1)

|

|

Proposed Maximum

Offering Price

Per Unit(1)

|

|

Proposed Maximum

Aggregate

Offering Price(1)

|

|

Amount of

Registration Fee

|

|

|

Common Stock, no par value

|

|

3,694,688

|

|

$

|

1.17

|

(2)

|

$

|

4,322,785

|

(2)

|

$

|

557.00

|

(2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

We are registering 2,463,125 shares of common stock issued to the selling stockholders pursuant to the Securities Purchase Agreement (as defined herein) and 1,231,563 shares of common stock issuable upon the exercise of warrants. In accordance with Rule 416 promulgated under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement shall be deemed to cover any additional securities to be offered or issued from stock splits, stock dividends or similar transactions with respect to the shares being registered.

(2)

Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(c) under the Securities Act, based on the average of the bid and asked prices of the common stock on the Pink Sheets Electronic Quotation Service on February 11, 2014.

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment that specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

Table of Contents

The information in this prospectus is not complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not the solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

PROSPECTUS

Subject to completion, dated February 14, 2014.

3,694,688 Shares

ENCISION INC.

Common Stock

The selling stockholders named in this prospectus may offer, from time to time, up to 3,694,688 shares of our common stock. We will not receive any proceeds from the sale of shares of common stock offered by the selling stockholders. We will bear a portion of the expenses of the offering of common stock, except that, the selling stockholders will pay any applicable underwriting fees, discounts or commissions and certain transfer taxes.

Our registration of the shares of common stock covered by this prospectus does not mean that the selling stockholders will offer or sell any of the shares. The selling stockholders may sell the shares of common stock covered by this prospectus in a number of different ways and at varying prices. We provide more information about how the selling stockholders may sell their shares in the section entitled “Plan of Distribution” beginning on page 7.

Our common stock is traded on the Pink Sheets Electronic Quotation Service under the symbol “ECIA.PK.” On February 11, 2014 the closing price of our common stock on the Pink Sheets Electronic Quotation Service was $1.17 per share.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page 2 of this prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2014

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of a registration statement on Form S-1 that we filed with the Securities and Exchange Commission, or the “SEC,” using a “shelf” registration process. Specific information about the terms of an offering will be included in a prospectus or a prospectus supplement relating to each offering of shares. The prospectus supplement may also add, update or change information included in this prospectus. You should read both this prospectus and any applicable prospectus supplement, together with additional information described below under the caption “Where You Can Find More Information” and “Incorporation by Reference of Certain Documents.” You should also carefully consider, among other things, the matters discussed in the section entitled “Risk Factors.”

We are responsible for the information contained and incorporated by reference in this prospectus, any applicable prospectus supplements and any related free writing prospectus we prepare or authorize. Neither we, the selling stockholders nor any underwriter has authorized anyone to provide information different from that contained in this prospectus and the documents incorporated by reference herein.

The information contained in this prospectus, in any prospectus supplement or in any document incorporated by reference is accurate only as of its date, regardless of the time of delivery of this prospectus or any sale of common stock.

This prospectus is not an offer to sell or solicitation of an offer to buy these shares of common stock in any circumstances under which or jurisdiction in which the offer or solicitation is unlawful.

Unless the context otherwise indicates, the terms “Encision,” “Company,” “we,” “us,” and “our” as used in this prospectus refer to Encision Inc. and its subsidiaries. Unless the context otherwise indicates, the phrase “this prospectus” refers to this prospectus and any applicable prospectus supplement(s).

ii

Table of Contents

OUR COMPANY

Encision, a medical device company based in Boulder, Colorado, has developed and markets innovative technology that provides unprecedented outcomes and patient safety in minimally-invasive surgery. We believe that our patented Active Electrode Monitoring® (“AEM”) surgical instruments are changing the marketplace for electrosurgical devices and laparoscopic instruments by providing a solution to a well-documented hazard unique to laparoscopic surgery.

We address market opportunities created by the increase in minimally-invasive surgery (“MIS”) and surgeons’ use of electrosurgery devices in these procedures. The product opportunity exists in that monopolar electrosurgery instruments used in laparoscopic procedures provide excellent clinical results, but are also susceptible to causing inadvertent collateral tissue damage outside the surgeon’s field of view due to insulation failure and capacitive coupling. The risk of unintended electrosurgical burn injury to the patient in laparoscopic surgery has been well documented. This risk poses a threat to patient safety, including the risk of death, and creates liability exposure for surgeons and hospitals, as well as increased and preventable readmissions.

Our patented AEM technology provides surgeons with the desired tissue effects, while preventing stray electrosurgical energy that can cause unintended and unseen tissue injury that may result in death. AEM surgical instruments are equivalent to conventional instruments in size, shape, ergonomics, functionality and competitive pricing, but they incorporate “Active Electrode Monitoring” technology to dynamically and continuously monitor the flow of electrosurgical current, thereby helping to prevent patient injury. With our “shielded and monitored” instruments, surgeons are able to perform electrosurgical procedures more safely, effectively and economically than is possible using conventional instruments or alternative energy sources.

AEM technology has been recommended and endorsed by sources from many groups involved in MIS. Surgeons, nurses, biomedical engineers, the medicolegal community, malpractice insurance carriers and electrosurgical device manufacturers advocate the use of AEM technology.

We were incorporated in Colorado on February 1, 1991. Our offices are located at 6797 Winchester Circle, Boulder, Colorado 80301. Our telephone number is (303) 444-2600. We maintain a site on the World Wide Web at www.encision.com. We do not intend that our website be a part of this prospectus.

1

Table of Contents

RISK FACTORS

Our business is subject to uncertainties and risks. You should carefully consider and evaluate all of the information included and incorporated by reference in this prospectus, including the risk factors incorporated by reference from our most recent annual report on Form 10-K, as updated by our quarterly reports on Form 10-Q and other filings we make with the SEC. Our business, financial condition, liquidity or results of operations could be materially adversely affected by any of these risks.

FORWARD-LOOKING STATEMENTS

This prospectus, any applicable prospectus supplement and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that are based on current expectations, estimates, forecasts and projections about us, our future performance, our liquidity, our beliefs and management’s assumptions. Words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “can have,” “likely” and variations of such words and similar expressions are intended to identify such forward-looking statements. For example, all statements we make relating to our estimated and projected costs, expenditures, cash flows, growth rates and financial results, our plans and objectives for future operations, growth or initiatives, strategies, or the expected outcome or impact of pending or threatened litigation are forward-looking statements. All forward-looking statements speak only as of the date on which they are made. These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions concerning future events that are difficult to predict. Therefore, actual future events or results may differ materially from these statements. We believe that the factors that could cause our actual results to differ materially include the factors that we describe under the caption “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended March 31, 2013, which is incorporated by reference. These factors, risks and uncertainties include, but are not limited to, the following:

·

the extent to which our products will be accepted by the medical community;

·

the success of our efforts to develop and train a network of independent sales representatives in the U.S. and to expand our international distribution efforts;

·

our need and ability to obtain additional funding, if necessary, to support our operations;

·

our ability to compete successfully against current manufacturers of conventional electrosurgical instruments or against competitors who manufacture products that are based on surgical technologies that are alternatives to monopolar electrosurgery;

·

our ability to continually enhance our products and keep pace with rapid technological changes;

·

our need to comply with existing and new government regulations;

·

our ability to maintain and enforce patent protection for our products and processes, to preserve our trade secrets and to operate without infringing the proprietary rights of third parties;

·

our dependence on single source suppliers for certain of the key components of our products and sub-contractors to provide much of the materials used in the manufacturing of our products;

·

fluctuations in our sales and results of operations on a quarterly basis;

·

the fact that our common stock is thinly traded, which may cause our stock price to be volatile;

·

that we

face an inherent business risk of exposure to product liability claims in the event that the use of our products is alleged to have resulted in adverse effects to a patient; and

·

that we are dependent upon certain key personnel.

2

Table of Contents

These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements included in this prospectus, any applicable prospectus supplement and the documents incorporated by reference herein. These risks and uncertainties, as well as other risks of which we are not aware or which we currently do not believe to be material, may cause our actual future results to be materially different than those expressed in our forward-looking statements. We caution you not to place undue reliance on these forward-looking statements. We do not undertake any obligation to make any revisions to these forward-looking statements to reflect events or circumstances after the date made or to reflect the occurrence of unanticipated events, except as required by law, including the securities laws of the United States and rules and regulations of the SEC.

3

Table of Contents

USE OF PROCEEDS

We will not receive any proceeds from the sale of shares of common stock offered by the selling stockholders. The exercise price of the outstanding warrants is $1.20 per share, subject to adjustment under specified circumstances. If all of the warrants are exercised for cash (assuming no exercise price adjustment), we will receive proceeds of $1,477,876, which we will use for working capital. Beginning six months after the issuance of the warrants, if at any time we are unable to maintain the continuous effectiveness of a registration statement for the resale of the shares of our common stock issuable upon exercise of the warrants, the warrants may be exercised by means of a “net exercise” for the duration of such unavailability, and we will not receive any proceeds at such time.

The selling stockholders will pay all selling commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred by the selling stockholders in connection with the sale of the shares of common stock, if any. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares of common stock covered by this prospectus, including, without limitation, all registration and filing fees, listing fees and fees and expenses of our counsel and our accountants.

SELLING STOCKHOLDERS

Beneficial Ownership

The selling stockholders may sell a total of up to 3,694,688 shares of common stock under this prospectus.

The table below sets forth information regarding the beneficial ownership of our common stock by the selling stockholders as of January 31, 2014. The information regarding the selling stockholders’ beneficial ownership after the sales made pursuant to this prospectus assumes that all of the common stock subject to sale pursuant to this prospectus will have been sold. The common stock subject to sale by the selling stockholders pursuant to this prospectus may be offered from time to time, in whole or in part, by the selling stockholders.

|

|

|

Shares

Beneficially

Owned Before Any Sale

|

|

Shares Subject to Sale

Pursuant to this

Prospectus

|

|

Shares Beneficially

Owned After Sale of All Shares Subject to Sale

Pursuant to this Prospectus

|

|

|

Name

|

|

Number

|

|

Percent

|

|

Number

|

|

Number

|

|

Percent

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DAFNA Lifescience Select LTD(1)

|

|

793,125

|

|

7.4

|

%

|

793,125

|

|

—

|

|

—

|

%

|

|

DAFNA Lifescience LTD(2)

|

|

684,375

|

|

6.4

|

%

|

684,375

|

|

—

|

|

—

|

%

|

|

DAFNA Lifescience Market Neutral LTD(3)

|

|

116,250

|

|

1.1

|

%

|

116,250

|

|

—

|

|

—

|

%

|

|

CMED Partners LLLP(4)

|

|

2,421,017

|

|

22.7

|

%

|

787,500

|

|

1,633,517

|

|

15.3

|

%

|

|

Charles E. Sheedy(5)

|

|

953,319

|

|

8.9

|

%

|

375,000

|

|

578,319

|

|

5.4

|

%

|

|

Tom Juda and Nancy Juda Living Trust(6)

|

|

375,000

|

|

3.5

|

%

|

375,000

|

|

—

|

|

—

|

%

|

|

Raul P. Esquivel(7)

|

|

300,000

|

|

2.8

|

%

|

300,000

|

|

—

|

|

—

|

%

|

|

Paul J. McCormick, Charles Schwab & Co. Inc. Custodian IRA Rollover(8)

|

|

169,370

|

|

1.6

|

%

|

93,750

|

|

75,620

|

|

*

|

|

|

Alan Budd Zuckerman(9)

|

|

101,415

|

|

1.0

|

%

|

46,875

|

|

54,540

|

|

*

|

|

|

Jordan Barrow(10)

|

|

71,875

|

|

*

|

|

46,875

|

|

25,000

|

|

*

|

|

|

Nicholas Sarchese(11)

|

|

52,226

|

|

*

|

|

37,500

|

|

14,726

|

|

*

|

|

|

Kathleen Bette Newton(12)

|

|

328,966

|

|

3.1

|

%

|

18,750

|

|

310,216

|

|

2.9

|

%

|

|

Gregory J. Trudel(13)

|

|

8,438

|

|

*

|

|

8,438

|

|

—

|

|

—

|

%

|

|

John Halt(14)

|

|

5,625

|

|

*

|

|

5,625

|

|

—

|

|

—

|

%

|

|

Thomas Whitley(15)

|

|

7,125

|

|

*

|

|

5,625

|

|

1,500

|

|

*

|

|

*

Indicates less than one percent.

(1)

Includes (i) 528,750 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 264,375 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of DAFNA Lifescience Select LTD is c/o DAFNA Capital Management LLC, 10990 Wilshire Blvd., Suite 1400, Los Angeles, CA 90024. Nathan Fischel, chief executive officer of the selling stockholder, has the power to vote or dispose of the shares held of record by the selling stockholder and may be deemed to beneficially own those shares.

(2)

Includes (i) 456,250 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 228,125 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of DAFNA Lifescience LTD is c/o DAFNA Capital Management LLC, 10990 Wilshire Blvd., Suite 1400, Los Angeles, CA 90024. Nathan Fischel, chief executive officer of the selling stockholder, has the power to vote or dispose of the shares held of record by the selling stockholder and

4

Table of Contents

may be deemed to beneficially own those shares.

(3)

Includes (i) 77,500 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 38,750 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of DAFNA Lifescience Market Neutral LTD is c/o DAFNA Capital Management LLC, 10990 Wilshire Blvd., Suite 1400, Los Angeles, CA 90024. Nathan Fischel, chief executive officer of the selling stockholder, has the power to vote or dispose of the shares held of record by the selling stockholder and may be deemed to beneficially own those shares.

(4)

Includes (i) 1,633,517 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 525,000 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 262,500 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of CMED Partners LLLP is 4605 S. Denice Drive, Englewood, CO 80111. Vern Kornelsen is the general partner of CMED Partners LLLP. As a result, Mr. Kornelsen (who is a director of the Company) may be deemed to have beneficial ownership of the shares held by CMED Partners LLLP.

(5)

Includes (i) 578,319 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 250,000 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 125,000 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Sheedy is Two Houston Center, Suite 2907, 909 Fannin Street, Houston, TX 77010.

(6)

Includes (i) 250,000 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 125,000 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of the selling stockholder is 410 S. Lucerne Blvd., Los Angeles, CA 90020. Tom Juda, a trustee of the selling stockholder, has the power to vote or dispose of the shares held of record by the selling stockholder and may be deemed to beneficially own those shares.

(7)

Includes (i) 200,000 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 100,000 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Esquivel is 91 Prospect Street, Summit, NJ 07901.

(8)

Includes (i) 75,620 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 62,500 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 31,250 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of the selling stockholder is 338 Spear Street, 19F, San Francisco, CA 94105. Paul McCormick has the power to vote or dispose of the shares held of record by the selling stockholder and may be deemed to beneficially own those shares.

(9)

Includes (i) 54,540 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 31,250 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 15,625 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Zuckerman is 6587 Lakeview Drive, Boulder, CO 80303.

(10)

Includes (i) 25,000 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 31,250 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 15,625 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Barrow is 401 E. 65

th

Street, Apt. 13D, New York, NY 10065.

(11)

Includes (i) 14,726 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 25,000 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 12,500 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Sarchese is 18 Red Cliff Ave., Port Washington, NY 11050.

(12)

Includes (i) 310,216 shares of common stock beneficially owned by David Netwon, a director of the company and Mrs. Newton’s spouse, prior to the closing of the December 2013 private placement; (ii) 12,500 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 6,250 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mrs. Newton is 8099 N. 63

rd

Street, Longmont, CO 80503.

(13)

Includes (i) 5,625 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 2,813 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Trudel, a direcor and CEO of the Company, is c/o Encision Inc., 6797 Winchester Circle, Boulder, Colorado 80301.

(14)

Includes (i) 3,750 shares of common stock issued pursuant to the Securities Purchase Agreement and (ii) 1,875 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Halt is 11840 Homewood Road, Ellicott City, MD 21042.

(15)

Includes (i) 1,500 shares of common stock held prior to the closing of the December 2013 private placement; (ii) 3,750 shares of common stock issued pursuant to the Securities Purchase Agreement; and (iii) 1,875 shares of common stock issuable upon the exercise of warrants issued pursuant to the Securities Purchase Agreement. The address of Mr. Whitley is 372 Fifth Avenue, Apt. 5M, New York, NY 10018.

5

Table of Contents

DESCRIPTION OF SECURITIES

The following summary description of the securities is not complete and is qualified in its entirety by reference to our articles of incorporation, as amended, and our bylaws.

Our authorized capital stock consists of 110,000,000 shares of capital stock without par value, of which 100,000,000 shares are designated as common stock and 10,000,000 shares are designated as preferred stock.

Common Stock

As of January 31, 2014, there were 10,673,225 shares of common stock issued and outstanding. The holders of the common stock (i) have equal ratable rights to dividends from funds legally available therefor, when, as and if declared by our Board of Directors; (ii) are entitled to share ratably in all Encision assets available for distribution to holders of the common stock upon liquidation, dissolution or winding up of our affairs; (iii) do not have preemptive, subscription or conversion rights and there are no redemption or sinking fund provisions applicable thereto; and (iv) are entitled to one vote per share on all matters which shareholders may vote on at all meetings of shareholders. All shares of the common stock now outstanding are fully paid and nonassessable.

The holders of common stock do not have cumulative voting rights, which means that the holders of more than 50 percent of such outstanding shares voting for the election of directors can elect all of our directors to be elected; if they so choose. In such event, the holders of the remaining shares will not be able to elect any of our directors.

Preferred Stock

Under governing Colorado law and our Articles of Incorporation, no action by our shareholders is necessary, and only action of the Board of Directors is required, to authorize the issuance of any of the preferred stock. Our Board of Directors is empowered to establish and to designate the name of each class or series of the shares and to set the terms of such shares (including terms with respect to redemption, sinking fund, dividend, liquidation, preemptive, conversion and voting rights and preferences). Accordingly, our Board of Directors, without shareholder approval, may issue preferred stock with terms (including terms with respect to redemption, sinking fund, dividend, liquidation, preemptive, conversion and voting rights and preferences) that could adversely affect the voting power and other rights of holders of the common stock.

The existence of preferred stock may have the effect of discouraging an attempt, through acquisition of a substantial number of shares of common stock, to acquire control of us with a view to affecting a merger, sale or exchange of assets or a similar transaction. The anti-takeover effects of the preferred stock may deny shareholders the receipt of a premium on their common stock and may also have a depressive effect on the market price of the common stock.

Warrants

On December 17, 2013, we entered into a Securities Purchase Agreement (the “Securities Purchase Agreement”) with the selling stockholders pursuant to which we agreed to sell 2,463,125 shares of common stock and warrants to purchase an aggregate of up to 1,231,563 shares of common stock. The warrants have an exercise price of $1.20 per share, subject to adjustment. The warrants are immediately exercisable, subject to certain limitations contained in the warrants, and expire December 17, 2018. The exercise price and number of shares of common stock issuable under the warrants are subject to anti-dilutive adjustments upon the occurrence of certain events. The warrants contain provisions concerning the repurchase of the warrants in connection with a Change of Control (as defined in the warrant). Beginning six months after the issuance of the warrants, if at any time we are unable to maintain the continuous effectiveness of a registration statement for the resale of the shares of our common stock issuable upon exercise of the warrants, the warrants may be exercised by means of a “net exercise” for the duration of such unavailability, and we will not receive any proceeds from any warrants that are net-exercised rather than exercise for cash.

6

Table of Contents

Transfer Agent and Registrar

The Transfer Agent and Registrar with respect to our common stock is Computershare Trust Company, 350 Indiana Street, Suite 750, Golden, Colorado 80401.

PLAN OF DISTRIBUTION

We are registering 3,694,688 shares of our common stock for possible sale by the selling stockholders. Unless the context otherwise requires, as used in this prospectus, “selling stockholders” includes the selling stockholders named in the table above and donees, pledgees, transferees or other successors-in-interest selling shares received from the selling stockholders as a gift, pledge, partnership distribution or other transfer after the date of this prospectus.

The selling stockholders may offer and sell all or a portion of the shares covered by this prospectus from time to time, in one or more or any combination of the following transactions:

·

on the Pink Sheets Electronic Quotation Service, in the over-the-counter market or on any other national securities exchange on which our shares are listed or traded;

·

in privately negotiated transactions;

·

settlement of short sales entered into after the effective date of the registration statement of which this prospectus is a part;

·

broker-dealers may agree with the selling stockholder to sell a specified number of shares at a stipulated price per share;

·

in a block trade in which a broker-dealer will attempt to sell the offered shares as agent but may position and resell a portion of the block as principal to facilitate the transaction;

·

through purchases by a broker-dealer as principal and resale by the broker-dealer for its account pursuant to this prospectus;

·

in ordinary brokerage transactions and transactions in which the broker solicits purchasers;

·

through the writing of options (including put or call options), whether the options are listed on an options exchange or otherwise; or

·

any other method permitted pursuant to applicable law.

The selling stockholders may sell the shares at prices then prevailing or related to the then current market price or at negotiated prices. The offering price of the shares from time to time will be determined by the selling stockholders and, at the time of the determination, may be higher or lower than the market price of our common stock on the Pink Sheets Electronic Quotation Service or any other exchange or market.

The shares may be sold directly or through broker-dealers acting as principal or agent, or pursuant to a distribution by one or more underwriters on a firm commitment or best-efforts basis. The selling stockholders may also enter into hedging transactions with broker-dealers. In connection with such transactions, broker-dealers of other financial institutions may engage in short sales of our common stock in the course of hedging the positions they assume with the selling stockholders. The selling stockholders may also enter into options or other transactions with broker-dealers or other financial institutions, which require the delivery to such broker-dealer or other financial institution of shares offered by this prospectus, which shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

Broker-dealers engaged by the selling stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts from the selling stockholders (or, if any broker-dealer acts as agent for a purchaser of shares, from such purchaser) in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction not in excess of a customary brokerage commission in compliance with FINRA Rule 2440; and in the case of a principal transaction a markup or markdown in compliance with FINRA IM-2440.

7

Table of Contents

The selling stockholders and any underwriters, dealers or agents participating in a distribution of the shares may be deemed to be “underwriters” within the meaning of the Securities Act, and any profit on the sale of the shares by the selling stockholders and any commissions received by broker-dealers may be deemed to be underwriting commissions under the Securities Act. The selling stockholders have advised us that they have not entered into any agreements, understandings or arrangements with any underwriters or broker-dealers regarding the sale of their shares. In no event shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed five percent (5%).

We will bear a portion of the expenses of the offering of common stock, except that the selling stockholders will pay any applicable underwriting fees, discounts or commissions and certain transfer taxes. We have agreed to indemnify the selling stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

The selling stockholders are subject to the applicable provisions of the Exchange Act and the rules and regulations under the Exchange Act, including Regulation M. This regulation may limit the timing of purchases and sales of any of the shares of common stock offered in this prospectus by the selling stockholders. The anti-manipulation rules under the Exchange Act may apply to sales of shares in the market and to the activities of the selling stockholders and their affiliates.

Because a selling stockholder may be deemed an “underwriter” within the meaning of the Act, it will be subject to the prospectus delivery requirements of the Securities Act. We will make copies of this prospectus available to the selling stockholder and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale. We have agreed to keep this prospectus effective until the earlier of (i) the date on which the shares may be resold by the selling stockholders without registration and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the shares have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale shares will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states, the resale shares may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption from the registration or qualification requirement is available and is complied with.

To the extent required, this prospectus may be amended and/or supplemented from time to time to describe a specific plan of distribution. Instead of selling the shares of common stock under this prospectus, the selling stockholders may sell the shares of common stock in compliance with the provisions of Rule 144 under the Securities Act, if available, or pursuant to other available exemptions from the registration requirements of the Securities Act.

8

Table of Contents

LEGAL MATTERS

The validity of the common stock offered hereby will be passed upon for us by Faegre Baker Daniels LLP, Boulder, Colorado.

EXPERTS

The financial statements and schedules incorporated by reference in this prospectus and elsewhere in the registration statement have been so incorporated by reference in reliance upon the reports of Eide Bailly LLP, independent registered public accountants, upon the authority of said firm as experts in accounting and auditing in giving said reports.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration statement on Form S-1 under the Securities Act with respect to the common stock offered by this prospectus. This prospectus, which is a part of the registration statement, does not contain all of the information set forth in the registration statement or the exhibits and schedules filed therewith. For further information with respect to us and the common stock offered by this prospectus, please see the registration statement and the exhibits filed with the registration statement. Statements contained in this prospectus regarding the contents of any contract or any other document that is filed as an exhibit to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to the full text of such contract or other document filed as an exhibit to the registration statement. A copy of the registration statement and the exhibits filed with the registration statement may be inspected without charge at the Public Reference Room maintained by the SEC, located at 100 F Street, N.E., Washington, D.C. 20549. Please call the SEC at 1-800-SEC-0330 for more information about the operation of the Public Reference Room. The SEC also maintains an Internet website that contains reports, proxy and information statements and other information regarding registrants that file electronically with the SEC. The address of the website is http://www.sec.gov.

We are subject to the information and periodic reporting requirements of the Exchange Act, and, in accordance therewith, we file periodic reports, proxy statements and other information with the SEC. Such periodic reports, proxy statements and other information are available for inspection and copying at the Public Reference Room and website of the SEC referred to above. We maintain a website at http://www.encision.com. You may access our Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports filed pursuant to Sections 13(a) or 15(d) of the Exchange Act with the SEC free of charge at our website as soon as reasonably practicable after such material is electronically filed with, or furnished to, the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus, and you should not consider the contents of our website in making an investment decision with respect to our common stock.

9

Table of Contents

INCORPORATION BY REFERENCE OF CERTAIN DOCUMENTS

We are “incorporating by reference” specified documents that we file with the SEC, which means that we can disclose important information to you by referring you to those documents that are considered part of this prospectus. We incorporate by reference into this prospectus the documents listed below (other than any portion of such filings that are furnished under applicable SEC rules rather than filed) under Sections 13(a), 13(c), 14, or 15(d) of the Exchange Act:

·

our Annual Report on Form 10-K for the fiscal year ended March 31, 2013 filed with the SEC on June 28, 2013;

·

our Quarterly Report on Form 10-Q for the fiscal quarter ended June 30, 2013 filed with the SEC on August 13, 2013;

·

our Quarterly Report on Form 10-Q for the fiscal quarter ended September 30, 2013 filed with the SEC on November 13, 2013;

·

our Quarterly Report on Form 10-Q for the fiscal quarter ended December 31, 2013 filed with the SEC on February 11, 2014;

·

our Current Reports on Form 8-K filed with the SEC on August 9, August 12, August 14, September 5, December 18 and December 23, 2013 and on January 8, 2014; and

·

the description of our capital stock, no par value, included under the caption “Description of Capital Stock” in the Prospectus forming a part of our Registration Statement on Form SB-2, dated June 25, 1996 (Registration No. 333-4118-D), including exhibits, and as amended, which description has been incorporated by reference in Item 1 of our Registration Statement on Form 8-A filed with the SEC on June 4, 1996 (File No. 000-28604).

Any statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus will be deemed to be modified or superseded for purposes of this prospectus to the extent that a statement contained in this prospectus or any other subsequently filed document that is deemed to be incorporated by reference into this prospectus modifies or supersedes the statement. Any statement so modified or superseded will not be deemed, except as so modified or superseded, to constitute a part of this prospectus. Our Commission File Number is 000-28604.

Our filings with the SEC, including our Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports, are available free of charge on our website at http://www.encision.com as soon as reasonably practicable after they are filed with, or furnished to, the SEC. Our website and the information contained on that site, or connected to that site, are not incorporated into and are not a part of this prospectus. You may also obtain a copy of these filings at no cost by writing or telephoning us at the office of our Corporate Secretary, Encision Inc., 6797 Winchester Circle, Boulder, Colorado 80301, (303) 444-2600.

Except for the documents incorporated by reference as noted above, we do not intend to incorporate into this prospectus any of the information included on our website.

10

Table of Contents

PART II

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14.

Other Expenses of Issuance and Distribution

The following table sets forth all estimated expenses to be paid solely by us in connection with the sale of the securities being registered hereunder.

|

SEC registration fee

|

|

$

|

557

|

|

|

Legal fees and expenses

|

|

10,000

|

*

|

|

Accounting fees and expenses

|

|

10,000

|

*

|

|

Printing fees and expenses

|

|

1,000

|

*

|

|

Miscellaneous expenses

|

|

443

|

|

|

Total

|

|

$

|

22,000

|

*

|

* These fees are calculated based upon the number of issuances in applicable offerings and amount of securities offered and, accordingly, cannot be estimated at this time.

Item 15.

Indemnification of Directors and Officers

Our Articles of Incorporation and Bylaws provide that we shall indemnify to the fullest extent permitted by Colorado law any person who was or is a party, or is threatened to be made a party, to any threatened, pending or completed action, suit or proceeding, by reason of the fact that he or she is or was a director or officer of Encision or, is or was serving at the request of Encision in any capacity and in any other corporation, partnership, joint venture, trust or other enterprise. The Colorado Business Corporation Act (the “Colorado Act”) permits us to indemnify an officer or director who was or is a party, or is threatened to be made a party, to any proceeding because of his or her position, if the officer or director acted in good faith and in a manner he or she reasonably believed to be in our best interests or, if such officer or director was not acting in an official capacity for us, he or she reasonably believed the conduct was not opposed to our best interests. Indemnification is mandatory if the officer or director was wholly successful, on the merits or otherwise, in defending such proceeding. Such indemnification (other than as ordered by a court) shall be made by us only upon a determination that indemnification is proper in the circumstances because the individual met the applicable standard of conduct. Advances of such indemnification may be made pending such determination. Such determination shall be made by a majority vote of a quorum consisting of disinterested directors or of a committee of at least two disinterested directors, or by independent legal counsel or by the shareholders.

In addition, our Articles of Incorporation provide for the elimination, to the extent permitted by Colorado law, of personal liability of directors to us and our shareholders for monetary damages for breach of fiduciary duty as directors. The Colorado Act permits the elimination of personal liability of directors for damages occasioned by breach of fiduciary duty, except for liability based on the director’s duty of loyalty to us, liability for acts or omissions not made in good faith, liability for acts or omissions involving intentional misconduct, liability based on payments of improper dividends, liability based on violations of state securities laws, and liability for acts occurring prior to the date such provision was added.

The indemnification rights set forth above shall not be exclusive of any other right which an indemnified person may have or hereafter acquire under any statute, provision of our articles of incorporation, provision of our bylaws, agreement, vote of shareholders or disinterested directors or otherwise.

We maintain standard policies of insurance that provide coverage (1) to our directors and officers against loss rising from claims made by reason of breach of duty or other wrongful act and (2) to us with respect to indemnification payments that we may make to such directors and officers.

In addition, a proposed form of purchase agreement or underwriting agreement filed as an exhibit in connection with an underwritten offering of the shares offered hereunder may provide for indemnification to our directors and officers by the underwriters against certain liabilities.

Item 16.

Exhibits

The list of exhibits in the Exhibit Index to this registration statement is incorporated herein by reference.

II-1

Table of Contents

Item 17.

Undertakings

(a)

The undersigned registrant hereby undertakes:

1.

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i)

To include any prospectus required by section 10(a)(3) of the Securities Act of 1933;

(ii)

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than a 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii)

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

Provided, however,

that paragraphs (a)(1)(i), (ii) and (iii) of this section do not apply if the information required to be included in a post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of this registration statement.

2.

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3.

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

4.

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

(i)

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(ii)

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Provided, however,

that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date.

5.

That, for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution of the securities: The undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the

II-2

Table of Contents

purchaser, if the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

(i)

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant to Rule 424;

(ii)

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by the undersigned registrant;

(iii)

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned registrant or its securities provided by or on behalf of the undersigned registrant; and

(iv)

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6.

That, for purposes of determining any liability under the Securities Act of 1933, the information omitted from the form of prospectus filed as part of this registration statement in reliance upon Rule 430A and contained in a form of prospectus filed by the registrant pursuant to Rule 424(b)(1) or (4) or 497(h) under the Securities Act shall be deemed to be part of this registration statement as of the time it was declared effective.

7.

That, for the purpose of determining any liability under the Securities Act of 1933, each post-effective amendment that contains a form of prospectus shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial

bona fide

offering thereof.

(b)

Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

II-3

Table of Contents

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant has duly caused this registration statement on Form S-1 to be signed on its behalf by the undersigned, thereunto duly authorized, in the city of Boulder, state of Colorado, on February 14, 2014.

|

|

Encision Inc.

|

|

|

|

|

|

/s/ Gregory J. Trudel

|

|

|

Gregory J. Trudel

|

|

|

President and Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature appears below constitutes and appoints Gregory J. Trudel and Mala Ray, and each of them singly, his or her true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, for him or her and in his or her name, place and stead, in any and all capacities, to sign any and all amendments (including post-effective amendments) to this registration statement and any and all additional registration statements pursuant to Rule 462(b) of the Securities Act, and to file the same, with all exhibits thereto, and all other documents in connection therewith, with the SEC, granting unto each said attorney-in-fact and agents full power and authority to do and perform each and every act in person, hereby ratifying and confirming all that said attorneys-in-fact and agents or either of them or their or his or her substitute or substitutes may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed by the following persons in the capacities and on the dates indicated.

|

/s/ Gregory J. Trudel

|

|

President, Chief Executive Officer and Director

(principal executive officer)

|

February 14, 2014

|

|

Gregory J. Trudel

|

|

|

|

|

|

|

|

|

|

/s/ Mala Ray

|

|

Controller

(principal financial officer and principal accounting

officer)

|

February 14, 2014

|

|

Mala Ray

|

|

|

|

|

|

|

|

|

|

|

|

Chairman of the Board of Directors

|

|

|

Patrick W. Pace

|

|

|

|

|

|

|

|

|

|

/s/ Robert H. Fries

|

|

Director

|

February 14, 2014

|

|

Robert H. Fries

|

|

|

|

|

|

|

|

|

|

/s/ Vern D. Kornelsen

|

|

Director

|

February 14, 2014

|

|

Vern D. Kornelsen

|

|

|

|

|

|

|

|

|

|

|

|

Director

|

|

|

Ruediger Naumann-Etienne

|

|

|

|

|

|

|

|

|

|

/s/ David W. Newton

|

|

Director

|

February 14, 2014

|

|

David W. Newton

|

|

|

|

II-4

Table of Contents

EXHIBIT INDEX

|

1.1*

|

|

Form of Underwriting Agreement

|

|

3.1

|

|

Articles of Incorporation of the Company, as amended. (Incorporated by reference from Registration Statement #333-4118-D dated June 25, 1996).

|

|

3.2

|

|

Bylaws of the Company. (Incorporated by reference from Current Report on Form 8-K filed on October 30, 2007).

|

|

4.1

|

|

Form of Certificate for Shares of Common Stock. (Incorporated by reference from Registration Statement #333-4118-D dated June 25, 1996).

|

|

4.2

|

|

Form of Warrant to Purchase Common Stock (attached as Exhibit B to the Securities Purchase Agreement filed below as Exhibit 10.7). (Incorporated by reference from Current Report on Form 8-K filed on December 23, 2013).

|

|

5.1****

|

|

Opinion of Faegre Baker Daniels LLP.

|

|

10.1

|

|

Lease Agreement dated June 3, 2004 between Encision Inc. and DaPuzzo Investment Group, LLC (Incorporated by reference from Quarterly Report on Form 10-QSB filed on August 12, 2004).

|

|

10.2**

|

|

Encision Inc. 2007 Stock Option Plan (Incorporated by reference from Proxy Statement dated June 30, 2007).

|

|

10.3

|

|

Loan and Security Agreement between Encision Inc. and Silicon Valley Bank (Incorporated by reference from Current Report on Form 8-K filed on November 10, 2006).

|

|

10.4***

|

|

Manufacturing, Supply and License Agreement dated April 3, 2009 between Encision Inc. and Intuitive Surgical Inc.

|

|

|

|

(Incorporated by reference from Annual Report on Form 10-K filed on June 29, 2009).

|

|

10.6

|

|

Amended and Restated Loan and Security Agreement between Encision Inc. and Silicon Valley Bank dated May 10, 2012. (Incorporated by reference from Annual Report on Form 10-K filed on May 16, 2012).

|

|

10.7

|

|

Securities Purchase Agreement dated December 17, 2013, between Encision Inc. and the selling stockholders party thereto. (Incorporated by reference from Current Report on Form 8-K filed on December 23, 2013).

|

|

10.8

|

|

Registration Rights Agreement dated December 17, 2013, between Encision Inc. and the selling stockholders party thereto. (Incorporated by reference from Current Report on Form 8-K filed on December 23, 2013).

|

|

10.9**

|

|

Employment Agreement dated December 17, 2013, between Encision Inc. and Gregory J. Trudel. (Incorporated by reference from Current Report on Form 8-K filed on December 23, 2013).

|

|

23.1****

|

|

Consent of Eide Bailly LLP, independent registered public accounting firm.

|

|

23.2****

|

|

Consent of Faegre Baker Daniels LLP (included in Exhibit 5.1)

|

|

24.1

|

|

Power of Attorney (Included on signature page of this Registration Statement)

|

*

To be filed, if necessary, after effectiveness of this registration statement by an amendment to the registration statement or incorporated by reference to a Current Report on Form 8-K filed in connection with an underwritten offering of the shares offered hereunder.

**

Denotes management contract or compensatory plan or arrangement.

***

Certain portions of this exhibit have been omitted pursuant to a request for confidential treatment and have been filed separately with the Securities and Exchange Commission.

****

Filed herewith.

II-5

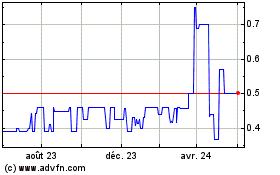

Encision (PK) (USOTC:ECIA)

Graphique Historique de l'Action

De Avr 2024 à Mai 2024

Encision (PK) (USOTC:ECIA)

Graphique Historique de l'Action

De Mai 2023 à Mai 2024